On-chain data shows that, for the first time in history, Bitcoin miners require more than 1 EH/s of daily computing power to mine just 1 token of the asset.

Bitcoin Hashcoin Has Set A New All-Time High Now

As explained by CryptoQuant head of research Julio Moreno in a post on X, the BTC Hashcoin has set a new record. The “Hashcoin” here refers to an indicator that keeps track of the daily Hashrate miners require to produce 1 BTC.

The Hashrate measures the computing power that the miners have attached to the Bitcoin network. This metric is measured in terms of hashes per second, or, in the much bigger and more practical unit these days, exahashes per second (EH/s).

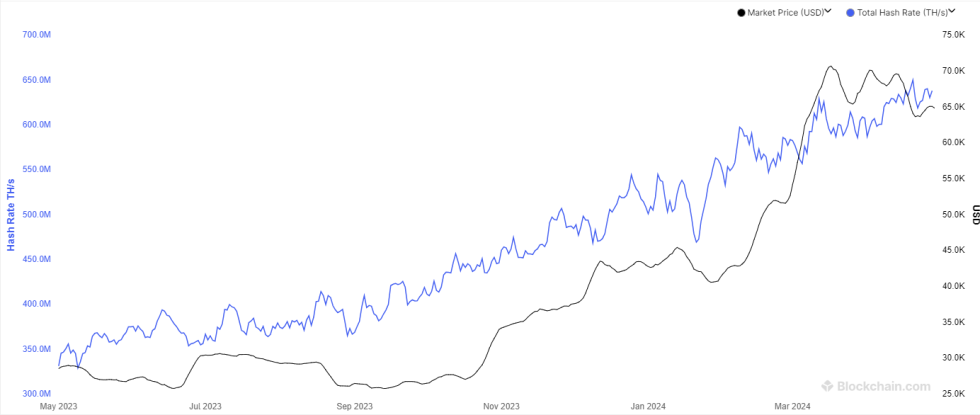

The total Hashrate on the blockchain has been near its all-time high (ATH) recently, as its 7-day average value is sitting at 638 EH/s. The chart below shows the trend in this indicator over the past year.

The value of the metric seems to have been heading up during this period | Source: Blockchain.com

A core feature of the Bitcoin blockchain is that the block time on the network (that is, the rate at which miners solve blocks) remains relatively constant at a standard 10 minutes per block.

This feature exists because miners receive block rewards for solving blocks, which are the only way to mint new tokens of the cryptocurrency. By ensuring that these blocks are given out at a constant rate, the asset’s growth remains stable, and its inflation is predictable.

Consequently, no matter how much Hashrate the miners add to the network, they won’t become faster at mining blocks in the long term.

The extra computing power will initially make them earn rewards faster, but only until the next biweekly Difficulty adjustment, where the chain would make the miners’ job just hard enough to counteract any benefits of the extra power.

Since the rewards stay capped in this manner, an increase in the Hashrate means that the distribution of rewards between the individual power units becomes smaller.

Thus, whenever the total network Hashrate goes up, an individual miner has to increase their power by the same percentage to remain competitive with the chain.

In other words, the earlier mentioned “Hashcoin” goes up when the Hashrate rises. As the Hashrate has been near ATH recently, the Hashcoin has also been relatively high.

Looks like the value of the metric has spiked in recent days | Source: CryptoQuant

The chart shows that the Bitcoin Hashcoin has observed sharp growth recently and has hit a new ATH. But the Hashrate has been moving sideways, so where did this spike come from?

The answer lies in the fourth Halving, which occurred on April 19th. Whereas the Difficulty ensures the inflation rate of the asset remains constant, the Halving is a measure to cut this rate actively.

Block rewards are slashed in exactly half during these events, which take place roughly every four years, and that has naturally been the case with the latest one as well.

With the block rewards now halved, miners can only produce half as much as before, which is why the Hashcoin has spiked. Miners now need 1.13 EH/s to mine a single token every day.

BTC Price

At the time of writing, Bitcoin is trading at around $62,900, down 5% over the past week.

The price of the asset appears to have been moving down recently | Source: BTCUSD on TradingView

Featured image from Dmytro Demidko on Unsplash.com, Blockchain.com, CryptoQuant.com, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Pepe

Pepe