Quick Take

Bitcoin recently reached a year-to-date high of approximately $65,500 during European trading hours.

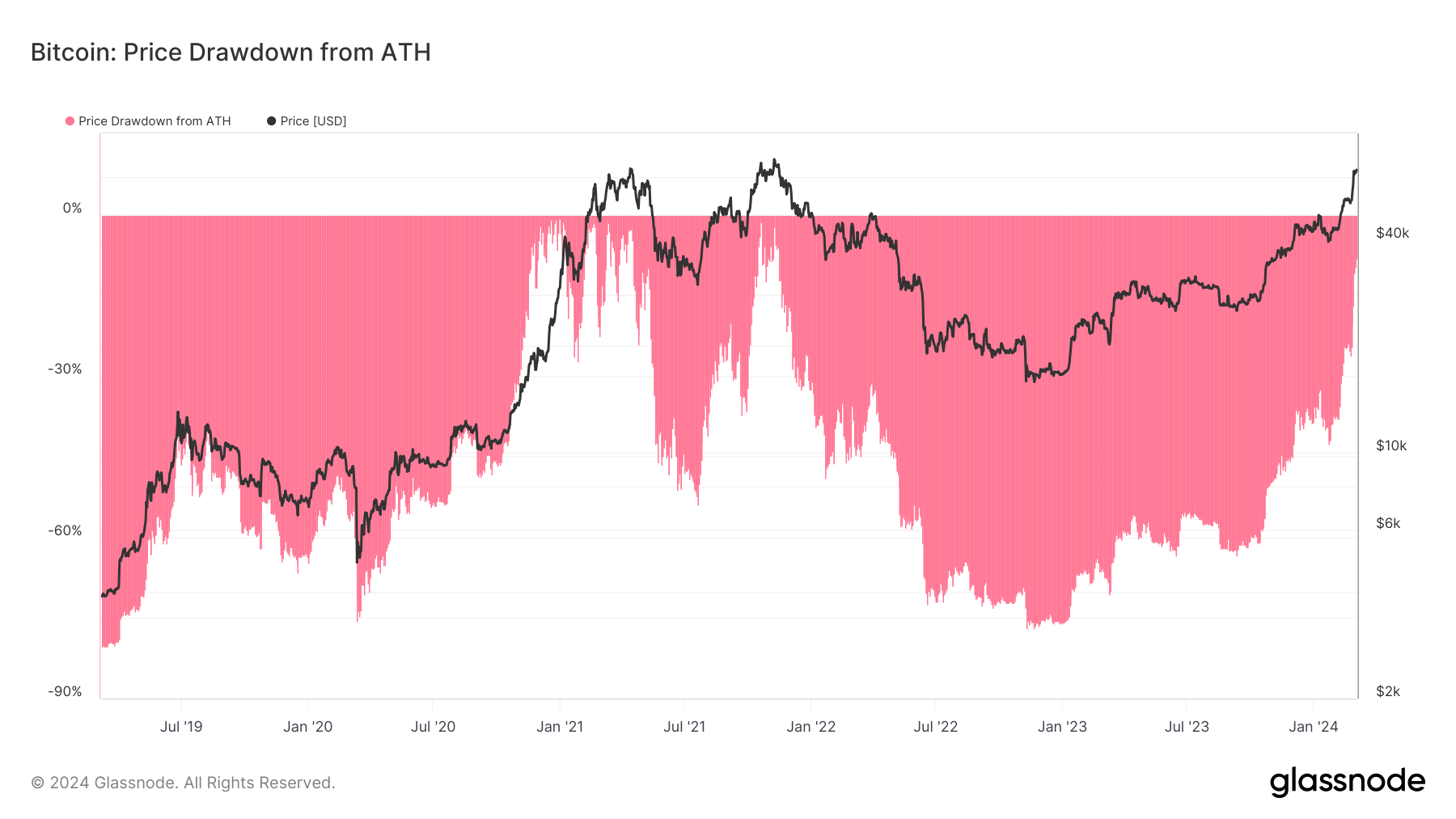

This resurgence brings Bitcoin within 8% of its all-time fiat value high of around $69,000, reached back in November 2021 (around 844 days ago). However, the journey upward has not been devoid of turbulence.

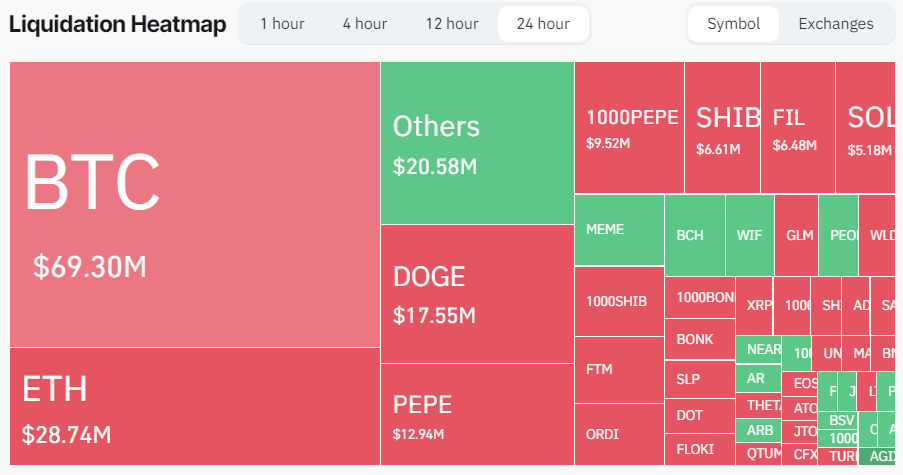

Recent data from Coinglass reveals that the digital asset ecosystem has suffered approximately $230 million in liquidations in the past 24 hours, with Bitcoin accounting for roughly $70 million, mainly driven by short positions equalling roughly $50 million.

It’s noteworthy to mention that Bitcoin has experienced a significant appreciation of approximately 44% year to date. In terms of nominal fiat value, this signifies a rise from $44,000 to a commendable $65,000.

Interestingly, Bitcoin’s rise comes before a “halving” event, a significant occurrence that has historically never been preceded by a Bitcoin all-time high.

The post Bitcoin passes $65,000 as liquidations surge and halving approaches appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor