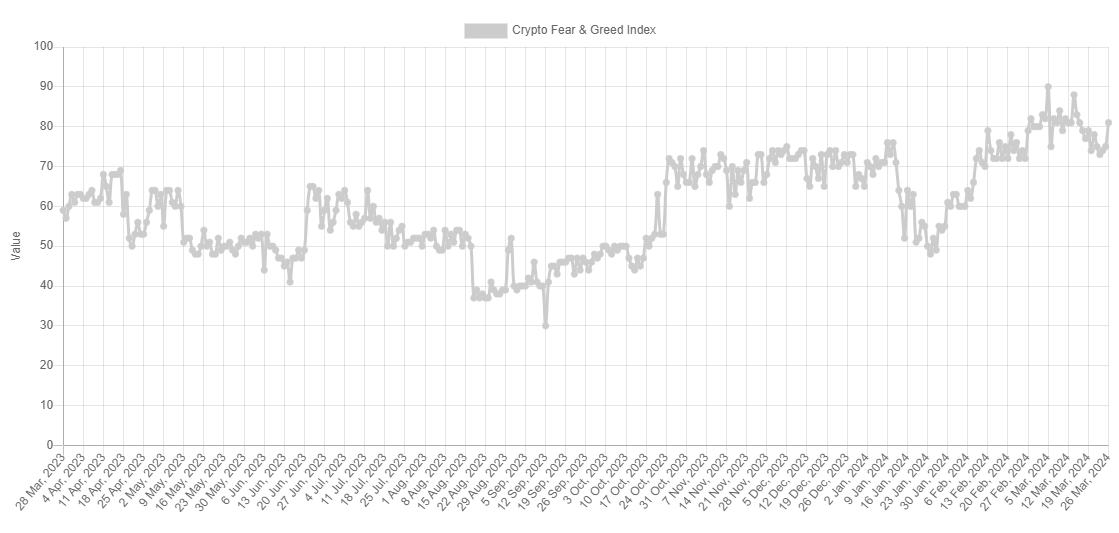

Data shows the Bitcoin market sentiment has returned to the extreme greed territory as BTC has registered its rally beyond the $71,000 level.

Bitcoin Fear & Greed Index Now Points To “Extreme Greed”

The “Fear & Greed Index” is an indicator made by Alternative that tells us about the general sentiment among the investors in the Bitcoin and wider cryptocurrency market.

This index represents the sentiment as a score between zero and hundred. To calculate this value, the indicator takes into account the data of these factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

When the indicator has a value of 46 or less, it means that the average investor holds a sentiment of fear right now. On the other hand, a value of 54 or more implies the market shares a majority mentality of greed. Naturally, the region in-between these two (47 to 53) corresponds to the neutral sentiment.

Now, here is what the latest value of the Bitcoin Fear & Greed Index looks like:

The index appears to have a value of 81 at the moment | Source: Alternative

As is visible above, the Bitcoin Fear & Greed Index is at 81 right now, meaning that it’s deep into the greed region. In fact, this value is so deep that it’s inside a territory known as “extreme greed.”

Extreme greed occurs when the index hits values higher than 75. Fear also has its own extreme region; this one occupying values under 25. Historically, these two sentiments have proven to be particularly significant for the market.

BTC and other assets in the sector have often tended to move in the opposite direction from what the majority expect. In the territory of the extreme sentiments, this expectation is naturally the strongest, and hence, the probability of a contrary move taking place is also the highest.

Because of this reason, major tops and bottoms in Bitcoin’s price have typically taken shape when the cryptocurrency has been inside the respective extreme zones.

Earlier in the month, the Fear & Greed Index had assumed especially high extreme greed levels, as the asset’s rally towards new all-time highs (ATHs) had occurred.

Two of the major tops in this period, including the current ATH, coincided with peaks in the indicator, implying that the overheated sentiment may have once again played a role.

Looks like the value of the metric has turned around in the past day | Source: Alternative

With the recent drawdown in the asset, though, the sentiment also cooled off and exited out of the extreme greed territory, as is visible in the above chart. In bullish periods, the sentiment retreading back to the normal greed region can be a positive sign for fresh upward moves to start.

And indeed, this has followed for the cryptocurrency this time as well, as its price has made notable recovery over the past couple of days. With the coin making a return back towards $71,000, the sentiment has also heated up again, hence why the index’s latest value is pointing at extreme greed.

The aforementioned tops from earlier in the month occurred at Fear & Greed Index values of 90 and 88, respectively, suggesting that the current extreme greed value of 81 may not be too high for another peak to be probable.

BTC Price

Bitcoin had broken above the $71,000 level earlier in the day, but the digital asset has since registered a bit of a pullback towards $70,700.

The price of the coin seems to have sharply risen over the past two days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, Alternative.me, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Sui

Sui  Canton

Canton  Avalanche

Avalanche  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Cronos

Cronos  USD1

USD1  Polkadot

Polkadot  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token