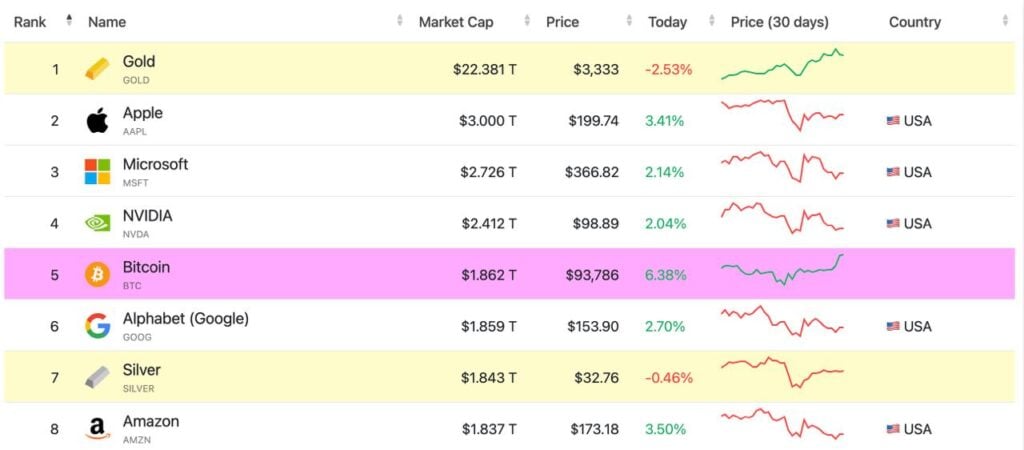

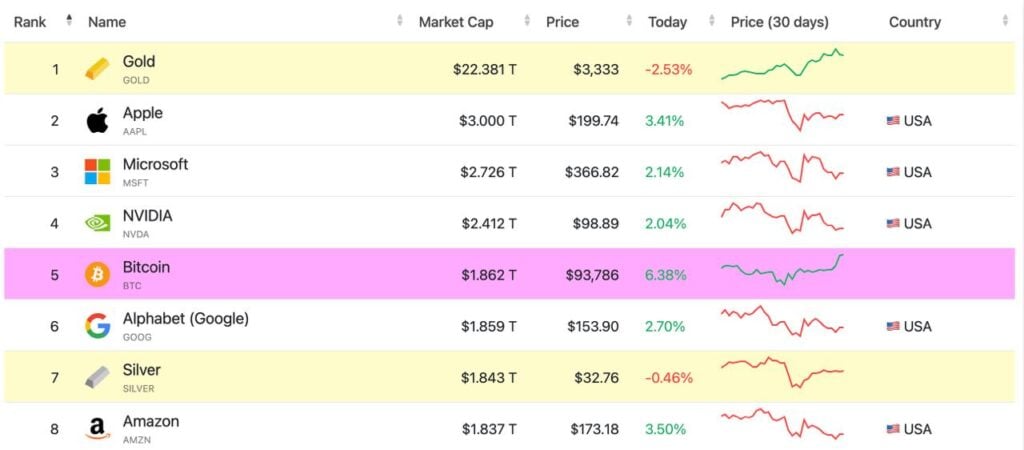

In a historic milestone, Bitcoin has surged past Google to claim a spot among the top 5 most valuable assets by market capitalization. This remarkable achievement underscores Bitcoin’s growing influence in the global financial landscape, sparking renewed confidence in its role as a transformative asset class.

Bitcoin Enters Top 5 Assets by Market Capitalization

On April 24, 2025, Bitcoin achieved a groundbreaking feat, surpassing Google’s market capitalization to secure a place among the world’s top five most valuable assets, as Companies Market Cap.

Source: Companies Market Cap

This milestone highlights the cryptocurrency’s meteoric rise amid a shifting economic environment. According to Standard Chartered’s head of digital assets research, Geoff Kendrick, Bitcoin’s upward trajectory closely relates to ongoing uncertainties surrounding the policies of the U.S. Federal Reserve. Kendrick remains bullish, reiterating his bold price predictions:

“This could be the catalyst for the next all-time high, and on that note, I reaffirm my current forecast for Bitcoin—$200,000 by the end of 2025 and $500,000 by the end of 2028.”

While Bitcoin’s climb into the top five may be temporary, its ability to compete with traditional giants like Google has bolstered confidence in its long-term potential. Investors and analysts alike view this achievement as a testament to Bitcoin’s growing legitimacy, challenging the dominance of conventional assets and reinforcing its appeal as a store of value.

Why Is Bitcoin Rising Among Centuries-Old Traditional Assets?

Several key factors drive Bitcoin’s ascent to the upper echelons of global assets.

First, it is increasingly considered a hedge against risks in traditional finance (TradFi) and U.S. Treasury bonds. According to a recent report by US Crypto News, Bitcoin’s appeal as a safe-haven asset has grown amid concerns over inflation, monetary policy uncertainty, and geopolitical tensions. Amid the escalating broader market trends, bitcoin, like many other hedging assets such as gold, which also reached new all-time highs, reflects investor caution in the face of global trade wars and economic instability.

Moreover, the rise of Bitcoin reflects a broader shift toward digital assets. Digital assets are now going to reach mass adoption, as institutional investors increasingly allocate capital to cryptocurrencies. Major financial institutions, once skeptical, are now embracing Bitcoin as a legitimate asset class. The recent flow of Bitcoin ETFs and the growing interest from institutional banks in Bitcoin and cryptocurrency in general are significant developments. Therefore, Bitcoin’s market capitalization is fueled, enabling it to outpace long-established corporations like Google.

The surge in Bitcoin’s value also underscores a cultural and technological shift. As digital assets gain traction, they are reshaping how investors perceive wealth and value. Unlike traditional assets tied to physical or corporate structures, Bitcoin operates on a decentralized blockchain, offering transparency and resilience in an era of economic uncertainty. This unique positioning has made it a focal point for those seeking alternatives to conventional financial systems.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor