Bitcoin’s stint at its new all-time high of $108,200 was short-lived. In less than a week, its price dropped by over 12%, reaching $95,000 on Dec. 23.

While pullbacks ranging from 20% to as high as 30% are commonplace dulling bull rallies, this price reversal was accompanied by a cascade of long liquidations, which further amplified the downward price pressure over the weekend.

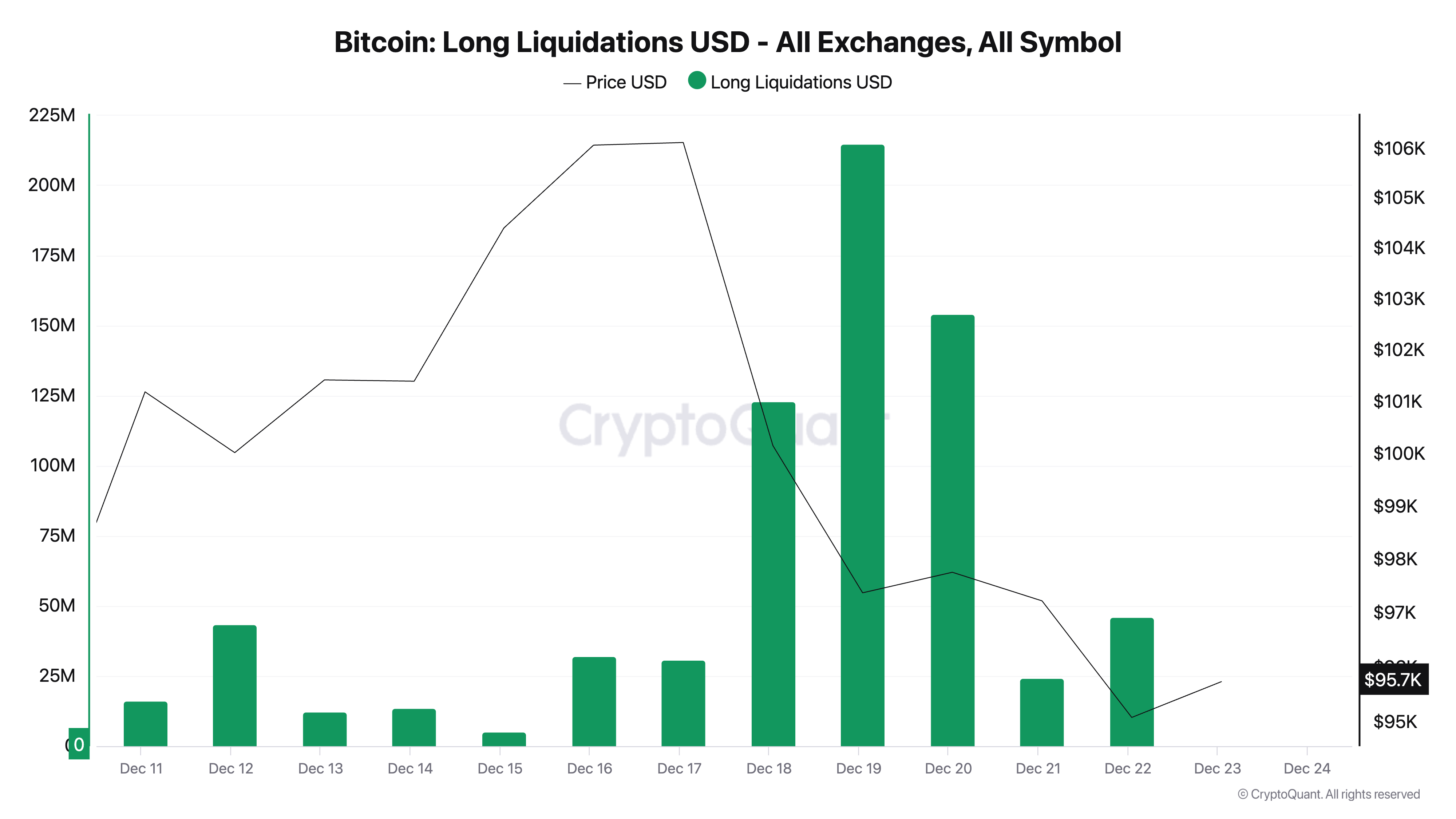

Between Dec. 17 and Dec. 22, over $540 million in long positions were liquidated across exchanges. The largest single day for liquidations was Dec. 19, when approximately $214 million in longs were wiped out.

The number of liquidations we’ve seen in the past week shows the risks of overleveraged trading. As soon as BTC began to retrace from its ATH, traders with high-leverage long positions were forced to close their positions as their margin levels were quickly breached. These forced liquidations added to the selling pressure, accelerating Bitcoin’s decline below the key psychological support of $100,000.

Long liquidations occur when the price of an asset drops below a trader’s liquidation threshold, often set by the level of leverage they use. The more leverage, the smaller the price movement needed to trigger a liquidation.

In this case, Bitcoin’s steep drop triggered a wave of liquidations as the market deleveraged. The Federal Reserve’s tighter monetary policy likely contributed to the sell-off by dampening investor sentiment and increasing market volatility. Once Bitcoin failed to maintain its price above $100,000, the subsequent liquidation cascade turned what might have been a controlled pullback into a sharper decline.

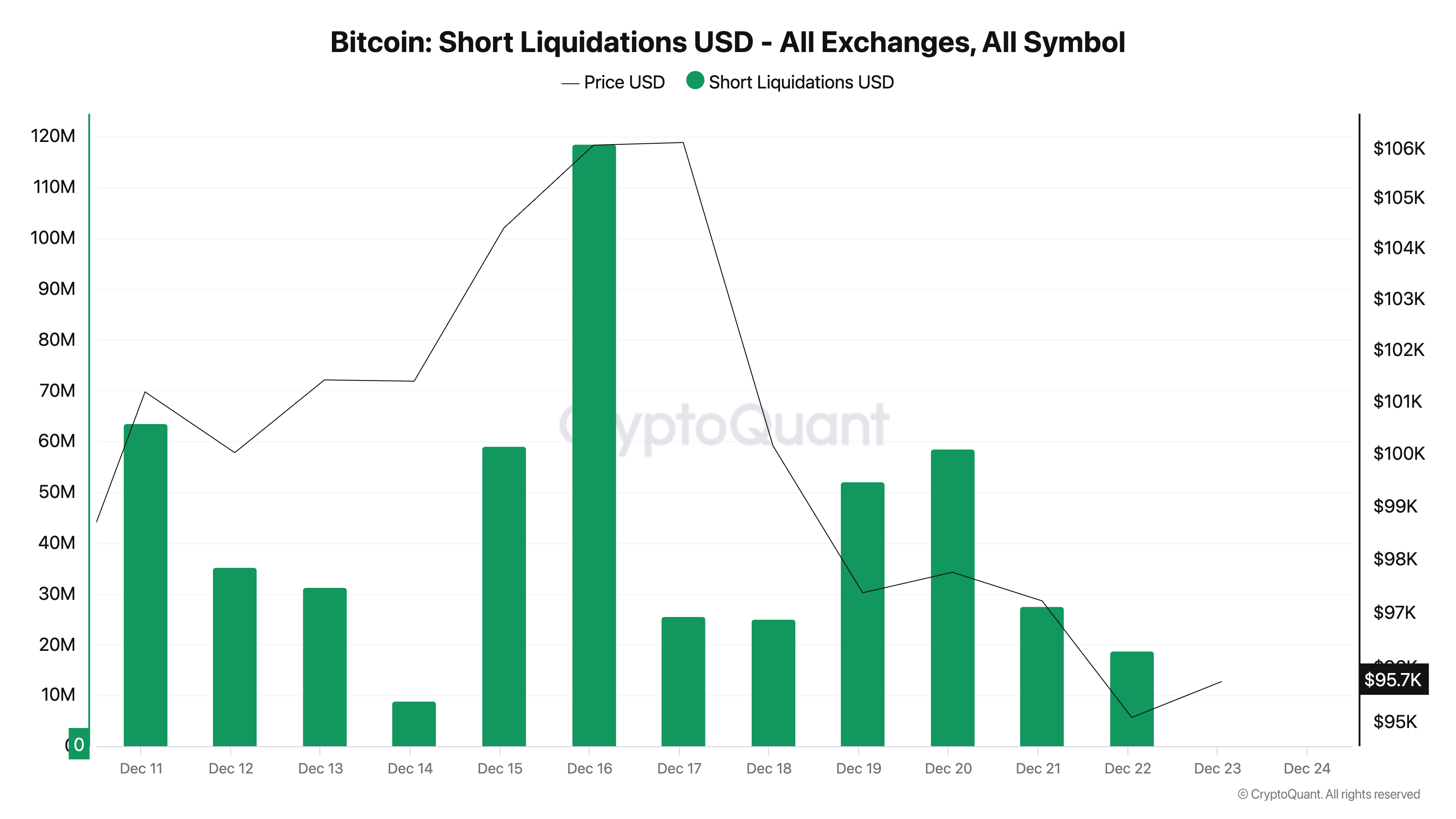

While long liquidations dominated during the price drop, it’s also important to analyze the earlier spike in short liquidations that occurred on Dec. 16, just as Bitcoin was approaching its all-time high. That day, approximately $120 million in short positions were liquidated as Bitcoin surged toward $108,200.

This move invalidated bearish bets made by traders who expected the rally to falter. The rapid price increase triggered a short squeeze, forcing traders to close their positions by buying Bitcoin, which in turn added upward pressure on the price.

The contrast between longs and shorts shows the role leverage plays in shaping price movements during periods of volatility. Longs, which totaled $540 million, far exceeded the $120 million in short liquidations, reflecting how market sentiment had shifted from over-optimism to a sharp correction.

Short liquidations peaked during the rally as bearish traders misjudged the strength of the bullish momentum. In contrast, long liquidations intensified during the sell-off, as bullish traders found themselves overextended when the price reversed.

The timing and magnitude of these liquidations also offer insights into trader behavior. Short liquidations occurred as Bitcoin reached new highs, indicating that some market participants underestimated the rally’s strength. On the other hand, the long liquidations during the price drop show that a significantly higher number of traders were caught off guard by the speed and depth of the correction, particularly as Bitcoin broke below $100,000.

Comparing the two trends, it’s evident that Bitcoin’s rally and subsequent drop were heavily influenced by leveraged positions. The short liquidation spike on Dec. 16 contributed to the rally’s momentum, pushing Bitcoin to its all-time high. However, the long liquidations that followed were far more significant in terms of market impact, driving Bitcoin’s price down by over 12% within a few days.

The post Bitcoin tumbled to $95k after $540 million in long liquidations appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Canton

Canton  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore