Onchain Highlights

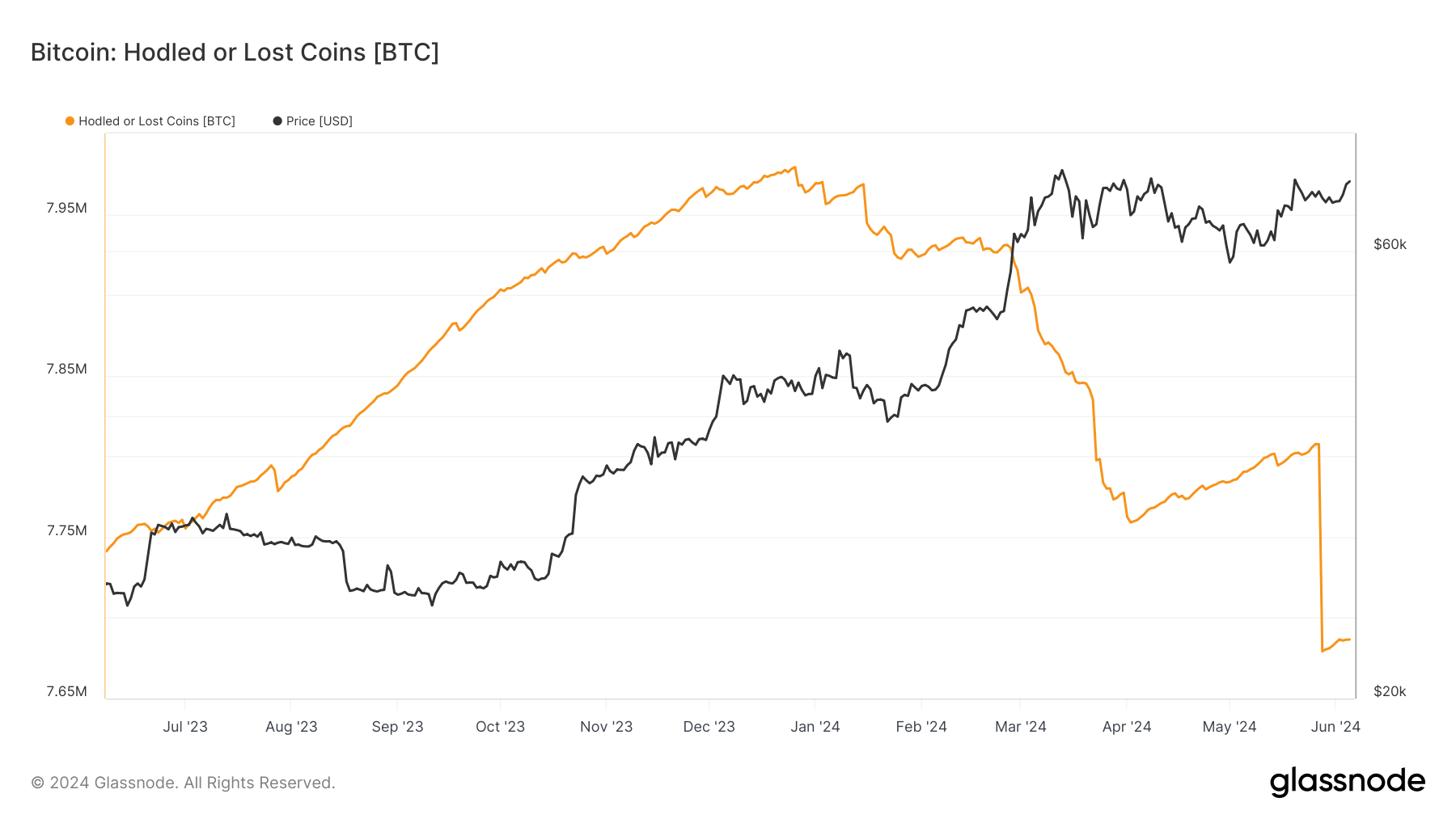

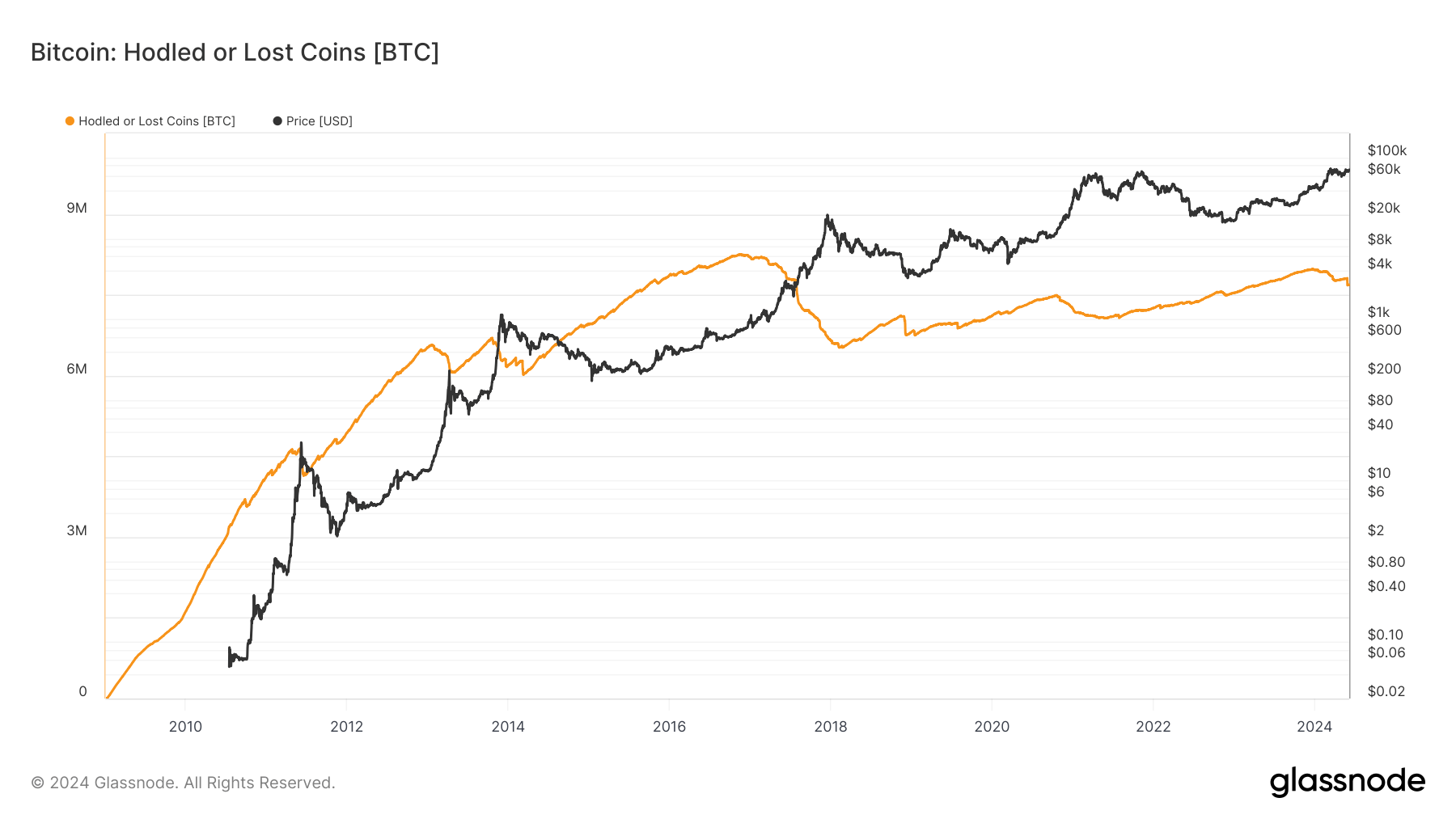

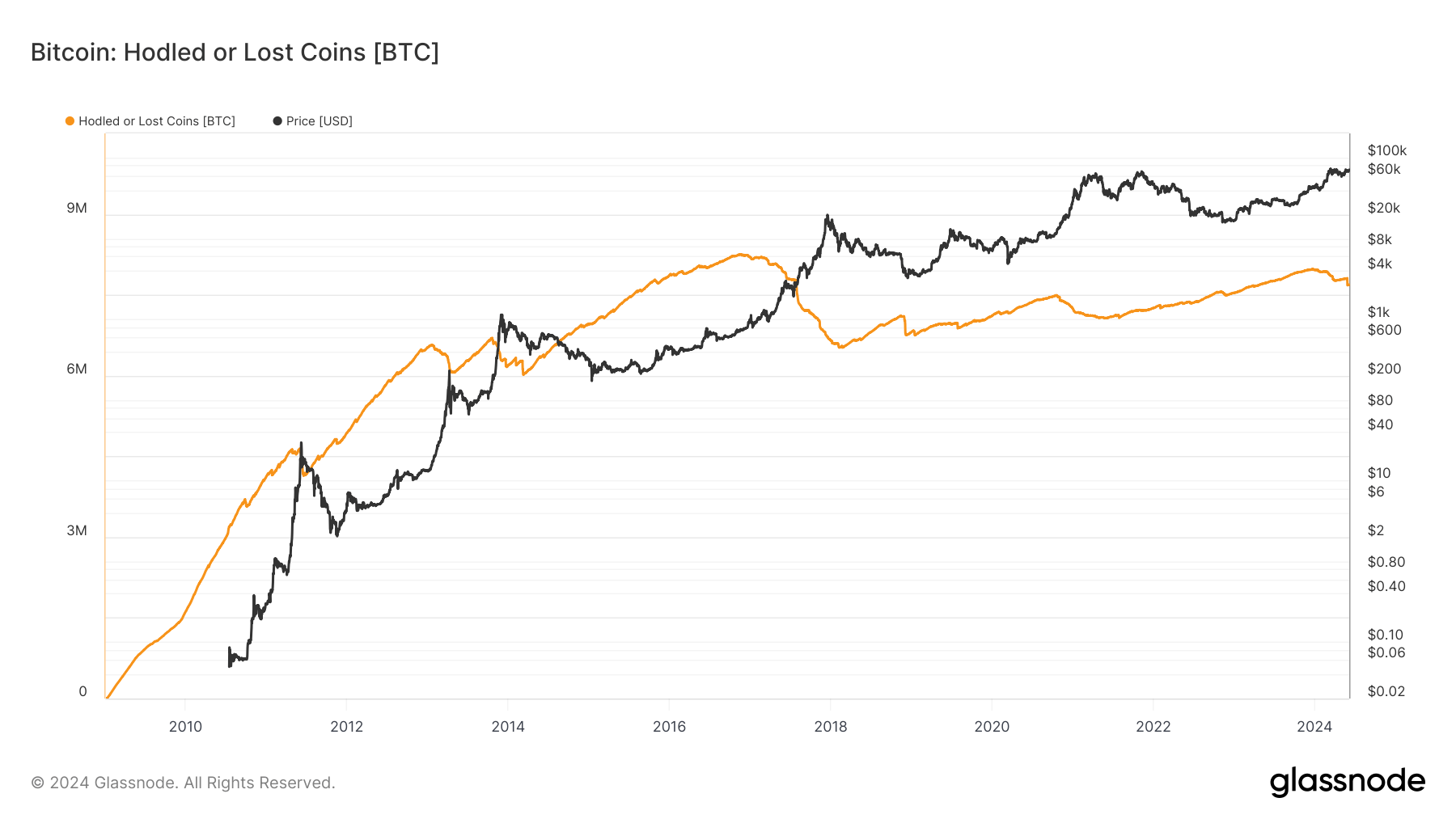

DEFINITION: Lost or HODLed Bitcoins indicate moves of large and old stashes. They are calculated by subtracting Liveliness from 1 and multiplying the result by the circulating supply.

Bitcoin’s “Hodled or Lost Coins” metric, as tracked by Glassnode, has reached notable levels, reflecting long-term trends in investor behavior. Glassnode estimates approximately 7.7 million BTC are either hodled or lost, significantly impacting the circulating supply and market forces.

In recent months, the metric has shown a decrease in hodled or lost coins, particularly in 2024. This shift suggests a possible reallocation of Bitcoin holdings as investors respond to market conditions post-halving. The last significant decline was in May, coinciding with Mt. Gox moving Bitcoin to a new wallet. Since January, there has also been a gradual decline, correlating with selling pressure from Grayscale, which held Bitcoin that may have been considered ‘hodled.’

Glassnode’s data highlights that periods of increased hodling typically correlate with reduced sell pressure, potentially leading to bullish price action. For example, during previous bear markets, increased hodling often preceded significant price recoveries.

Per CryptoSlate’s analysis, the current trend may reflect strategic decisions by long-term holders to retain or consolidate their positions in anticipation of future market movements (CryptoSlate). This behavior emphasizes the importance of monitoring on-chain metrics to understand broader market sentiments and investor strategies.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Canton

Canton  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Tether Gold

Tether Gold  Uniswap

Uniswap  Mantle

Mantle