Quick Take

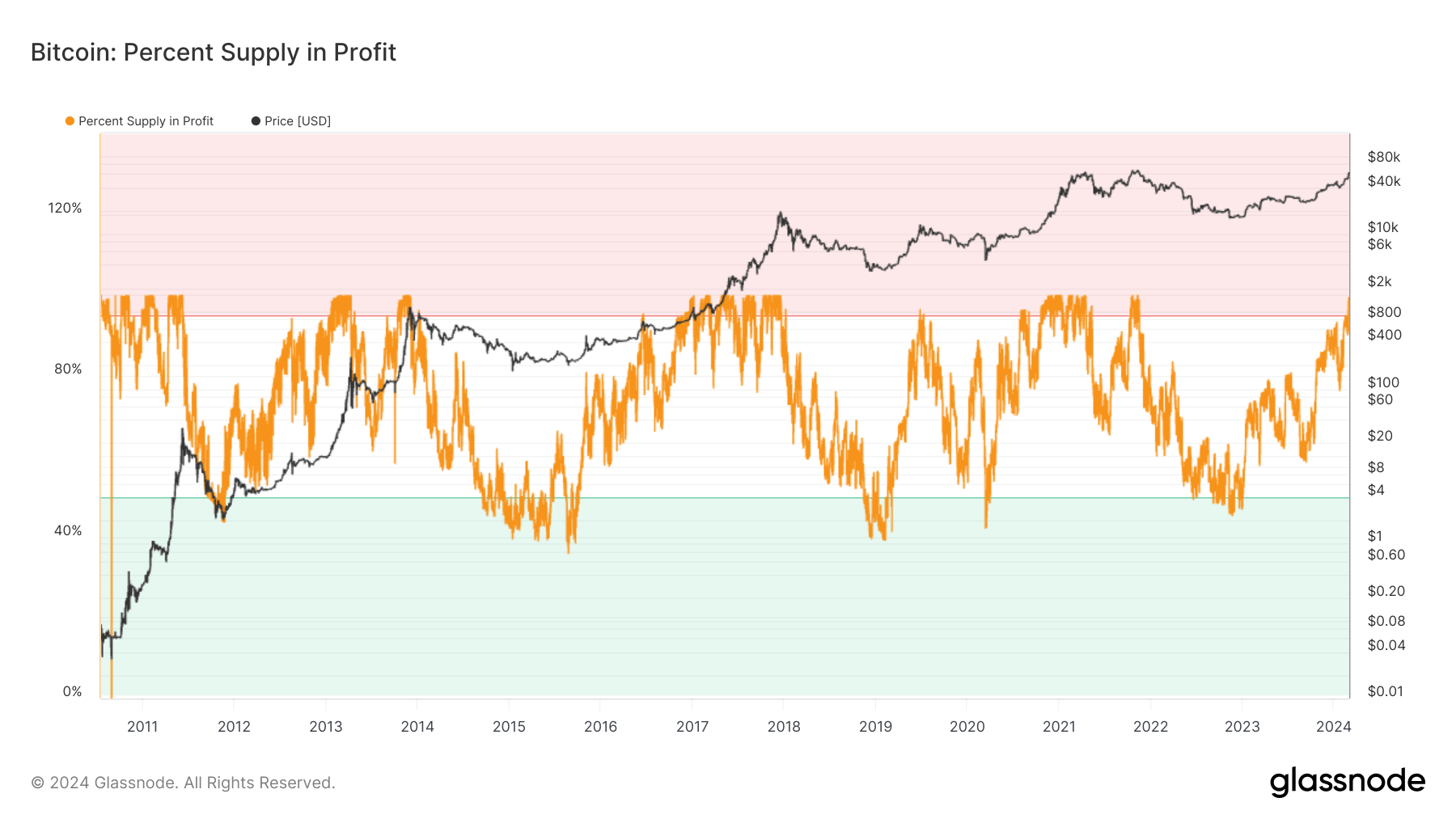

The past week saw Bitcoin reach a yearly high, hitting $64,000, causing the circulating supply in profit to reach a staggering 99.6%. Notably, on Feb. 26, we observed the supply in profit elevate above 95% for the first time since November 2021, according to Glassnode.

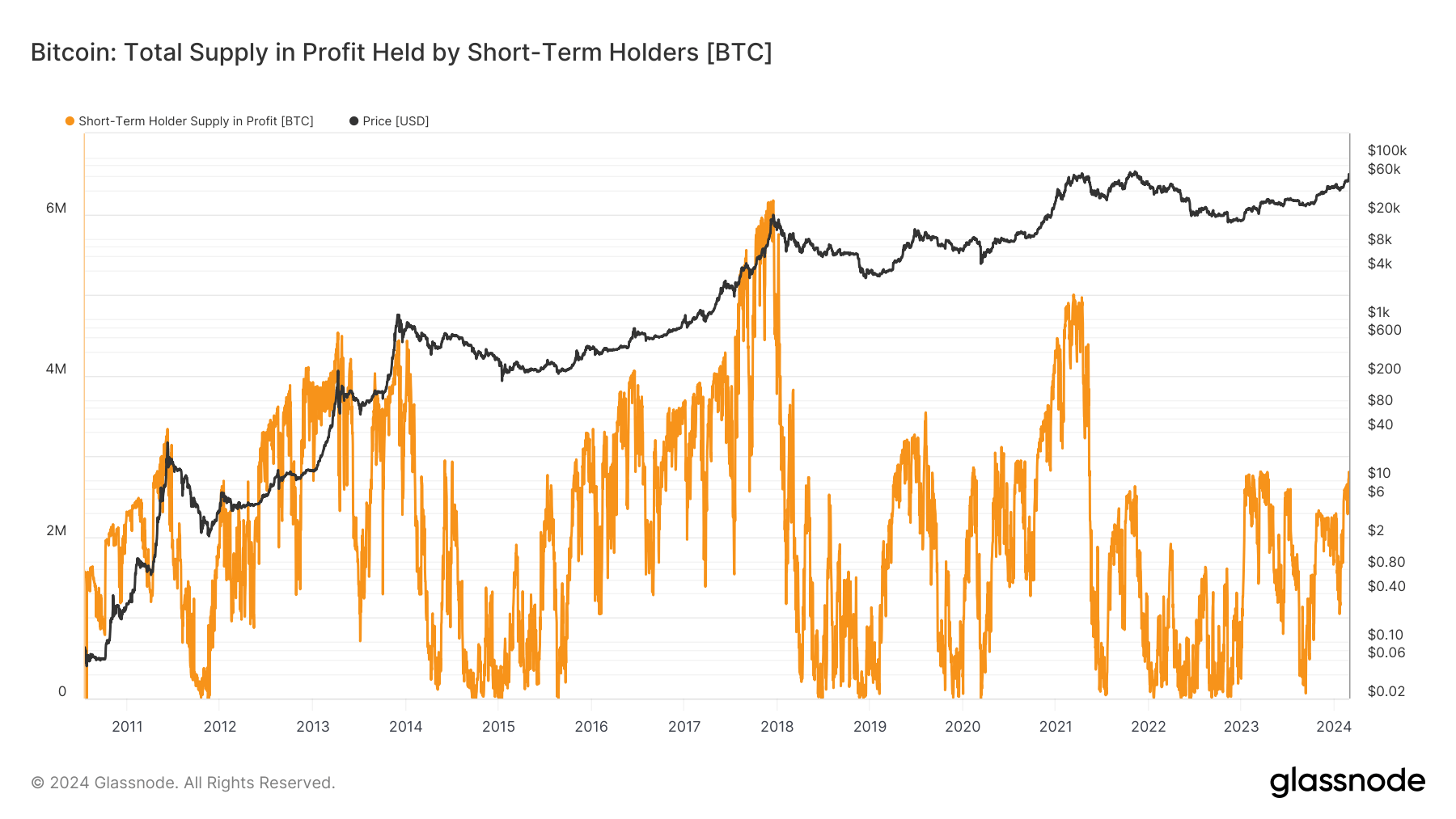

As Bitcoin’s price appreciated from $51,000 to $64,000 this week, a wave of profit-taking was triggered. Short-term holders, those holding Bitcoin for less than 155 days, transferred $3 billion in profits to exchanges. This forms part of a 128-day streak of realized net profits, indicative of the current market regime.

Interestingly, these short-term holders only account for 2.83 million BTC, with approximately 2.7 million being in profit, according to Glassnode.

Looking back at previous bull runs, we’ve seen figures as high as 4 and 6 million BTC in profit from short-term holders. This disparity highlights the potential for growth as short-term holders continue to buy Bitcoin.

The post Bitcoin’s surge to yearly high marked 99.6% of its supply in profit appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Pepe

Pepe