BlackRock’s iShares Bitcoin Trust ETF (IBIT) has become the fastest-growing ETF in history, exceeding $30 billion in assets under management.

According to Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, IBIT reached this milestone in just 293 days, setting a new record. This pace surpasses the JPMorgan Equity Premium Income ETF (JEPI) and major Gold ETFs’ growth rates, reaching the $30 billion threshold in 1,272 days and 1,790 days, respectively. CryptoSlate predicted the ETF’s performance would outpace Gold ETFs in January.

Bloomberg data reveals that IBIT’s market valuation crossed $30 billion following substantial inflows and Bitcoin’s price appreciation on Oct. 29. The fund currently holds more than 417,000 Bitcoin, representing about 2% of the total Bitcoin supply.

Bitcoin community member Sani observed that BlackRock’s IBIT could accumulate up to 500,000 Bitcoin by the end of 2024 if its current growth continues. If achieved, this would make IBIT the third-largest Bitcoin holder worldwide, following only Coinbase and Binance.

Growing institutional demand

The success of BlackRock’s ETF aligns with a surge in institutional demand for Bitcoin.

As of Oct. 29, the ETFs cumulatively reported a daily net inflow of $870 million, with BlackRock’s IBIT leading the flow. Other leading funds are also experiencing strong interest, with Fidelity’s FBTC receiving $133.86 million in net inflows, while Bitwise’s BITB attracted $52.49 million.

Meanwhile, VanEck’s HODL, Ark, and 21Shares’ ARKB recorded inflows of $16.52 million and $12.39 million, respectively. The remaining spot Bitcoin ETFs saw no inflows on that day.

Nate Geraci, president of the ETF Store, highlighted that this level of inflow marks the third-highest daily inflow for spot Bitcoin ETFs since their launch in January.

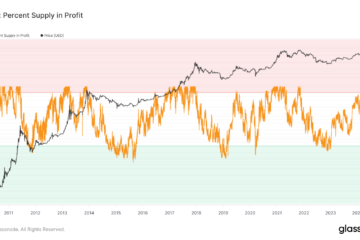

According to research firm CryptoQuant, these impressive numbers reflect a broader trend of institutional interest in Bitcoin.

Ki Young Ju, the firm’s founder and CEO, noted that over the past year, about 278,000 BTC—primarily from retail investors—flowed into US spot ETFs.

During the same period, approximately 670,000 BTC moved into “whale” wallets holding over 1,000 BTC, excluding those on exchanges and mining pools. Ju explained that this trend indicates institutional demand in custodial wallets is roughly double that of retail investors.

This surge highlights the expanding role of institutional investors in the Bitcoin market, with major funds like BlackRock’s IBIT setting the pace.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  Hedera

Hedera  Shiba Inu

Shiba Inu  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle