The cryptocurrency market continues to captivate investors worldwide, with a total market capitalization of approximately $3.51 trillion as of May 12, 2025. Bitcoin (BTC), Ethereum (ETH), and XRP remain at the forefront of investor attention, alongside other large-cap cryptocurrencies.

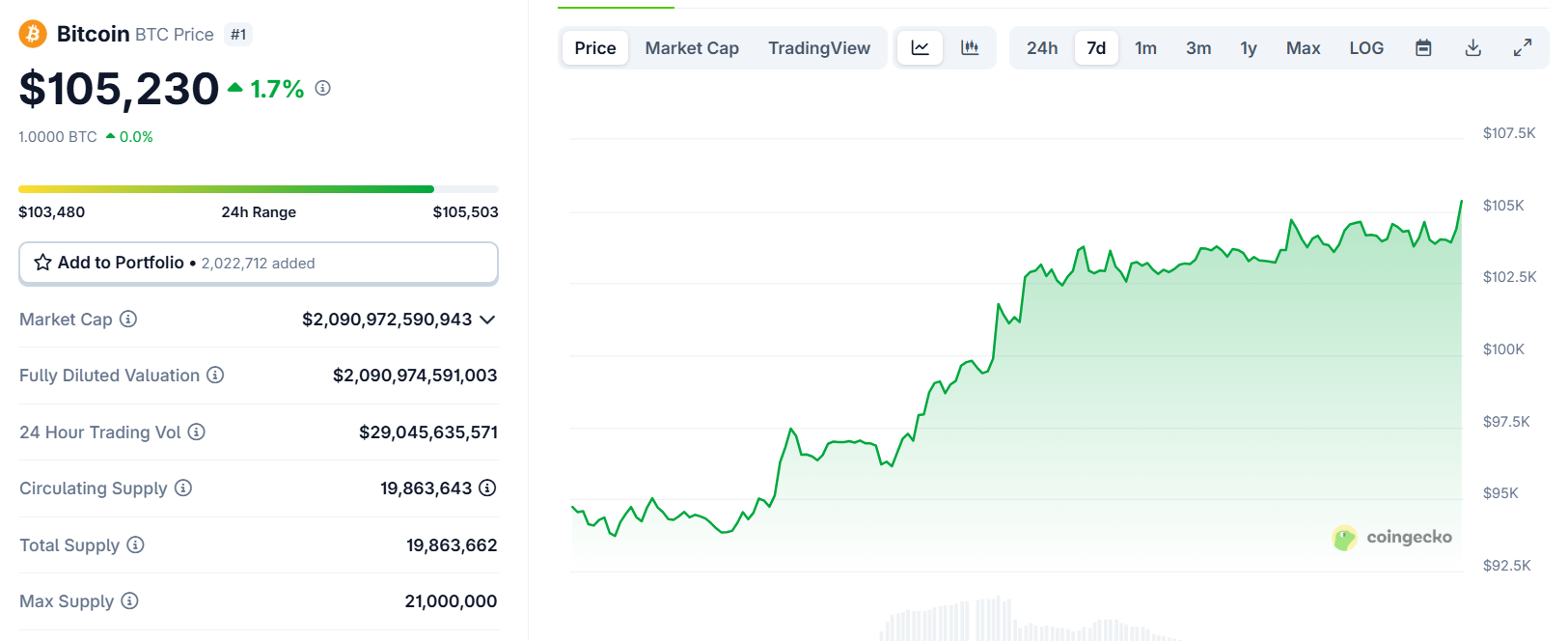

Bitcoin Remains Stable Near $105k

Bitcoin, the flagship cryptocurrency, is trading at around $106,000, up 2% on the day. Its market dominance stands at 59.6%, underscoring its pivotal role in dictating market sentiment. The momentum is driven by optimism around macroeconomic developments and U.S. policy shifts, including discussions of a strategic Bitcoin reserve.

Source: CoinGecko

However, Bitcoin has since pulled back, with analysts noting low volatility—a 563-day low—suggesting a potential cooling-off phase. The immediate resistance lies at $97,000, with the psychological $100,000 barrier looming large. If bullish momentum resumes, analysts project a push toward $107,000, while support holds firm at $85,645.

Read more: CryptoQuant CEO: “A New Era for Bitcoin has Begun”

Market sentiment remains cautiously optimistic, bolstered by institutional adoption and ETF inflows, though concerns about macroeconomic uncertainties, such as U.S. trade policies, could introduce volatility.

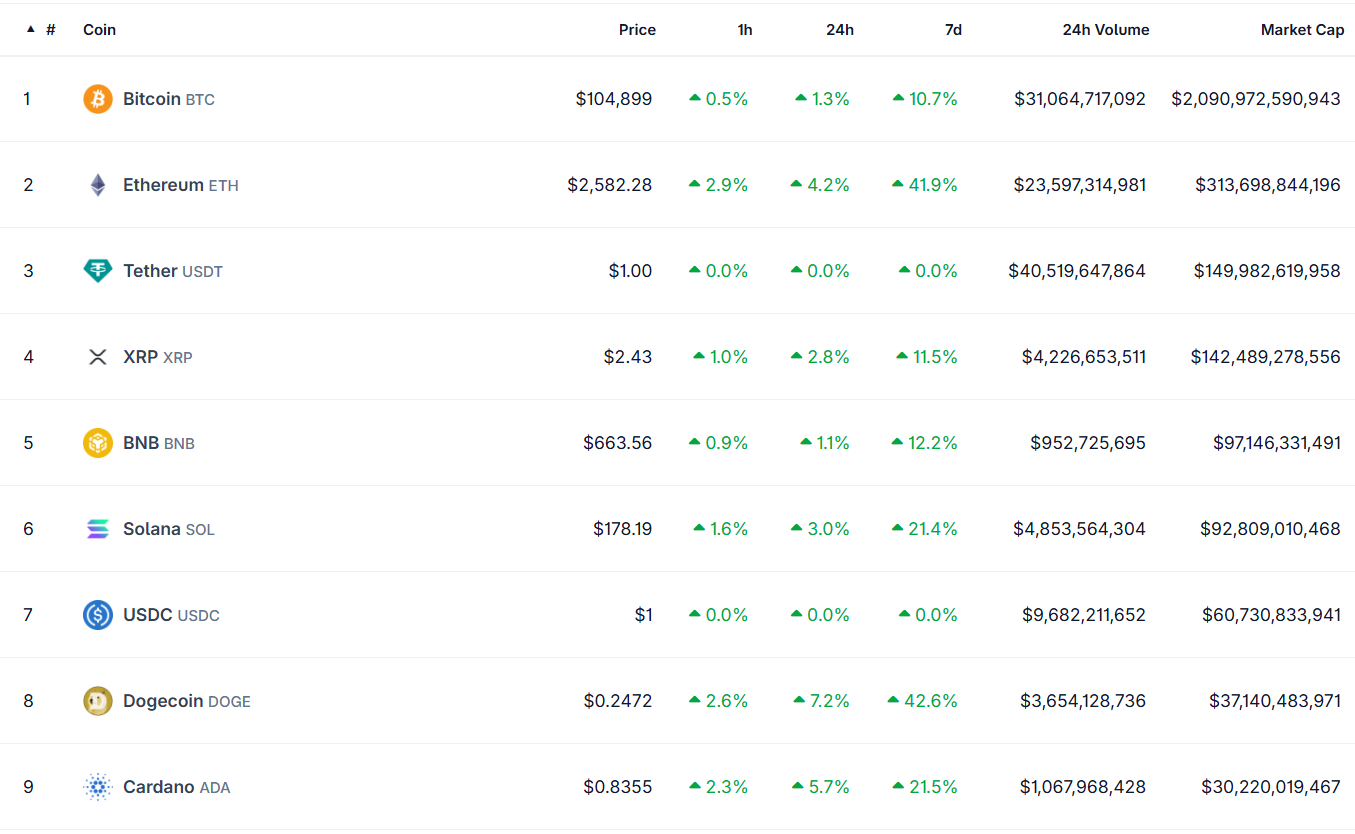

Ethereum’s Market Capitalization Surpasses Coca-Cola

Ethereum, the second-largest cryptocurrency by market cap, is priced at approximately $2,500, reflecting a robust 40% weekly gain and a daily increase of 4%. With a market cap of $311 billion, ETH has surpassed Coca-Cola’s market value, ranking 40th in the top global asset market capitalization.

Source: CoinGecko

The recent rally is partly attributed to anticipation for the Pectra upgrade and positive market sentiment following Bitcoin’s upward movement.

$ETH‘s market cap has surpassed Novo Nordisk and is looking at Coca-Cola, Alibaba and BOA.$ETH is currently the 36th largest asset in the world. pic.twitter.com/bCYdWzAIja

— CW (@CW8900) May 12, 2025

Technical indicators suggest Ethereum is testing resistance around $2,500, with potential to reclaim its multi-month high of $2,600 if bullish momentum persists. However, analysts warn of possible pullbacks to $1,500 if liquidity issues arise.

Vitalik Buterin’s recent comments on improving rollup security have highlighted ongoing development efforts, reinforcing long-term confidence in Ethereum’s ecosystem. Despite occasional underperformance compared to Bitcoin, ETH’s role as a smart contract platform continues to drive institutional interest, with ETF outflows recently stabilizing.

Read more: BlackRock Proposes Ethereum ETF Staking, Boosting ETH Price

All Eyes on Altcoin Season

Other large-cap cryptocurrencies, such as XRP, Solana (SOL), Binance Coin (BNB), exhibit varied performance. Solana is trading at $179, up slightly but struggling to regain its $200 highs from earlier in 2025. Analysts forecast a wide range for SOL in 2025, from $122 to $490, contingent on continued scalability improvements. BNB maintains stability, with market caps comparable to XRP, though they lack the same upward momentum.

Source: CoinGecko

The broader altcoin market is showing signs of life, with decreasing USDT dominance indicating investors are shifting funds from stablecoins to riskier assets like ETH and XRP. However, an “Altcoin Season” remains elusive, as Bitcoin’s dominance continues to suppress smaller rallies. Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) are also gaining traction, driven by social media buzz, but their volatility makes them less reliable for sustained gains.

The crypto market is navigating a complex landscape shaped by macroeconomic factors, regulatory developments, and technical trends. The Fear & Greed Index is neutral at 51, reflecting uncertainty among investors. U.S. policies under the Trump administration, including a proposed strategic crypto reserve featuring BTC, ETH, XRP, and SOL, have sparked both optimism and debate. Meanwhile, global trade tensions and potential tariff wars could dampen bullish sentiment, as seen in March 2025 when BTC dropped below $83,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Pepe

Pepe  Bittensor

Bittensor