In a major move for the digital asset community, Castle Crypto has announced the acquisition of NFT-Stats.com, a leading portal for NFT market analytics. This integration combines one of the most extensive data dashboards monitoring the worldwide NFT ecosystem with Castle Crypto’s knowledge of blockchain media and cryptocurrency. Together, Castle Crypto will be able to advance NFT stats coverage and provide investors, collectors, and fans with a more comprehensive, transparent, and useful understanding of the market.

Why This Deal Matters

The NFT market is frequently characterized as erratic, quick-moving, and challenging to monitor in real time. Projects have fluctuated nearly instantly, from the peak of 2021 to the cyclical declines and recoveries of 2023–2025. Making sense of the cacophony now requires having reliable, precise statistics; it is no longer a choice.

With this acquisition, Castle Crypto gains access to detailed metrics on trading volumes, sales, transactions, collections, and blockchain-level performance across Ethereum, Solana, Polygon, Arbitrum, Base, BNB Chain, and beyond. The synergy will not only benefit Castle Crypto’s readers but also expand its influence as a go-to hub for professional-grade Web3 intelligence.

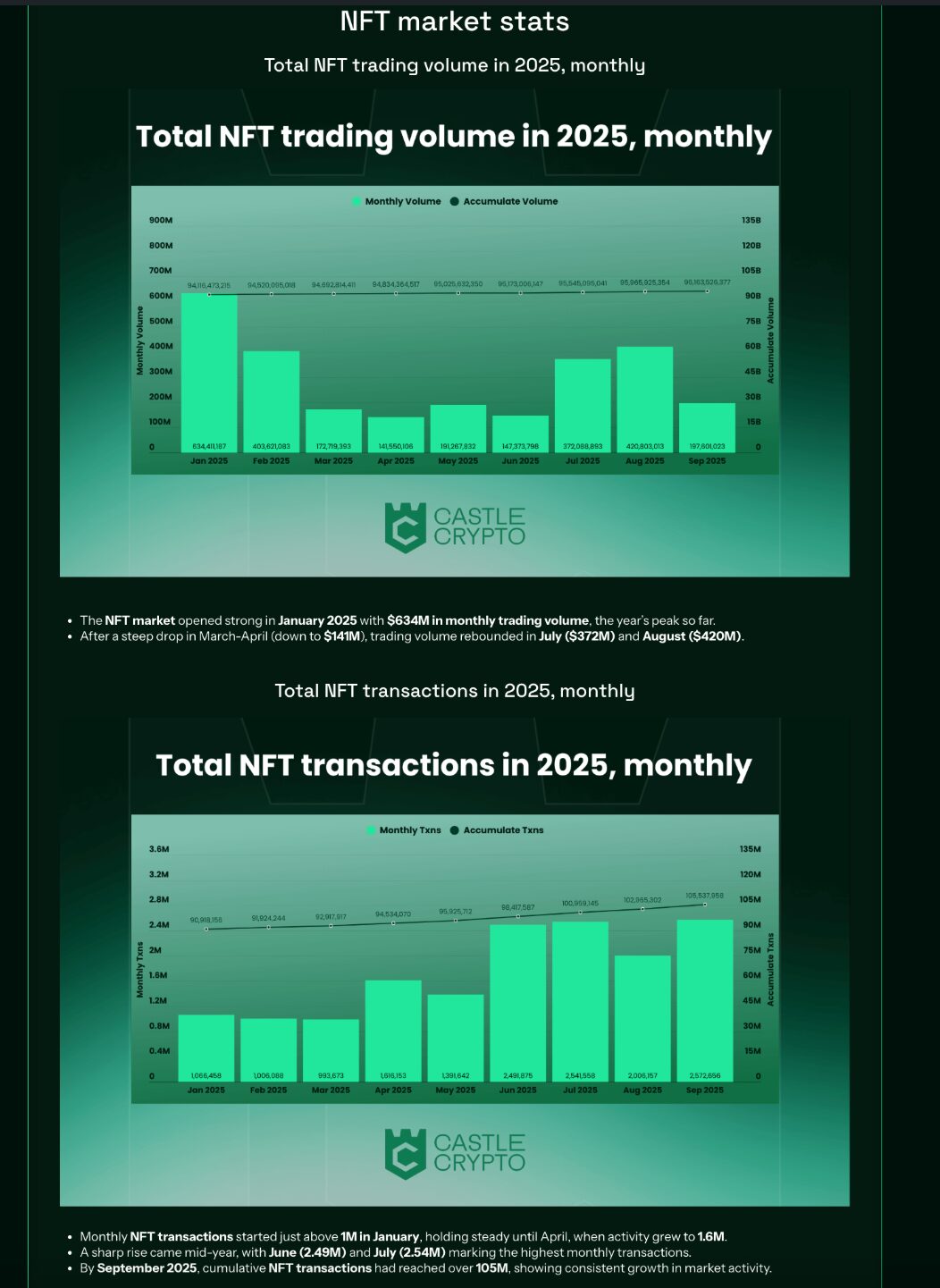

A Market Defined by Highs and Lows

The NFT ecosystem in 2025 illustrates how quickly fortunes can shift. Trading volumes, for example, reached a yearly peak of $634 million in January, only to plunge to just $141 million by March–April. A sharp rebound in midsummer saw volumes recover to $372 million in July and $420 million in August, underscoring the cyclical nature of the space.

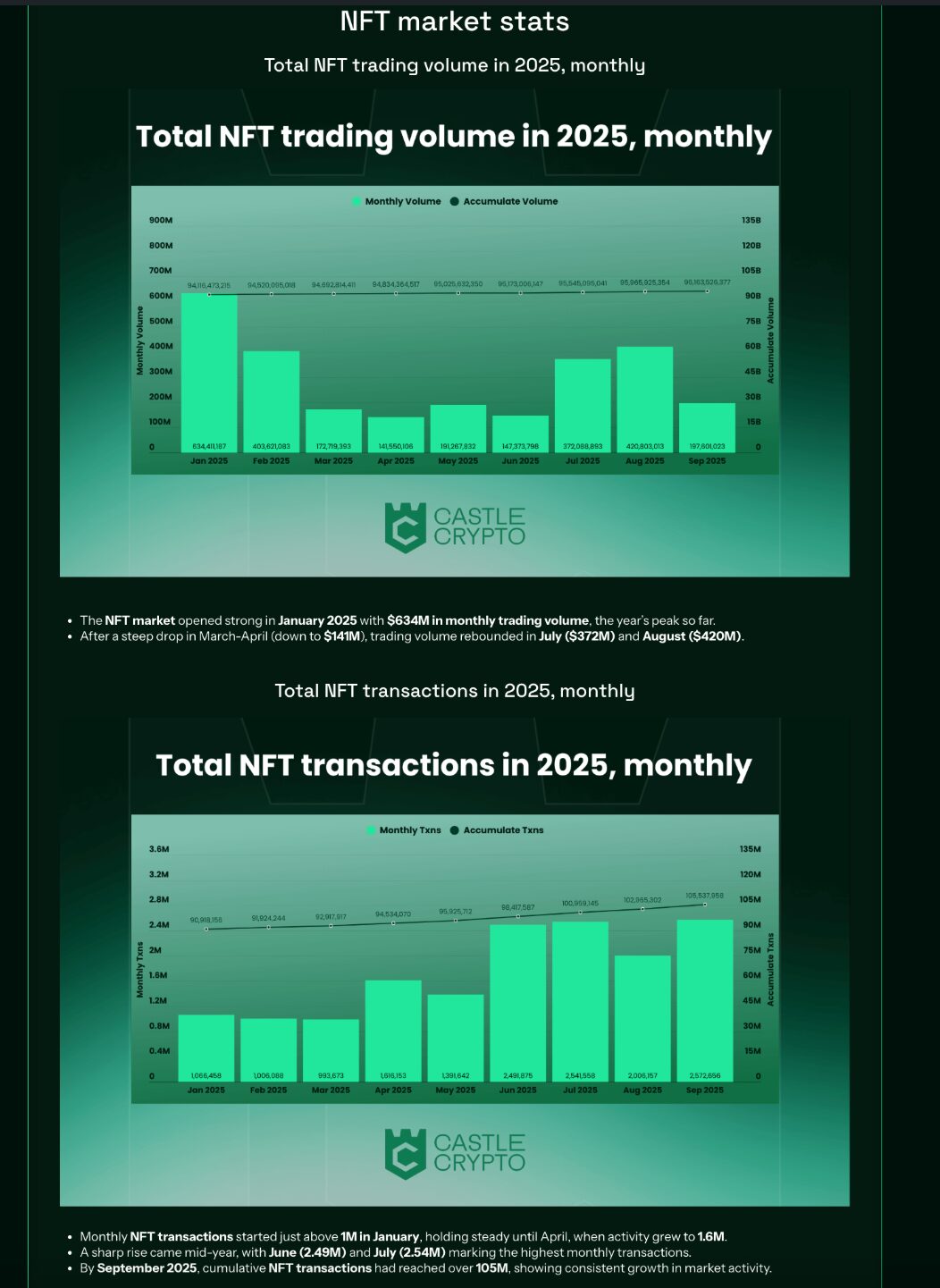

Transaction counts tell a similar story. Monthly activity began at roughly 1 million transactions in January, accelerated to 1.6 million by April, and spiked above 2.5 million during June and July. By September, cumulative transactions exceeded 105 million, proof that despite volatility, engagement continues to expand.

Sales, however, reveal the fragile side of demand. The market peaked in April but dropped significantly afterward, with late-summer activity barely reaching 1–4 million sales per month. The imbalance between buyers and sellers was especially pronounced in spring, although the second half of the year saw the two sides nearly equalize at around 450,000 each by September.

Multi-Chain Competition and Expansion

Ethereum remains the undisputed heavyweight, commanding $90.93 billion in total trading volume and more than 38 million transactions. Yet the story of 2025 is not just Ethereum’s dominance but the rapid emergence of challengers.

- Solana generated $2.48 billion in volume with notable spikes on Magic Eden, though activity cooled sharply in Q3.

- Polygon processed over 22.9 million transactions, cementing its role as a high-velocity, lower-cost hub.

- Base, a relative newcomer, surpassed 10 million transactions and delivered 124 billion sales in January before settling into steadier levels later in the year.

- BNB Chain’s transactions collapsed from around 1,000 in April to only 36 by September, while Arbitrum’s volume dropped from $6.8 million in January to just $1.8 million in September. Both companies found it difficult to sustain their momentum.

This cross-chain competition shows that while Ethereum sets the benchmark, the NFT market is far from monolithic. Each network cultivates unique communities, marketplaces, and use cases.

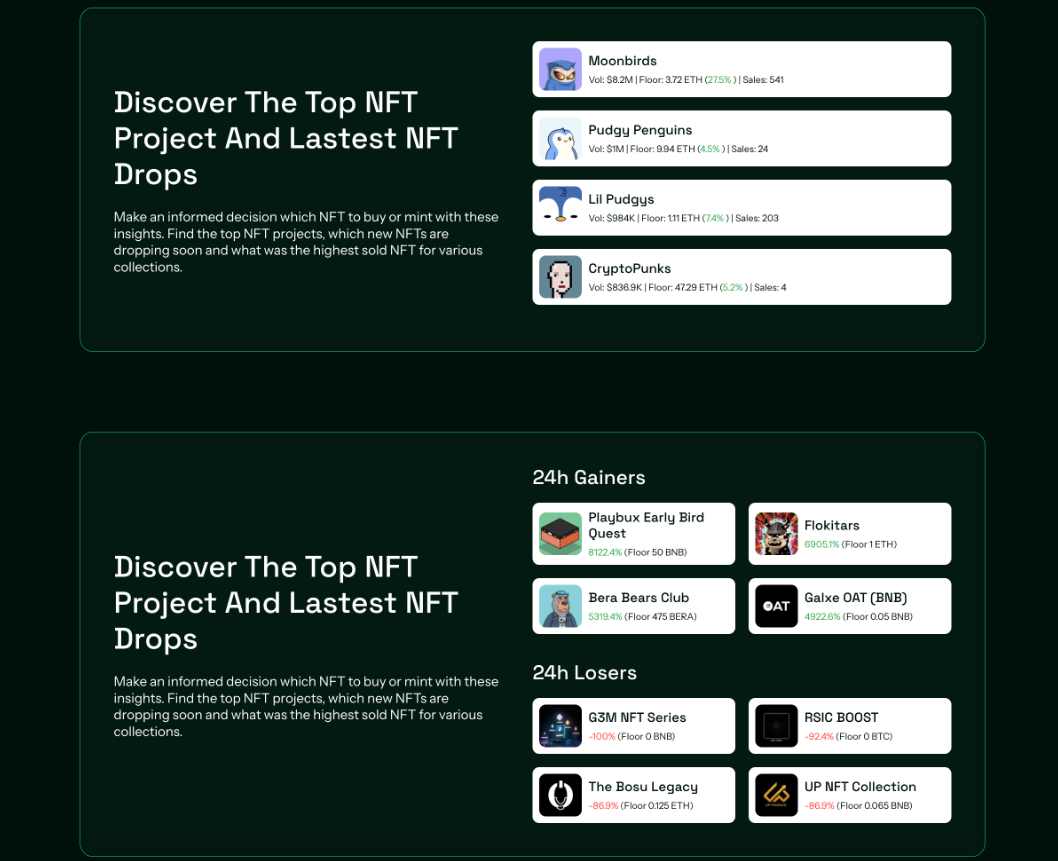

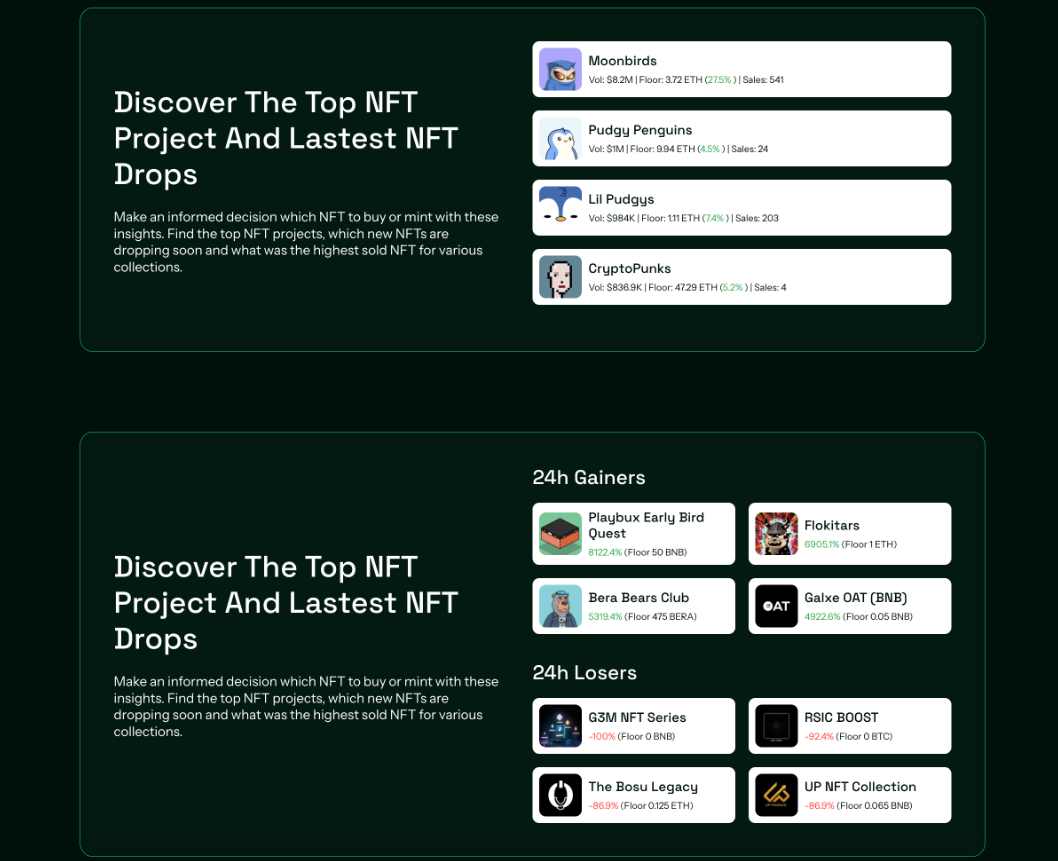

Blue Chips and Rising Stars

NFT collections provide another lens on market health. Legacy projects like Crypto Punks and Bored Ape Yacht Club (BAYC) remain iconic, but their performance reflects ongoing hype cycles.

- BAYC surged to $34.2 million in trading volume in August, more than six times higher than June. Floor prices hover near $39,000, up from a mint price of just $26.

- Crypto Punks, originally free to mint, boast a floor price exceeding $182,000 and cumulative trading volume surpassing $3.28 billion.

Other collections tell stories of explosive growth and equally dramatic corrections:

- Doodles hit a high of $41.9 million in trading volume in February with 3,800+ sales, but activity faded toward the fall.

- Pudgy Penguins delivered one of the strongest returns on investment, with a mint price of $1.18 rising to a floor of over $42,000.

- Azuki, once riding high at $116.5 million in January volume, lost more than 98% of monthly activity by September.

- Emerging collections like Mad Lads and Milady showcased strong ROI for early adopters, though their trading volumes trended downward through the year.

Such statistics highlight the dual nature of NFTs: on one hand, they create long-term blue chips with enduring cultural cachet, and on the other, they produce projects subject to speculative bursts and steep declines.

Marketplace Wars

Equally telling is the battle among NFT marketplaces.

- Magic Eden dominates Solana with monthly volumes exceeding $33 million, while rivals like TensorSwap nearly vanished.

- OpenSea remains the primary driver on Ethereum, Polygon, and Base, leading in both sales and transaction counts. In June alone, OpenSea processed more than 248,000 Ethereum transactions.

- Blur, a fast-rising competitor, peaked at $341 million in trading volume in January but struggled to maintain that momentum as the year progressed.

- On BNB Chain, PancakeSwap and Tofu competed for scraps, handling volumes measured in thousands rather than millions.

These dynamics reveal not just where liquidity concentrates but how community trust and network effects can quickly consolidate around a few dominant platforms.

The Value of Transparent NFT Stats

The integration of NFT-Stats.com into Castle Crypto’s ecosystem will make these insights more accessible and contextual. For professional traders, seeing real-time winners and losers across 24-hour windows provides a tactical advantage. For long-term investors, understanding ownership distribution, floor price stability, and cross-chain expansion offers a more strategic perspective.

Castle Crypto’s editorial expertise will ensure that raw data is not only presented but also interpreted. Rather than a static dashboard of numbers, readers can expect deep dives into what those numbers mean, how they connect to broader market shifts, and where opportunities or risks may lie.

Looking Ahead

The acquisition is a symptom of how seriously the crypto media scene is changing, and it goes beyond a simple financial deal. Castle Crypto hopes to establish a new benchmark for dependability and transparency in a field that is sometimes tainted by hype by integrating strong NFT analytics into its wider coverage of blockchain and Web3 games.

Accurate data will influence how developers, investors, and collectors traverse this rapidly evolving field as NFTs continue to find their way into games, metaverse platforms, and real-world applications. With Castle Crypto’s relocation, anybody with an interest in NFTs will have a single location with thorough data, expert analysis, and actionable insights.

Final Thoughts

Despite its volatility, the NFT market of 2025 exhibits resilience, innovation, and growing multi-chain acceptance over the long run. By acquiring NFT-Stats.com, Castle Crypto places itself at the forefront of this development by providing not just data but also the stories that accompany it.

This new alliance marks a turning point for anybody who is serious about understanding NFTs: the start of a more sustainable, transparent, and informed era for digital ownership.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor  Aave

Aave