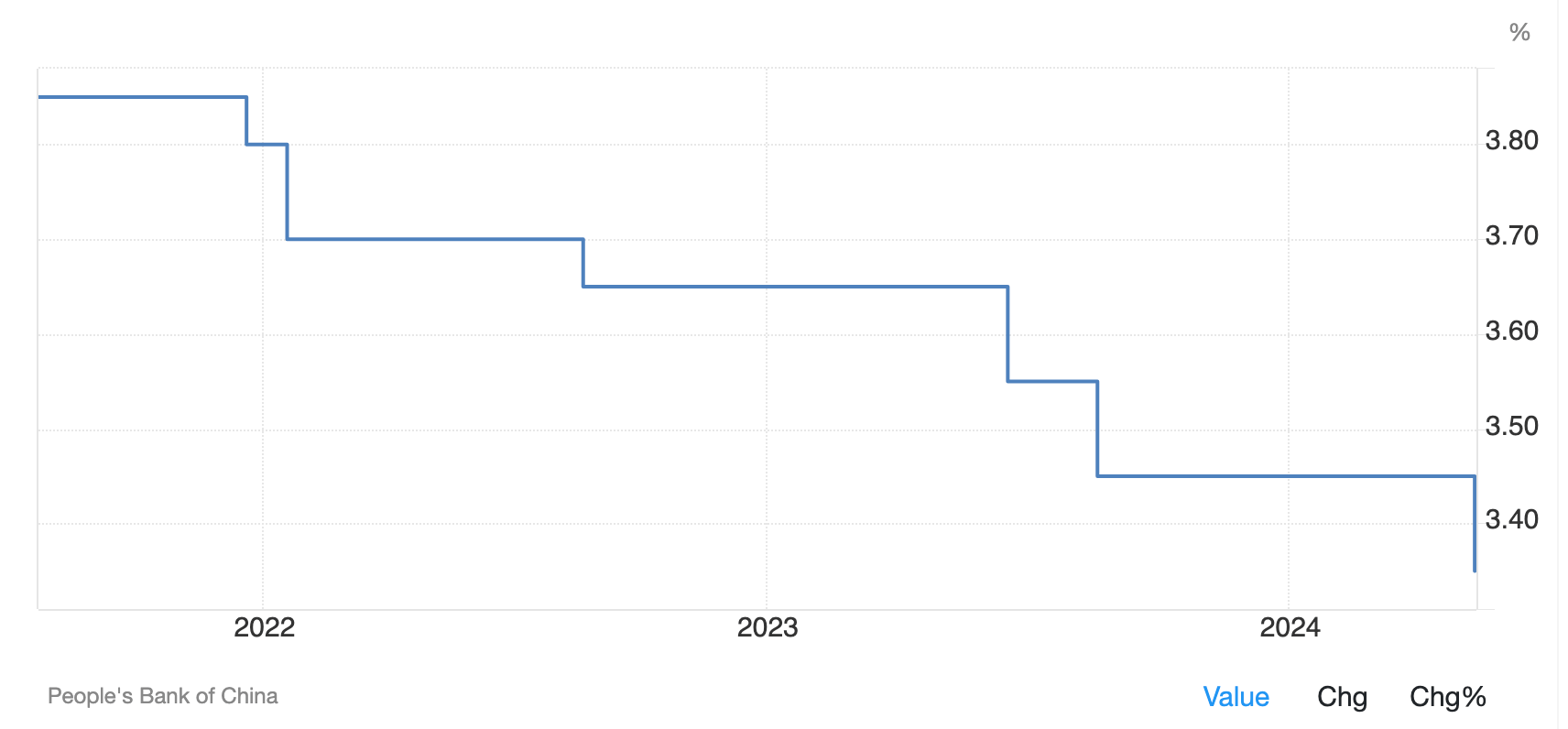

China’s central bank, the People’s Bank of China (PBOC), has cut key interest rates to stimulate economic growth amid ongoing challenges in the property sector and the broader economy. The seven-day reverse repo rate was reduced from 1.8% to 1.7%, the one-year loan prime rate (LPR) from 3.45% to 3.35%, and the five-year LPR from 3.95% to 3.85%.

These cuts follow weaker-than-expected second-quarter GDP growth of 4.7% and aim to address weak consumer demand and deflationary pressures. The property sector remains troubled, with major developers facing financial difficulties. Market reactions were mixed, with muted responses in Chinese stock markets but some positive movement in Hong Kong’s Hang Seng index.

Following Bitcoin’s rally on the initial news of Biden dropping out of the US presidential race from $65,800 to $68,500 hours later, the top digital asset retraced to around $67,800 by the time of the Chinese announcement. It rose around 0.5% as the news of the rate cut broke but has since declined around 1% to $67,400 as of press time.

The effectiveness of the rate cuts remains uncertain, and further policy actions may be necessary for sustained economic recovery.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Canton

Canton  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore