Onchain Highlight

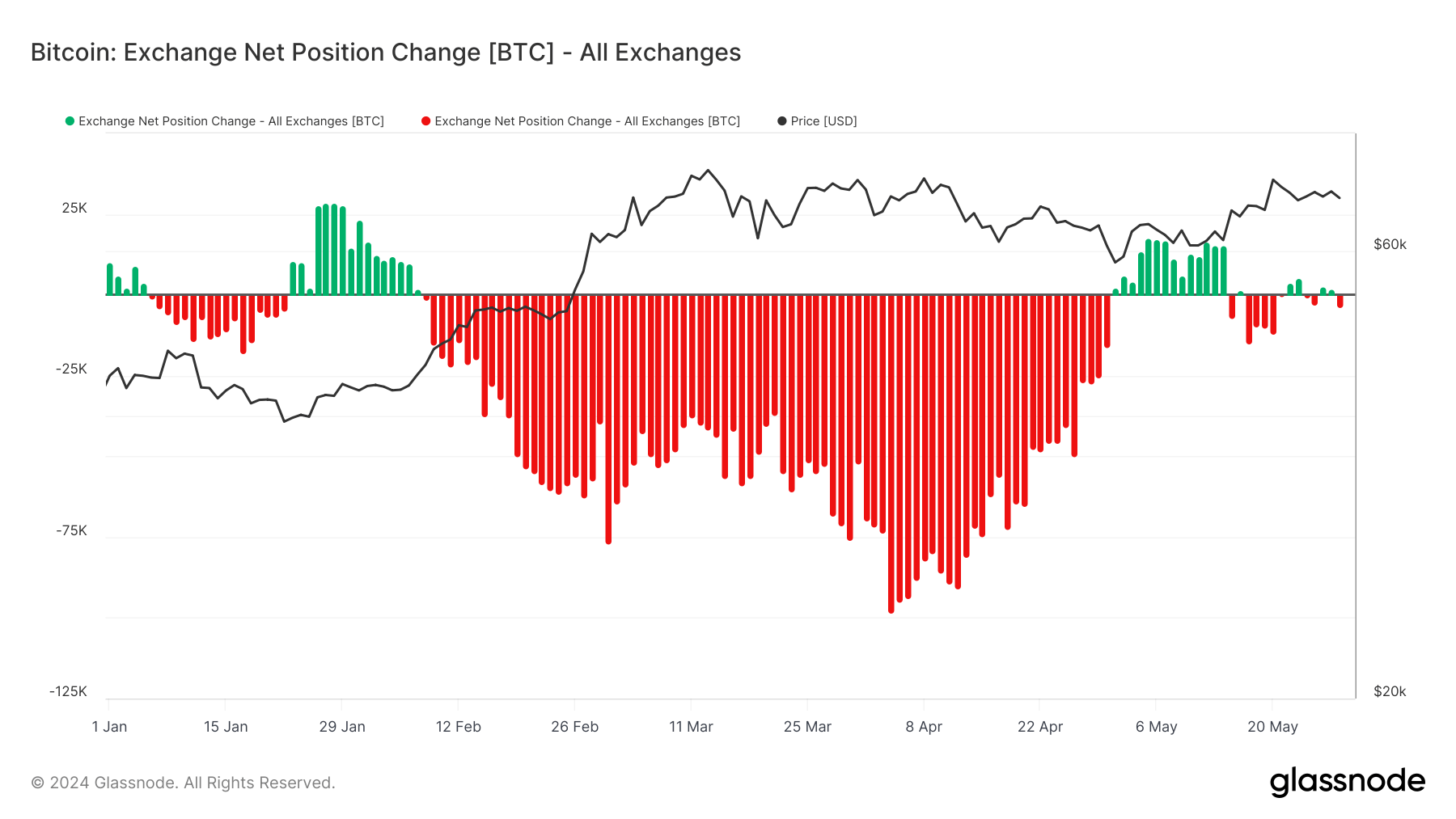

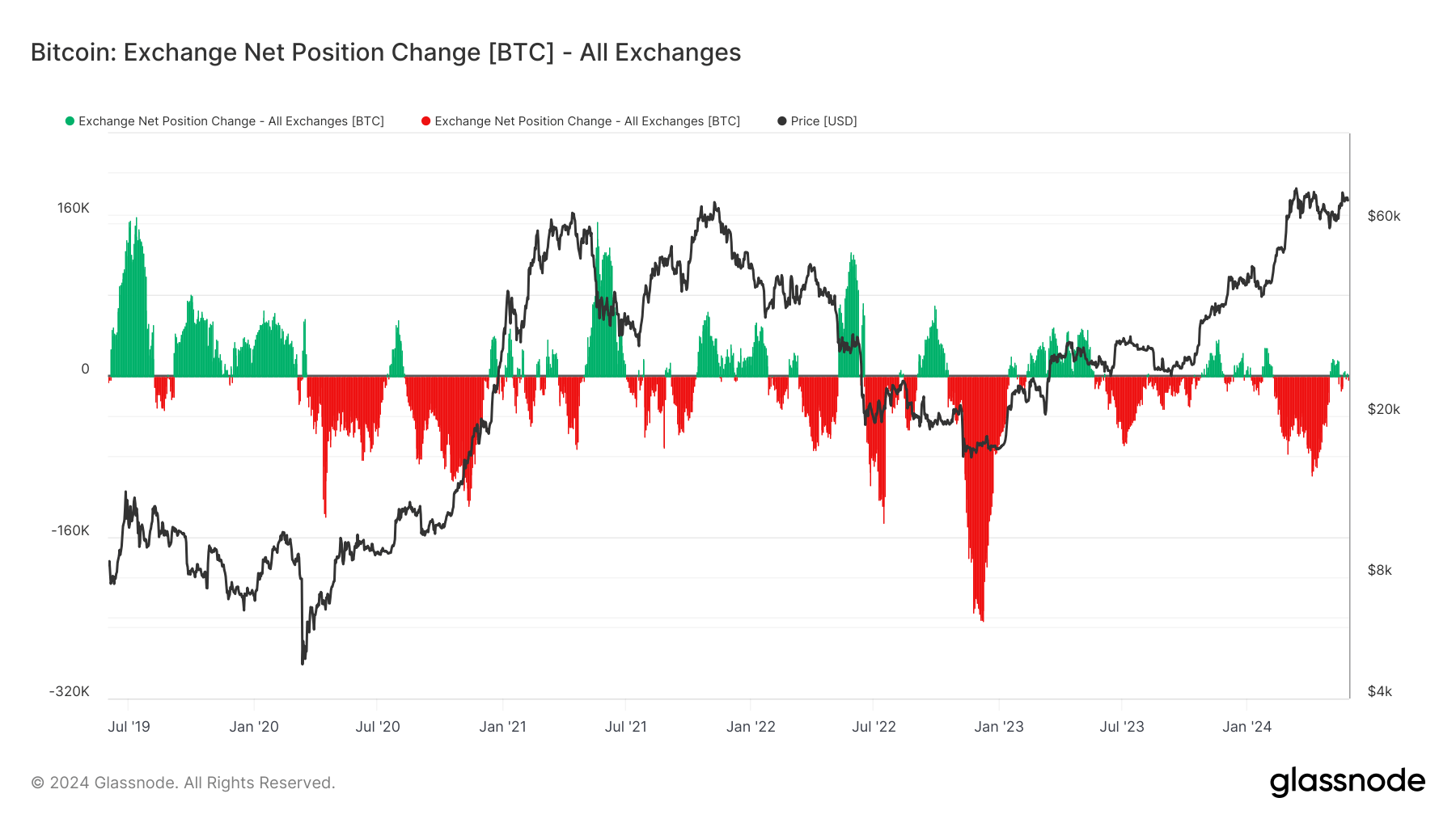

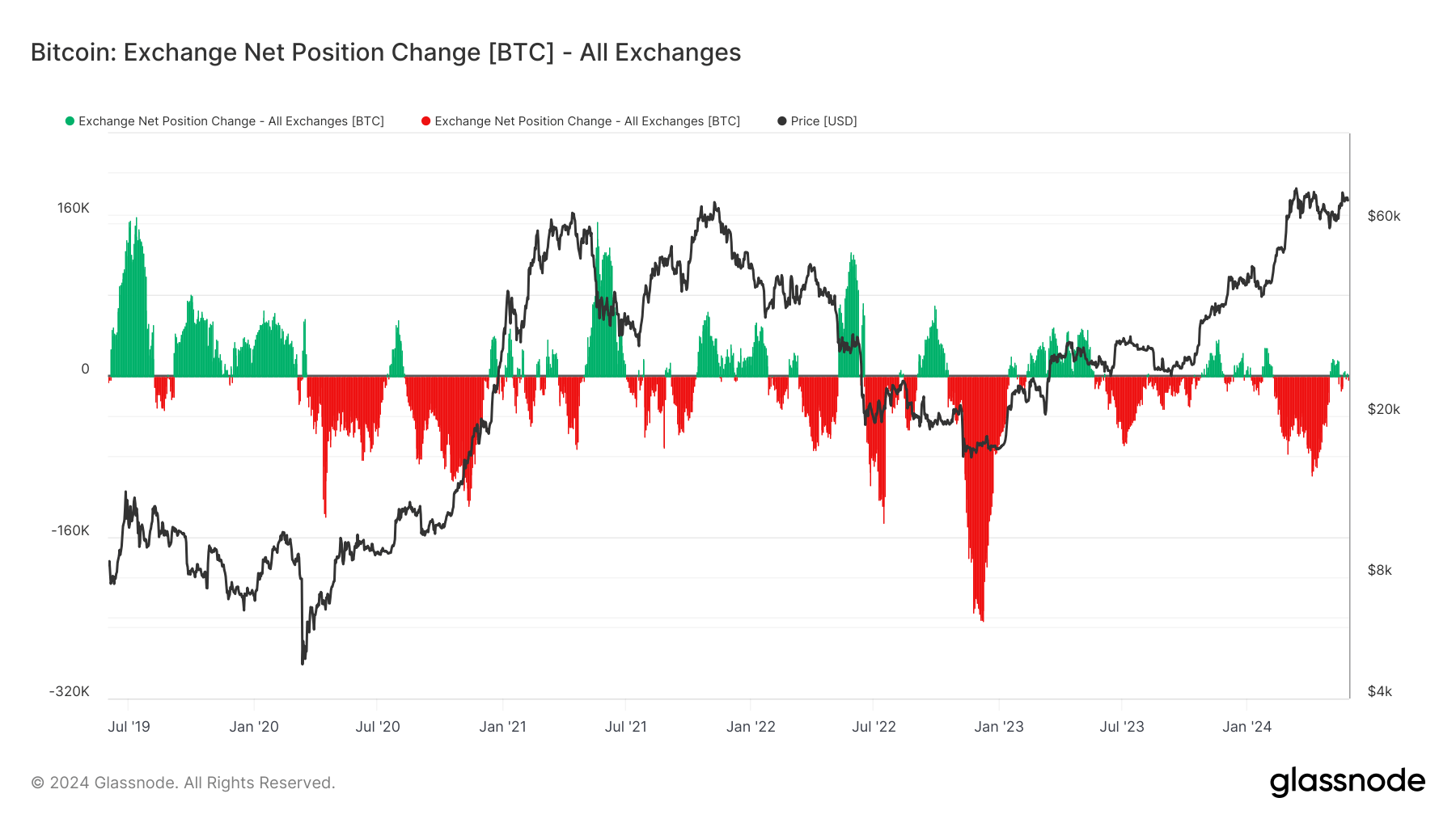

DEFINITION: Exchange Net Positon Change by Glassnode is the 30-day change in the supply held in exchange wallets.

Bitcoin’s exchange net position change has been experiencing notable fluctuations, influenced by various market factors. According to Glassnode data, the significant outflows from Bitcoin exchanges in 2023 have reversed in recent months. The trend of net withdrawals that dominated the market has shifted towards net inflows, indicating a change in investor behavior as more Bitcoin is being moved back onto exchanges.

This shift in exchange net position is mirrored by activities surrounding Bitcoin ETFs. BlackRock’s IBIT ETF notably attracted substantial inflows, contributing significantly to the overall increase in Bitcoin held on exchanges. On May 21, BlackRock’s ETF saw an inflow of $290 million, highlighting the growing institutional interest in Bitcoin.

Simultaneously, Grayscale’s Bitcoin Trust (GBTC) has continued to see outflows, though at a decreasing rate compared to earlier in the year. This outflow is partially offset by the inflows into other ETFs, demonstrating a redistribution of Bitcoin holdings among different types of investment vehicles.

The increasing exchange deposits and ETF inflows suggest that investors are positioning themselves for potential market movements, possibly anticipating future price changes or regulatory developments. This dynamic interplay between exchange net positions and ETF activities provides a comprehensive view of the current state of Bitcoin investment strategies.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave