In a new post on X, Miles Deutscher, a noted crypto analyst with over half a million followers, has proclaimed the current market condition as “one of the most bullish setups” he has seen in his six-year career in the crypto industry. Deutscher outlined ten pivotal catalysts that he believes are primed to drive the cryptocurrency markets higher in the near term.

“There has been a lot of talk recently about headwinds (Germans selling, Gox, macro etc.). But the reality is, there is A LOT to look forward to,” Deutscher emphasized.

10 Reasons To Be Ultra Bullish On Crypto

#1 German Government BTC Sales: Deutscher notes that the German government has exhausted its BTC reserves to sell, which removes a significant selling pressure on the market. “The best thing about overhang is that once selling is priced into the market, there is a floor on downside and headroom for price to move higher. We still have Gox, but there’s now light at the end of the tunnel,” he explained.

#2 Bitcoin ETF Inflows: According to Deutscher, the strong inflows into Bitcoin ETFs are underappreciated. Over the past month, these ETFs have seen inflows exceeding $1 billion, signaling sustained investor interest.

“I think many people are underestimating the magnitude of the long-term impact of the ETFs on BTC. It provides a strong passive bid for the market, and appetite for the ETF isn’t going away (we’ve had +$1b this past month),” Deutscher added.

Related Reading

#3 US Presidential Election: The crypto analyst pointed out betting markets like Polymarket, where Trump is favored to win. A Trump presidency is viewed as a positive catalyst for crypto, given his administration’s perceived support for the industry.

#4 Trump Advocacy at BTC 2024 Conference: Deutscher also highlighted Trump’s scheduled appearance at the BTC 2024 conference, where he is expected to advocate for Bitcoin and cryptocurrencies more broadly. Rumors have it that Trump could make another major announcement. Bitcoin Magazine CEO David Bailey has floated the idea of making BTC a strategic reserve asset for the United States.

#5 FTX Repayments: The repayment of $16 billion to creditors by FTX is a less discussed but crucial factor. “Many of these recipients will likely re-enter the market, leading to a fresh bid,” Deutscher predicts, suggesting a potential increase in buying activity in the crypto markets.

#6 Global Liquidity Cycle: Deutscher also mentioned the correlation between global liquidity and crypto prices. “It’s crazy how correlated crypto (especially BTC) is to global liquidity. Interestingly, we’ve been closely following a 65-month cycle. This would suggest a late 2025 peak,” Deutscher predicted.

Related Reading

#7 Spot ETH ETFs: The imminent launch of Spot ETH ETFs is another major catalyst. This marks the first time an altcoin has received such an investment vehicle, potentially expanding Ethereum’s market exposure and investor base dramatically.

#8 Goldman Sachs Tokenization Projects: Goldman Sachs’ involvement in three tokenization projects lends significant credibility to the crypto space. This institutional endorsement is expected to benefit a wide array of altcoins and related real-world asset (RWA) applications.

#9 Anticipated Rate Cuts: According to the CME FedWatch tool, the market is currently factoring in the likelihood of three rate cuts until the end of the year, with a 90% chance of a 25 basis point reduction in September. This could serve a massive tailwind.

#10 Forward-Looking Markets: Lastly, Deutscher emphasized the reflexive nature of crypto markets, where positive sentiment itself can trigger substantial rallies. “Over the coming months, you’re likely to see the market price in these tailwinds. As crypto is highly reflexive, a positive bid off the back of increased sentiment can, in and of itself, lead to a major rally,” Deutscher concluded.

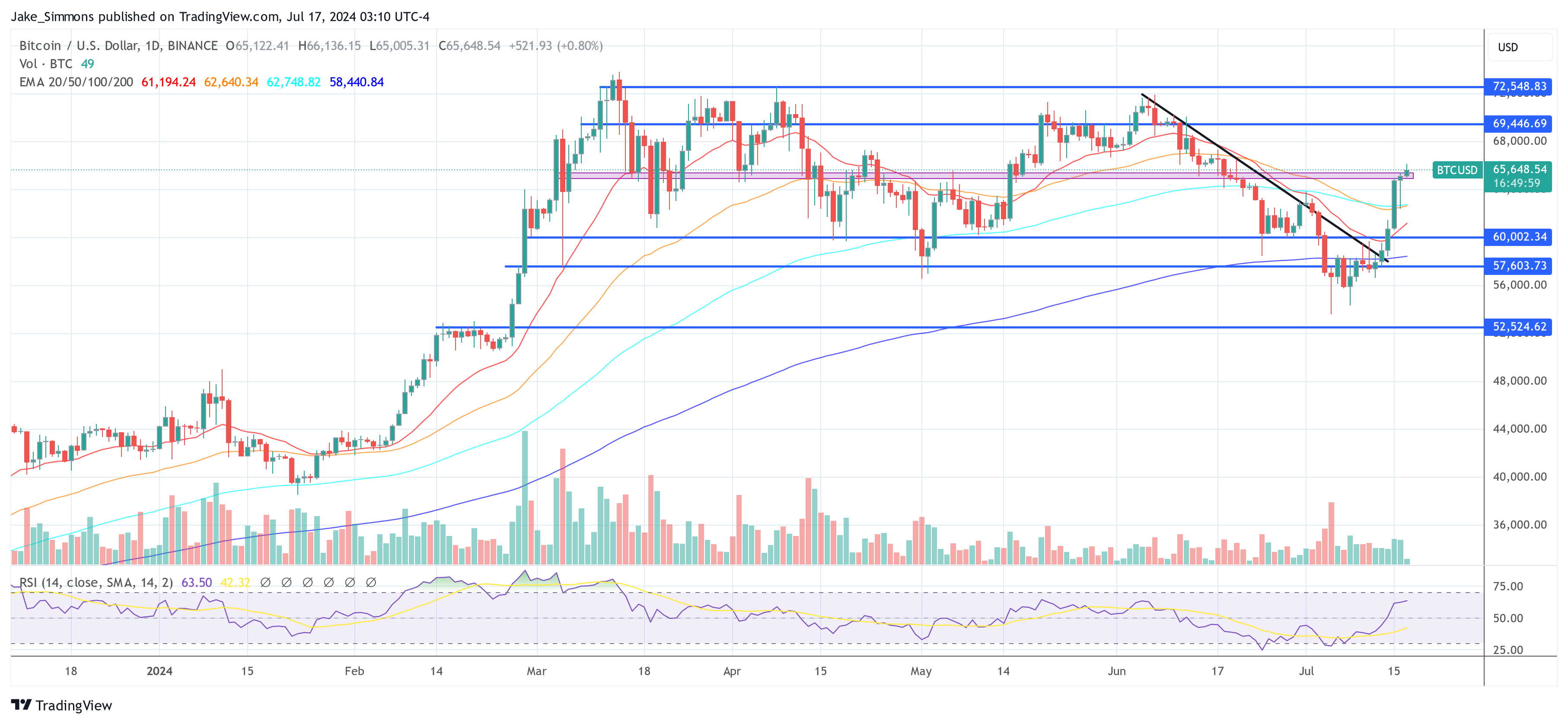

At press time, BTC traded at $65,648.

Featured image created with DALL·E, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor