Data shows the total open interest in the crypto sector has recently been at an all-time high, indicating that volatility may be coming for the coins.

Crypto Open Interest Has Been At Extreme Levels Recently

As CryptoQuant Netherlands community manager Maartunn pointed out in a post on X, the total crypto open interest has recently been sitting around a whopping $51.3 billion.

The “open interest” here refers to the total amount of derivative positions related to all digital assets currently open on the various exchanges in the sector.

When the value of this metric rises, it means that the investors are opening up fresh positions on the market right now. Generally, the total leverage in the sector goes up when such a trend takes form, so the assets could become more likely to show some volatility.

On the other hand, a downtrend in the indicator implies that the investors are closing their positions of their own volition or getting forcibly liquidated by their platform.

A sharp plunge in the metric could accompany some violent price action, but once the indicator’s value has settled down, the markets could become more stable due to a washout of leverage.

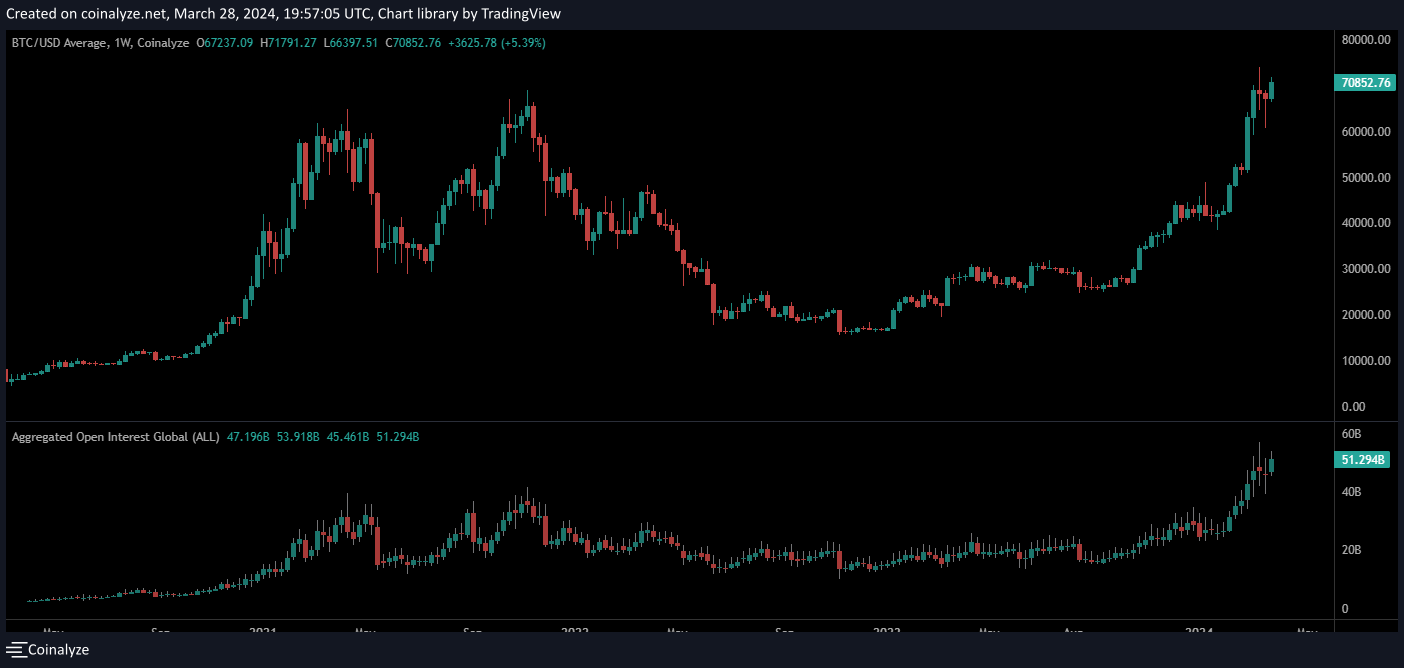

Now, here is a chart that shows the trend in the crypto open interest over the past few years:

The value of the metric appears to have been going up in recent days | Source: @JA_Maartun on X

As displayed in the above graph, the total open interest in the crypto sector has been riding an uptrend recently. This rise in the metric has come as the prices of Bitcoin and other assets have gone through their rallies.

This isn’t unusual, as the market attracts much attention during such price action. With a large amount of attention naturally comes speculation, so users flood exchanges with positions in these periods.

From the chart, it’s visible that open interest in the crypto market also rose during the 2021 bull run. The latest values of the indicator, however, have already surpassed the peak witnessed back then.

The metric has recently been around $51.3 billion, an all-time high. As mentioned before, high metric values can lead to volatility for the various assets in the sector.

As such, the current extreme levels of open interest could mean that the market may be prone to seeing some sharp price action in the near future. This volatility could take the market in either direction, at least on paper.

As is apparent from the graph, though, the indicator has historically only seen a significant cooldown with crashes in the Bitcoin price, so the current overheated open interest may be a bad sign for the crypto market.

Bitcoin Price

At the time of writing, Bitcoin is floating around the $70,100 mark, up more than 9% over the past week.

Looks like the price of the asset has gone stale recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor