Onchain Highlights

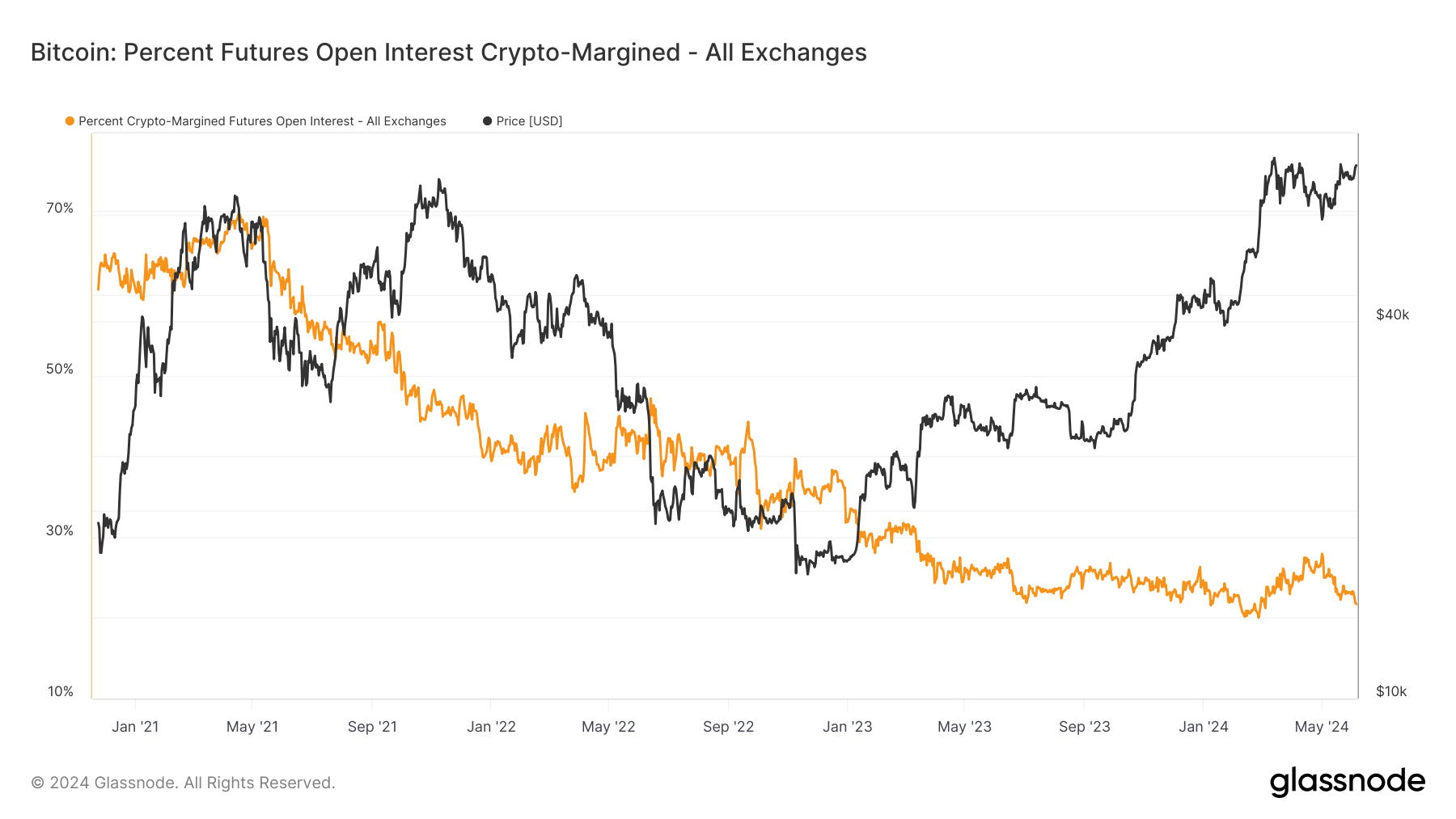

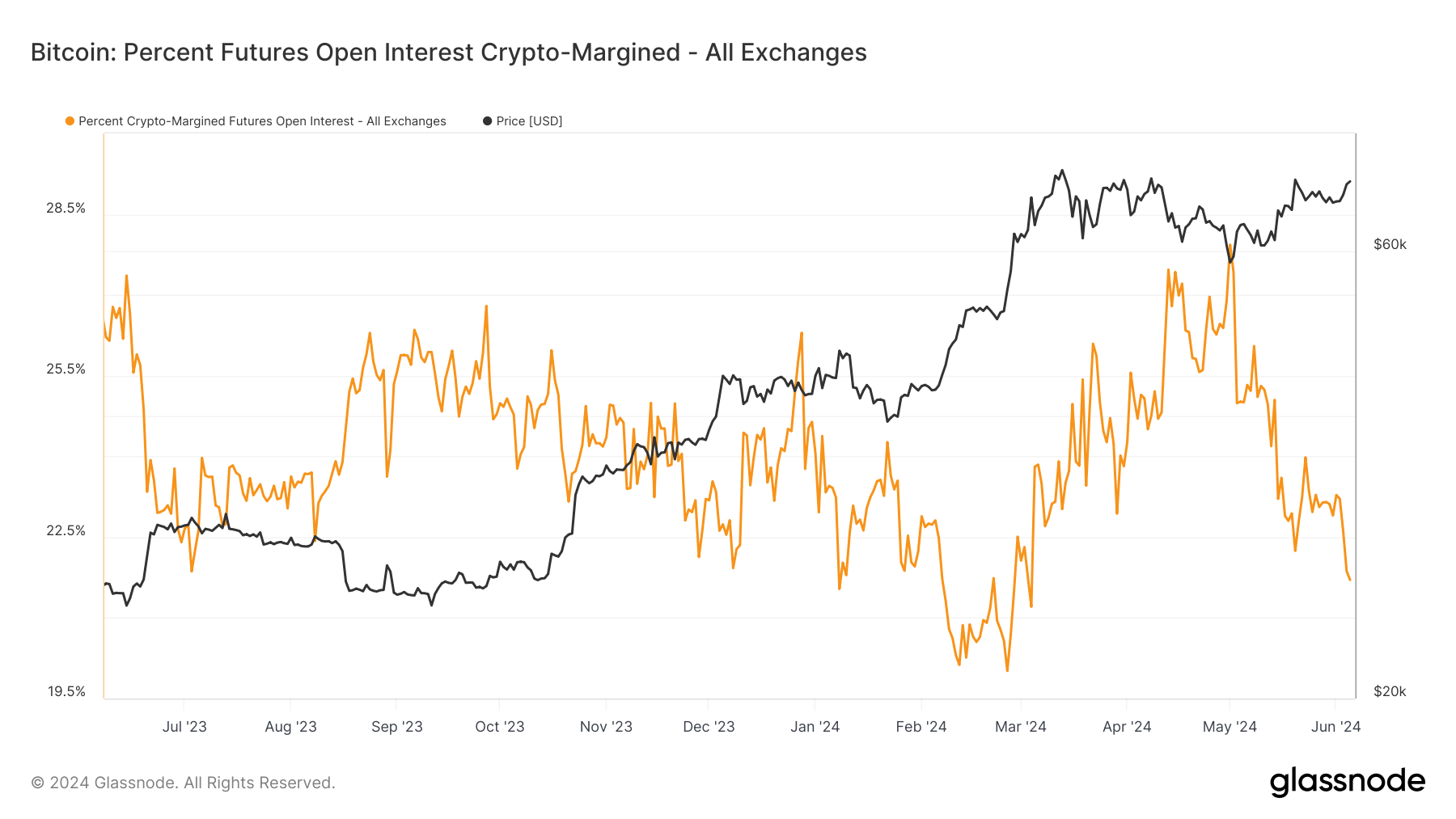

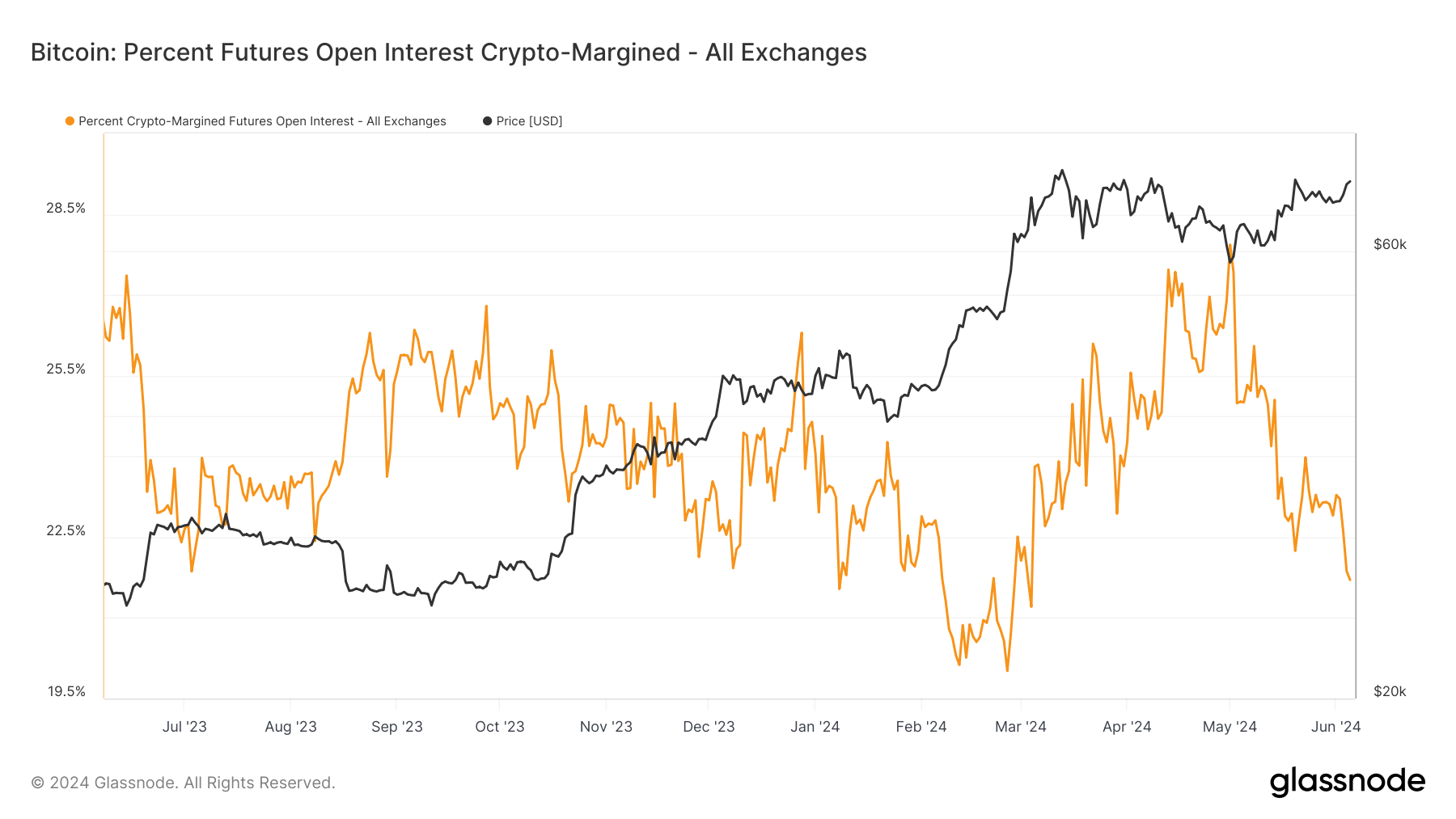

DEFINITION: The percentage of futures contracts open interest that is margined in the native coin (e.g., BTC) and not in USD or a USD-pegged stablecoin.

Bitcoin’s futures market is undergoing a notable shift, as reflected in the declining percentage of crypto-margined futures open interest across all exchanges. Data from Glassnode highlights a significant drop in the use of Bitcoin as collateral for futures contracts, falling from 70% in early 2021 to less than 20% by mid-2024.

This trend suggests a growing preference for more stable forms of collateral, such as USD or stablecoins, over Bitcoin itself. The rationale behind this shift is to mitigate the compounded risks associated with the volatility of Bitcoin prices, which can lead to increased liquidations during market swings. This move towards stability and risk mitigation signals a maturation of the market, where traders are adopting strategies to manage volatility more effectively.

Furthermore, the futures market’s response to Bitcoin’s price stabilization around $70,000 indicates an evolving landscape where open interest is beginning to recover. This recovery in open interest, coupled with the ongoing shift towards stable collateral, highlights changing trader behaviors and market forces.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor