Crypto futures are derivative contracts that enable you to speculate on the future price movements of cryptocurrencies. They help you gain exposure to the crypto market without actually purchasing, owning, or transacting the underlying assets.

In this article, we’ll offer valuable insights into cryptocurrency futures contracts, their working, types, features, benefits, and risks. We’ll also provide a step-by-step guide to trading futures, covering key strategies and top cryptocurrencies for contract trading.

What Are Cryptocurrency Futures?

Crypto futures are agreements between two traders to buy or sell the underlying cryptocurrencies at specific prices by certain dates. They are settled in fiat, stablecoins, or the underlying digital currency.

In essence, cryptocurrency futures are similar to traditional futures contracts. They require both buyers and sellers to fulfil their obligations at predetermined prices by or before a contract’s expiration date.

How Does Crypto Futures Work?

When traders buy a futures contract, they open a long position. Conversely, when they sell, they open a short position.

However, before engaging in futures trading, traders need to fulfil margin requirements. Exchanges collect two types of margins: initial and maintenance margins. Initial margin is the minimum collateral required to open a futures position. Maintenance margin is the minimum fund balance traders should maintain in their margin accounts to keep their positions open.

If a cryptocurrency’s value drops drastically due to adverse price movements, the collateral may be unable to cover the position. In such scenarios, a margin call is triggered, informing traders to replenish their margin accounts. If you fail to respond to a margin call, your position will be liquidated.

3 Ways to Close a Futures Contract

- Offsetting: Offsetting a futures position is the best way to liquidate a contract. It also helps traders avoid physical delivery of the underlying assets. You need to execute equal and opposite transactions to offset a position. For example, imagine you bought two Bitcoin futures contracts expiring in September. To neutralize this trade, you must sell two Bitcoin futures that also expire in September.

- Rolling over: You can roll over a cryptocurrency futures contract if you want to maintain your exposure to the dynamic market. For instance, assume you’ve gone long on two Ether futures contracts that expire in October. You can roll over this position by selling two October contracts and buying two December contracts.

- Settling the contract: A futures contract is settled only when both parties fulfil their obligations by the expiry date. Traders holding long and short positions must buy or sell the underlying cryptocurrency as per the contract terms.

Types of Crypto Futures Contracts

- Perpetual futures: They are linear contracts with no expiry date. Hence, traders can hold them indefinitely.

- Expiry futures: They are linear contracts with a fixed expiry date, after which they cease to exist.

- Inverse futures: They are non-linear contracts that are quoted in fiat but settled in the underlying cryptocurrency.

Key Features of Crypto Futures Contracts

Zero-sum game

Since one trader must incur losses for the other trader to make gains, crypto futures trading is a zero-sum game.

Expiration date

It is the date on which a futures contract ceases to exist. It is also called the strike or exercise date. Both parties agree upon the expiration date at the time of entering into the contract.

Exercise price

It is the price at which the futures contract will be executed. It is also called the strike price, and is fixed at the time of formation of the contract.

Contract size

It indicates the quantity of the underlying asset a derivatives contract represents. A contract can be priced in terms of the underlying digital currency or asset. For example, 1 contract = $2,50,000 worth of Ether or 1 contract = 50 Ether.

You can also do fractional trading of crypto futures. Thus, you can buy or sell contracts with sizes as low as 0.0001 BTC.

Leverage

Most exchanges enable traders to use leverage to control large positions with smaller amounts of capital upfront. For instance, a 10x leverage means you must deposit only 1/10th of the future contract’s notional value as margin. Thus, if the notional value is $550,000, you must fulfil a margin requirement of $55,000.

The settlement method also varies across futures exchanges and products. For example, Binance offers USD-margined contracts that are settled in United States Dollar Coin (USDC) and Tether (USDT). It also offers coin-margined contracts that are settled in the underlying cryptocurrencies. For both products, traders must deposit their actual cryptocurrency holdings as collateral.

Contrarily, CME Group facilitates the cash settlement of crypto futures. It means traders must settle the contracts in a fiat currency like USD.

Tick

Every futures contract comes with a minimum price fluctuation, known as a tick. For instance, the minimum tick size of CME Bitcoin futures is $5, while its contract size is 5 BTC. Therefore, the value of a tick move equals $25 ($5 X 5).

Crypto Futures vs Crypto Options: What’s the difference?

| Cryptocurrency futures | Cryptocurrency Options |

| A crypto futures contract is an obligation to buy or sell the underlying cryptocurrency at a predetermined price on a future date. | A crypto options contract gives buyers the right, not the obligation, to purchase or sell the underlying digital currency. |

| Futures contracts are settled in cash (fiat currency), stablecoins, or cryptocurrencies. | Most exchanges offer crypto options settled in stablecoins, especially USDT and USDC. |

| Crypto futures are available on multiple cryptocurrencies. | Crypto options are offered only on a limited number of cryptocurrencies, particularly Bitcoin and Ether. |

| Losses can be unlimited, especially when traded using leverage. | For buyers, losses are limited to the option premium paid. For sellers, losses can be unlimited depending on market volatility. |

Best Cryptocurrencies for Futures Trading

Bitcoin futures

Bitcoin (BTC) is the largest cryptocurrency by market capitalization (cap) and has the highest dollar value per coin. With Bitcoin futures, you can get exposure to the Bitcoin market without actually owning BTC. Moreover, Bitcoin futures are the most liquid and actively traded.

Ether futures

Ether (ETH) is the second-largest cryptocurrency by market cap. It is the prime governance token of Ethereum, the pioneer blockchain that supports smart contracts and decentralized applications. Through Ether futures, you can garner profits from ETH’s price movements in either direction.

Solana futures

SOL is the native token of the Solana blockchain. It is an ultra-fast, highly scalable, and energy-efficient network, making it a hot choice for upcoming Web3 projects. Thus, SOL carries a strong growth potential, and Solana futures offer you a powerful way to tap into it.

XRP futures

XRP is the utility token of the XRP ledger, an open-source network that fosters cost-efficient cross-border payments. It is also the third-largest crypto as per market cap. With XRP futures, you can gain exposure to this promising market.

How to Trade Crypto Futures

Step 1: Register on an exchange

To trade futures, you must create your account on a crypto exchange using your email or phone number. If you already have an account, log on to the exchange.

Step 2: Open a futures trading account

Exchanges like Binance require traders to open a separate futures account. To activate this account, you must complete a few tasks on the platform.

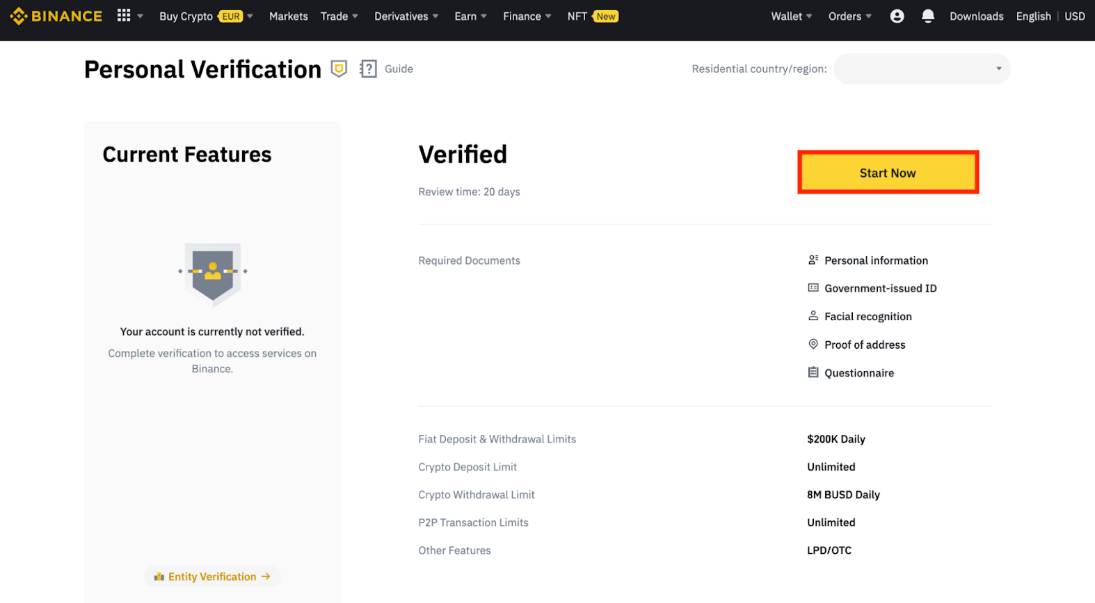

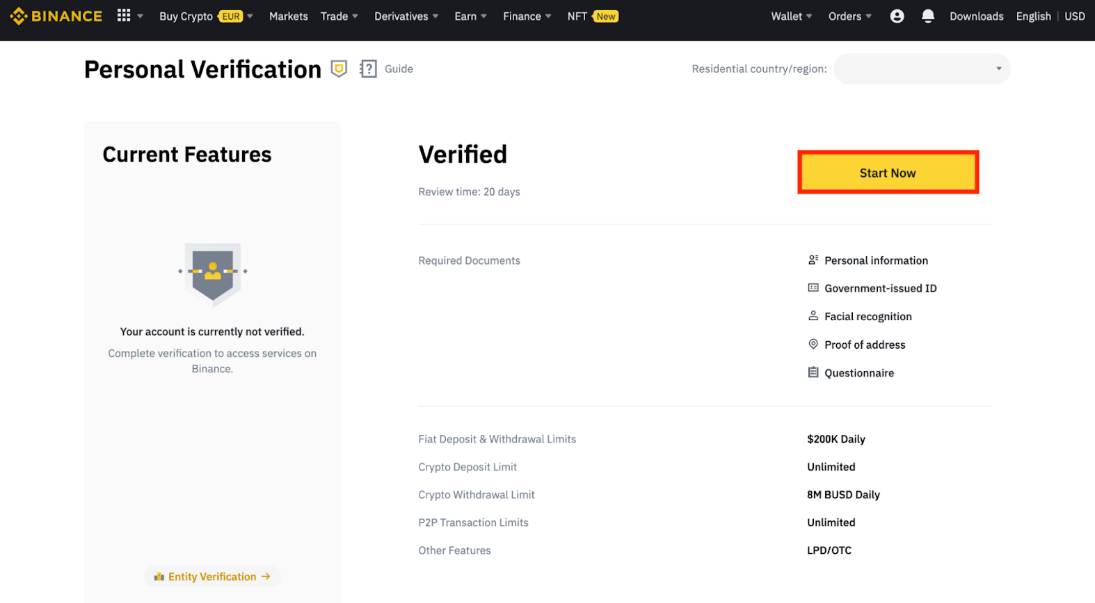

Step 3: Complete identity verification

Before you begin contract trading, you must complete the know-your-customer (KYC) process. Enter basic details such as name, location, etc., and pass a facial recognition test. Additionally, submit a government-authorized identity proof and a valid address proof.

Step 4: Make the first deposit

Once your account is verified, deposit fiat or cryptocurrencies into your exchange wallet. Usually, exchanges support various payment methods like bank transfer, credit/debit card, PayPal,… to help traders make deposits. Once done, you’re ready to open a futures position.

Trading on Regulated vs. Unregulated Exchanges

Regulated exchanges operate under the oversight of government authorities. For example, the CME Group is regulated by the Commodities Futures Trading Commission (CFTC).

These government agencies also determine the amount of leverage a trader can use. Moreover, margin requirements are higher on exchanges operating in a regulated environment. Thus, they help curtail the magnitude of losses suffered by traders due to adverse price movements. Furthermore, exchanges like the CME Group use reference rates to ensure fair pricing.

Conversely, unregulated exchanges allow traders to assume excessive risks. Some platforms offer leverage of up to 500x on certain futures pairs. The higher the leverage, the higher the risk of incurring significant losses. Additionally, no legal recourse is available if you lose your assets on unregulated exchanges.

What is Chicago Mercantile Exchange (CME)?

CME is the best regulated exchange for trading cryptocurrency futures on XRP, Solana, Bitcoin, and Ether. It forms part of the CME group, the world’s most popular derivatives marketplace.

Apart from crypto market insights, CME Group publishes benchmark reference rates and live spot price indices for various cryptocurrencies. Additionally, CME is the go-to platform for traders seeking micro Bitcoin futures and innovative products like Bitcoin Friday Futures.

| Futures Products | Contract Size | Minimum price fluctuation per contract | Margin requirement |

| Bitcoin futures | 5 Bitcoin | $25 | 50% |

| Micro Bitcoin futures | 0.1 Bitcoin | $0.5 | 50% |

| Bitcoin Friday Futures | 0.02 Bitcoin | $0.1 | 50% |

| Spot-quoted Bitcoin futures | 0.01 Bitcoin | $0.1 | 50% |

| Ether futures | 50 Ether | $25 | 60% |

| Micro Ether futures | 0.1 Ether | $0.05 | 60% |

| Spot-quoted Ether futures | 0.2 Ether | $0.1 | 50% |

| Solana futures | 500 SOL | $25 | 50% |

| Micro Solana futures | 25 SOL | $1.25 | 50% |

| XRP futures | 50,000 XRP | $25 | 50% |

| Micro XRP futures | 2,500 XRP | $1.25 | 50% |

Benefits and Risks of Crypto Futures Trading

Benefits

- Hedging: It is a risk management strategy that serves as a safety net for crypto portfolios, especially during high market volatility. As crypto futures are powerful hedging tools, they help you manage the risk of losses caused by sudden price swings. Traders can safeguard long positions in the spot market by going short in the futures market, and vice versa.

- Speculation: Cryptocurrency futures help traders speculate on future prices of underlying digital currencies. Usually, traders go long on futures contracts when the cryptocurrency market rallies and go short when the market slumps.

- No cryptoasset ownership: If managing crypto wallets or purchasing cryptocurrencies baffles you, futures trading can be your best bet. It enables you to gain exposure to cryptoasset prices without owning the assets.

- Lower fees: The futures trading fee is usually lower than spot trading charges on most exchanges.

- Arbitrage: Crypto futures are ideal for traders who wish to take advantage of price discrepancies across multiple trading platforms. However, the futures contracts on both platforms should have the same settlement date, underlying cryptocurrency, leverage, and price tracking method. Cryptocurrency futures also help you garner profits from the price differences between the underlying asset’s spot and futures markets. Typically, you can make gains from arbitrage opportunities by assuming opposite positions in the two markets or platforms.

- High liquidity: Many crypto futures contracts are highly liquid, meaning traders can enter and exit positions quickly.

Risks

- Leverage: Many exchanges facilitate leveraged trading of crypto futures contracts. They allow traders to control large positions without investing significant amounts of capital. However, leverage is a double-edged sword. While it magnifies potential gains, it also amplifies potential losses.

- High margins: Some exchanges impose higher maintenance margins that constitute a significant proportion of a contract’s notional value. Thus, traders may be forced to adjust their position sizing or liquidate their trades.

- High volatility: Both cryptocurrencies and futures contracts are highly volatile. They are often subject to adverse price movements, causing significant losses for traders.

Popular Crypto Futures Exchanges

- Coinbase: is a top US-based exchange for cryptocurrency futures trading. It offers CFTC-compliant perpetual contracts and nano futures on various cryptocurrencies, including Bitcoin and Ether. The exchange also provides leverage of up to 10x for futures trading.

- Binance Futures: is the largest exchange by trading volumes. In July 2025, its futures volume touched $2.55 trillion, and its open interest reached a whopping $88 billion.

- Dydx: is the best decentralized exchange for trading crypto perpetuals. It has recorded $220 million in open interest and offers up to 50x leverage for futures trading.

Crypto Futures Trading Strategies

- Going long: You should go long when the underlying asset’s price is rising. This strategy helps you procure the asset at a lower price.

- Going short: You should go short when the underlying cryptocurrency’s price is falling. This strategy helps you sell the asset at a higher price and buy it back later at a lower price.

- Scalping: It is a quick-fire strategy, where traders execute multiple small trades throughout the day to profit from minor price fluctuations. It yields high returns during intense price volatility in highly liquid cryptocurrency markets.

- Day trading: It is a suitable strategy for both experienced and new traders who want to avoid overnight price fluctuations. It involves opening and closing positions on the same day.

- Breakout trading: During periods of high volatility and rapid changes in market sentiment, breakout trading is helpful. It helps you clock profits when prices break pivotal support and resistance levels.

Conclusion

Cryptocurrency futures help traders potentially profit from speculation and arbitrage opportunities. Moreover, the price volatilities of cryptocurrencies depend on multiple factors, including market sentiment, macroeconomic trends, and regulatory developments. Understanding these dynamics and using risk management strategies like hedging is imperative to profit from futures trading.

FAQs

You can make $100 a day through spot trading of crypto. However, it depends on various factors like your available capital, risk tolerance, and trading strategy. Making $100 a day is easier with cryptocurrency futures, as many exchanges facilitate leveraged trading of derivatives.

Crypto futures enable you to make profits by speculating on a cryptocurrency’s future prices or through arbitrage opportunities. Additionally, you can use leverage to trade futures contracts and boost your gains.

With $100, you can trade futures on low-priced coins. You can also trade micro futures on popular cryptocurrencies. Moreover, many platforms offer over 100x leverage on select pairs. Therefore, you can open a $10,000 position with a margin of just $100.

Standardized futures are full-size contracts that allow traders to take large positions in the futures market.

Conversely, micro futures are byte-sized contracts that are ideal for traders with low risk tolerance and who want to take small positions.

For example, the size of CME Group’s standardized Bitcoin futures contract is 5 BTC. Their micro Bitcoin futures contracts are sized at 0.1 BTC.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Sui

Sui  Zcash

Zcash  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  USDT0

USDT0  Shiba Inu

Shiba Inu  Canton

Canton  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  USD1

USD1  Polkadot

Polkadot  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave