In a significant milestone for the cryptocurrency market, Bitcoin (BTC), the largest digital asset, shattered its previous records, surging past the $69,000 mark to establish a new all-time high (ATH) of $69,300 on Tuesday.

The achievement marked a historic moment for BTC, which hadn’t reached such levels in over two years. However, the crypto’s upward trajectory shows no signs of slowing down, with experts predicting further price gains.

Bitcoin Price And ETFs In Perfect Harmony

According to data from Deribit, an options and futures crypto exchange and analytics firm GenesisVol, BTC is anticipated to experience a potential increase of up to 20.8% within the next 30 days.

These projections suggest that, under ideal circumstances, Bitcoin’s price could break through the $80,000 barrier. Even conservative traders are optimistic, expecting BTC to easily surpass $70,000 and reach around $75,000.

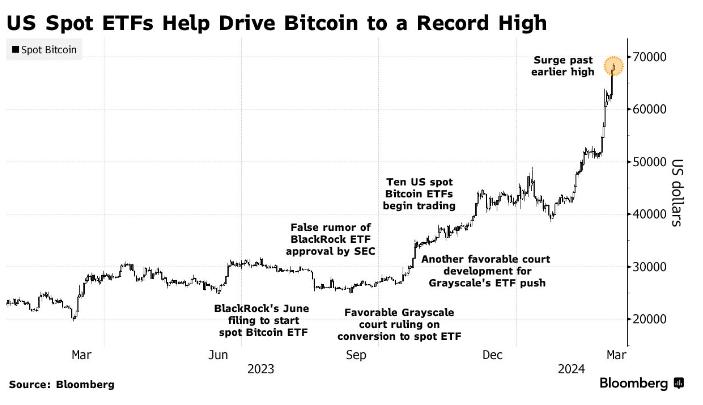

In addition, the recent approval of spot Bitcoin exchange-traded funds (ETFs) has played a pivotal role in Bitcoin’s success, suggesting that the upward trend in BTC prices, coupled with bullish sentiment among options traders and institutional and retail investors, is far from over.

Bloomberg ETF expert Eric Balchunas emphasized the significance of this development, stating that it represents a crucial moment for both Bitcoin and ETFs. Balchunas believes the surge from $25,000 to $69,000 was largely driven by hopes of ETF approval and subsequent flows.

The expert claimed that the synergy between ETFs and Bitcoin has proven mutually beneficial, as ETFs have enhanced liquidity, affordability, convenience, and standardization for investors.

Notably, the ten-spot Bitcoin ETFs have amassed over $50 billion in assets, with a staggering $8 billion generated from flows and the rest attributed to the rising value of Bitcoin.

However, as Bitcoin reached its new peak, increased market volatility led to a liquidation surge. Journalist Colin Wu reported a sharp 5% drop in Bitcoin’s price within an hour, with Binance recording below $65,000. During this hour, liquidations amounted to a staggering $142 million.

BTC Sell Signal

Although bullish investors are currently on cloud nine, renowned crypto analyst Ali Martinez has sounded the alarm as the TD Sequential indicator recently flashed a sell signal on the daily chart of Bitcoin.

The TD Sequential indicator, developed by market expert Tom DeMark, utilizes price patterns and sequences to identify potential trend reversals in various financial markets, including cryptocurrencies.

Martinez emphasized the indicator’s notable track record in predicting Bitcoin’s price movements since the beginning of the year. The TD Sequential indicator issued a buy signal in early January, just before Bitcoin’s price surged 34%.

Conversely, a sell signal was given in mid-February, followed by a 4.44% drop in the value of BTC. So, considering the previous sell signals, a potential drop towards the $62,000 price level could be in the making for the largest cryptocurrency on the market, still holding the $60,000 support, which will be key for BTC’s prospects.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  Dai

Dai  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor