Onchain Highlights

DEFINITION:The percentage of unique addresses whose funds have an average buy price that is lower than the current price. “Buy price” is here defined as the price at the time coins were transferred into an address.

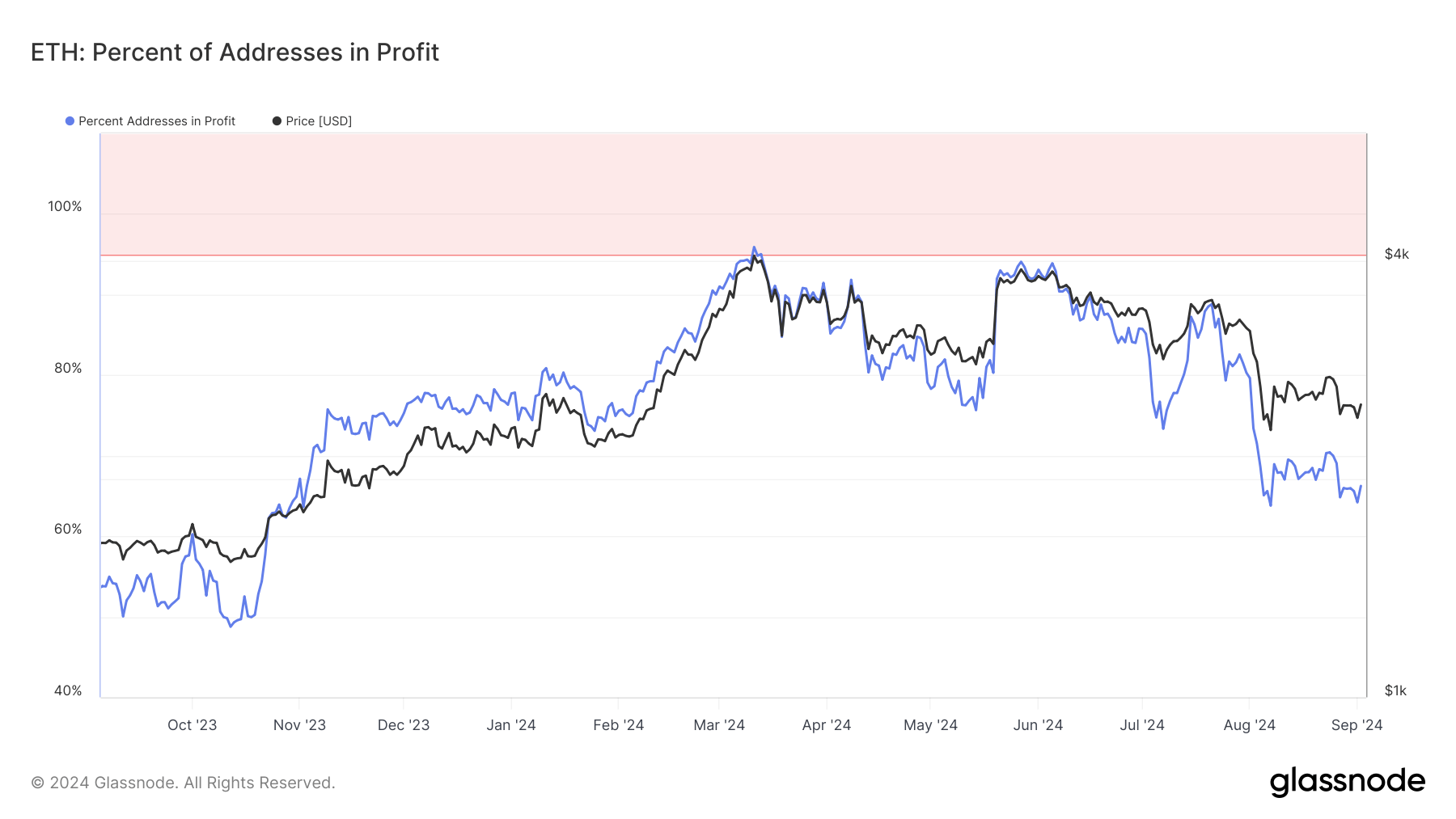

Ethereum addresses in profit have seen a notable decline in 2024. The percentage of addresses in profit has fallen to 65% as of Sept. 3 after reaching a peak near 90% in March. This decline is evident from the broader context of Ethereum’s price, which has also retraced from its earlier highs this year.

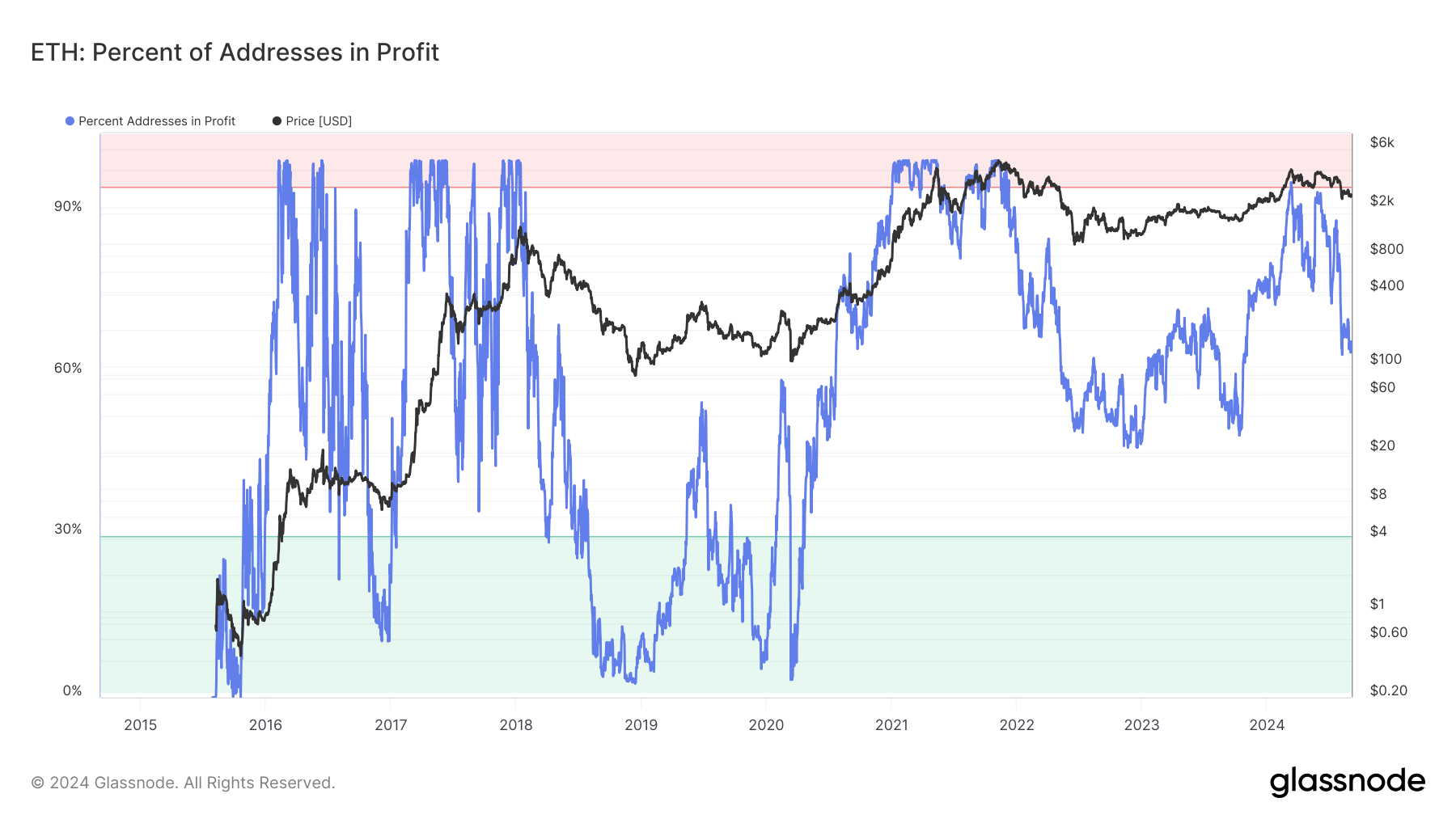

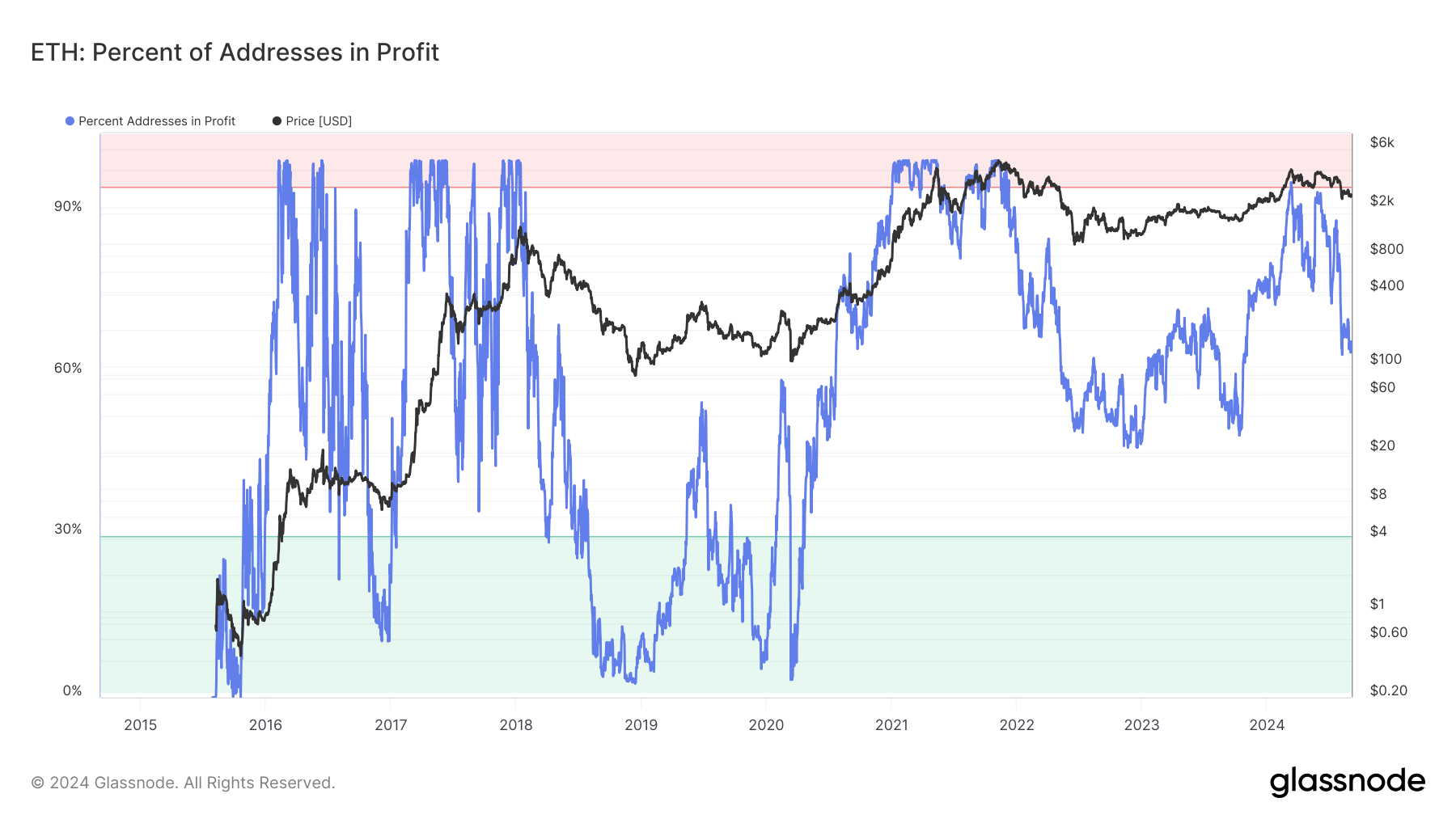

Historical data reflects a similar pattern during market downturns. In late 2018, Ethereum’s percentage of profitable addresses plunged below 10% as the asset’s price fell sharply, marking one of its most significant drops. A similar trend occurred in early 2020 when profitability dipped to nearly 0% during the broader market correction.

The current trend suggests Ethereum’s profitability is mirroring past bear markets, where a decrease in profitable addresses preceded extended periods of lower prices. As Ethereum’s price remains under pressure, the percentage of addresses in profit may continue to decline, potentially revisiting levels seen in previous market cycles, indicating cautious market sentiment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Tether Gold

Tether Gold  Uniswap

Uniswap  Mantle

Mantle