The Ethereum price is up 4% to trade for $3,936 as of 04:50 EST time on trading volume that slumped 23%.

It comes amid growing uncertainty in the cryptocurrency market, with the Bitcoin price still range-bound below the $69,000 psychological level.

Nevertheless, the Ethereum price is steadily edging towards the $4,000 milestone, levels last seen in January 2022.

Meanwhile, a Bitwise analyst says that while Bitcoin is the main topic of discussion after it “sucked up all the attention” recently, Ether could more than double from current prices this year.

Ether $ETH has been “largely overshadowed” by Bitcoin $BTC for the past several months, but the laggard could more than double in price in 2024, according to a Bitwise analyst.

This month’s Dencun upgrade in mid March will make transactions cheaper on layer 2 networks, which… pic.twitter.com/4P85InbtcH

— DefiDive (@defi_dive) March 8, 2024

Juan Leon, a cryptocurrency research analyst at asset manager Bitwise, told CoinDesk that the Ethereum price may go to $10,000 or even higher this year.

“Bitcoin has sucked up all the attention with the bitcoin ETFs launching,” said the analyst, adding, “but [ETH] has at least two major catalysts that will come into focus.”

Why The Bitwise Analyst Is Optimism About Ethereum Price

The Bitwise analysts ascribes the optimism to two bullish fundaments in the Ethereum network.

-

Dencun Upgrade

Ethereum Core developers said that the Dencun upgrade was successful y deployed on the Holesky Testnet early on January 31. With the smooth release, the upgrade is ready for its mainnet release and could arrive as early as March 2024.

In a series of posts on social media platform X, Ethereum Core Developer Parithosh J said that the next step for the Dencun upgrade is the mainnet launch.

Holesky is finalized for Deneb 😀

Churn limit looks good so far and blobs are flowing smoothly!

Next stop, Mainnet! https://t.co/MiEsJfHvFz

— parithosh | 🐼👉👈🐼 (@parithosh_j) February 7, 2024

In hindsight, the testnet rollout was not eventful; an outcome that inspired increased confidence among Ether token holders. Another Core developer, Terrence, had indicated that the participation of nodes dropped by approximately 5%. He ascribed this to node operators being offline. The developer also highlighted that no bugs were reported.

Holesky is finalized for Deneb. Another successful upgrade!!

Participation dropped by approximately 5%, which I suspect is mostly due to node operators being offline. I have not seen any bugs reported yet. https://t.co/qlrZFedAnN

— terence.eth (@terencechain) February 7, 2024

For the layperson, the Dencun upgrade is expected to make transactions cheaper on layer 2 (L2) networks. Such an outcome would enhance the network activity while at the same time attracting mainstream, mass consumer demand for the Ethereum, said Leon.

Nevertheless, the Bitwise analysts acknowledged that “most of the positive sentiment will happen weeks and months after the upgrade as the effects take place.”

-

ETH ETFs

Meanwhile, there remains speculation that an Ethereum exchange-traded fund (ETF) would launch in the market soon. This assumption comes after spot BTC ETFs were approved in a landmark decision on January 10.

While it remains unclear if ETH ETFs will follow, given the odds remain lower than they were for the BTC alternative, Bitwise’s Leon said the mere possibility is a source of excitement for community members. With this, the analyst gives a 50%-60% chance for an approval.

The possibility of an approval would increase the allure of Ether among more conservative, institutional investors, like it did for BTC.

Other fundamentals that could also bode well for the Ethereum price include ETH’s deflationary supply, its restaking offering, and enhanced decentralized finance (DeFi) activity.

Ethereum Price Outlook As Bitwise Analyst Speculates More Gains For ETH

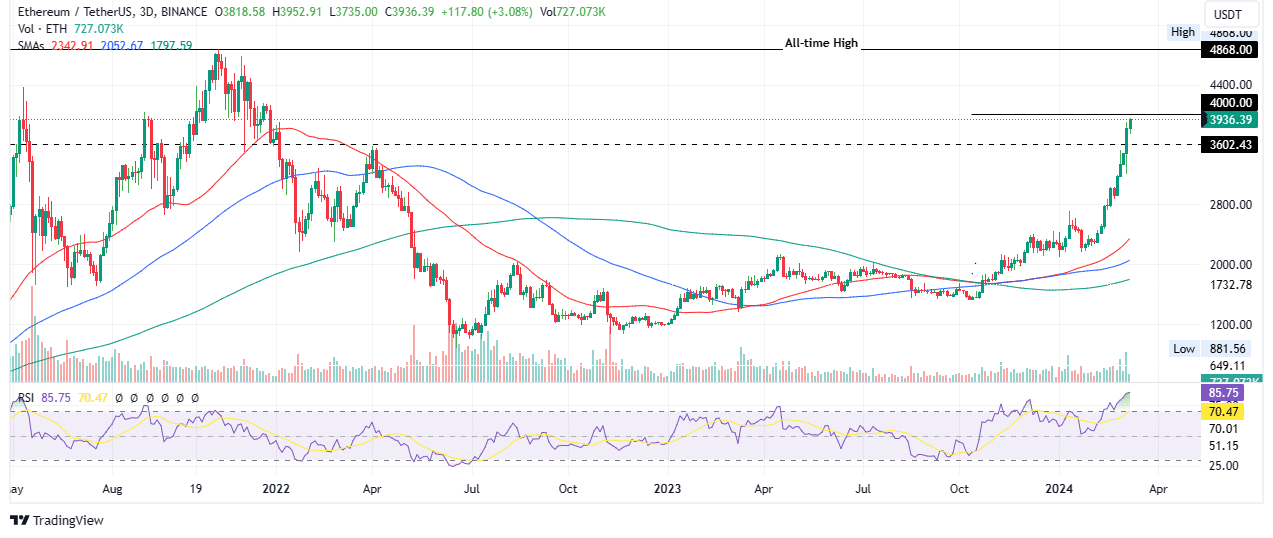

The Ethereum price is closing in on the $4,000 psychological level, which could come soon considering momentum is rising fast. This is seen with the ascending Relative Strength Index (RSI), accentuated by the growing bars of the volume indicator. The latter suggests a bullish trend that is only growing stronger.

If the Ethereum price manages a candlestick close above $4,000, it would clear the path for Ether to reclaim its all-time high of $4,868. Such a move would constitute a 23% move above current levels. In a highly bullish case, the Ethereum price could extend a neck high to nick the $5,000 psychological level, marking a new all-time high.

TradingView: ETH/USDT 3-day chart

On the other hand, profit booking could interrupt the rally, sending the Ethereum price lower. This could see ETH provide another buy opportunity around the $3,602 threshold before the next leg up.

Meanwhile, many investors are looking at GBTC, a BTC derivative that many experts say might be the best crypto to buy now.

Promising Alternative To Ethereum

After raising almost $2.5 million from investors drawn by the allure of the ongoing Bitcoin bull run, GBTC is on a roll. It is the ticker for the Green Bitcoin ecosystem, a predict-to-earn project project built atop Ethereum’s infrastructure using the ERC-20 token standard.

$2M raised!

We couldn’t be more thrilled to have you all along with us on this Green Revolution.

We’re building something huge! pic.twitter.com/RDOvEyCyGW

— GreenBitcoin (@GreenBTCtoken) March 6, 2024

GBTC is a gamified staking platform with participants earning rewards by predicting the Bitcoin price. It combines staking with gamified prediction, delivering rewards for GBTC holders and up to 100% token bonuses for the challenges presented live every week. There are daily and weekly BTC price prediction challenges that offer attractive rewards.

Introducing Green Bitcoin: A Revolutionary Predict-To-Earn Token.

Join us on our Gamified Green Staking Platform, where your predictions can turn into profits!

Website: https://t.co/dG5cEeCtRs

Telegram: https://t.co/bWanoe0vHv pic.twitter.com/eXuGQBkxio— GreenBitcoin (@GreenBTCtoken) December 3, 2023

The project also presents a sustainable staking model called ‘Gamified Green Staking’ where users can earn passive income through staking rewards. The initiative embraces a sustainable approach, attracting eco-conscious investors and ESG-focused institutions.

Employing Ethereum network’s energy-efficient proof-of-stake mechanism, the project delivers a remarkable 10,000-fold reduction in energy consumption compared to Bitcoin’s proof-of-work model.

Green Bitcoin has already amassed $2.47 million in funds out of a target objective of $2.535 million. Its token is selling for $0.6882, with a price increase coming in less than four days.

Visit and Buy GBTC here.

Also Read:

Green Bitcoin – Gamified Green Staking

- Contract Audited by Coinsult

- Early Access Presale Live Now – greenbitcoin.xyz

- Predict To Earn – Featured In Cointelegraph

- Staking Rewards & Token Bonuses

- $1+ Million Raised

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Pepe

Pepe