Embattled crypto exchange KuCoin endured a surge in withdrawal requests the past day after the US authorities levied criminal charges against the platform.

Data from various on-chain analytics firms, including DefiLlama, Nansen, and SpotOnChain, showed a surge in withdrawals across multiple categories of traders, including whales, funds, smart money, and market makers.

On March 26, the US authorities alleged that the exchange and its founders operated without proper legal permissions and violated bank secrecy and anti-money laundering (AML) laws.

KuCoin withdrawals

The exchange experienced significant withdrawals of Ethereum-based tokens during the reporting period.

SpotOnChain reported withdrawals totaling approximately $500 million, encompassing $274 million USDT, 15,500 ETH (approximately $55 million), 50 million ONDO tokens (roughly $46 million), and 12 million FET ($34 million), among others.

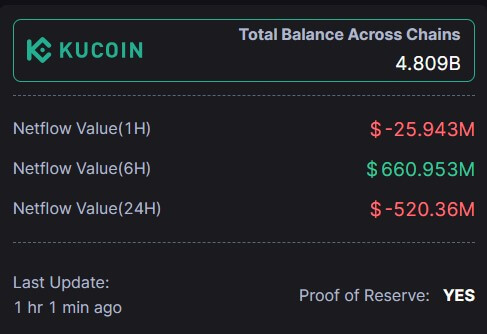

Similarly, the 0xscope dashboard places total net outflows from KuCoin at $520 million during the reporting period.

Additionally, blockchain sleuth LookonChain identified two whale accounts that collectively moved $86 million USDT to platforms like OKX and Bybit.

Amid the withdrawals, numerous users reported delays, sparking concerns reminiscent of the FTX collapse.

However, CryptoQuant CEO Ki Young Ju doused these worries, saying the platform possesses adequate reserves to process withdrawals while emphasizing that KuCoin does not mix customers’ funds.

He said:

“On-chain wise, KuCoin is fine. BTC and ETH withdrawals surged, driven mainly by retail users, with a small impact on the overall reserve. They appear to not commingle customers’ funds and have sufficient reserves to process user withdrawals.”

DefiLlama CEX transparency dashboard shows that the exchange’s wallets still hold assets worth $3.68 billion as of press time.

Touts compliance

KuCoin CEO Johnny Lyu said the exchange’s legal battles are not unique but “typical growth and regulatory issues encountered by emerging industries.”

According to him:

“Early-stage development often sees regulatory gaps, but as the industry matures, we move towards and embrace compliance and standardization.”

He pointed out that the platform recently became the first global exchange to register in India, adding that this reflects the platform’s “respect for local regulations and a proactive approach to compliance.”

Lyu reiterated that the exchange continues to operate optimally and that the firm’s lawyers were investigating the details of the allegations.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave