Quick Take

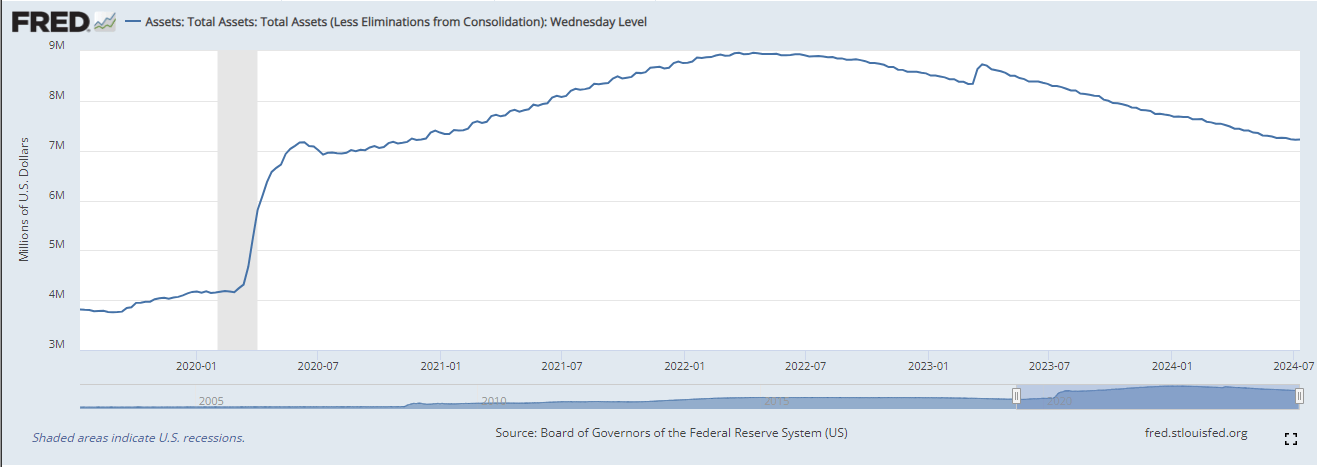

Data from FRED shows that the Federal Reserve’s balance sheet has increased by $2.6 billion to $7.2 trillion. Despite the Fed’s ongoing quantitative tightening, there have been intermittent periods of stagnation or growth in the balance sheet. However, the long-term trend remains downward.

The balance sheet peaked at $9.0 trillion in the second quarter of 2022, indicating a roughly 22% reduction over the past two years. Pre-pandemic, the balance sheet stood at $4.2 trillion, reflecting an over 50% increase since then.

As the end of the rate-hiking cycle approaches, speculation about the Federal Reserve’s first rate cut is mounting. This speculation has intensified following the Consumer Price Index (CPI) inflation print on July 11, which recorded a deflationary headline rate month-over-month at -0.1%. The decrease in CPI inflation suggests a cooling economy, potentially prompting the Fed to consider a rate cut. The balance sheet and inflation trends will be crucial in shaping the Fed’s monetary policy decisions in the coming months.

The post Federal Reserve balance sheet rises amidst looming rate cut speculation appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor