Amid persistent inflation, a weakening U.S. dollar, escalating trade wars, and waning trust in fiat currencies, the two assets most frequently discussed by investors today are gold and Bitcoin.

From fears of devaluation to the desire to preserve purchasing power, the race to become the “safe deposit box” of the 21st century has never been more intense.

Gold and Bitcoin Surge Amid Economic Uncertainty

Spot gold prices surpassed $3,500 per ounce on April 22, marking a new all-time high. JPMorgan forecasts the average gold price in 2025 to reach $3,675/oz, potentially climbing to $4,000/oz if high interest rates persist over an extended period.

Data shows that China now holds over 2,292 tonnes of gold, accounting for 6.5% of its total foreign exchange reserves. The People’s Bank of China has been steadily accumulating gold for several consecutive months, fueling global demand and accelerating the trend toward de-dollarization.

Bitcoin has also made significant strides. As of April 23, BTC is trading around $93,500, up more than 20% year-to-date. BlackRock’s spot ETF (IBIT) has attracted over $39.7 billion, becoming a key driver in Bitcoin’s institutional adoption. Investment giants such as Fidelity, ARK Invest, and VanEck are also increasing their BTC allocations in long-term portfolios.

When Cash Is No Longer Attractive

On a policy level, Bitcoin’s role has been elevated following U.S. President Donald Trump’s executive order to establish a “Strategic Bitcoin Reserve” under the Department of the Treasury. This move not only carries symbolic significance but also formalizes Bitcoin as part of the nation’s reserve assets. Meanwhile, gold continues to serve as a traditional pillar in central bank reserves worldwide.

According to data published by CoinShares on April 22, both gold and Bitcoin act as effective hedges against declining purchasing power in inflationary environments. Purchasing power, the ability of a unit of currency to buy goods and services has been consistently eroded amid rising inflation.

The Consumer Price Index (CPI) remains a common tool to measure this decline, and in such a landscape, gold and Bitcoin stand out as two of the few assets capable of preserving real value.

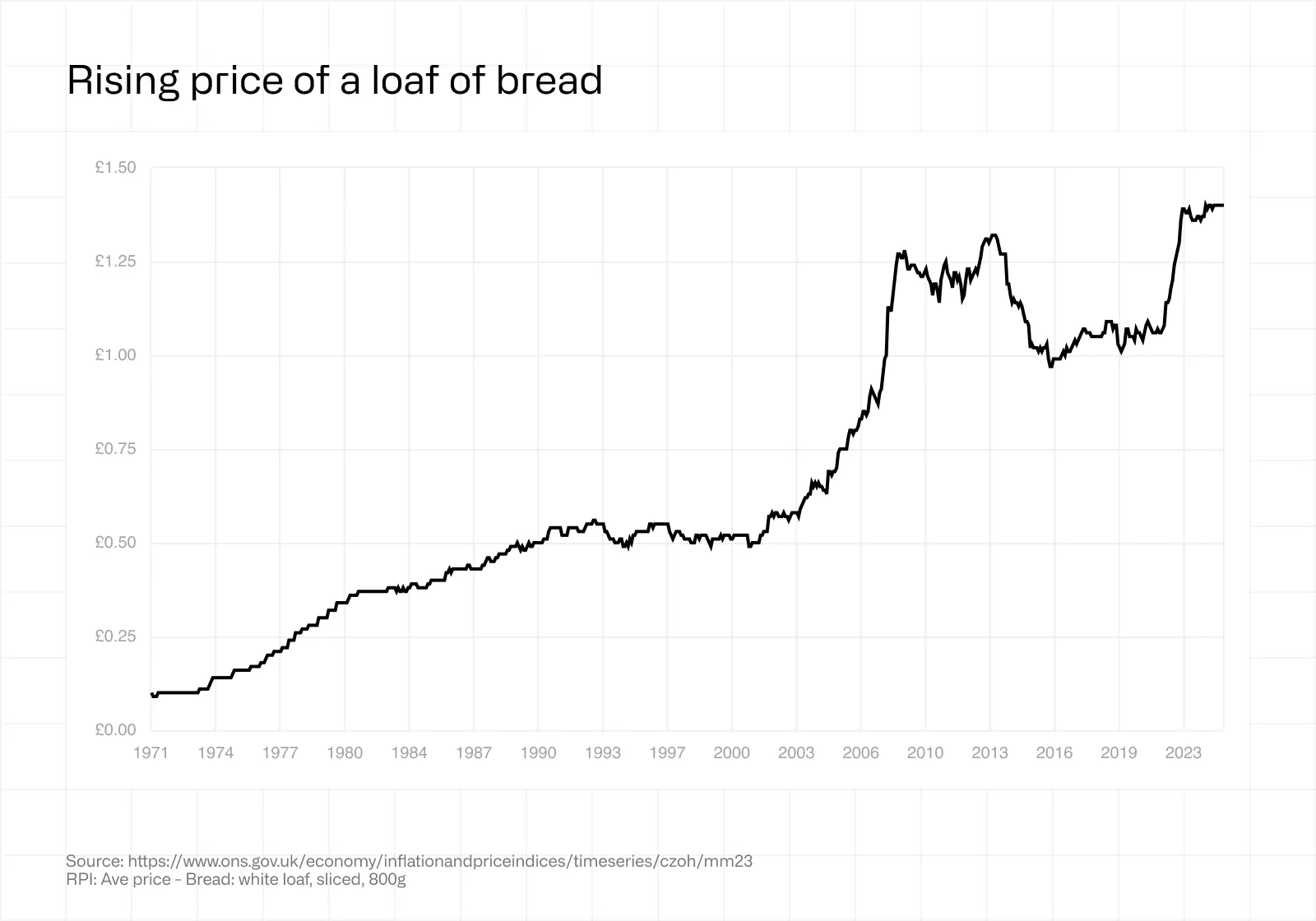

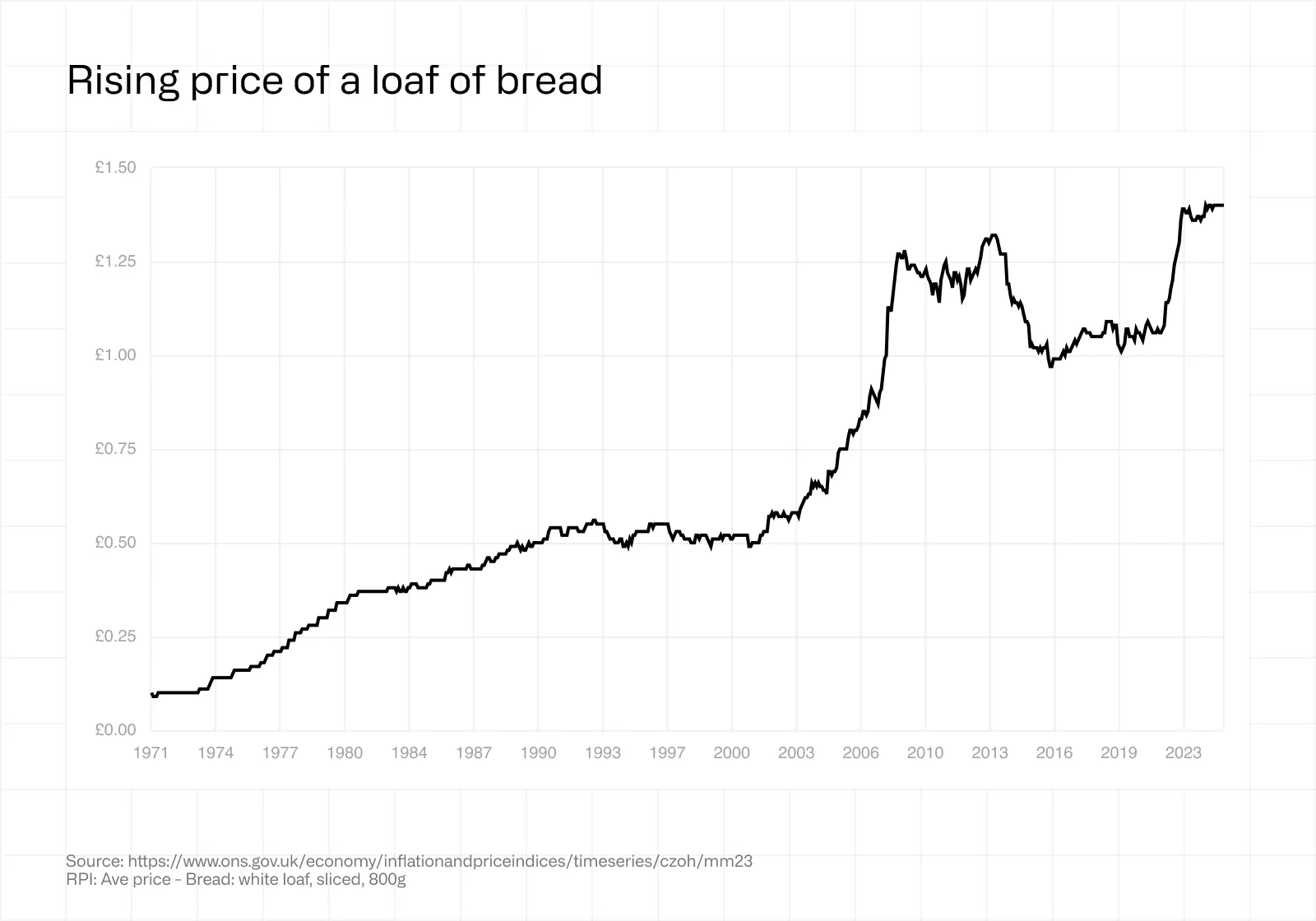

The report cites examples such as the United Kingdom, where the price of an 800-gram loaf of white bread has increased steadily since 1971, reflecting significant depreciation of the British pound. In Lebanon, where inflation peaked at 268% in April 2023, citizens were forced to abandon their local currency in favor of gold and Bitcoin to preserve purchasing power.

These are clear indicators that fiat currencies can fail in their role as a store of value, prompting a shift toward “hard assets.” Bitcoin has emerged as the digital successor to gold, particularly favored by younger generations and communities excluded from the traditional banking system.

Bread Price – Source: UK Investing

In practical terms, Bitcoin offers superior flexibility in storage and transfer. Unlike gold, Bitcoin stores in cold wallets and moves globally in minutes with low cost. A rapidly evolving security infrastructure, featuring multi-signature wallets, offline storage, and digital asset insurance is also strengthening its appeal.

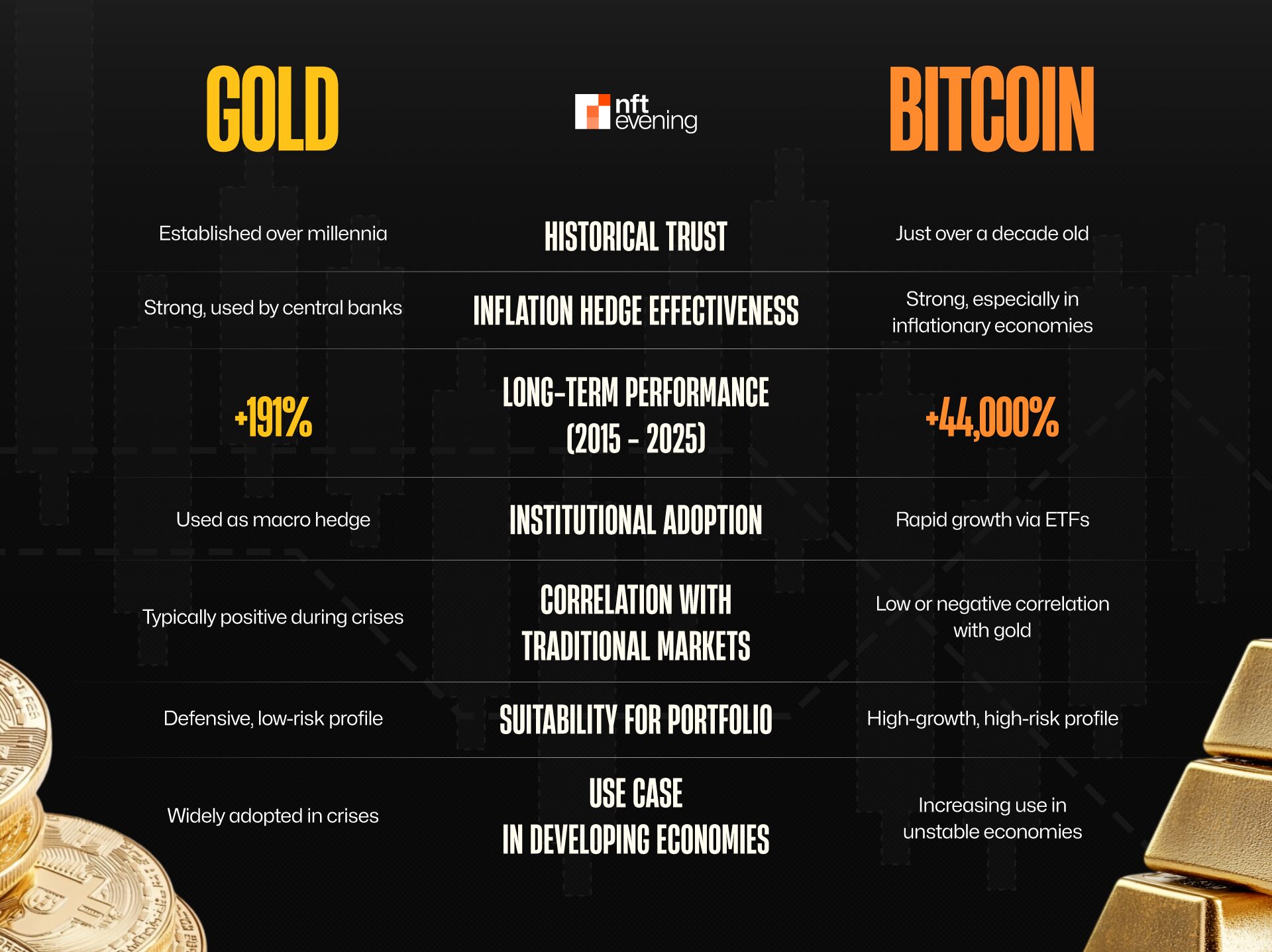

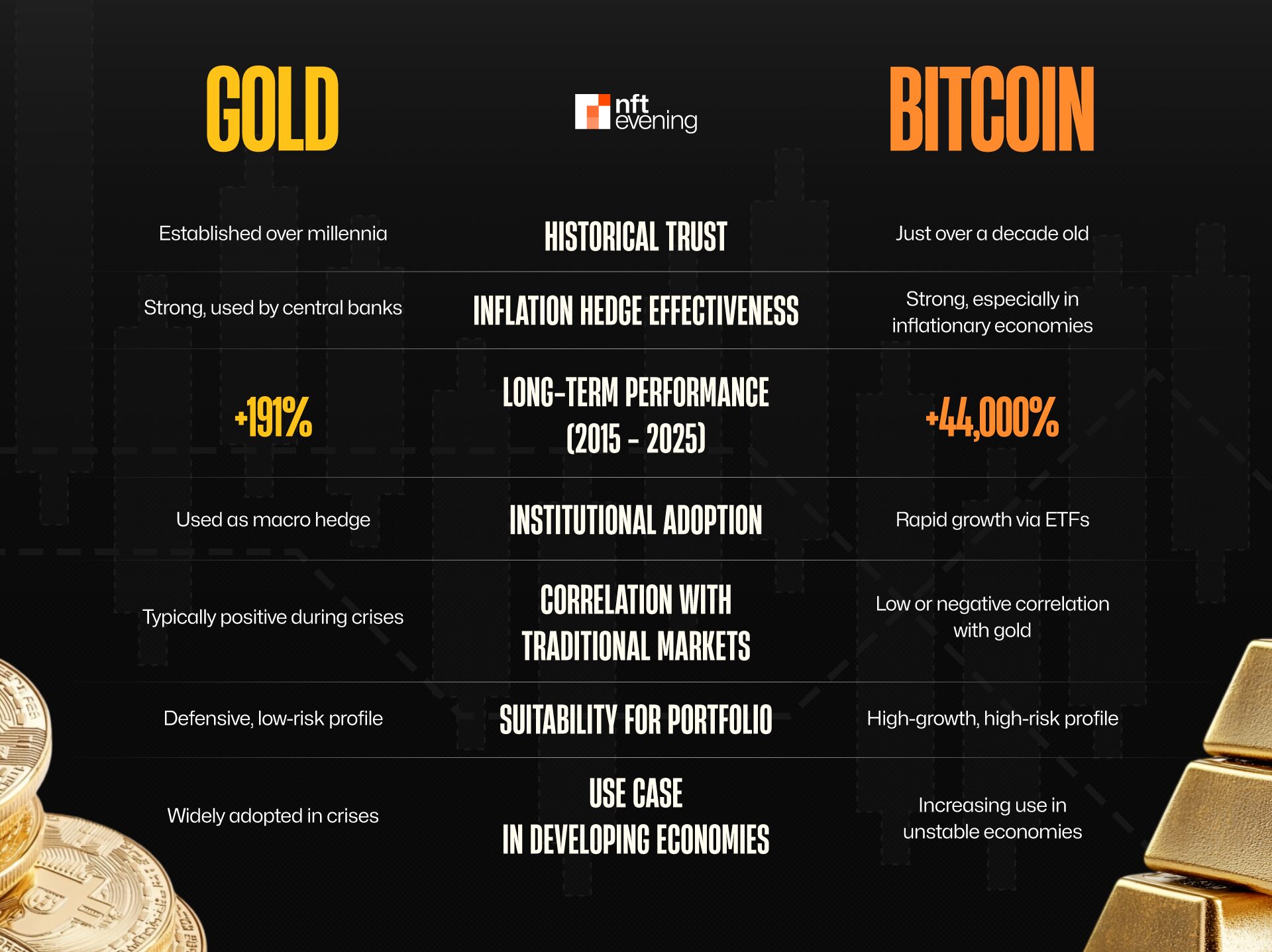

Gold and Bitcoin: Which one is better?

Volatility – once seen as Bitcoin’s biggest drawback, is showing signs of stabilization. According to data from CoinMetrics and Bloomberg, Bitcoin’s 30-day volatility currently sits at 46%, its lowest level in two years. In contrast, the Gold Volatility Index (GVZ) is climbing to its highest point since the pandemic, signaling a resurgence in short-term speculation.

Long-term trends offer a compelling view: in terms of purchasing power growth since 2011, Bitcoin has significantly outperformed gold. However, due to its higher volatility, Bitcoin is better suited for long-term investors with a high risk appetite, while gold remains the defensive asset of choice.

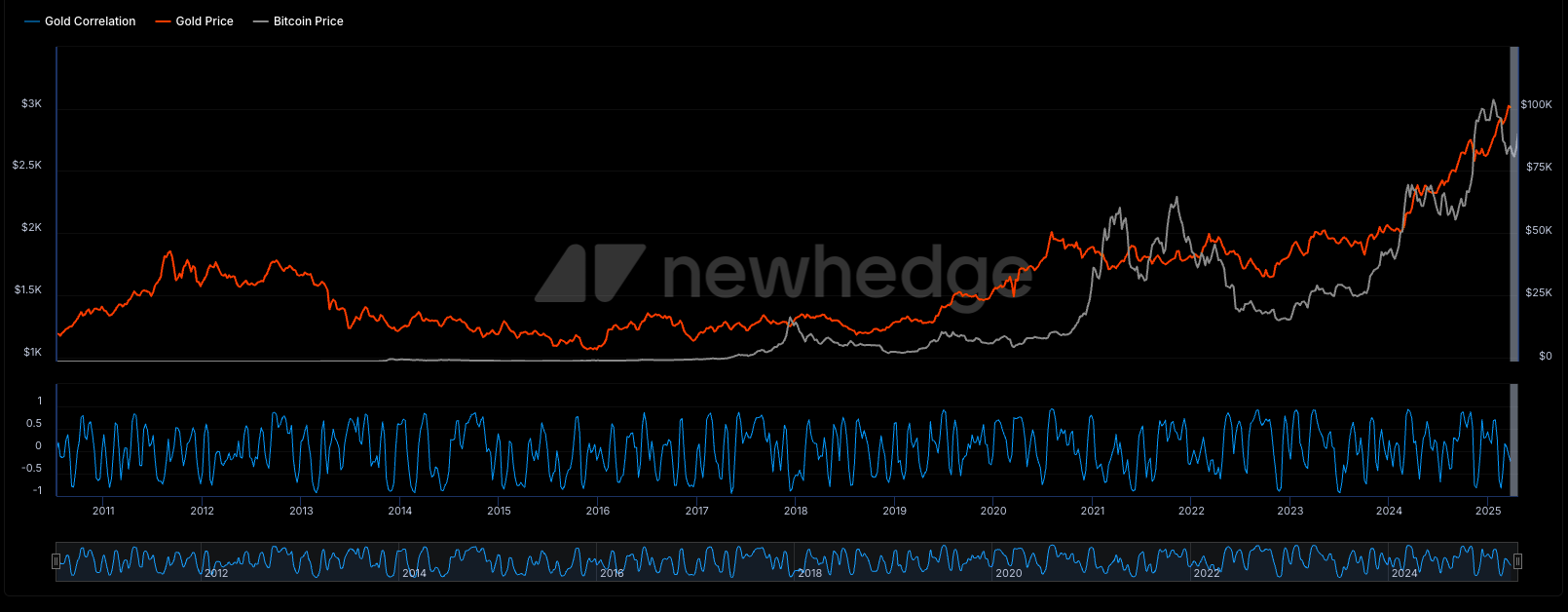

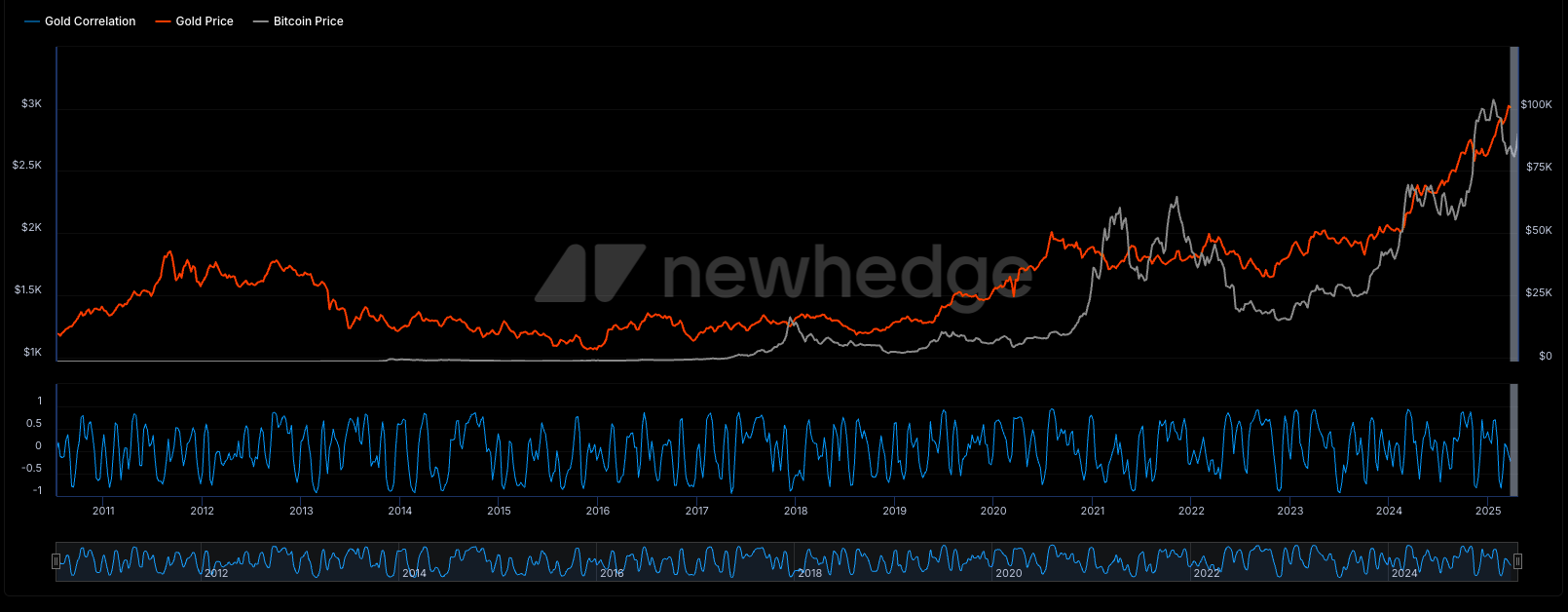

Studies show Bitcoin and gold stay weakly or negatively correlated, especially in market stress. Newhedge data shows the Bitcoin and gold correlation rarely stays above 0.5, often turning negative.

Notably, during major Bitcoin drawdowns (2018, 2022) or sharp rallies (2021), its correlation with gold tends to decline. This evidence shows gold reacts to risk, while Bitcoin responds to growth and liquidity shifts.

Bitcoin and Gold correlation – Source: Newhedge

As a result, combining both assets in a portfolio can improve risk-adjusted returns through diversification. Investors increasingly view Bitcoin and gold as complementary assets in modern allocation strategies.

Major institutional players now favor dual exposure: gold for macroeconomic stability and Bitcoin for asymmetric growth potential. ARK Invest holds gold as a hedge and raised Bitcoin exposure to 12% in 2024.

SkyBridge Capital allocates 85% to gold and bonds and 15% to Bitcoin and tech stocks. This balanced strategy has proven effective amid increasingly volatile market cycles.

Conclusion

While gold offers consistency and trust built over millennia, Bitcoin provides adaptability and scalability for a digital future. Historical performance, institutional momentum, and evolving monetary policies suggest that the optimal strategy for investors is not to pick sides but to diversify intelligently. Allocating a portion of one’s portfolio to both assets, balancing gold’s defensive strength with Bitcoin’s growth trajectory, may offer the best chance at preserving and expanding wealth in the 21st century.

Read more: Day Trading Crypto: A Beginner’s Guide

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Avalanche

Avalanche  World Liberty Financial

World Liberty Financial  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  USD1

USD1  Dai

Dai  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold