Quick Take

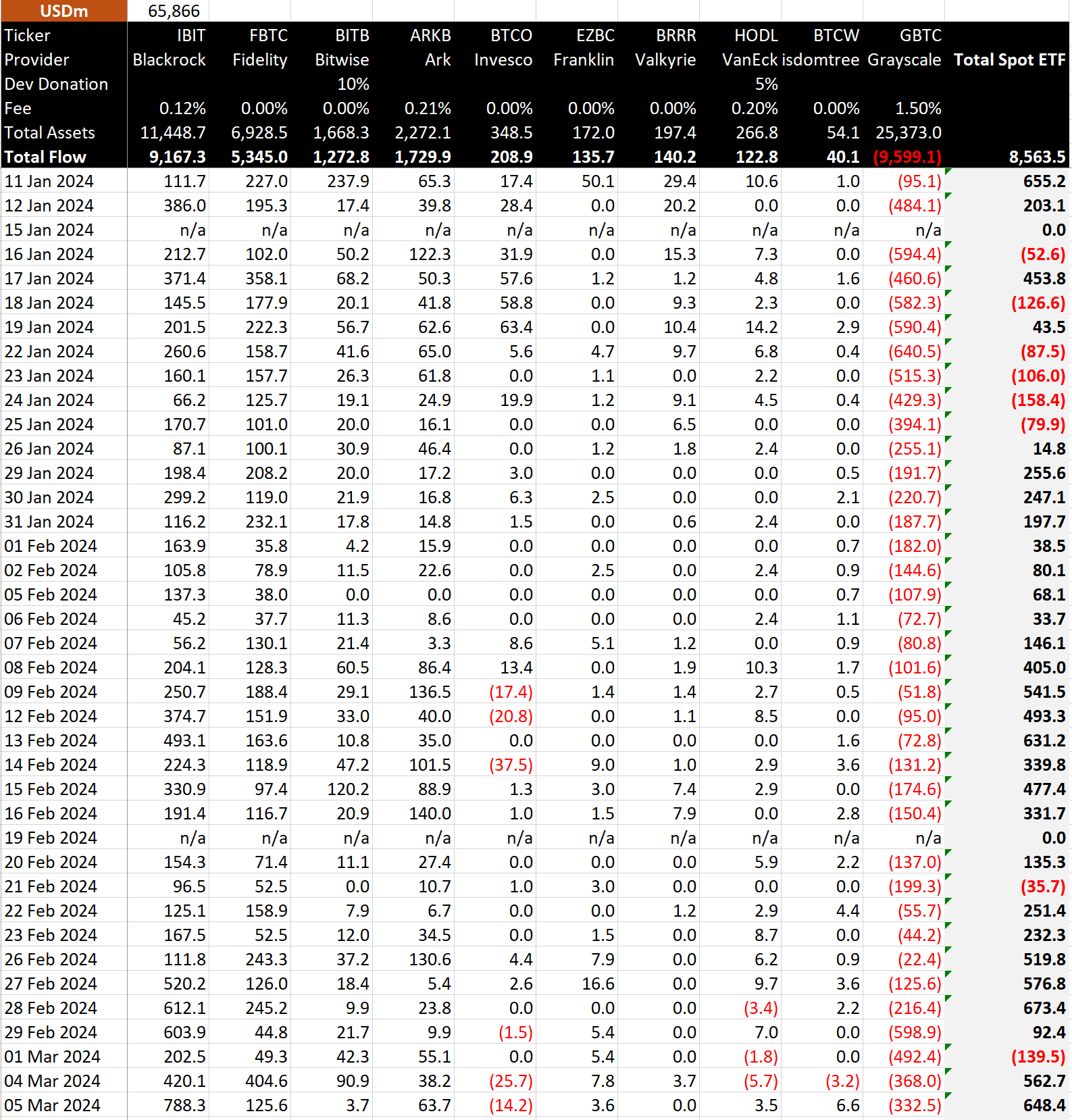

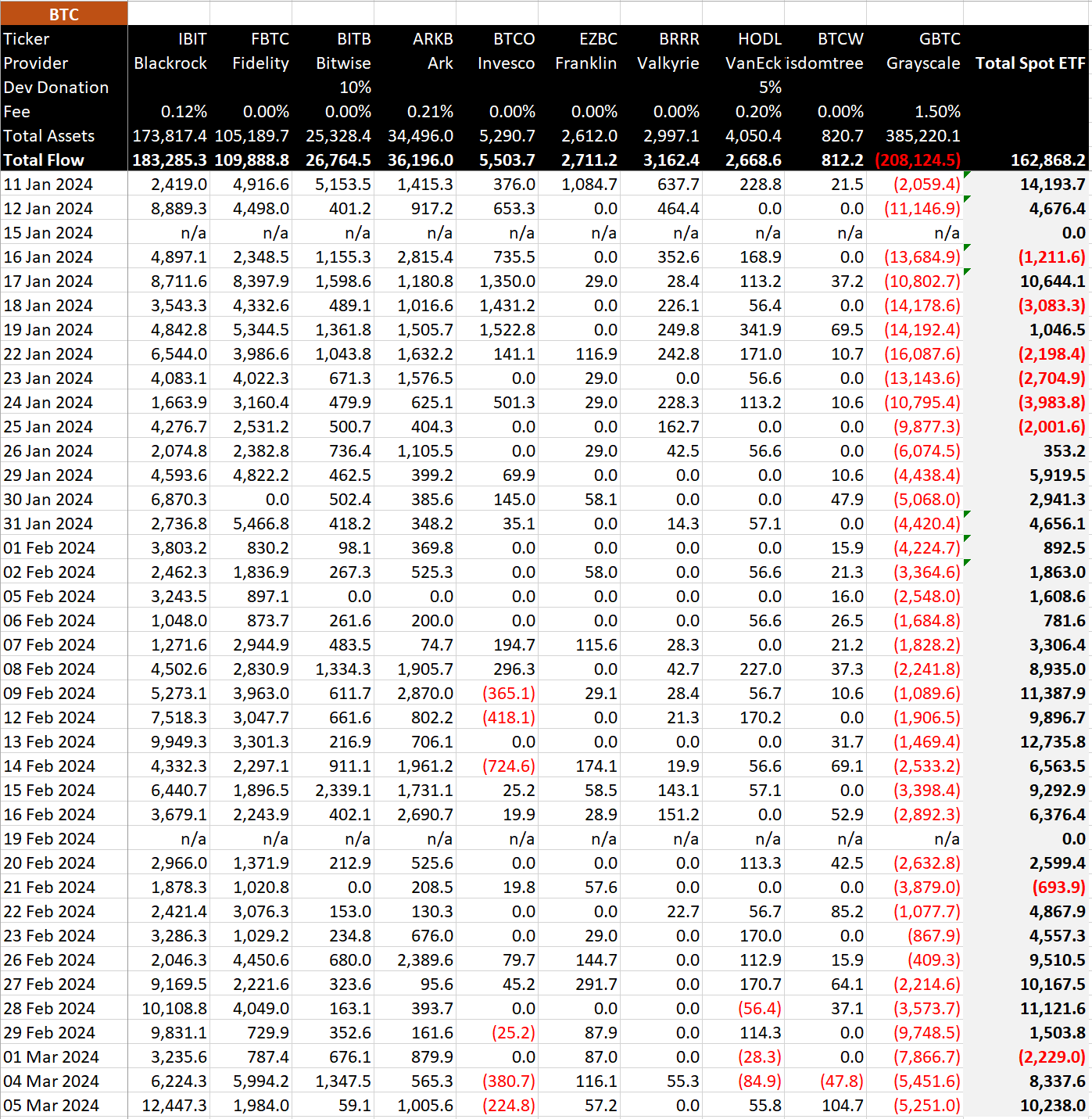

Data from BitMEX shows that on March 5, a staggering $648 million inflow was recorded into the US Bitcoin ETFs, which equates to approximately 10,238 BTC. This was the third biggest day in terms of net inflows since trading began. The principal driver was BlackRock IBIT, with a substantial inflow of $788 million, or another 12,447 BTC, increasing their total net inflows to an impressive $9.2 billion, roughly 183,000 BTC. The $788 million inflow by BlackRock represents the most substantial inflow ever recorded from an ETF provider.

Fidelity’s FBTC also had a significant inflow of $126 million, pushing their total net inflows to $5.3 billion. Simultaneously, GBTC witnessed an outflow of $333 million, marking a continuation of decreasing outflows and suggesting a positive trend. Despite this, GBTC’s total outflows have hit $9.6 billion, according to BitMEX.

Overall, the total net inflows for Bitcoin ETFs stand at an imposing $8.6 billion, the equivalent of 162,868 BTC.

The post Historical day for Bitcoin ETFs as BlackRock’s inflow hits a record $788 million appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Canton

Canton  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor  Pepe

Pepe