Amid a market downturn, where most tech-focused coins are stagnating or experiencing sharp declines, Hyperliquid continues to solidify its position with remarkable resilience. Let’s dive in and analyze the next potential trend for Hyperliquid Price Prediction.

What is Hyperliquid?

Hyperliquid touts itself as a next-generation platform designed to completely revolutionize how you interact with digital assets. Crafted from the ground up to provide simple, seamless one-click trading, Hyperliquid combines cutting-edge technology with a focus on real-time liquidity and precision.

Hyperliquid: The DEX Revolution Challenging Top CEXs

Hyperliquid is rapidly establishing itself as one of the leading DeFi platforms, surpassing traditional decentralized exchanges (DEXs) by fully integrating an optimized Layer 1 blockchain ecosystem for trading and smart contract deployment.

With over 60% market share in the decentralized derivatives sector, Hyperliquid is not only competing with other DEXs but also directly challenging centralized exchanges (CEXs) like Binance, OKX, and Bybit. Capable of handling up to 100,000 transactions per second, featuring a fully on-chain order book for complete transparency, and utilizing the HyperBFT consensus mechanism to reduce latency to just 0.2 seconds, the platform delivers a high-speed trading experience while maintaining full decentralization.

Beyond achieving a record-breaking $15 billion in daily trading volume, Hyperliquid has also become the highest revenue-generating blockchain, surpassing Ethereum, Solana, and BNB Chain with a daily income of $3 million. This proves its ability to sustain liquidity and growth without relying on Binance or other centralized listings. Furthermore, with a transparent tokenomics model free from venture capital (VC) manipulation, $HYPE remains undervalued compared to its actual potential, making it an attractive investment opportunity. Hyperliquid is more than just a DEX—it is laying the foundation for a next-generation decentralized financial ecosystem, where users have full control over their assets, benefit from optimized transaction costs, and access groundbreaking financial opportunities.

Source: TradingView

Hype Tokenomics

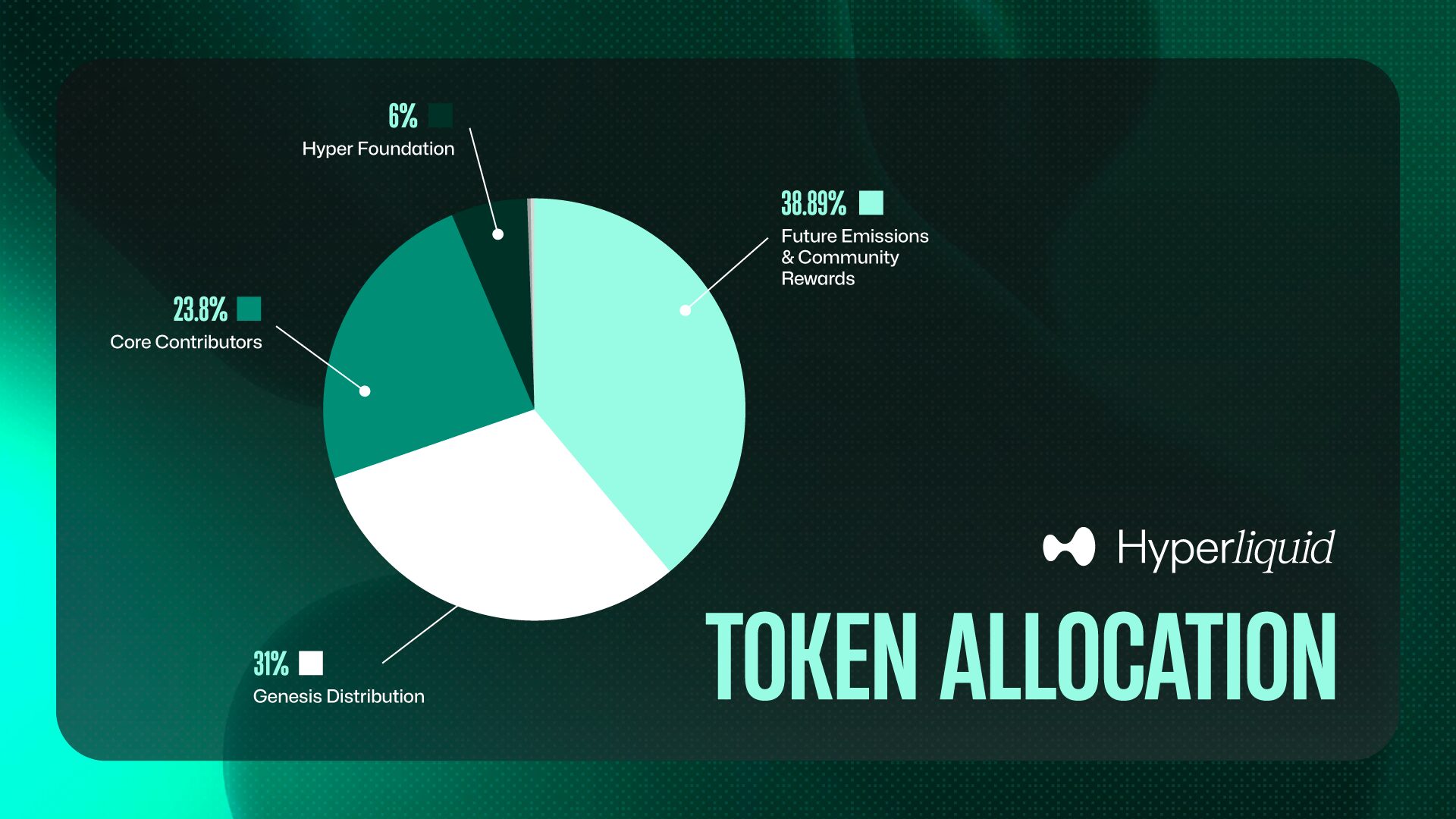

HYPE Token Distribution

Total Supply: 1 billion HYPE tokens

- Genesis Distribution: 31%

- Future Emissions and Community Rewards: 38.888%

- Core Contributors: 23.8%

- Hyper Foundation: 6%

- Community Grants: 0.3%

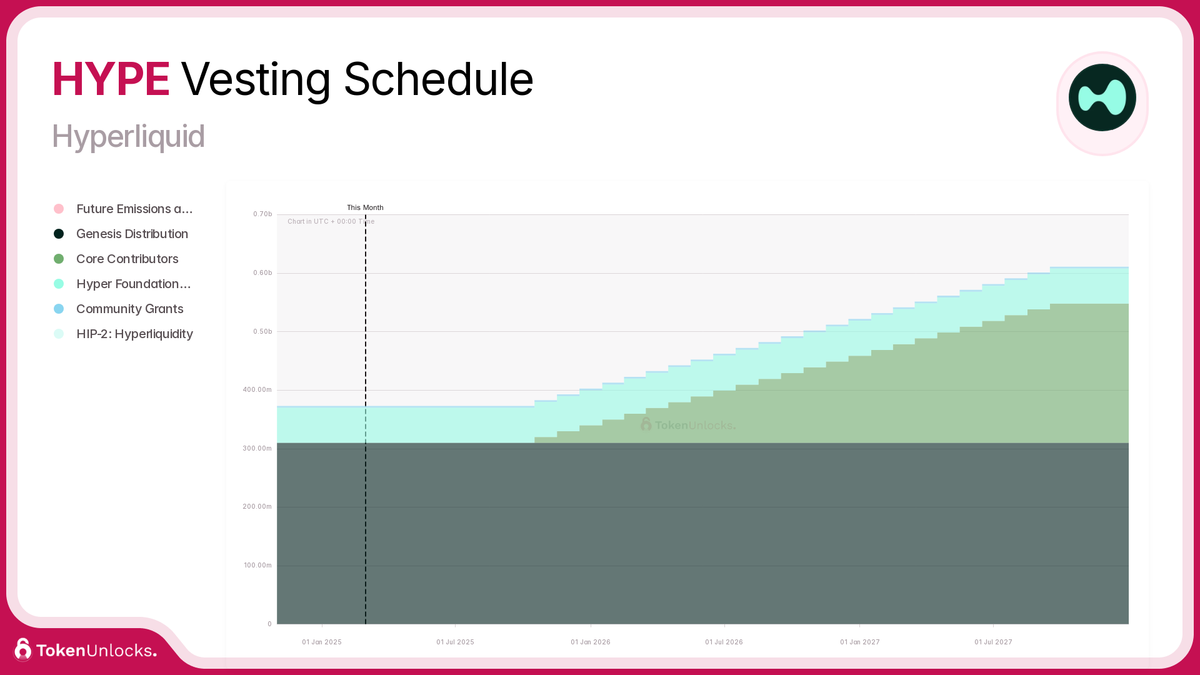

Vesting Schedule

- Community Allocation: Over 30% of the total supply was distributed at launch via the airdrop.

- Team Tokens: Locked for one year, followed by a gradual monthly unlock over two years, with full distribution by 2027–2028.

Source: Tokenomist

Hyperliquid Price Prediction

Overview of the HYPE Chart

HYPE is a relatively new trading pair with limited historical data. This makes it challenging to determine past support and resistance levels. However, by utilizing Fibonacci retracements, analyzing price structure, and evaluating recent market behavior, we can make a well-informed assessment of its potential future trend.

According to CoinGecko, the current price of HYPE, reflects a 24-hour change of -4.9% and a 7-day decline of -20.3%. However, over the past 30 days, the price has increased by 42%, indicating a notable recovery trend.

Historical data shows that the ATH was $34.96 on December 22, 2024, while the all-time low (ATL) was $3.81 on November 29, 2024, highlighting the token’s significant price volatility. The current market capitalization stands at $4,533,147,158, with a 24-hour trading volume of $134,598,198, demonstrating a relatively high level of trading activity.

Recent Price Trend Analysis

Based on data from CoinGecko, HYPE has experienced significant price fluctuations over the past month. Specifically:

- 30 days ago, the price was around $9.51 (calculated from the 42% increase to reach the current $13.51).

- 14 days ago, the price was approximately $10.04 (based on a 34.5% rise in 14 days).

- 7 days ago, the price was around $16.95 (reflecting a 20.3% decline in the past 7 days to reach the current level of $13.51).

Fundamental Analysis: Hyperliquid’s Technological Edge and Community-Centric Approach

Technological Innovations

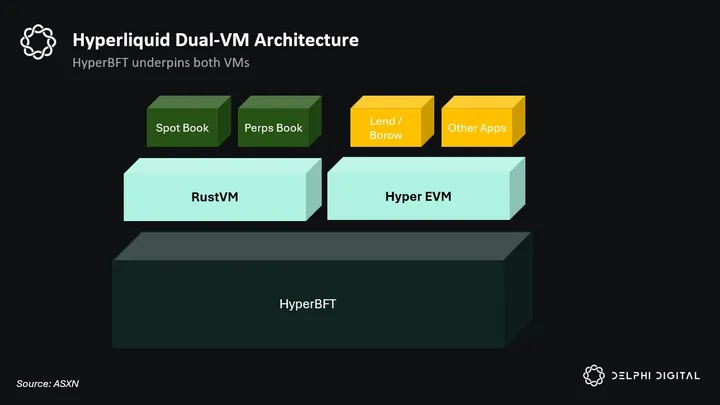

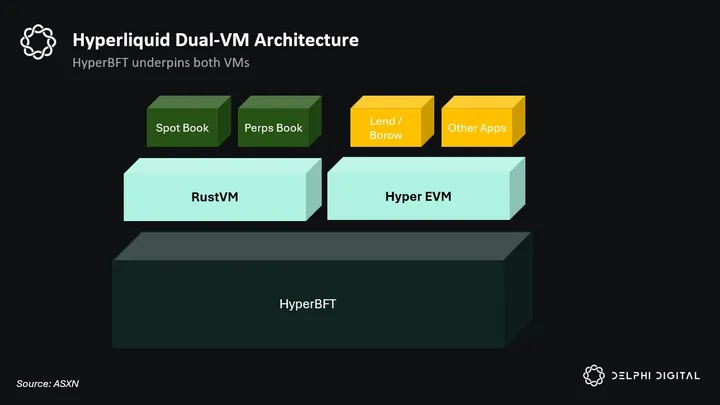

Hyperliquid’s blockchain employs the HyperBFT consensus mechanism, a variant of Byzantine Fault Tolerance (BFT), enabling rapid transaction speeds with block finality under 1 second. This efficiency supports high-frequency trading and complex decentralized finance (DeFi) applications. The integration of HyperEVM ensures compatibility with Ethereum’s Virtual Machine (EVM), facilitating seamless deployment of smart contracts and decentralized applications (dApps) by developers familiar with Ethereum’s ecosystem.

Source: Delphi Digital

Unlike many DEXs that utilize Automated Market Maker (AMM) models, Hyperliquid employs an order book system, providing deeper liquidity and more favorable pricing for traders. This approach mirrors traditional CEXs, offering users a familiar and efficient trading experience. Additionally, Hyperliquid eliminates gas fees for transactions, significantly reducing costs for users and enhancing the platform’s accessibility. This is the reason why large-volume leveraged positions are now being opened on this platform rather than the more tenured ones.

Team and Community Engagement

The core team behind Hyperliquid comprises alumni from prestigious institutions such as Harvard, Caltech, and MIT, with professional backgrounds at leading tech and financial firms like Google, Hudson River Trading, and Nuro. This diverse expertise underpins the platform’s innovative development and strategic direction.

Emphasizing a community-first philosophy, Hyperliquid has eschewed venture capital funding, allocating a substantial portion of its native token, HYPE, directly to the community. This approach fosters a decentralized governance model and aligns the platform’s success with its user base, promoting active participation and long-term commitment.

Revenue Model and Financial Sustainability

Hyperliquid’s revenue is primarily derived from transaction fees, with a significant portion redistributed to the community. Notably, all fees are directed to the Hyperliquid Liquidity Providers (HLP) and the assistance fund, ensuring that the community directly benefits from the platform’s growth. This model contrasts with other protocols where fees primarily benefit the team or insiders.

The platform’s tokenomics are designed to support long-term sustainability and community engagement. A portion of the tokens may be burned during staking to reduce circulation, integrating a deflationary model to boost the token’s value.

Differentiation from Other Layer 1 Platforms

Hyperliquid distinguishes itself from other Layer 1 platforms like Ethereum and Solana through several key aspects:

- Dedicated Blockchain: Operating on its own Layer 1 blockchain, Hyperliquid ensures tailored optimizations for trading activities, resulting in enhanced performance and user experience.

- Community-Centric Tokenomics: By allocating a substantial portion of its native token to the community and avoiding venture capital funding, Hyperliquid fosters genuine decentralization and aligns incentives with its user base.

- Order Book Model: The use of an order book system, as opposed to the prevalent AMM model, provides traders with deeper liquidity and more precise pricing, catering to both retail and institutional participants.

Identifying Key Levels in Technical Analysis

Key Support Levels

- The bottom point before HYPE reached its highest peak plays a crucial role in confirming support levels.

- After breaking through this key support level, the price retested it, confirming Fibonacci retracement levels.

- When the price reaches a deep support zone, a minor rebound may occur.

Accumulation and Breakout Zones

- The chart shows price consolidating within narrow ranges—a sign of accumulation.

- When price breaks out of an accumulation zone, it is essential to confirm whether it is a genuine breakout or just a trap.

- If the price moves up after a breakout, it could signal a confirmed bullish trend.

- Conversely, if the price fails to hold above the breakout level, it may indicate a bull trap.

Source: TradingView

HYPE Trading Strategies

Currently, there are no clear signs of a confirmed trend reversal. Therefore, NFTevening still prioritizes the bearish scenario in the near future, especially as the price has broken out of the accumulation zone and is now showing a recovery move to confirm this breakout.

- If the price continues to stay below the newly formed resistance zone, the downtrend is likely to persist.

- On the other hand, if a strong reversal signal emerges in the market, the strategy should be adjusted accordingly.

Key Support Levels if the Price Continues to Decline

If the downtrend continues, the price may reach key Fibonacci levels that act as potential support zones:

- 12 – 12.5 USDT: This range is near the previous low, where buying pressure could emerge, potentially triggering a slight rebound.

- 10 – 10.5 USDT: This is expected to be the strongest support zone. If the bearish momentum persists, NFTevening anticipates the price could drop into this range.

Conclusion

HYPE is currently in a strong downtrend, with no clear reversal signs. Trading at this stage requires caution and confirmation through technical signals. To optimize trading strategies, investors should monitor price reactions at key support levels and wait for a reversal pattern before making any buy decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Litecoin

Litecoin  Avalanche

Avalanche  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore