The following is a guest post by Tim Haldorsson, CEO of Lunar Strategy.

The sweet sounds of upward price alerts hit your phone non-stop. Mega green candles are seen on every crypto chart. The smells of profits are all over the place.

In other words, the bull market is back in full swing, and it feels like a digital gold rush has followed. In the middle of this bullish craziness, everyone suddenly imagines themselves as venture capitalists.

Of course, this raises more questions than answers. Why is this the case? Does the market need more VCs? Is this a healthy sign or a top signal, a warning of another bubble?

In this article, we’ll find that the answers are not as binary as a simple “yes” or “no.”

What Fuels Hype in a Bull Market?

The excitement in a bullish market is not just driven by impressive profits. What really draws people in during a crypto bull market are the powerful psychological and economic factors that are set loose.

With a surge in market activity and constant media hype, a contagious sense of optimism takes hold. Some might even call it a frenzy, though I don’t think we’re quite there yet.

In such an energized atmosphere, the distinction between experienced investors and newcomers blurs. People caught up in the fervor start to view themselves as savvy venture capitalists. Every new startup or project, no matter its actual chances of success, is called “the next big thing.”

It’s true that this wave of excitement isn’t baseless. Past bull markets have shown time and again that fortunes can be made almost overnight. However, what often gets overlooked are the intricate strategies that lead to profitable investments. Seasoned venture capitalists bring with them years of expertise and unique skills that help them navigate the unpredictable world of investing with caution.

Psychological Drivers Behind the VC Mindset

One could argue that this common mindset taps into several core psychological drivers:

- The fear of missing out (FOMO);

- A feeling of excessive confidence;

- The enticing allure of quick profits.

FOMO, in particular, plays a significant role. It is the persistent idea that somewhere within the vast array of tokens and projects being introduced on the chain, there exists a valuable opportunity that you would deeply regret overlooking forever.

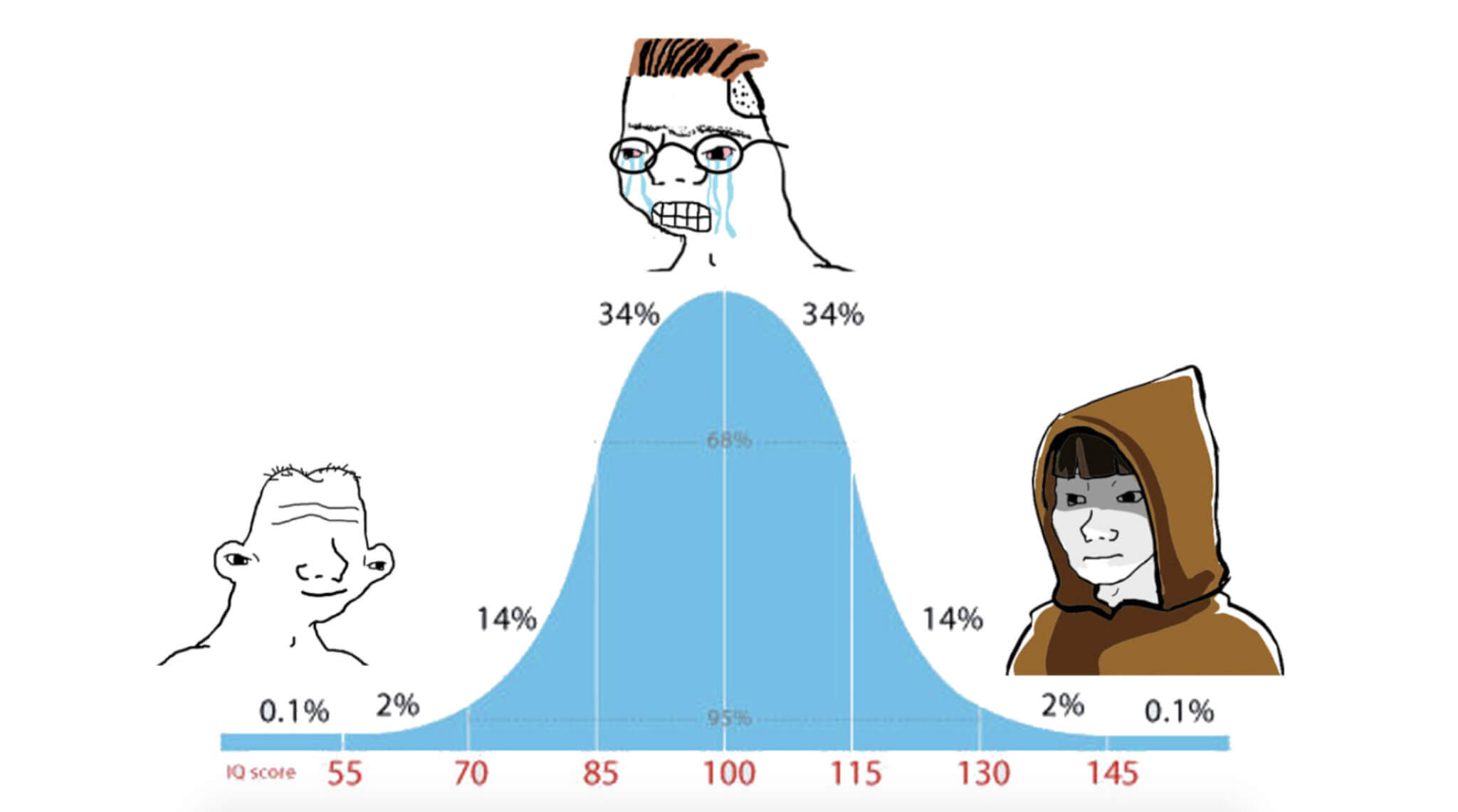

The well-known left-right curve meme encapsulates this mindset perfectly. On one side, some individuals simply follow trends and intriguing narratives without much consideration, holding onto the hope, no matter how unlikely, that their selected investment will soar in value. On the opposite side are the more seasoned participants who excel at recognizing hidden gems among the ordinary. In between these extremes are those who view the world logically and find little logic in crypto market dynamics.

Most crypto enthusiasts, whether long-time participants or newcomers, tend to gravitate toward either end of this curve. It serves as a visual representation of the risk appetite that drives the ‘VC mindset’ during a bullish market period. Traditional investors are often seen as conservative individuals who may not align with the general mindset of the crypto market.

So, what drives this highly esteemed ‘risk-taking’ attitude? Many are influenced by overconfidence, fueled by success stories and the seemingly easy profits showcased on social media, causing them to overestimate their investment skills. The anonymity within the crypto community also emboldens people to take risks they would avoid in more conventional environments.

Lowering Entry Barriers

One standout feature of the crypto market is its inclusive nature when it comes to investment opportunities. Unlike traditional venture capital with closed networks and significant capital demands that can be daunting for most, the crypto space welcomes everyone with open arms.

Whether it’s Initial DEX Offerings (IDOs), token presales, or NFT launches, getting involved requires minimal barriers as long as you have a crypto wallet and some funds ready to invest.

Influencer-driven fundraising is another intriguing aspect of accessibility that has become synonymous with crypto. It’s no secret that social media influencers hold sway over market sentiments through their platforms.

However, a new type of influencer is emerging, opting to have more personal investment by actually backing up their words with action. Startups and initiatives are launching programs where social influencers are given early access to fundraising opportunities.

Similar to traditional venture capitalists, these influencers contribute funds along with exposure, creating a mutual incentive system where all parties collaborate for the success of the project.

Playing it Smart: What Does the Market Want?

The influx of funds and attention during a bullish market can significantly enhance the performance and value of crypto projects. While this presents various opportunities, it also brings about a level of volatility and speculation that can be both advantageous and detrimental to the market as well as its stakeholders. This raises significant concerns regarding sustainability in relation to risk.

An increasingly ‘risk on’ strategy driven by inexperienced market participants chasing after high returns like venture capitalists can lead to bubbles and promote unhealthy speculation.

Furthermore, the abundance of projects competing for attention may result in a decrease in quality, with hype often overshadowing substance. This starkly contrasts with the traditional venture capital approach, which relies on thorough research and a long-term perspective to manage risks and ensure investment viability.

Despite the accessibility and potential for quick profits in investing, it’s essential for investors to proceed with caution. The saying “DYOR” (Do Your Own Research) holds significant weight in today’s climate. Anyone entering the crypto market likely understands its volatile and speculative nature.

Therefore, conducting thorough research, grasping the risks involved, and implementing a disciplined investment approach are crucial. While the bullish market may give a taste of venture capitalism to many, it can also serve as a stark reminder of the consequences when impulsive trading surpasses fundamental analysis and prudent decision-making.

In Summary

It’s tempting to get swept up in the thrill of envisioning oneself as a savvy investor identifying and backing promising ventures early on. However, true venture capitalism – whether in crypto or traditional markets – involves recognizing potential opportunities and taking measured steps supported by patience, discipline, and risk management acumen.

Presently, striking a balance between making investments accessible to all while emphasizing education and prudence is key to fostering a robust market that benefits everyone involved.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Sui

Sui  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  USDT0

USDT0  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Canton

Canton  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  PayPal USD

PayPal USD  USD1

USD1  Polkadot

Polkadot  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave