ETH’s price has recently performed like a stablecoin. 4 years ago, if you had invested $10,000 in Ethereum (ETH), you might expect a significant return by now, given the crypto market’s reputation for volatility. However, as of March 31, 2025, that investment would hover around $10,000 to $11,000, reflecting ETH’s surprisingly minimal performance.

The Modest Volatility of ETH Over the Past 4 Years

Back on March 31, 2021, ETH was priced at around $1,800. Fast forward to today, and it sits between $1,700 and $1,800—a negligible change over four years. While ETH hit an all-time high (ATH) of $4,878 in November 2021, it plummeted to roughly $1,000 during the 2022 bear market, only to recover gradually to its current range.

Source: Coingecko

This rollercoaster contrasts sharply with other cryptocurrencies. Bitcoin BTC, for instance, surged from $58,000 in 2021 to a peak of $109,000 in 2025, though it’s now down over 30% to around $82,000. Solana SOL skyrocketed from $35 to $126 (+260%), while XRP XRP has seen mixed results but outperformed ETH in percentage gains at times.

Looking ahead, ETH’s price often mirrors BTC’s trends. Historically, BTC drops 30-50% after hitting an ATH. For this period, after reaching the ATH of $108,786 on January 2025, BTC had decreased about 25-30%, to BTC today. With this case, some analysts have predicted a further decline to $66,000 in BTC’s price; then ETH could follow suit.

However, the ETH/BTC trading pair has also weakened significantly, with BTC/ETH approximately equal to 45, signaling ETH’s growing disconnect from BTC’s dominance. Moreover, the recent Pectra update, unlike past upgrades such as The Merge, has failed to spark a positive price reaction, adding to the bearish outlook.

Therefore, if you had invested $10K in ETH four years ago, you’d actually be at a slight loss this year.

Source: Coingecko

ETH’s Price Performs Like a Stablecoin

ETH’s lackluster performance can be traced to broader economic fears and market dynamics. With recession concerns mounting, traditional safe-haven assets like gold have hit record highs. Especially amid rising diplomatic tensions and global trade wars since Trump took office earlier this year, gold has emerged as the top safe-haven asset for investors, surging to $3,122 per ounce. Or another option, BTC, has solidified its status as “digital gold,” also a common way to reserve assets for investors.

In contrast, the lack of a strong enough use case for ETH is causing price stagnation. Investors are hesitant to pour money into assets perceived as less reliable, like ETH or other digital assets, during uncertain times.

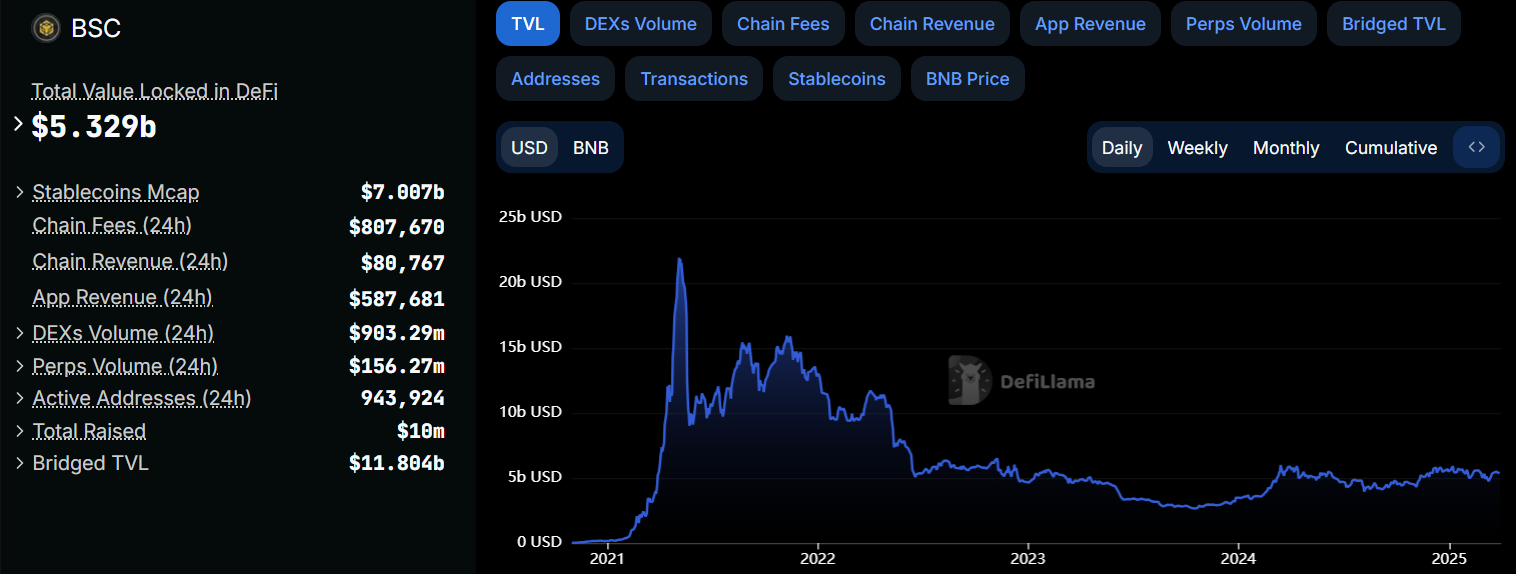

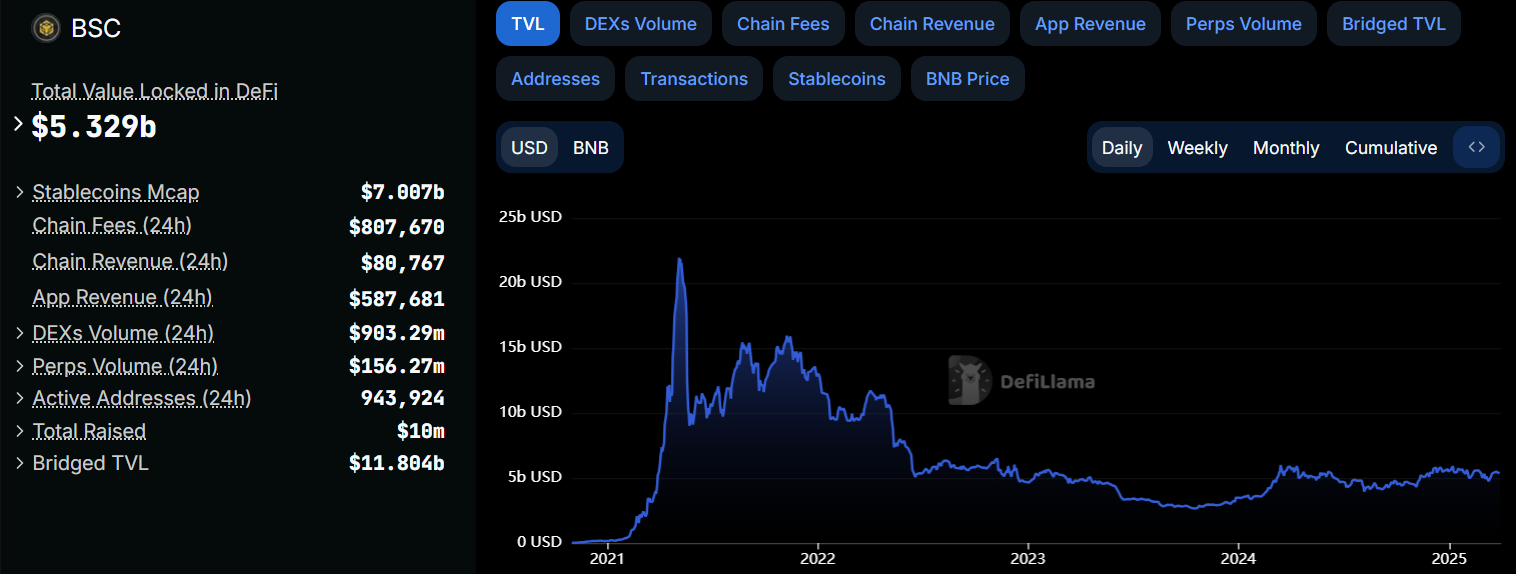

Meanwhile, competitors like Binance Coin (BNB) thrive through proactive measures. BNB’s ecosystem has rolled out initiatives like the third Liquidity Program, memecoin stimulation from CZ, and projects like WIO and Binance Alpha. These efforts have kept BNB’s price buoyant, climbing from $300 in 2021 to over $600 in 2025—a 100%+ gain—while its chain’s total value locked (TVL) rivals Ethereum’s in DeFi activity.

Source: DefiLlama

Ethereum, by contrast, lacks such dynamic catalysts. While technically impressive, its upgrades haven’t translated into immediate market excitement. While The Merge significantly reduced energy consumption, Pectra’s emphasis on scalability improvements has not yet yielded significant results.

Without a bold push akin to BNB’s multi-pronged strategy—or even Solana’s relentless marketing of its high-speed blockchain—ETH remains stuck, mimicking a stablecoin’s predictability rather than a growth asset’s volatility. This inertia highlights a broader challenge: ETH’s maturity may be stifling its ability to compete with hungrier rivals.

Read more: ETH Suddenly Dropped to $1,900

Despite the Downsides, ETH Still Holds Immense Potential

Even with these challenges, ETH remains a cornerstone of the crypto world. As the largest and most established Layer 1 blockchain, it boasts a robust community and a sprawling ecosystem, including Layer 2 solutions and a wide array of applications. Its technology continues to lead the industry, driven by top-tier developers and market-leading upgrades.

Besides that, there have been several rumors within the community of the growing real-world adoption of Ethereum. For instance, discussions around ETH’s use in payments and its increasing recognition suggest a promising future. Trump’s gone big on ETH, holding 70% of his portfolio in it over BTC.

Banks are now greenlit to stake ETH, and BlackRock is betting on it as their sole tokenization pick—showing ETH’s quietly winning where it counts. While the market may not reflect it now, ETH’s fundamentals—its scalability, developer activity, and ecosystem strength—position it for long-term success. Patience could yet pay off for ETH believers.

5/➮ Strange that, despite everything I mentioned, we have Trump buying more ETH than BTC and holding 70% of his portfolio in it

🕷 There’s also the fact that banks have been allowed to use ETH for staking

🕷 And BlackRock, for whom ETH has become the only option for…

— symbiote (@cryptosymbiiote) March 15, 2025

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Aave

Aave