The Israeli Air Force launched a series of coordinated preemptive strikes late Thursday targeting dozens of sites across Iran, including facilities believed to be linked to the country’s nuclear program. The escalation comes amid rising tensions between the two long-time adversaries, with Israeli officials declaring the operation as an attempt to eliminate Iran’s nuclear threat.

Senior Israeli officials, speaking to Channel 13, said the country is bracing for “days of battle,” following the aggressive military campaign aimed at neutralizing what it calls existential threats. While full details of the strikes are still emerging, reports indicate that the air raids hit military installations, research facilities, and missile depots.

Market Reaction: Crypto Takes a Hit

The news immediately sent shockwaves through the global financial markets, with risk assets pulling back amid rising geopolitical uncertainty. Bitcoin (BTC) fell sharply by 2% within an hour of the news breaking, while Ethereum (ETH) plunged 4.4% over the same period.

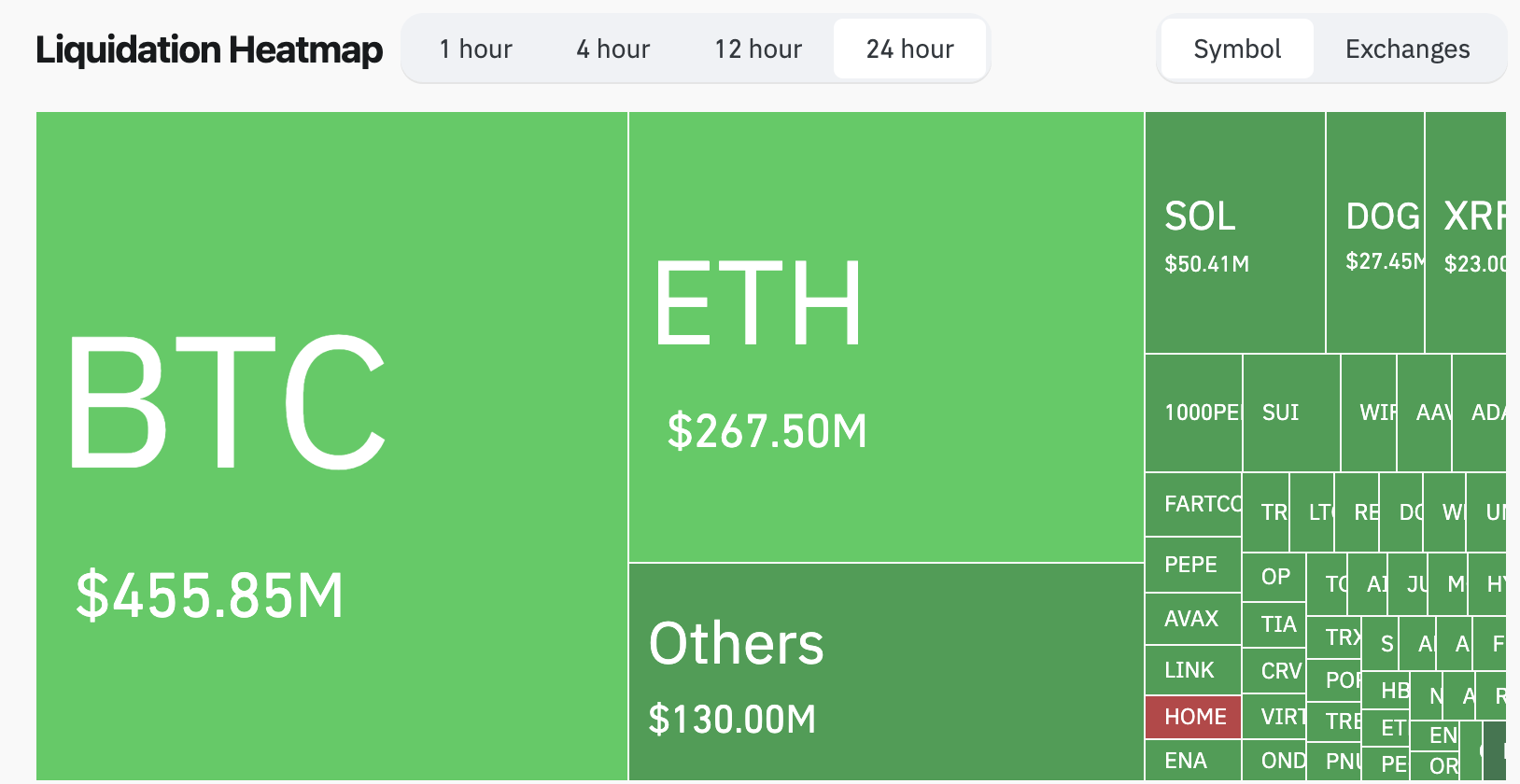

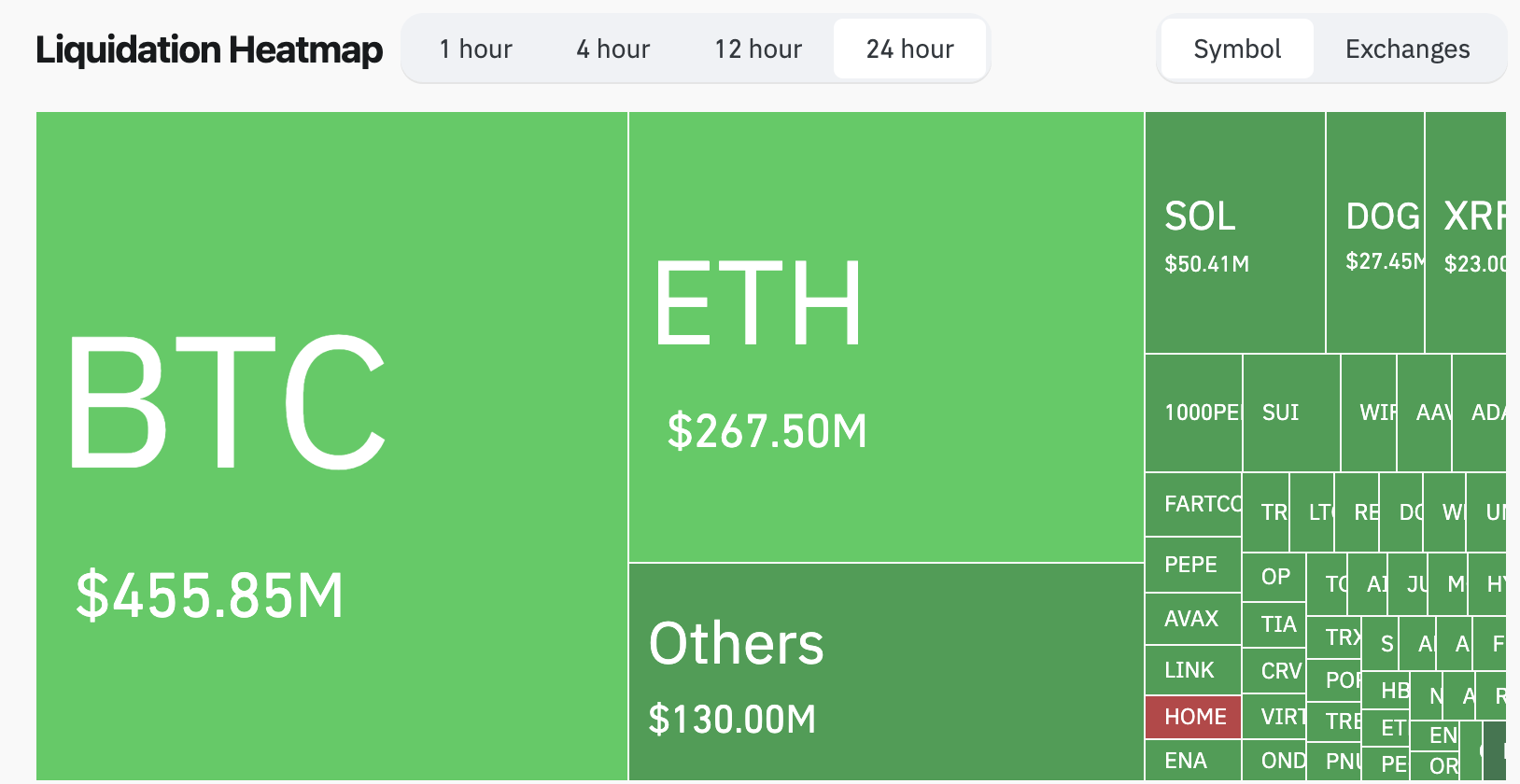

According to data from CoinGlass, the sudden downturn in the crypto market led to massive liquidations. In the past 24 hours, approximately 215,000 traders were liquidated, totaling $1.019 billion in positions wiped out. Long positions accounted for a staggering $945 million of that total. The largest single liquidation occurred on Binance’s BTCUSDT pair, with a value of $201 million.

Source: CoinGlass

Broader Implications

While traditional equity markets had closed before the strikes were confirmed, futures for global indices pointed to a volatile open, with energy prices likely to react strongly to any further escalation in the Middle East.

The situation remains fluid. International observers and allies are closely monitoring Iran’s potential response. Tehran has not yet issued an official statement, though Iranian media outlets have begun acknowledging the damage.

Analysts warn that any prolonged conflict could inject further volatility into markets already grappling with inflation concerns, interest rate uncertainty, and slowing global growth.

Military analysts believe the Israeli operation may not be a one-off. “This is not a single-night offensive. We’re looking at the early stages of what could be a prolonged military engagement,” said Amos Harel, defense correspondent for Haaretz.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle