Leading U.S. banks are in early talks to launch a joint stablecoin venture, while the Trump family’s USD1 stablecoin surges to prominence, highlighting blockchain’s growing role in reshaping digital payments and raising ethical concerns.

A Stablecoin Project Backed by America’s Top Banks

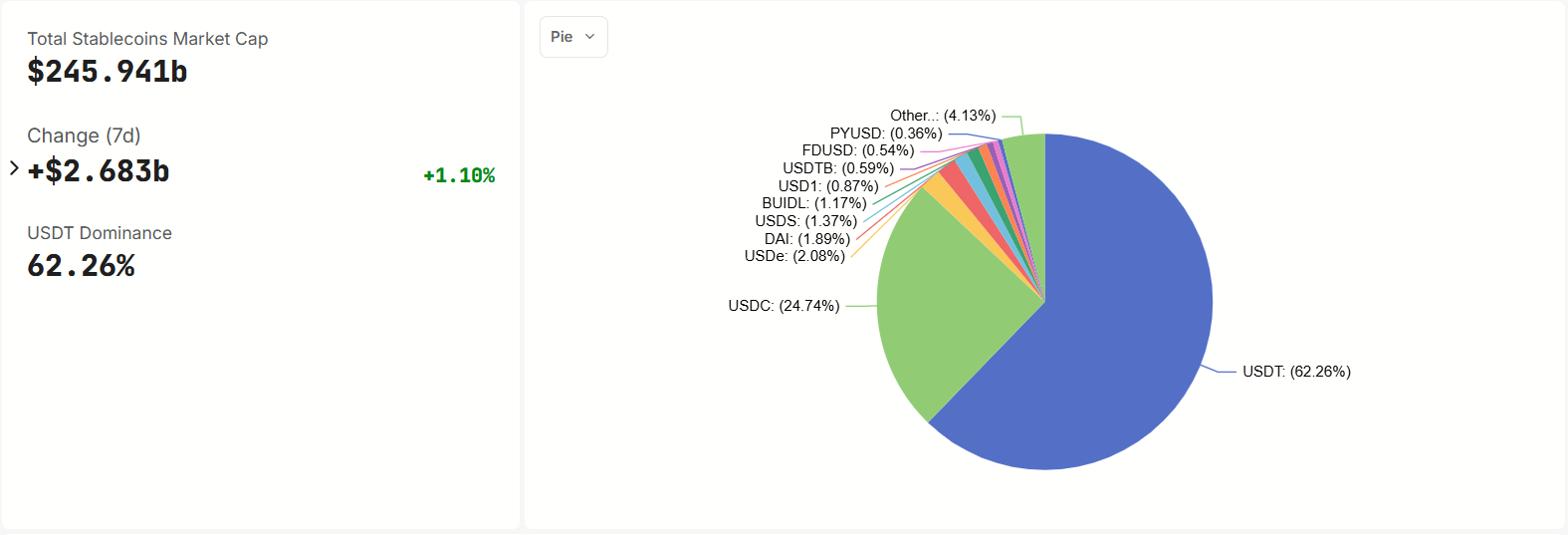

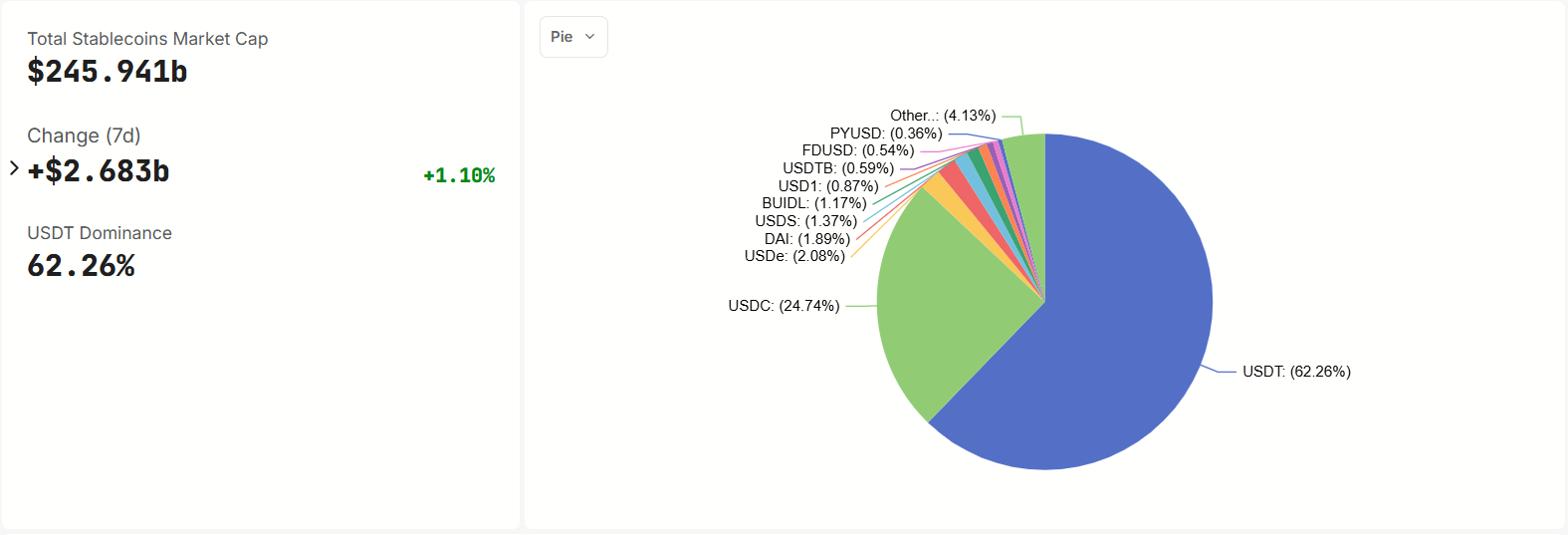

Major U.S. banks, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are exploring a collaborative stablecoin initiative to compete in the $245 billion stablecoin market, currently led by Circle’s USDC and Tether’s USDT.

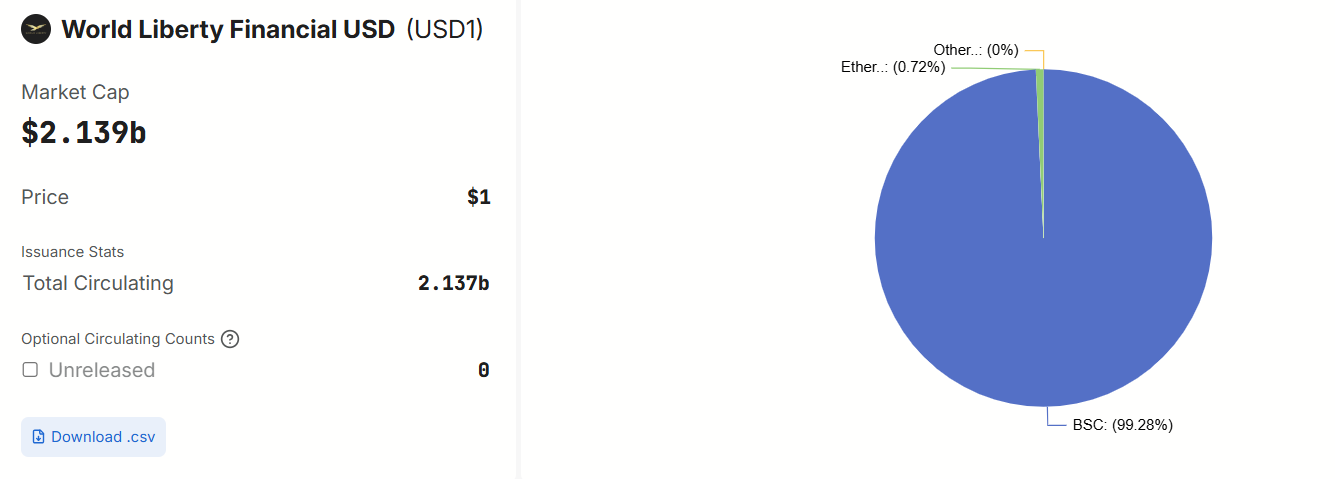

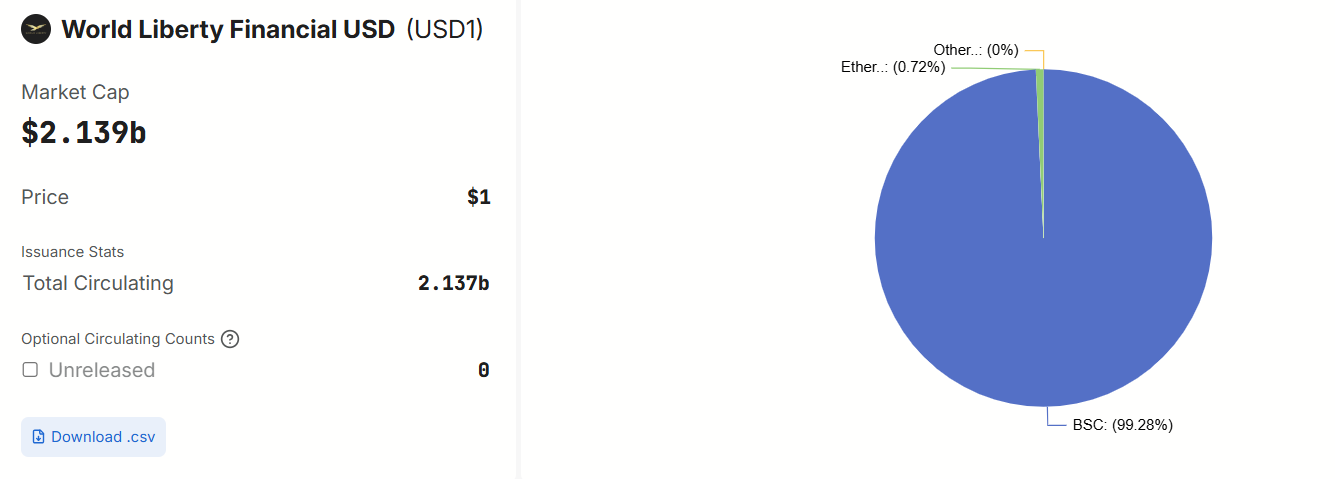

Source: DefiLlama

According to The Wall Street Journal, these discussions involve payment firms like Early Warning Services (Zelle’s operator) and The Clearing House, co-owned by the banks. The move aims to counter the growing influence of crypto-based digital payments, which threaten traditional banking’s deposit bases and transaction volumes.

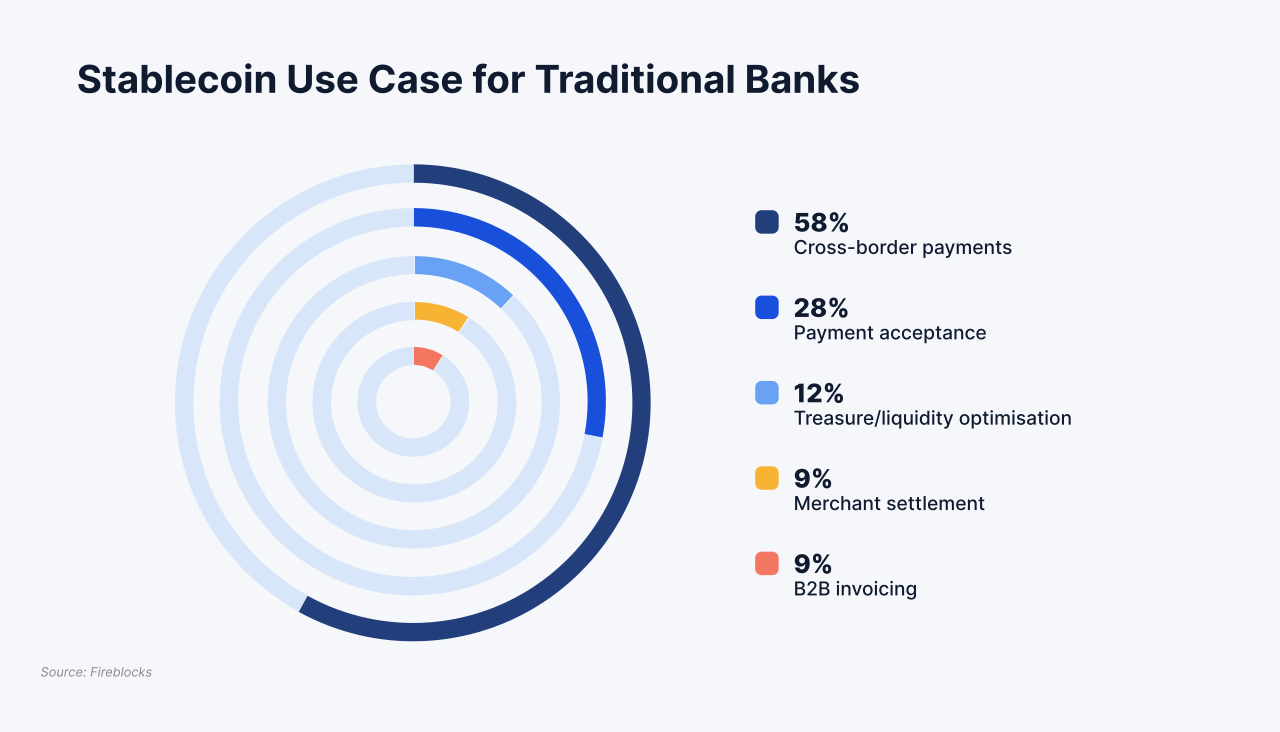

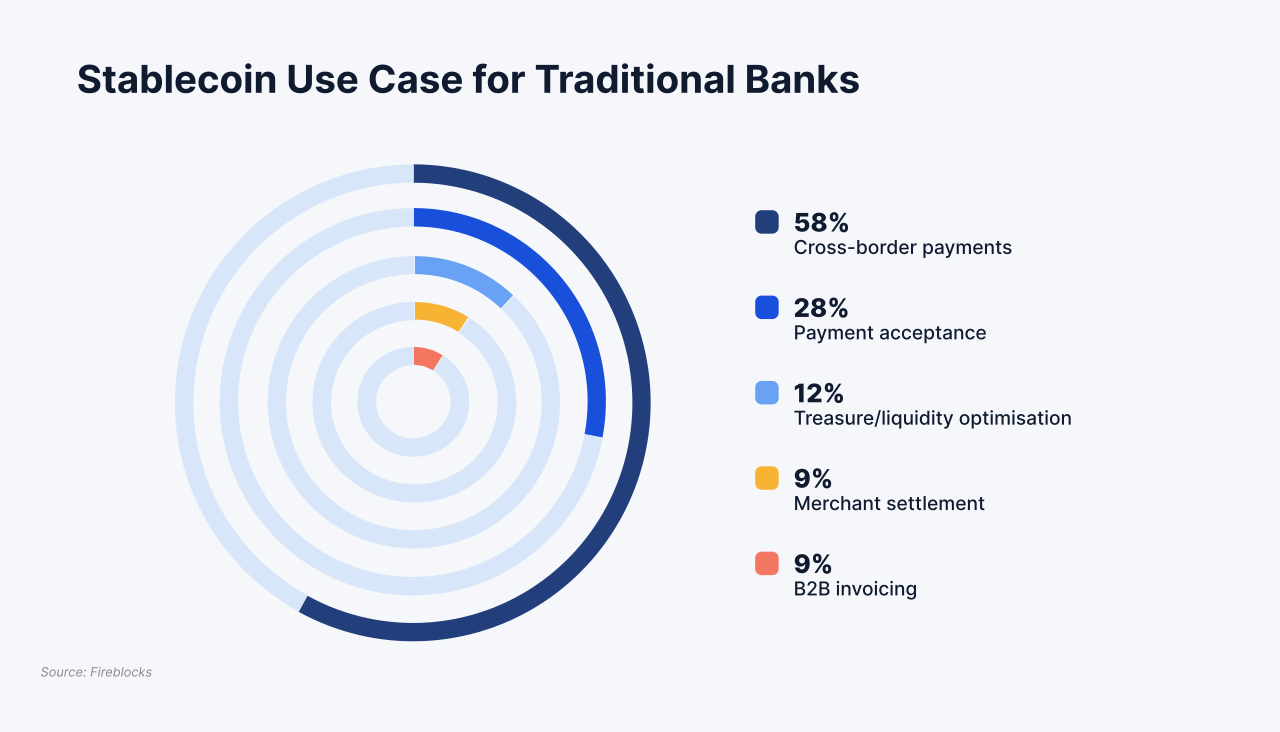

Stablecoins, pegged to the U.S. dollar, offer fast, low-cost cross-border transfers, making them attractive for global finance. A Fireblocks survey notes that 58% of traditional banks already use stablecoins for such payments, reflecting institutional adoption.

Source: Fireblocks

The banks’ consortium model could enable broader participation from other financial institutions, enhancing the stablecoin’s reach. However, the venture’s progress depends on U.S. stablecoin legislation, particularly the GENIUS Act, which recently cleared a Senate procedural vote with bipartisan support. The Act requires stablecoins to be 1:1 backed by liquid reserves, addressing regulatory concerns like anti-money laundering and consumer protections.

USD1 Stablecoin by World Liberty Financial Fuels Growth and Debate

Parallel to the banks’ efforts, the Trump family’s World Liberty Financial has launched USD1, a dollar-backed stablecoin that has rapidly gained traction. Issued by BitGo Trust Company under U.S. regulatory compliance, USD1 has surged to a $2.14 billion market cap, ranking as the second-largest stablecoin on BNB Chain after USDT.

A significant boost came from a $2 billion investment by Abu Dhabi’s MGX fund to acquire a stake in Binance using USD1, highlighting its global appeal. The Trump family holds a 60% stake in World Liberty Financial, raising ethical concerns about potential conflicts of interest, especially given President Trump’s crypto-friendly policies.

Learn more: World Liberty Financial Launches Stablecoin USD1

Critics, including Senator Elizabeth Warren, argue that USD1’s rise, fueled by foreign investments like the UAE deal, risks corruption, especially as the GENIUS Act progresses. The stablecoin’s integration with Chainlink for multi-chain transfers further enhances its utility, but concerns persist about transparency and regulatory oversight.

The U.S. aims to dominate the crypto sector, echoing President Trump’s remarks at a TRUMP token holders’ event, where he likened crypto leadership to America’s global economic dominance through the USD. The banks’ stablecoin venture and USD1’s rise reflect this ambition, positioning the U.S. to shape the future of digital finance. By leveraging blockchain’s efficiency, banks aim to modernize payments, while USD1’s rapid growth signals crypto’s mainstream potential.

However, challenges like regulatory clarity, public trust, and financial stability risks, highlighted by critics comparing stablecoins to volatile money-market funds, could hinder progress. Both initiatives underscore blockchain’s transformative power, but their success depends on navigating ethical concerns and regulatory hurdles.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Sui

Sui  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave