The market has been gearing up for volatility before the launch of spot ETH ETFs in the US today. While ETH’s price action has been relatively uninteresting in the past few weeks, it seems that large holders are expecting price swings and are rushing to cash out.

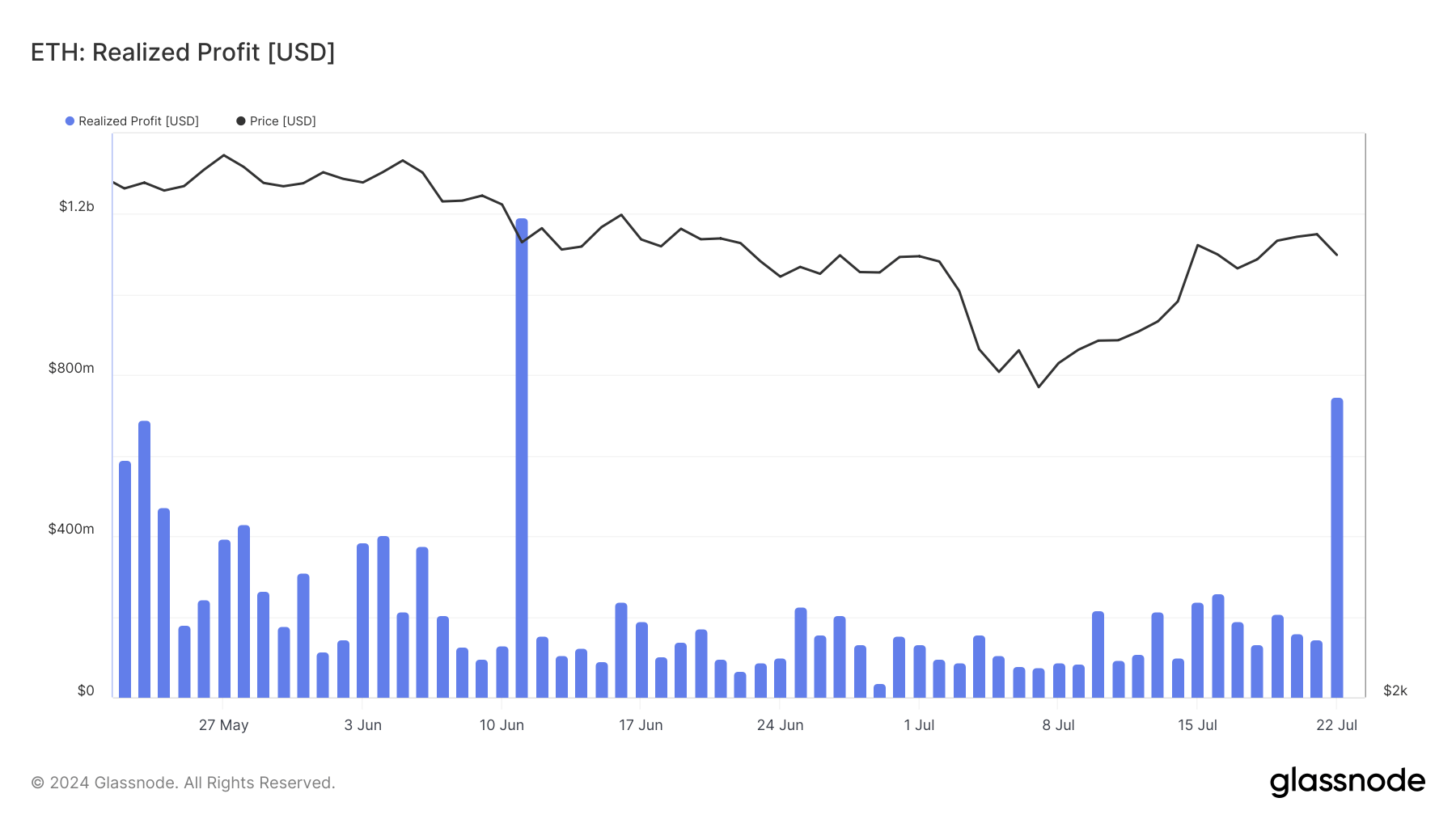

Glassnode’s data on realized profit for Ethereum holders shows a dramatic increase from $144.598 million on July 21 to $747.311 million on July 22. This is a significant spike and the highest realized profit in over 40 days.

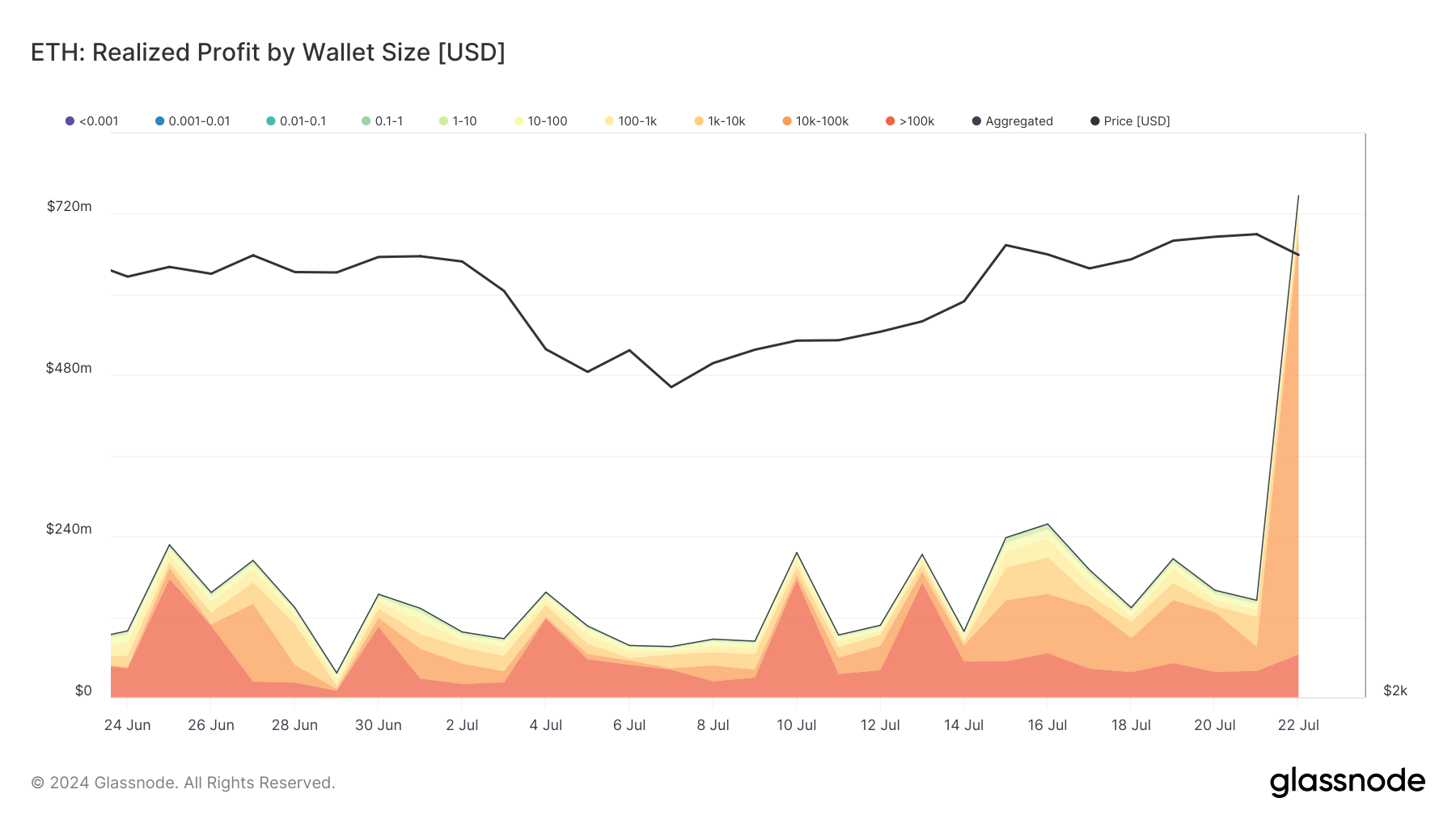

Such a high spike warrants a detailed examination of wallet sizes and holding periods involved in the sell-off. Data shows that wallets holding between 10,000 and 100,000 ETH realized $626.982 million in profits on July 22, up from $35.744 million the previous day. This indicates that large holders, most likely institutional players or high-net-worth individuals, are cashing out ahead of the ETF launch.

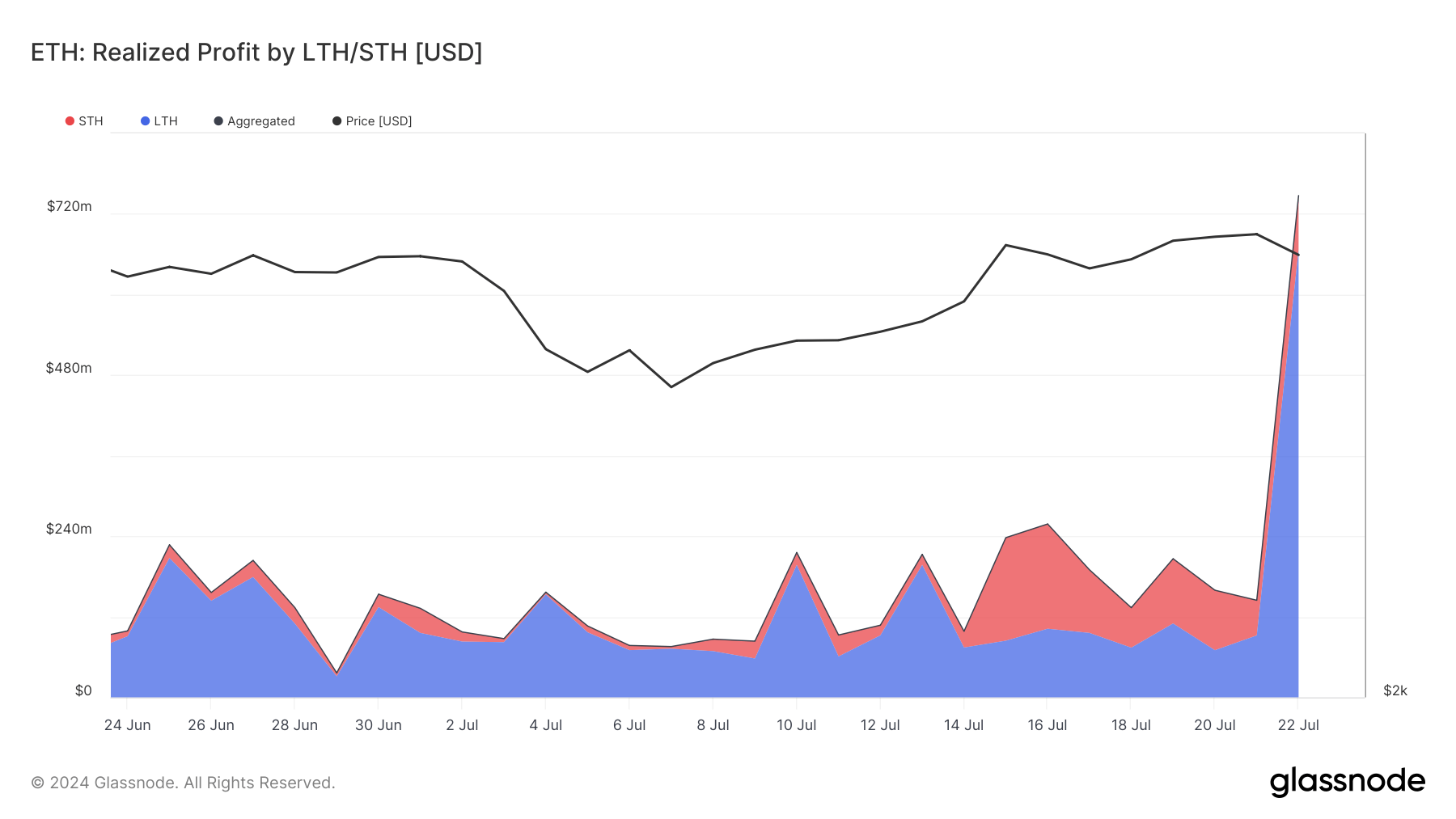

Additionally, long-term holders were primarily responsible for the significant increase in realized profits. Profits from wallets holding ETH for over a year surged from $92.751 million to $666.227 million. This behavior aligns with a strategic move to lock in gains before potential market volatility associated with the ETF launch.

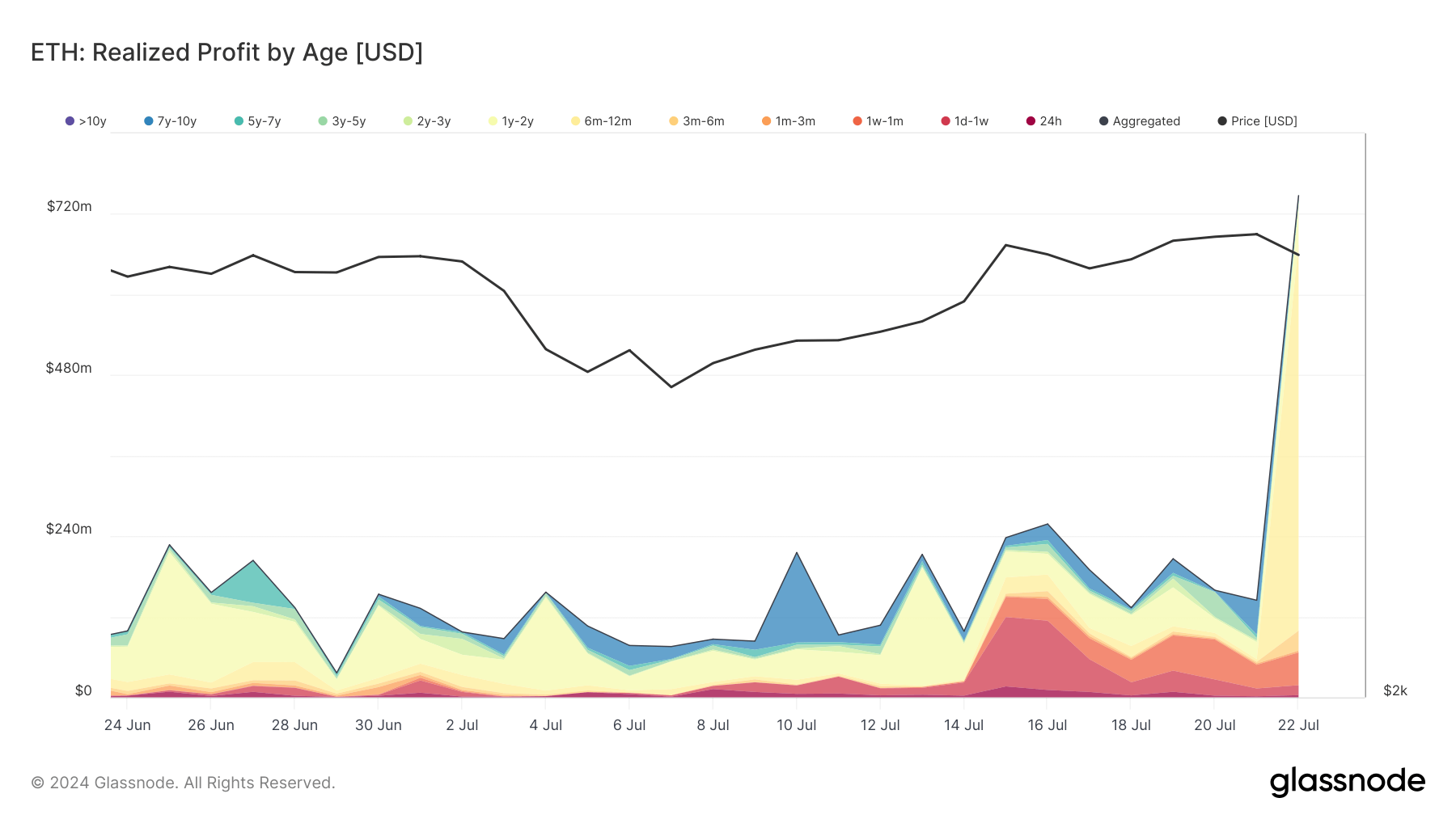

Analyzing realized profits by holding age, the most significant increase is seen in the 6 to 12-month holding age category, with realized profits jumping to $577.677 million from $3.964 million. This suggests that holders from mid-2023 are securing their profits.

The spike in realized profits highlights the market’s cautious approach to the anticipated changes with the advent of spot ETH ETFs. As trading heats up, we can expect more realized profits in the coming weeks. CryptoSlate previously reported that premarket trading of ETH ETFs has already generated significant interest, showing that the market is positioning itself for all of the potential opportunities and risks associated with the new ETFs.

It’s also possible that large and institutional Ethereum holders are realizing profits and reinvesting them into ETH ETFs instead of holding spot ETH directly. For institutional investors and high-net-worth individuals, ETFs’ regulatory oversight and transparency can reduce the risks associated with holding ETH directly. Another significant benefit is the simplified tax reporting associated with ETFs. In many jurisdictions, ETFs are treated more favorably for tax purposes than holding the underlying assets directly. This can translate into more efficient tax management for investors, especially with large asset volume sets.

Liquidity is another critical factor. ETFs are traded on traditional stock exchanges, which tend to offer better liquidity and easier transaction settlement. For large holders, the ability to quickly liquidate ETH positions without significantly impacting the market price could be a substantial advantage.

The post Large holders cashed out ahead of Ethereum ETF launch appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Canton

Canton  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  Litecoin

Litecoin  USD1

USD1  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  Hedera

Hedera  Shiba Inu

Shiba Inu  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Tether Gold

Tether Gold  Uniswap

Uniswap  Mantle

Mantle