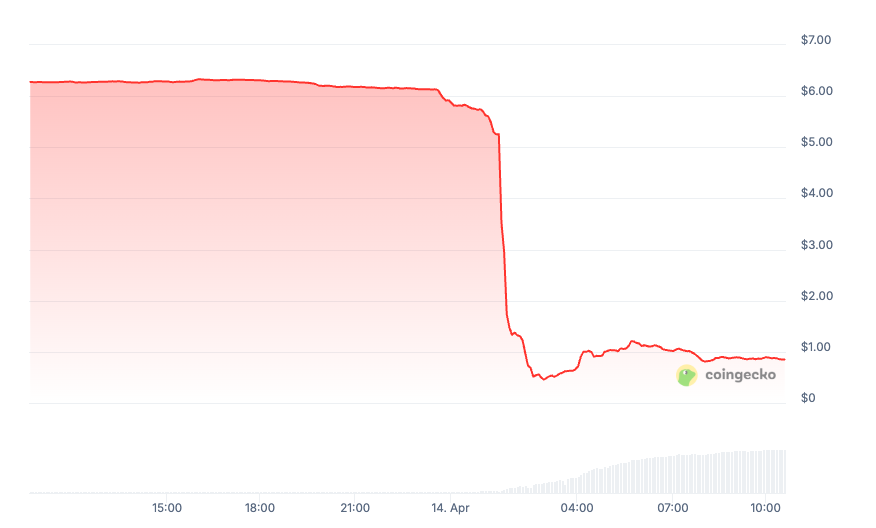

In just two hours on April 13, 2025, Mantra’s native token OM lost more than 90% of its value – a crash that echoed the infamous Luna collapse and now stands as one of the most severe price meltdowns in crypto history.

About Mantra, it’s a Layer 1 blockchain project with OM as its native token. In February 2025, OM experienced a parabolic rally, surging from $5 to a peak of $8.99.

From Asia’s Promising Project to a Luna-Style Meltdown

According to data from CoinMarketCap and TradingView, OM began to plummet from $6.33 on the evening of April 13 to around $0.40 in less than two hours— a nearly 94% drop.

As a result, Mantra’s market capitalization evaporated by nearly $5.5 billion, falling from $6 billion to just $500 million.

“I haven’t seen a crash of this speed and scale since the LUNA collapse,” one trader commented on X.

On-chain data revealed that a personal wallet transferred approximately 3.9 million OM tokens to the OKX exchange just before the crash occurred. The community now suspects the wallet belongs to an insider from the project.

Additionally, according to a report from BeInCrypto, the Mantra team was involved in undisclosed over-the-counter (OTC) transactions, allegedly selling tokens at discounts of up to 50% compared to market prices.

“MANTRA has a highly centralized token distribution structure, with over 85% of the total supply held by the team and strategic investors. An internal sell-off could easily trigger a domino effect,” Lookonchain commented.

Who dropped the price of $OM?

Before the $OM crash(since Apr 7), at least 17 wallets deposited 43.6M $OM($227M at the time) into exchanges, 4.5% of the circulating supply.

According to Arkham’s tag, 2 of these addresses are linked to Laser Digital.

Laser Digital is a strategic… pic.twitter.com/zB8yAPRPSO

— Lookonchain (@lookonchain) April 14, 2025

The incident sparked strong backlash against the Mantra team. Some social media users began digging into the team’s past, pointing out that WuBlockchain had previously warned that certain key members of the project were allegedly linked to the online gambling platform 21Pink.

WuBlockchain warned the risk of MANTRA DAO in 2021. It is composed of several core members of the online gambling platform 21Pink. OM once falsely claimed to have received FTX investment but FTX later denied the information. https://t.co/N1SeACx7A5

— Wu Blockchain (@WuBlockchain) April 14, 2025

There were also claims that MANTRA once stated it had received investment from FTX, a statement later publicly denied by the now-defunct exchange.

“Not Our Fault”: Mantra Points at Exchanges After 94% OM Collapse

Shortly after OM’s dramatic plunge, Mantra co-founder John Patrick Mullin issued a public statement in an attempt to calm the community.

Posting on his personal account, Mullin firmly denied any involvement from the core team, the MANTRA Chain Association, or internal investors in the sell-off. He emphasized that all tokens remain locked under the publicly disclosed vesting schedule and that all project-related wallets are fully transparent and trackable.

Mullin claimed that centralized exchanges (CEXes) triggered forced liquidations during a period of low market liquidity—specifically late Sunday UTC.

“The timing and depth of the drop point to an unexpected position closure with no warnings or prior notice. Such an incident highlights a lack of oversight by centralized exchanges and may reflect an intentional attempt to dominate the market,” Mullin stated.

He added “We are actively working with our exchange partners – entities that hold significant control. But when such power is misused, events like this will continue to happen.”

Mantra also announced a community AMA on X to further clarify the incident. The project warned users to avoid clicking on suspicious links, as scammers are attempting to exploit the situation.

Notably, Binance – one of the world’s largest cryptocurrency exchanges and the current listing venue for OM, issued an official statement confirming that it is closely monitoring the ongoing developments surrounding MANTRA. In a notice today, Binance stated that it may suspend trading, delist the token, or apply other risk management measures to protect users if it detects serious violations related to transparency or false listing disclosures.

Given the extreme price volatility, disrupted liquidity, and unresolved concerns, analysts urge investors to trade OM cautiously to avoid unnecessary financial risks.

This dramatic collapse also sparked an unexpectedly ironic twist, dragging a completely unrelated project with a similar name – Manta, into the crossfire. Manta’s co-founder publicly clarified that their project has no affiliation whatsoever with Mantra after confusion spread due to the similar names.

Conclusion

The team attributes the crash to external liquidations, but on-chain activity and OTC deal reports have fueled community skepticism.

With its tokenomics under scrutiny and trust in the project rattled, Mantra’s path forward hinges on transparency, swift communication, and structural reform. It remains unclear whether this marks a temporary setback or signals the start of a deeper unraveling.

Read more: NFTs on Monad Are Exploding: +2,000% Gains in Weeks

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  Monero

Monero  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Sui

Sui  Litecoin

Litecoin  Canton

Canton  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  PayPal USD

PayPal USD  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  MemeCore

MemeCore  Mantle

Mantle  Tether Gold

Tether Gold