Geopolitical tensions and economic uncertainties have been causing significant volatility in the financial markets recently. Recently, President Donald Trump stepped into the spotlight again with remarks about U.S.-China relations and the Federal Reserve. Known for his ability to sway markets, Trump’s latest remarks have triggered a wave of green across trading screens, even boosting cryptocurrencies.

Trump’s Latest Moves

The U.S.-China trade conflict has escalated sharply, with President Trump imposing a hefty 145% import tax on Chinese goods. China swiftly responded by imposing 125% tariffs on American products, thereby intensifying the economic conflict. As a result, stock prices have faltered, and interest rates on U.S. debt have risen, driven by investor concerns over sluggish economic growth and mounting inflationary pressures.

Learn more: Trump Tariffs Drive Miners Out of the U.S.

In a recent interview, President Trump stated, “We’re doing fine with China,” signaling a positive outlook on the situation. He also suggested the possibility of adjusting the import tariffs on Chinese goods, clarifying that while tariffs would not be reduced to 0%, they would be significantly lower than the 145% rate that had previously alarmed the market.

According to The Guardian, the President also stated that he has no plans to dismiss Federal Reserve Chairman Jerome Powell. His remarks come just days after he posted on social media that Powell should be removed for not cutting interest rates more quickly.

Source: The Guardian

Bitcoin’s Rally: The Trump Effect

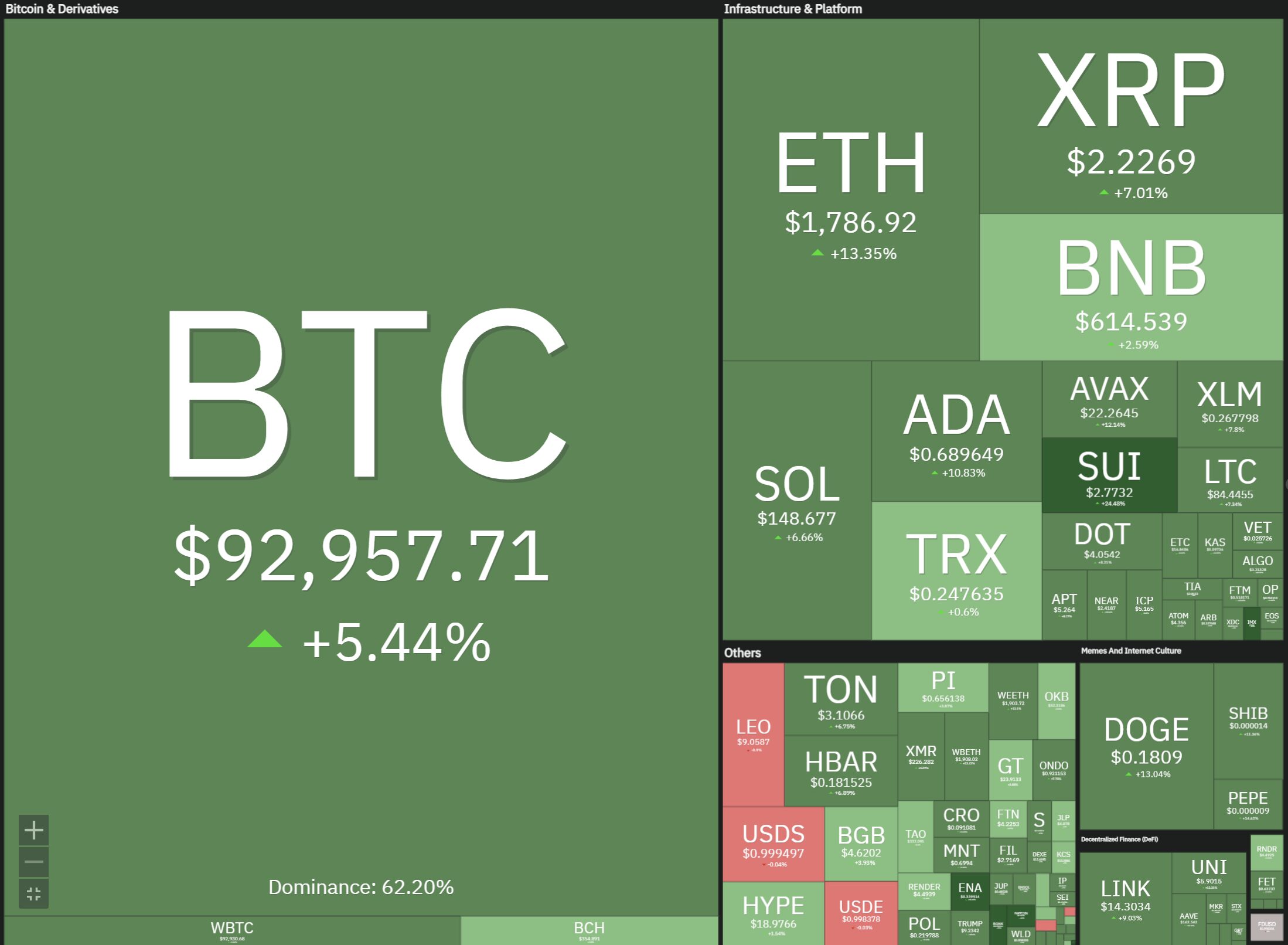

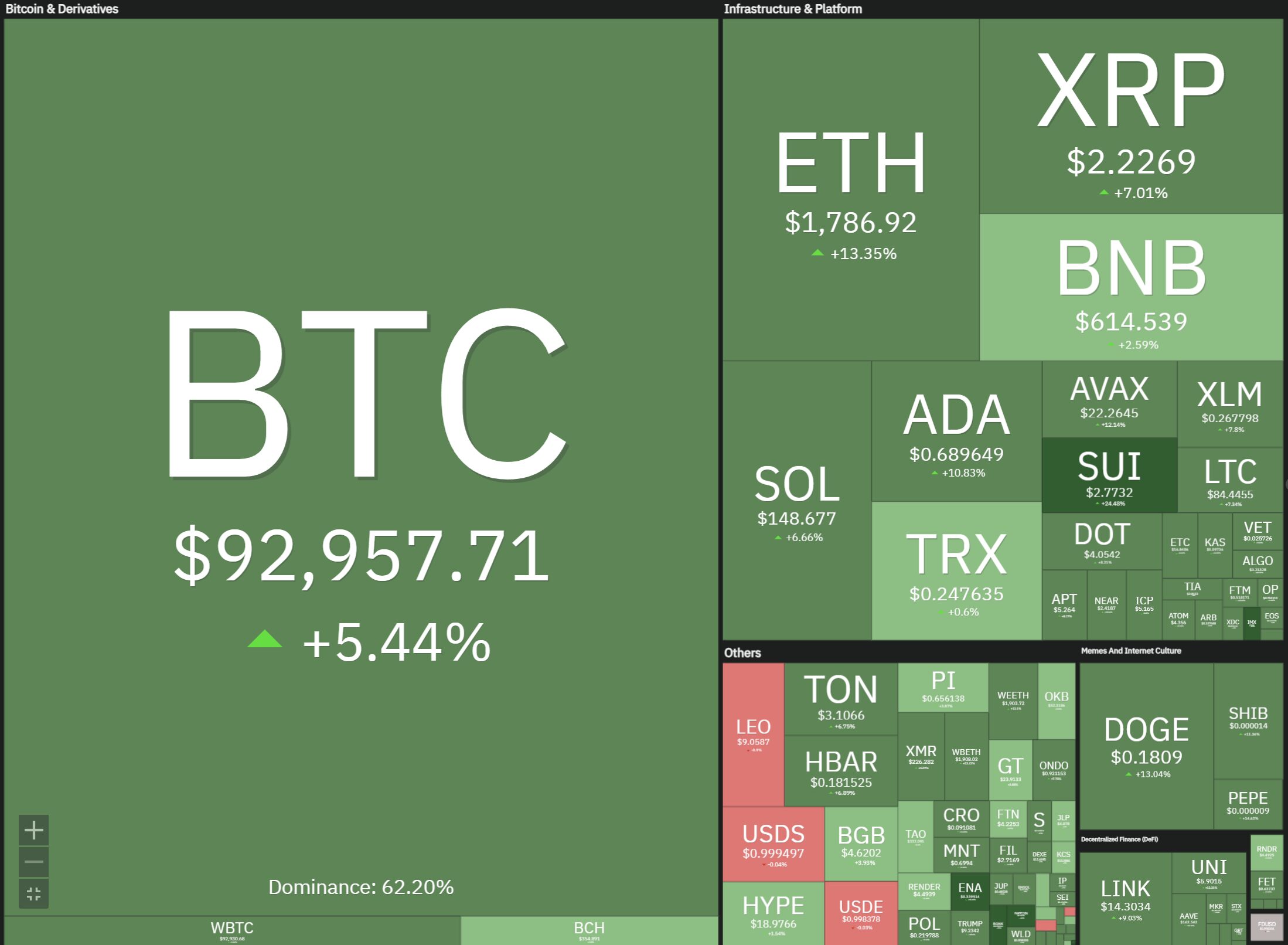

Trump’s remarks have ignited a rally in the crypto market, with Bitcoin surging to $93,000. Ethereum and other altcoins have also jumped on the optimism wave. The overall crypto market capitalization has increased by nearly 5.9%, surpassing $$2.91 trillion, as investor confidence rebounds on the back of Trump’s optimistic signals.

Source: COIN360

Also, record inflows into Bitcoin ETFs from institutional heavyweights, recording an unprecedented net inflow of $911.20 million, the highest since the Trump inauguration, according to Trader T. Notable inflows include a massive $267.10 million inflow to Ark Invest’s ARKB, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $253.82 million, and BlackRock’s iShares Bitcoin Trust (IBIT) with $192.08 million.

4/22 Bitcoin ETF Total Net Flow: $911.20 million

(HIGHEST INFLOW SINCE TRUMP INAUGURATION)$IBIT (BlackRock): $192.08 million$FBTC (Fidelity): $253.82 million$BITB (Bitwise): $76.71 million$ARKB (Ark Invest): $267.10 million$BTCO (Invesco): $18.27 million$EZBC (Franklin):… https://t.co/dXaa4M6Lew pic.twitter.com/Nm7G5c1MpE— Trader T (@thepfund) April 23, 2025

This institutional buying spree has slashed Bitcoin’s circulating supply, fueling its price rally. With more ETFs likely on the horizon, Bitcoin’s upward trajectory could continue, solidifying its role as a global financial asset.

However, with trade policy details clashing and the future uncertain, it’s not all smooth sailing. Investors should keep their eyes peeled for shifts with China or the Fed could flip the script fast. For now, the outlook’s bright, but the long game’s still up in the air. Diversifying and staying tuned to the headlines might just be the smartest play in this wild ride.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Hyperliquid

Hyperliquid  Canton

Canton  Sui

Sui  Litecoin

Litecoin  Avalanche

Avalanche  USD1

USD1  USDT0

USDT0  Hedera

Hedera  Shiba Inu

Shiba Inu  Dai

Dai  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold