Dozens of token unlocks worth approximately $1.5 billion are set to take place in April 2025. Notably, the first week of April will kick off with over $642 million – over half of the total value unlocked in April from major players like SUI, ENA, dYdX, and more.

Notable Token Unlocks in the First Week of April

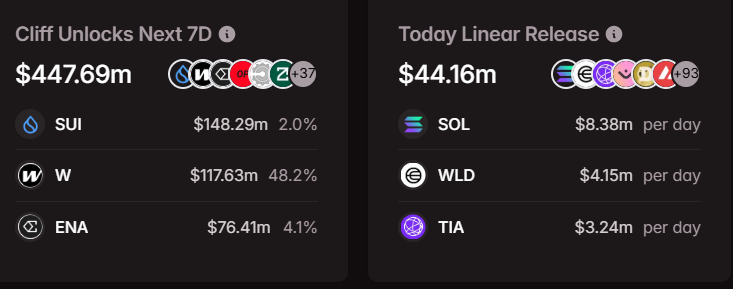

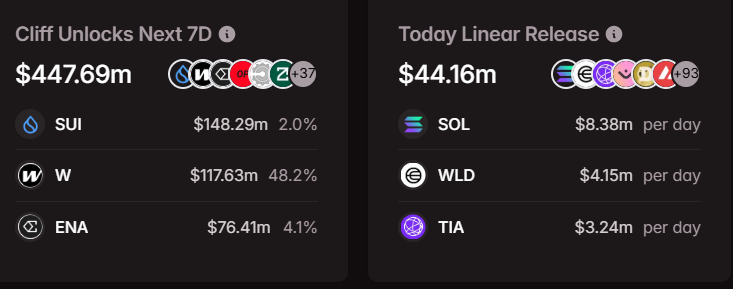

In the next 7 days, the cryptocurrency market is bracing for a significant wave of token unlocks, with a total value exceeding $642 million, according to Tokenomist. This event involves both cliff and linear unlocks for several prominent tokens, potentially impacting market dynamics due to increased circulating supply.

Source: Tokenomist

Among the cliff unlocks, SUI leads with 64.19 million tokens valued at $149.83 million, representing 2.14% of its circulating supply. Other notable unlocks include:

- W (Wormhole): 1.39 billion tokens, $116.12 million, 46.27% of circulating supply

- ENA (Ethena): 212.50 million tokens, $78.81 million, 4.02% of circulating supply

- OP (Optimism): 31.34 million tokens, $23.40 million, 2.11% of circulating supply

- JTO (Jito Labs): 11.31 million tokens, $24.4 million, 3.65% of circulating supply

Tokens like BIGTIME, ZETA, KAS, NEON, and DYDX also feature, with unlock values ranging from $6.79 million to $44.26 million. On the linear unlock front, SOL tops the list with $58.80 million daily (0.09% of circulating supply), followed by WLD ($29.22 million, 3.06%), TIA ($22.69 million, 1.20%), and DOGE ($15.84 million, 0.09%).

Other tokens like OM, TAO, AVAX, and NEAR will also see daily unlocks exceeding $1 million.

Significant Impact on Market

These unlocks could introduce significant selling pressure, as a sudden increase in circulating supply often leads to price dilution when demand fails to match the new token influx. For example, tokens like W, with 46.27% of its circulating supply unlocking ($116.12 million), and TIA, with 1.20% daily unlocks ($22.69 million), are particularly vulnerable to pronounced price volatility. Such high percentages can overwhelm market absorption, potentially driving prices down as early holders or investors sell off their newly released tokens. Also, such a significant increase in circulating supply can impact price movements, as it requires more capital to drive the price upward. Consequently, there is a high likelihood of token price volatility leading up to the unlock event.

Conversely, tokens like SOL, with a modest 0.09% daily unlock ($58.80 million), and DOGE, also at 0.09% ($15.84 million), are likely to experience milder effects due to their higher liquidity and larger market caps. These projects benefit from broader adoption and stronger demand, which can better absorb the additional supply.

Investors should stay vigilant, monitoring official announcements and market sentiment, as these unlocks could reshape price trends and overall market stability in the coming week.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Avalanche

Avalanche  World Liberty Financial

World Liberty Financial  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold