Since early May 2025, Ethereum (ETH) has staged a notable recovery, rising from around $2,200 in mid-April to above $2,600 in the first days of May.

Despite the strong price rebound, on-chain signals and market sentiment suggest that ETH may not have entered its true breakout phase in this cycle. Instead, the current price rally appears to be driven mainly by institutional accumulation, while common indicators of an “altseason” have yet to clearly emerge. Has Ethereum already peaked or is this just the beginning of a new growth phase?

Ethereum Gas: A Reflection of the Ecosystem’s Real Demand

One of the key indicators that the Ethereum ecosystem has not fully heated up again is the current gas fee level. According to data from Ultrasound Money, average gas prices have remained low, often below 25 gwei for several consecutive weeks.

This is modest compared to previous bull markets, when gas prices often exceeded 100 gwei due to surging demand for dApps, NFTs, and DeFi activity.

It indicates that major trends in the Ethereum ecosystem, such as NFTs, DeFi, SocialFi, or memecoins, have yet to generate enough pressure to push the network into congestion. While ETH’s price is rising, actual on-chain activity remains cautious – a sign that the current rally lacks the retail-driven FOMO typically seen at cycle peaks.

Institutions Are Accumulating, But That Doesn’t Mean ETH Is Ready to Soar

According to data from Glassnode, institutional capital continues to flow into ETH through investment vehicles such as the Grayscale Ethereum Trust (ETHE) and CME futures. The growing accumulation by whale wallets and institutional players suggests increasing long-term confidence in ETH.

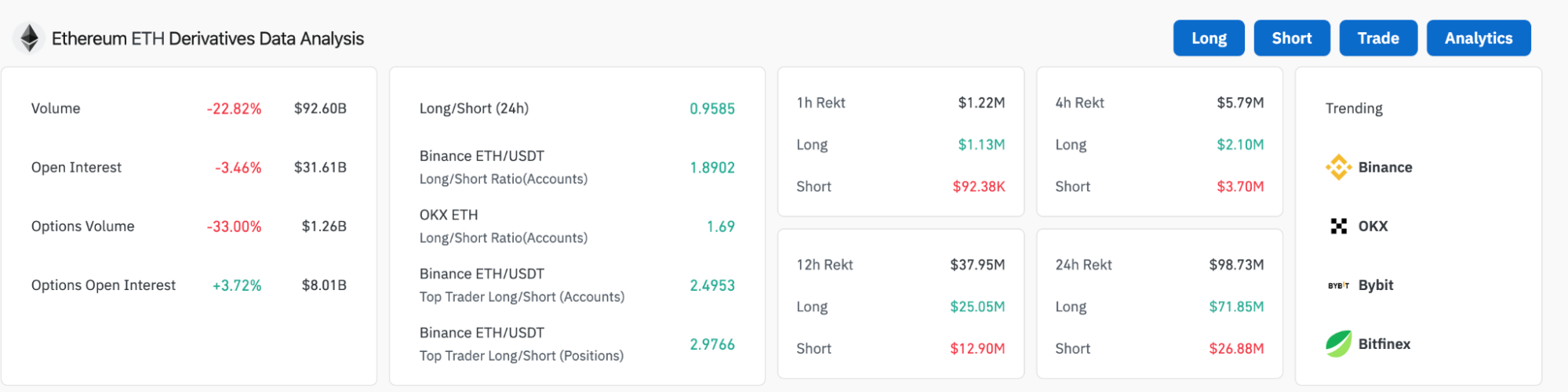

Source: Coinglass

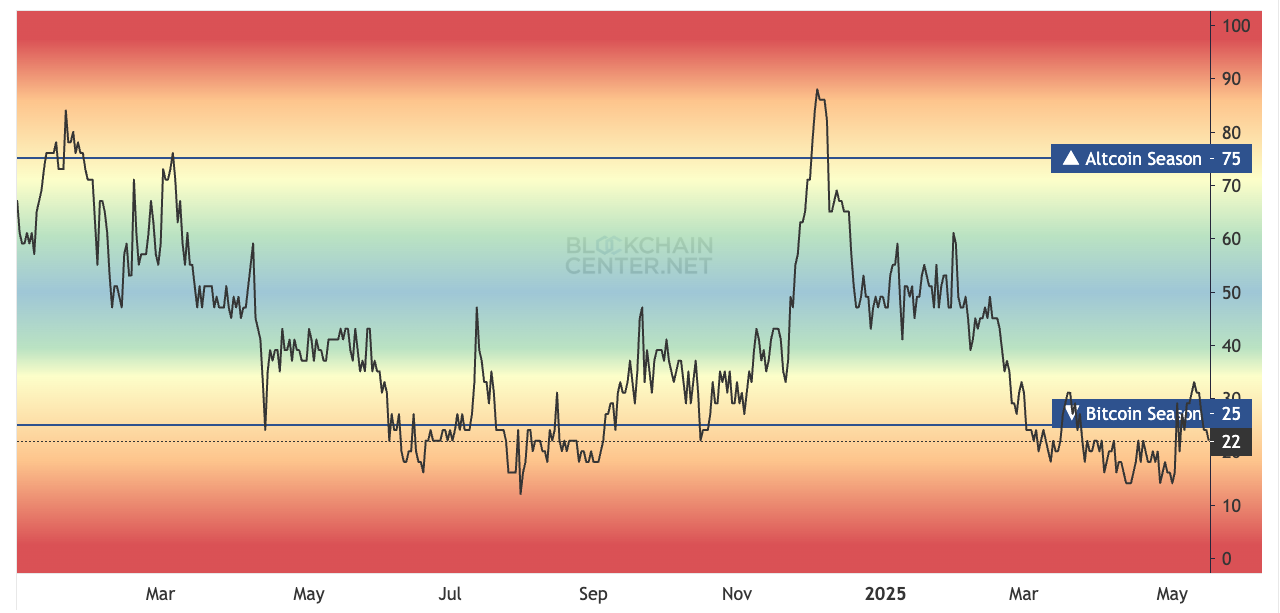

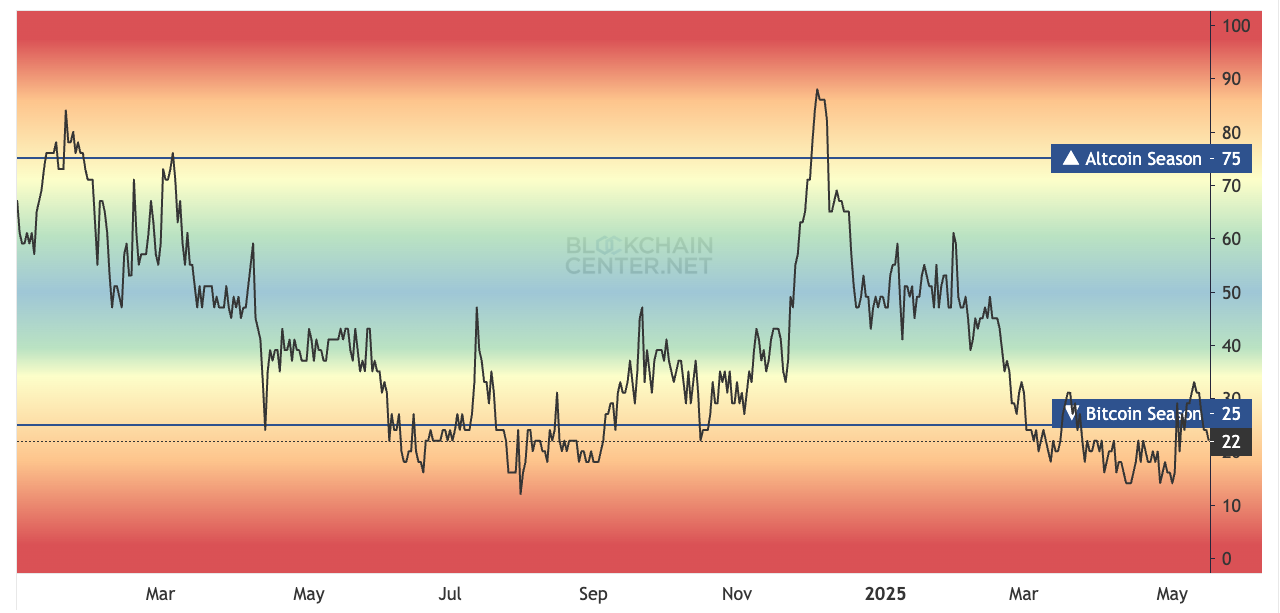

Altseason Not Yet Here: Index Remains in the Lows

Another important indicator is the Altseason Index, which measures the relative strength of altcoins compared to Bitcoin. Currently, the index is still hovering below 30, indicating that the market has not yet entered a full-blown FOMO phase for tokens smaller than ETH. In previous cycles, this index typically had to exceed 75 to confirm that an altseason had truly begun.

With altseason still absent, it suggests that ETH – as the leading representative – has yet to reach its final euphoric peak in this cycle. This leaves room for ETH to continue rising, but the market needs more time for a clearer rotation of capital from BTC into higher-risk assets.

Source: BlockchainCenter

What’s particularly notable is that despite ETH’s strong recent rally, the Altseason Index has remained subdued. Historically, such a powerful move in ETH would trigger broader market enthusiasm and push the index higher. The fact that this has not happened indicates that there is still significant untapped potential in the altcoin market, and further upside momentum could emerge as capital gradually rotates beyond ETH.

ETH Shorts No Longer at Record Highs, Has the Market Turned?

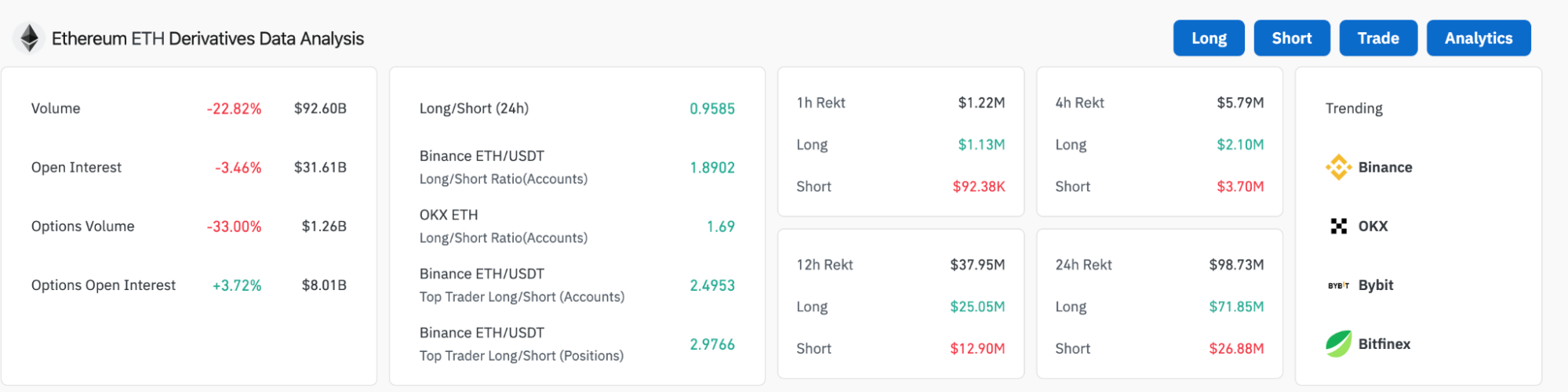

Data from Coinglass shows a significant shift in Ethereum’s derivatives market positioning. The 24-hour Long/Short ratio is currently near parity (0.9585), while top traders on Binance are showing a clear bias toward long positions with a nearly 3:1 ratio (2.9766).

In addition, total short liquidations over the past 24 hours reached $26.88 million, while long liquidations were significantly higher at $71.85 million. In reality, short positioning has weakened considerably compared to February 2025, when it had surged over 500% since November of the previous year.

This suggests that institutional players may be gradually abandoning a bearish short-term outlook and instead waiting for stronger signals to confirm a sustained bullish trend in ETH. The market currently appears to be in a phase of positioning and recalibration rather than another large-scale short wave.

Source: CoinGlass

Ethereum’s Potentially Leading Trends Still Awaiting Activation

Ethereum remains the foundational platform for many of the most promising trends of this new cycle, including:

- Restaking: With the growth of EigenLayer, Karak, and other restaking protocols, ETH is becoming an asset capable of delivering multiple layers of value for holders.

- Layer 2: Networks like Arbitrum, Optimism, Base, and others continue to expand, reducing gas fees and improving accessibility for retail users.

- Next-gen DeFi: Protocols like Ethena, Pendle, and Gearbox are reviving decentralized finance with innovative strategies, especially those integrating LSDs (liquid staking derivatives).

- Memecoins: While not yet as explosive as on Solana, tokens like Pepe, MOG, and AI-driven characters such as Cookie or PAAL (on Ethereum) are beginning to attract speculative capital.

However, the common denominator across these trends is that none has truly exploded to the point of lifting the entire ecosystem. This reinforces the view that ETH remains in the final accumulation phase of a mid-cycle, rather than having reached a cycle top.

Conclusion

Recent ETH price gains are a positive sign, but they are not enough to confirm that Ethereum’s growth cycle has peaked. With low gas fees, a weak altseason index, muted ecosystem activity, and growing institutional short positions, ETH is likely still in a pre-breakout phase.

This means long-term investors may still have an opportunity to accumulate ETH at reasonable prices before the cycle truly tops out. At the same time, caution is warranted in the short term, as the market has yet to fully “mature” in this current rally phase.

Once trends like restaking, Layer 2, or next-gen DeFi gain stronger momentum and retail capital flows back in, that’s when ETH could enter a true acceleration phase. In that case, today’s $2,500 may only be a temporary stop on a much longer journey throughout the 2025 cycle.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor