Bitcoin is currently holding above the $62,000 mark following a 5% surge from lower demand in the past few days. While the market grapples with uncertainty, recent data from Coinglass indicates that Bitcoin’s volatility has significantly decreased during this period of sideways trading. This reduction in volatility often serves as a precursor to major price movements, leading many investors to speculate that a significant shift in market dynamics could be on the horizon.

As traders analyze market trends, the prevailing sentiment is mixed, with some expressing optimism about a potential bullish rally, while others remain cautious due to the current volatility landscape.

With many eyes on Bitcoin’s next move, the question remains: will it break out to new highs, or will it face further corrections? As the cryptocurrency market continues to evolve, Bitcoin’s ability to maintain its position above $60,000 may set the stage for the next chapter in its price action.

Bitcoin Analysts Expect A Big Move

Bitcoin is currently navigating a landscape filled with speculation following several weeks marked by significant price fluctuations. While the recent volatility has made some investors cautious, the prevailing sentiment among many traders is that BTC and the broader crypto market are on the verge of a bullish rally.

This optimism is bolstered by key data shared by crypto analyst Daan from Coinglass, indicating a notable decrease in Bitcoin’s volatility levels during this period of price consolidation.

Currently, Bitcoin’s volatility is not yet back to the levels seen during the summer before the sharp drop in August. Typically, when volatility compresses, it creates an environment ripe for a substantial price movement in either direction. This characteristic of cryptocurrency markets suggests that a breakout could be imminent. Should BTC manage to hold above the current demand levels, the potential for a rally to new all-time highs becomes increasingly likely.

Traders are closely monitoring market trends, looking for confirmation signals that could indicate the direction of the next major price move. If Bitcoin can maintain its position and leverage the decreasing volatility, it may set the stage for a significant upward shift.

As investors anticipate this potential rally, the focus remains on Bitcoin’s ability to sustain its momentum and capitalize on the current market conditions, setting a new course for the cryptocurrency’s future.

BTC Testing Key Liquidity

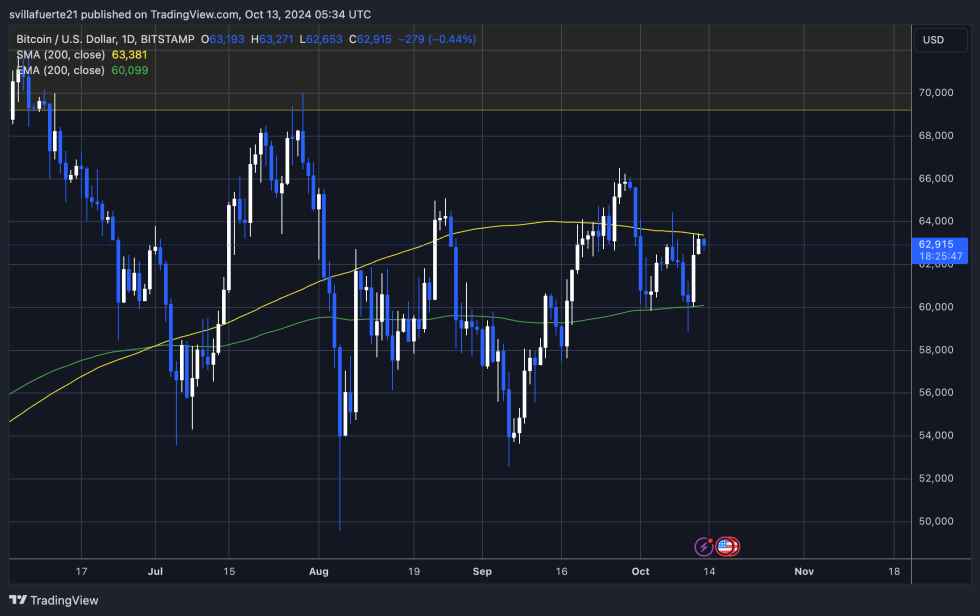

Bitcoin is currently trading at $62,900, fluctuating between the 1D 200 exponential moving average (EMA) at $60,099 and the 200 moving average (MA) at $63,381. Holding above the crucial $60,000 mark, a psychological threshold, sets a positive sentiment in the market. For bulls to take control and push the price higher, it is essential to break above the 1D 200 MA at $63,381 and surpass local highs around $66,000.

The current price action reflects a critical moment for BTC, as these levels will determine the direction of its next move. A successful rally above the 200 MA could ignite further buying interest and potentially lead to a surge toward new all-time highs. However, if BTC fails to maintain its position above the 1D 200 EMA at $60,000, a deeper correction could occur, with the next support level potentially dropping to $57,500.

Traders and investors are closely monitoring these key levels, as they will play a significant role in shaping Bitcoin’s short-term outlook and determining the market’s trajectory in the coming days.

Featured image from Dall-E, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor