The crypto market just witnessed a major shake-up: Plume, a public blockchain purpose-built for RWA, providing infrastructure for tokenization, compliance, and yield generation, has been approved by the U.S. Securities and Exchange Commission (SEC) to become the first on-chain transfer agent, paving the way to bring the trillion-dollar U.S. securities market onto blockchain and paving the way for traditional U.S. stocks to be fully incorporated with blockchain technology.

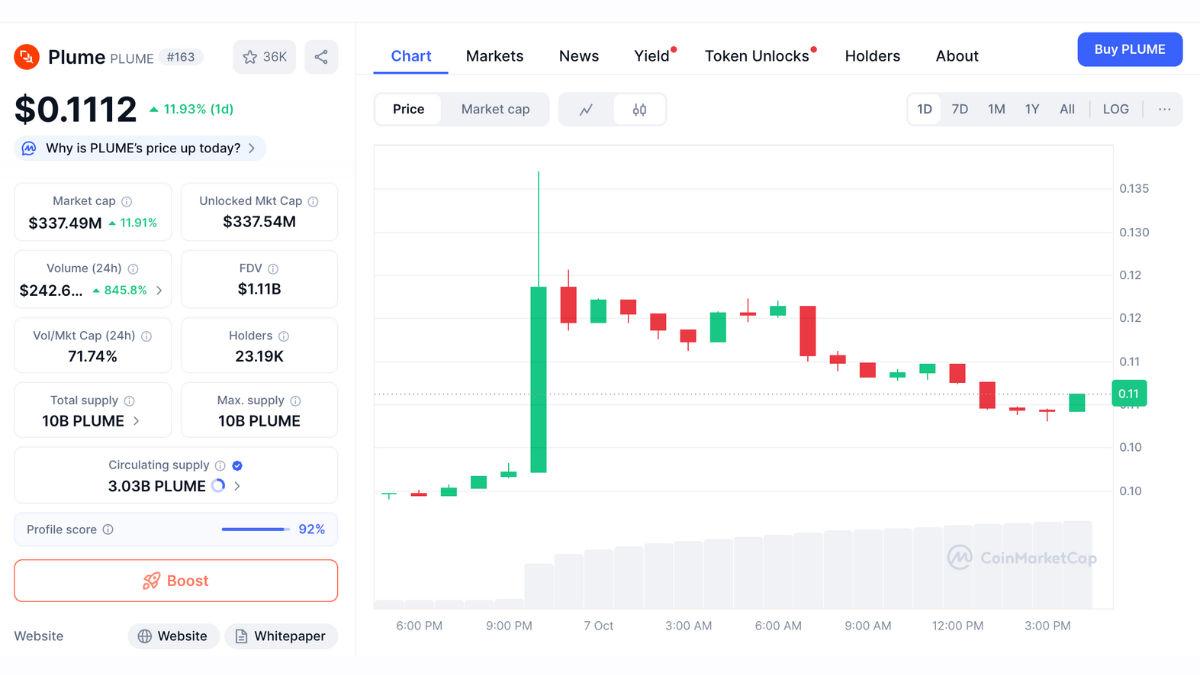

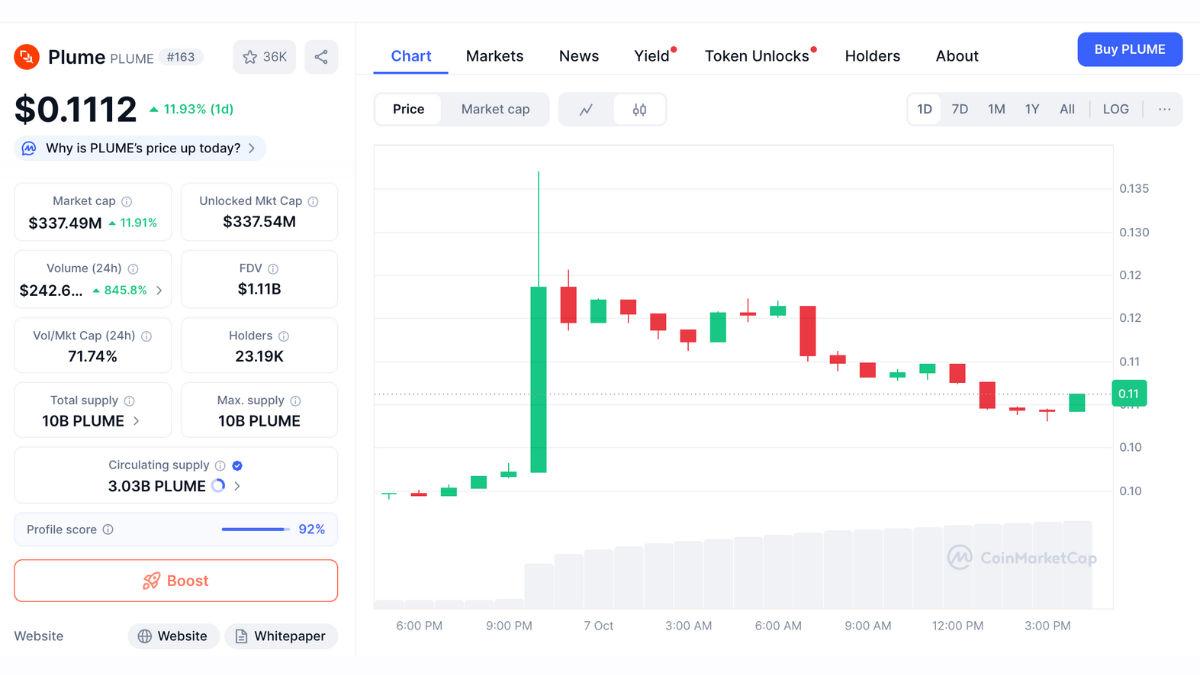

The announcement rocked the crypto community, sending Plume’s native token, PLUME, up over 25% in hours as trade volumes reached all-time highs.

Plume Bridges DeFi and Traditional Finance

Plume Bridges DeFi and Traditional Finance – Source: Coinmarketcap

SEC Approval Positions Plume at the Center of Blockchain Integration in U.S. Capital Markets. The SEC’s approval of Plume marks a major milestone in advancing blockchain adoption across regulated U.S. markets.

As the first on-chain transfer agent, Plume will connect traditional capital markets with decentralized finance (DeFi), creating new pathways for compliant on-chain transactions. Industry analysts see the decision as a clear endorsement of the Real World Asset (RWA) movement — one of the fastest-growing sectors in the crypto space — that seeks to tokenize trillions of dollars in traditional assets online.

Within hours of the announcement, PLUME’s trading volume spiked over 800%. Investors interpreted the approval as a sign of growing institutional and regulatory confidence in tokenized securities and blockchain-based financial infrastructure.

Project Details & Technology

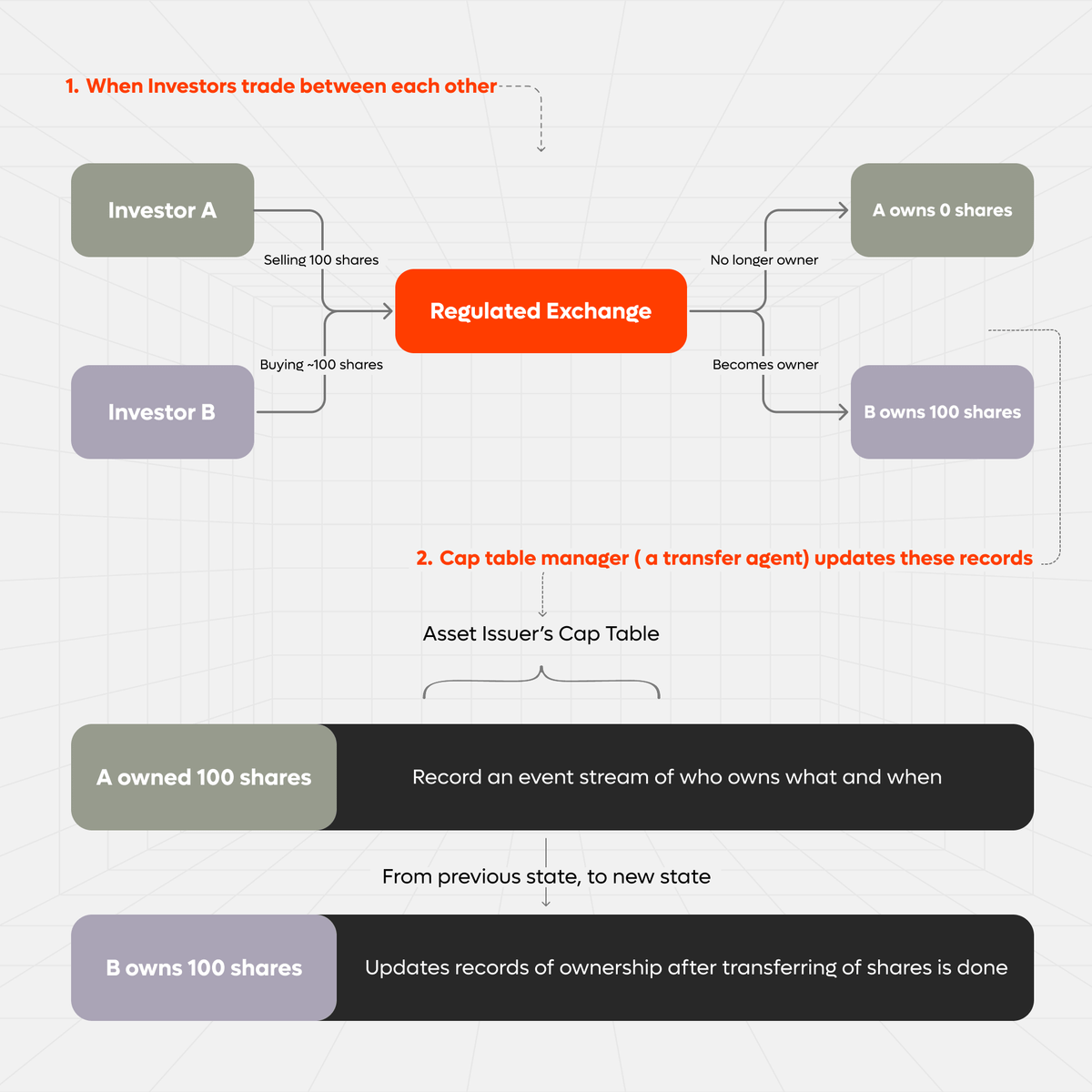

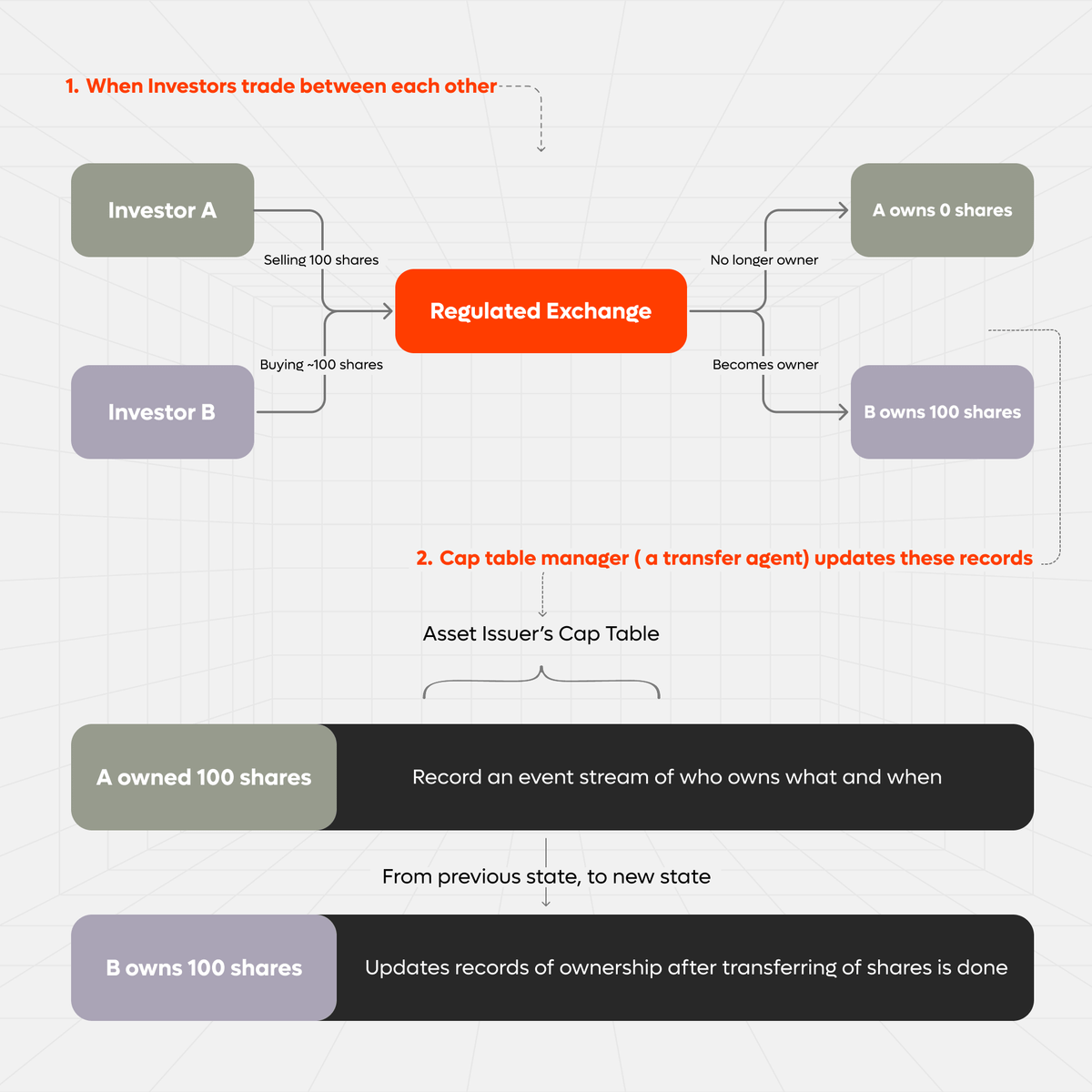

Project Details & Technology – Source: Plume Network

According to Plume official X announcement, the company will migrate the entire legacy of transfer agent infrastructure to blockchain – management of shareholder records, tracking transactions, and payment of dividends.

Unlike traditional firms that make use of internal databases, the platform of Plume records every activity on-chain, reporting automatically to DTCC and the SEC via smart contracts. This offers end-to-end transparency, real-time compliance, and significant cost and time reduction for both regulators and issuers.

In a matter of just three months, Plume onboarded more than 200,000 real asset investors and tokenized assets worth over $62 million on its NestCredit platform – demonstrating the growing appetite for compliant blockchain-based asset management.

Learn more: Plume list Binance…

The SEC license is a huge leap for the tokenized asset sector – verifying RWA and bringing the vision of RWAfi to life: a secure, compliant, and transparent financial system. Plume will be the go-between that TradFi can’t live without between decentralized finance (DeFi) and traditional finance (TradFi).

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Sui

Sui  Canton

Canton  Avalanche

Avalanche  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  PayPal USD

PayPal USD  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token