The crypto market is ending the year on a strong note as a record $18 billion worth of options contracts are set to expire.

Options allow traders to speculate or hedge against price movements. A call option grants the right to buy an asset at a specific price, while a put option provides the right to sell under similar terms.

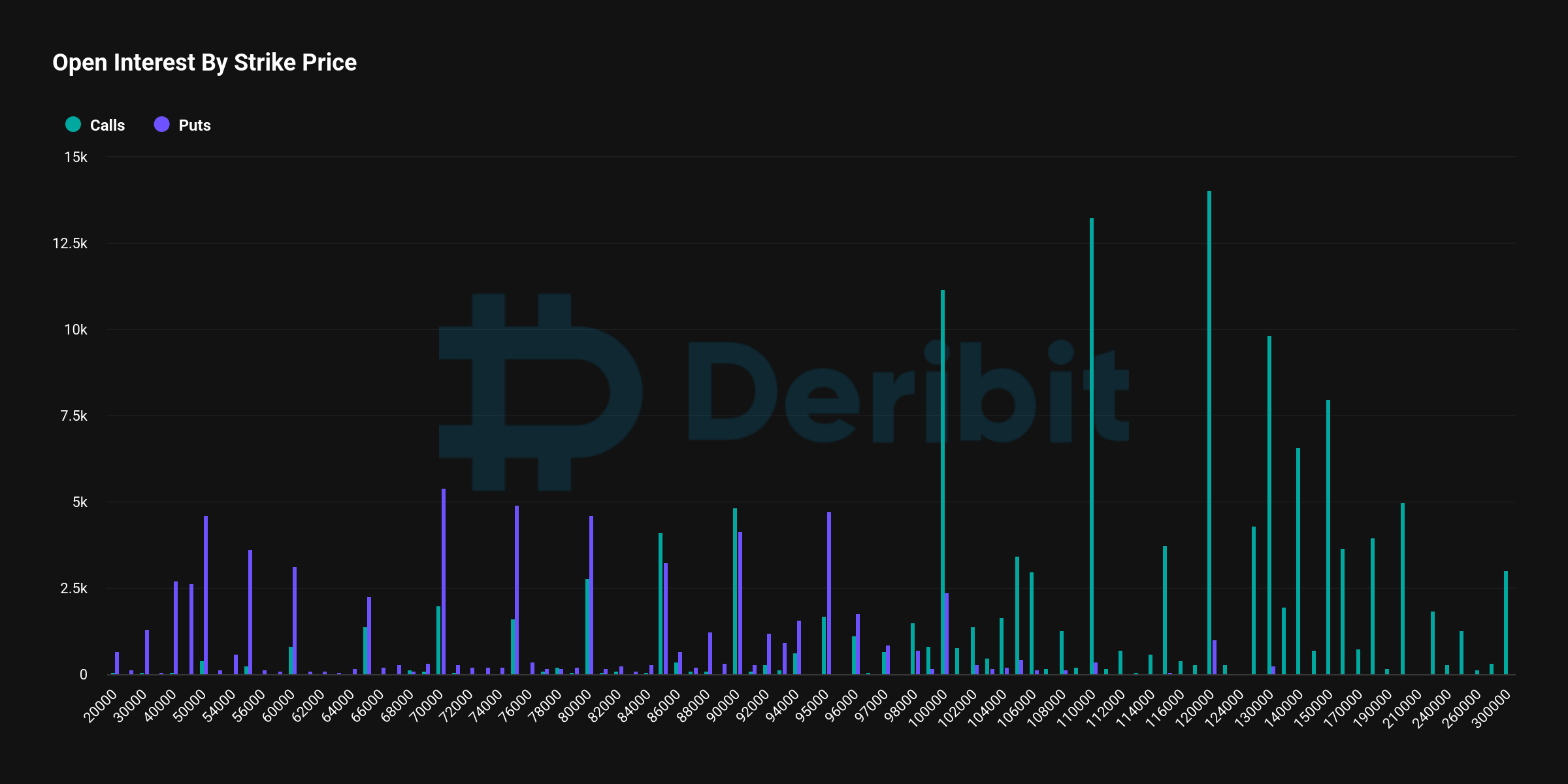

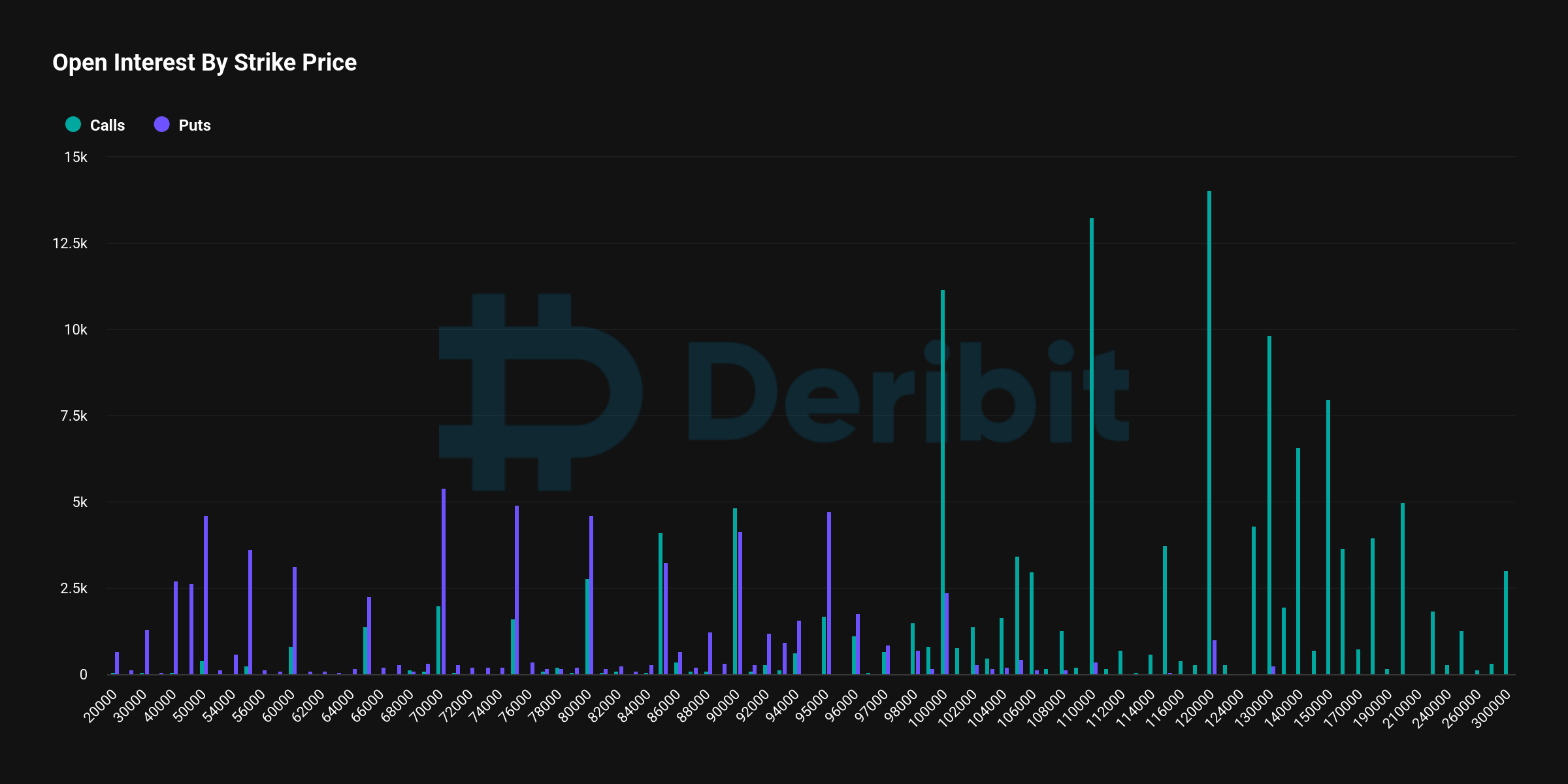

Data from Deribit shows that nearly 150,000 Bitcoin (BTC) contracts—valued at $14.17 billion—are involved in this expiry.

These contracts show a Put-Call Ratio of 0.69, meaning bullish traders dominate as they bet on higher prices. The Max Pain level, where most buyers face losses and sellers profit, is $85,000.

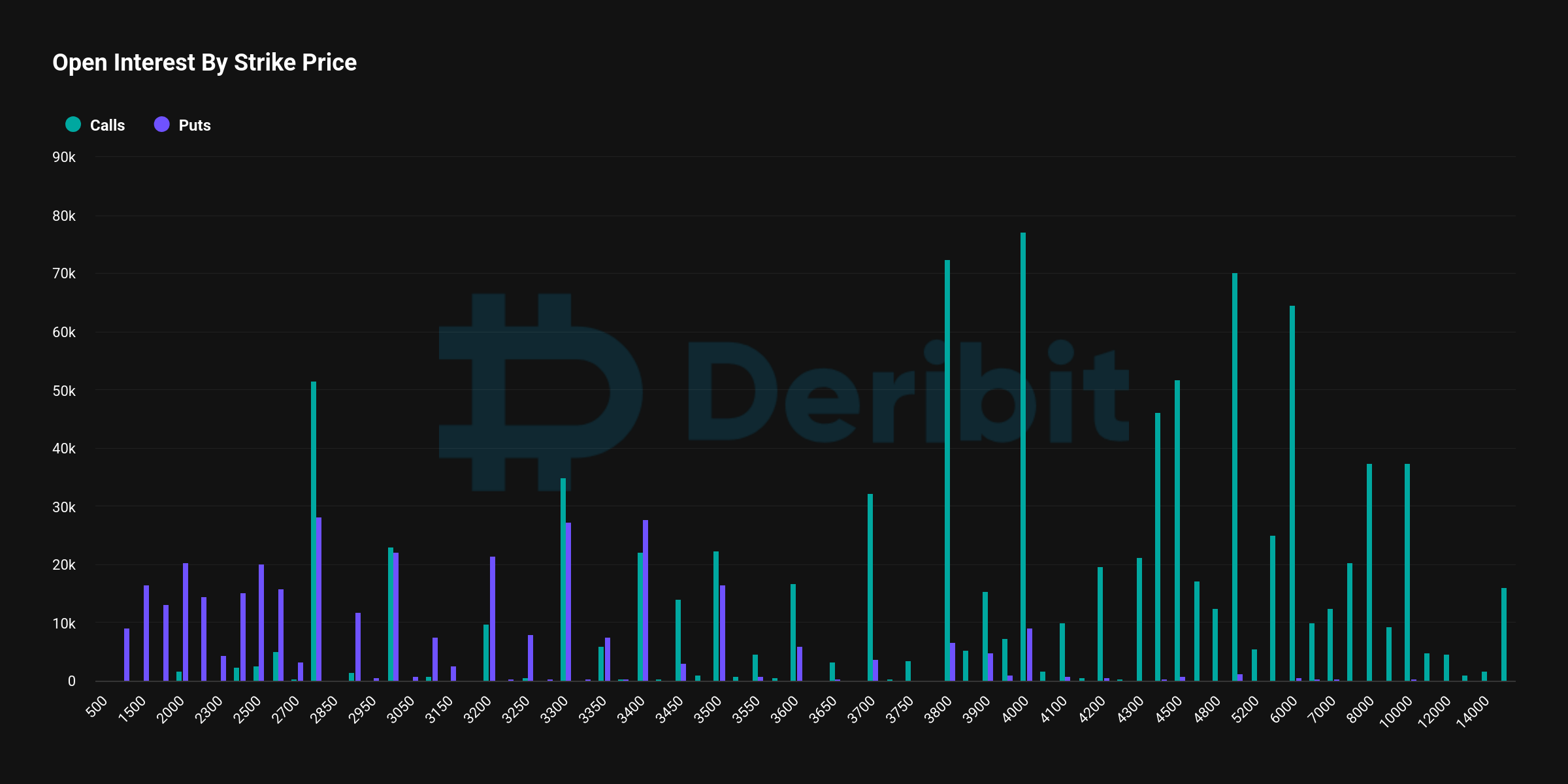

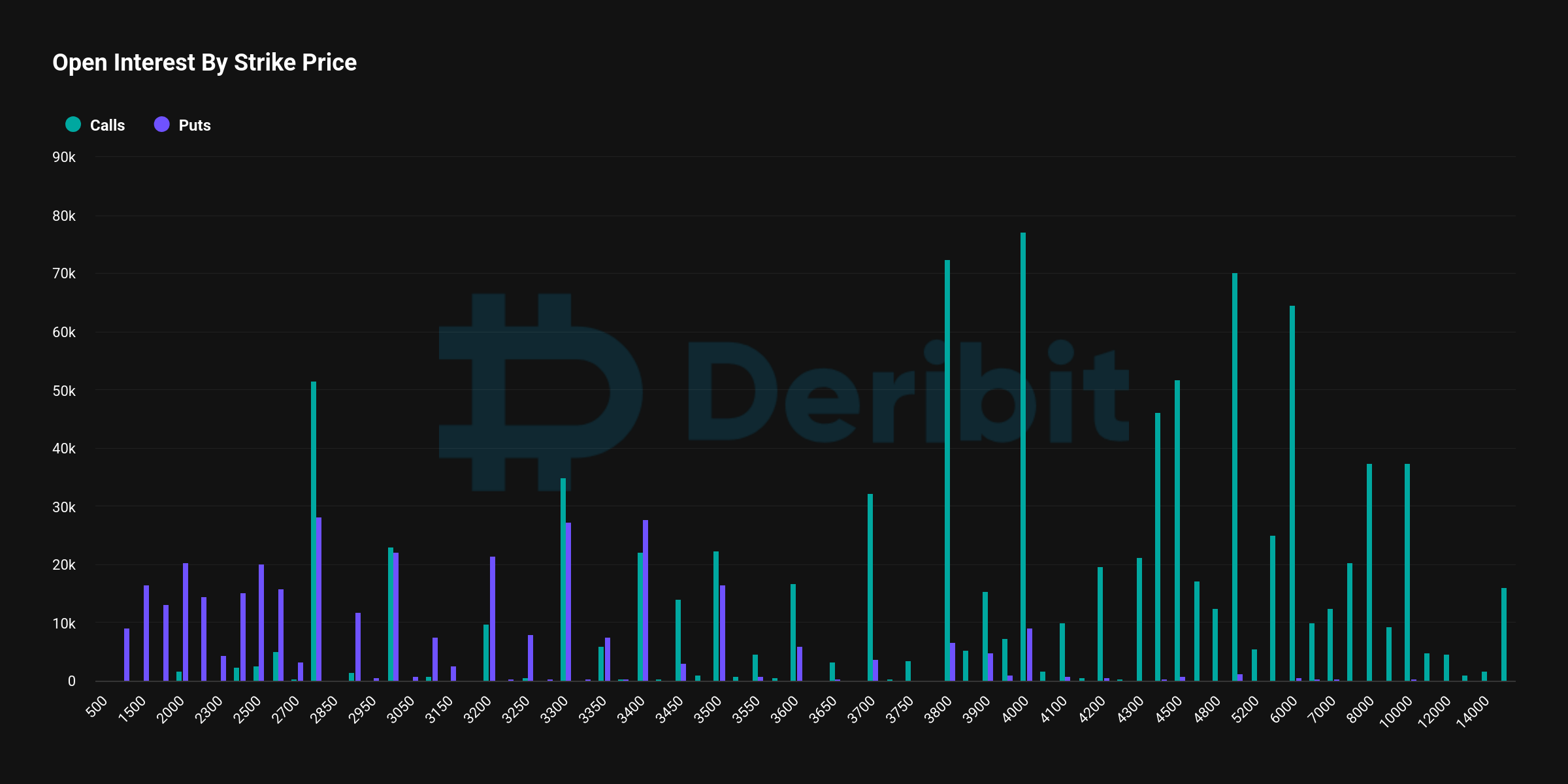

Ethereum (ETH) options are also experiencing significant activity, with 1.12 million contracts expiring. These contracts, carrying a combined value of over $3 billion, reflect a bullish market outlook with a Put-Call Ratio of 0.41. The maximum pain price is $3,000.

Deribit stated that this year-end event illustrates the bullish year for crypto markets, but uncertainty remains high. The firm noted that fluctuations in volatility measures like the Deribit Volatility Index (DVOL) and vol-of-vol suggest the potential for sharp price swings.

It added:

“With the market heavily leveraged to the upside, any significant downside move could trigger a rapid snowball effect.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Canton

Canton  Shiba Inu

Shiba Inu  Hedera

Hedera  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor