Resolv is a newly launched cryptocurrency token powering the Resolv DeFi protocol – an ambitious project centered on a delta-neutral, yield-bearing stablecoin called USR. With the token generation event (TGE) happening yesterday, many investors are evaluating Resolv’s short-term price potential.

Resolv Protocol and Tokenomics in Brief

The Resolv protocol aims to create a “true delta-neutral stablecoin” called USR, which is pegged 1:1 to the US dollar but fully backed by crypto assets (not fiat).

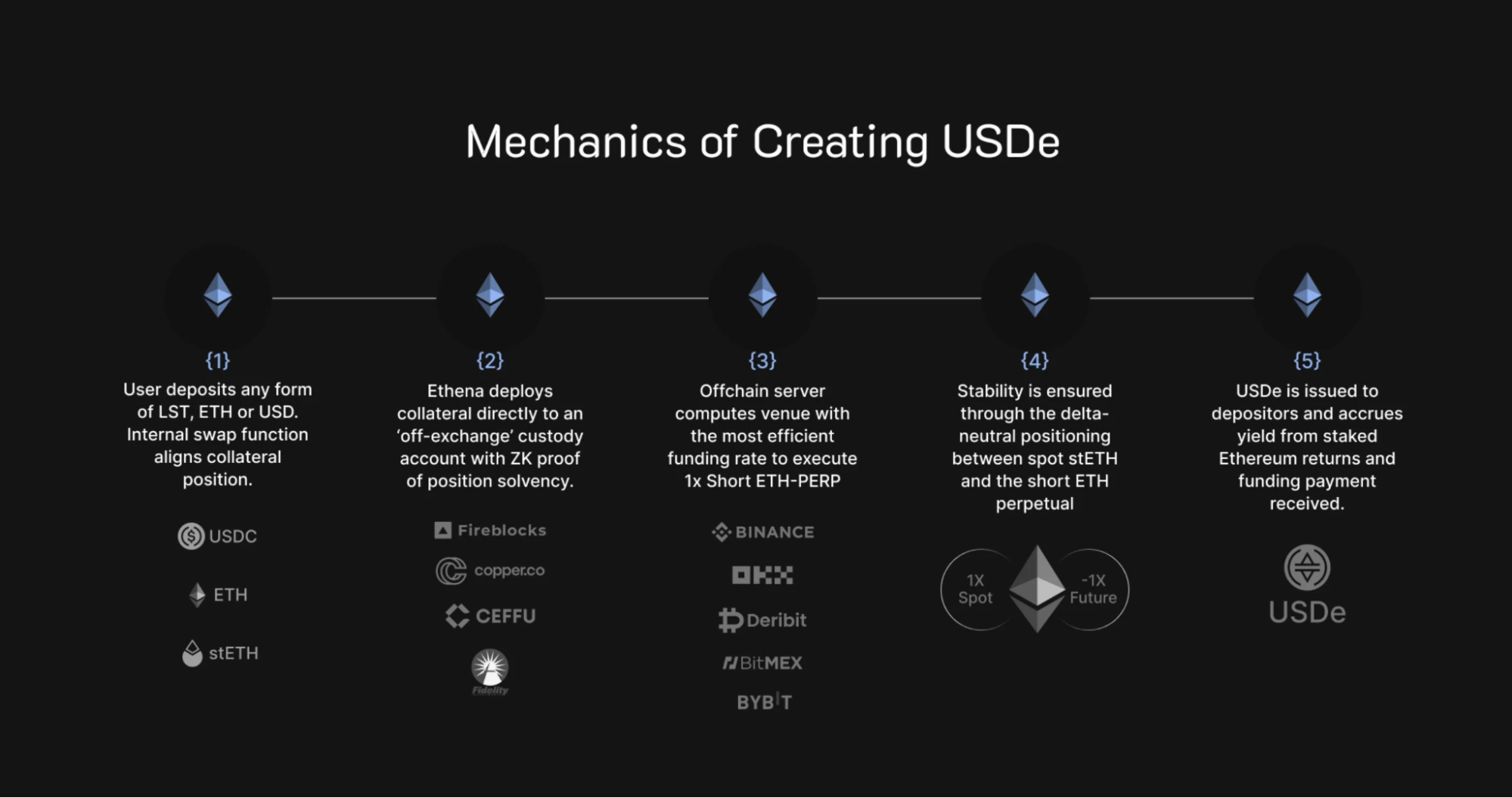

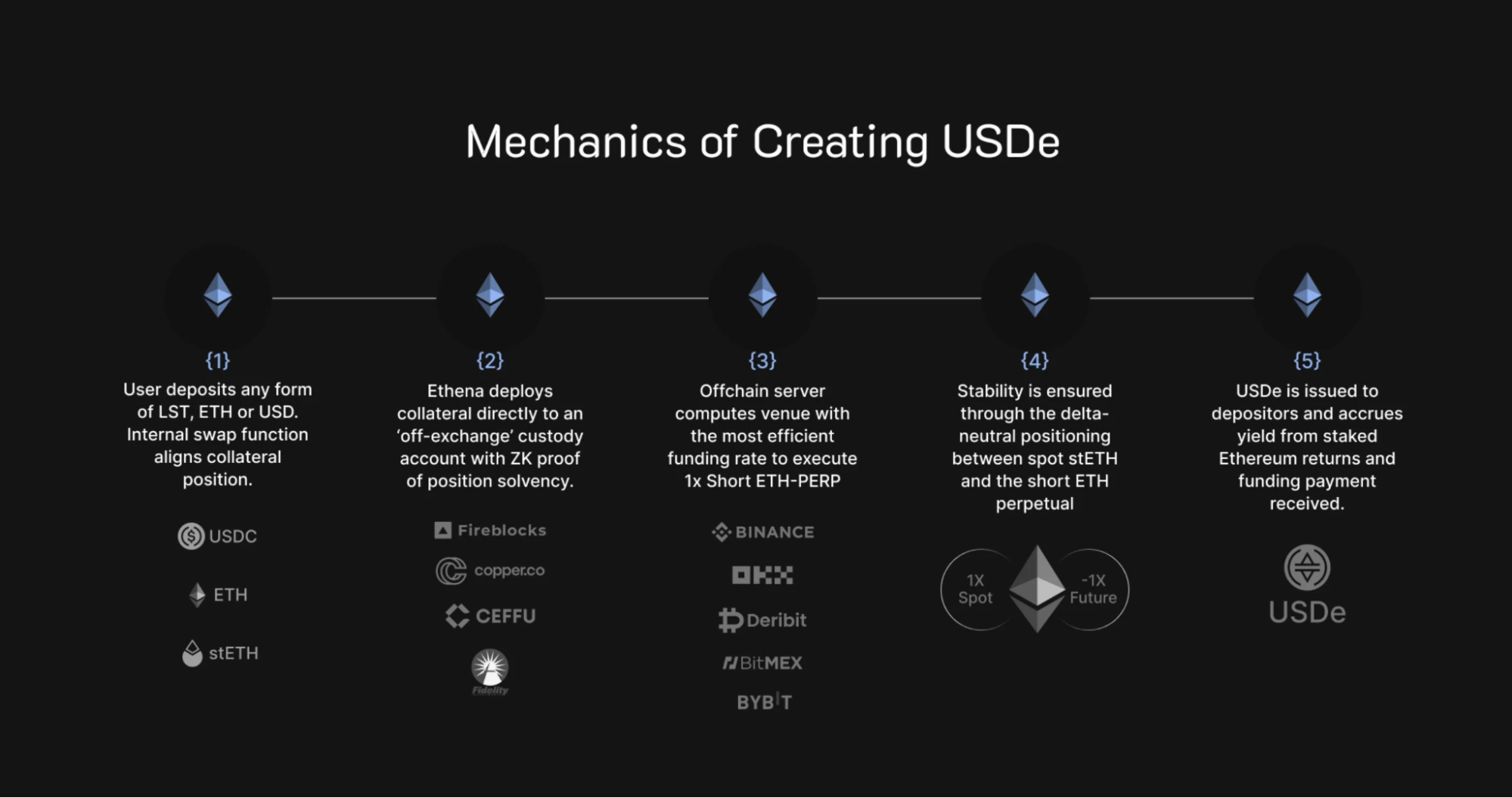

It accomplishes this by holding Ethereum (ETH) and Bitcoin (BTC) as collateral while simultaneously taking short positions in futures – a hedging strategy that neutralizes price swings. This innovative mechanism maintains USR’s stability without relying on traditional reserves or over-collateralization, setting Resolv apart from earlier algorithmic stablecoins that proved fragile.

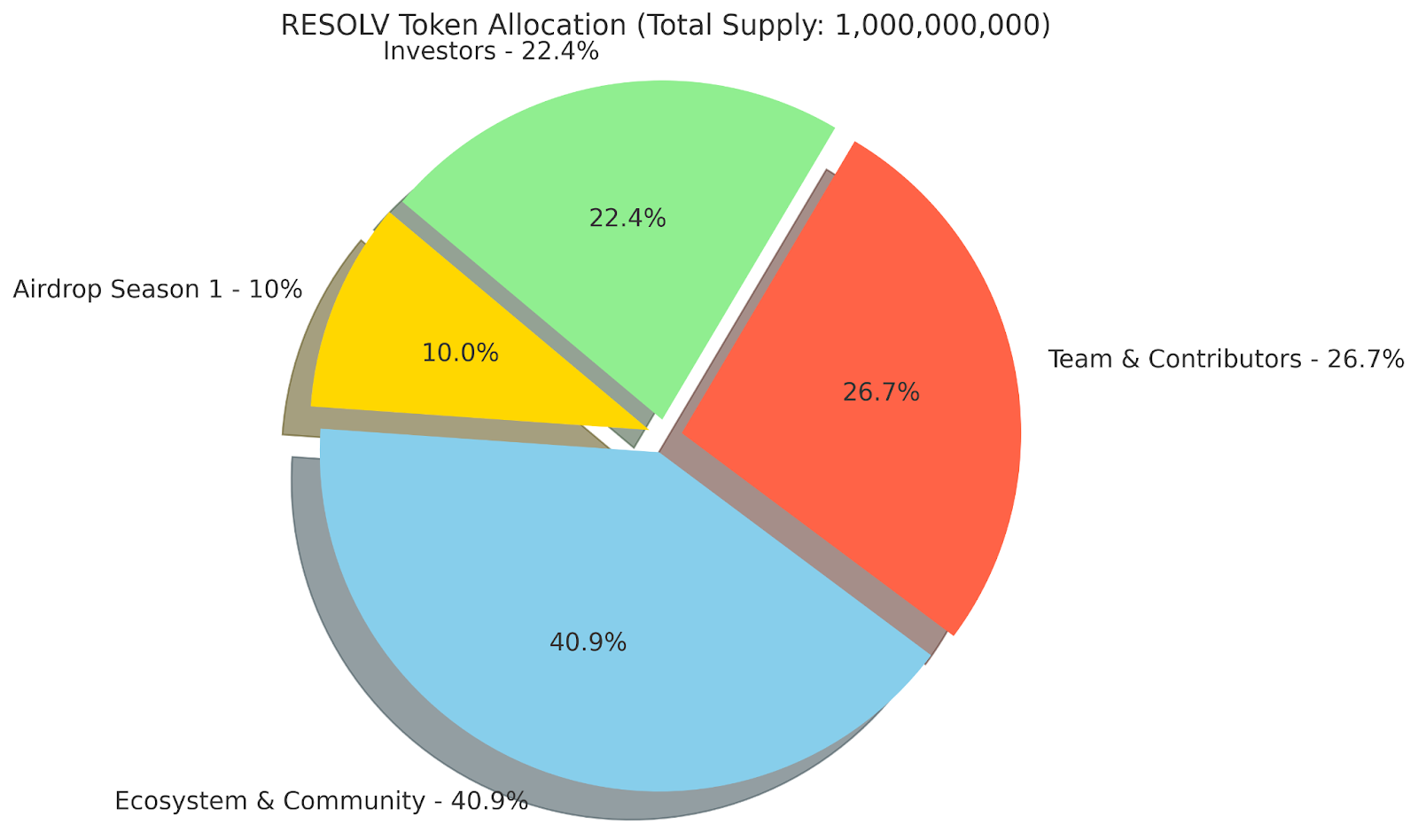

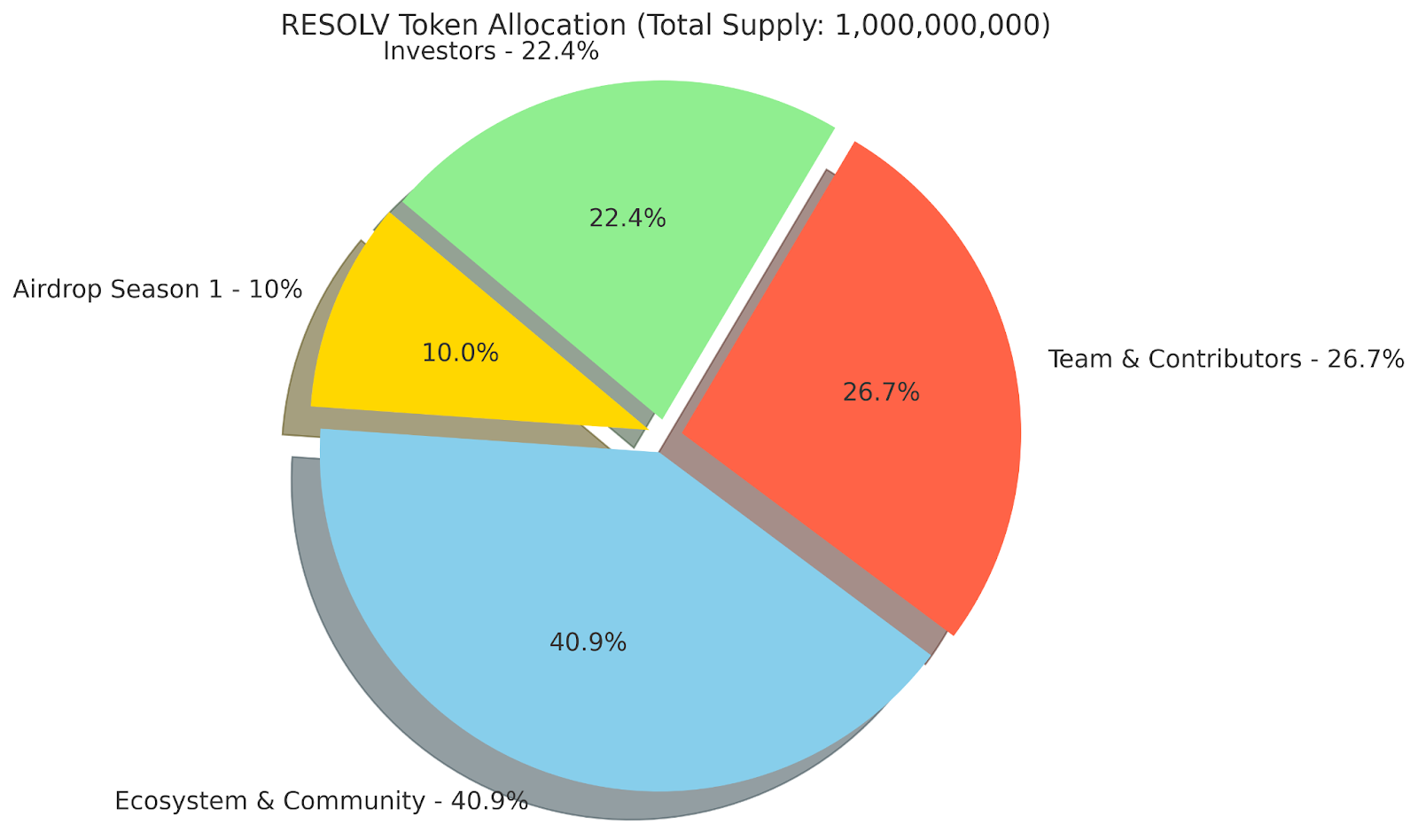

Resolv has a fixed total supply of 1 billion RESOLV tokens, enforcing a non-inflationary model. At launch, approximately 15.6% (155.75 million) are in circulation.

The allocation was designed to reward early community members while preventing immediate oversupply: for example, 10% was airdropped to early users, 40.9% reserved for ecosystem and community (mostly vested over 24 months), and team/investor tokens have one-year lockups and multi-year vesting.

This staged unlock means initial circulating supply is limited, which can reduce immediate selling pressure and allow price to be driven by genuine demand for the token’s utility.

However, it also means liquidity is relatively low at first – a factor that can amplify volatility if big trades occur.

RESOLV trades around $0.34 per token, giving it a market capitalization of roughly $53 million on a circulating supply of ~155 million. The fully diluted valuation is about $342 million.

Use Cases and Unique Features of Resolv

The cornerstone of Resolv’s use case is the USR stablecoin, positioned as a next-generation stable asset for DeFi. Unlike USDT or USDC (which hold cash or bonds), USR is backed by crypto (ETH, BTC) and derivatives positions, enabling it to earn real yield from the crypto markets.

Through a delta-neutral strategy (holding BTC/ETH long and shorting futures), Resolv captures funding rate income and staking yield, which is partially shared with USR holders and RESOLV stakers.

This means simply holding or staking within the Resolv ecosystem can produce passive income – a compelling utility in times of lower standalone yields elsewhere. In fact, Resolv has already distributed over $10 million in yield to users since launch, demonstrating the viability of its model.

Beyond the stablecoin, Resolv introduces a notable security feature: an on-chain asset recovery system. In the event a user’s ERC-20 tokens are stolen, Resolv enables them to convert those tokens into a special “vaulted” form, and if a theft occurs, a decentralized jury of experts can be convened to review the claim.

While time will test this system’s effectiveness, it adds a narrative of decentralized security/insurance to Resolv’s use case – something few competitors offer. It could attract users who are security-conscious, further driving adoption of USR and by extension interest in RESOLV tokens.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

Team Background and Partnerships

Resolv was founded in 2023 by a trio of experienced DeFi builders – Ivan Kozlov, Tim Shekikhachev, and Fedor Chmilevfa.

The seed round was led by prominent crypto VCs CyberFund and Maven 11, with participation from Coinbase Ventures, Arrington Capital, Animoca Ventures and others. This is a strong lineup of backers.

High-profile backing often correlates with greater market visibility and credibility, which can support token value as more investors become aware of Resolv’s fundamentals.

At this stage, Resolv has not announced partnerships in areas like e-commerce or identity. However, its collaboration with major exchanges and integration into Hyperliquid’s network functionally serve to raise its profile.

We can expect more partnerships to form if the protocol grows – for instance, integrations with wallets, lending platforms, or stablecoin-focused applications that could use USR as collateral or as a yield-bearing asset.

Current Market Trends and Sentiment

Any short-term price prediction must account for the broader crypto market conditions. Fortunately for Resolv, it launched into a market that is showing signs of a strong bull cycle in mid-2025. Bitcoin recently flirted with its all-time high, breaking above $110,000 in early June.

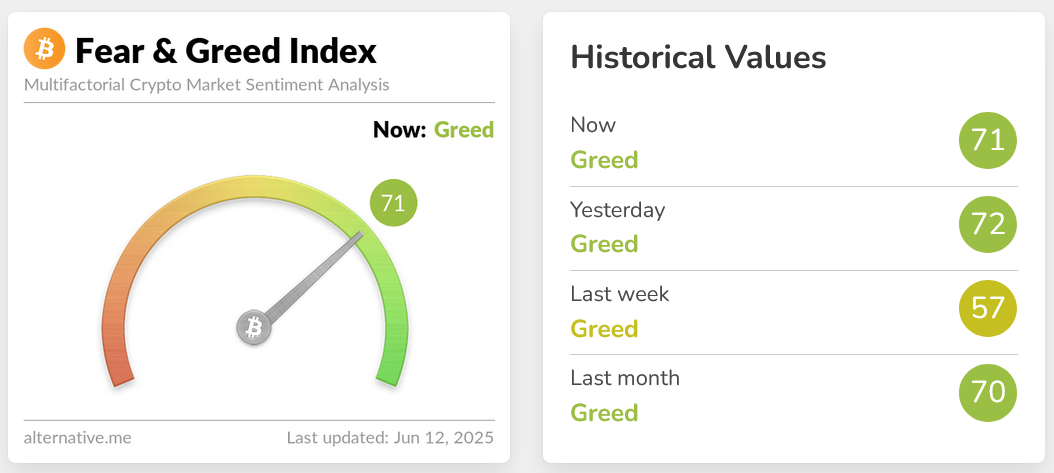

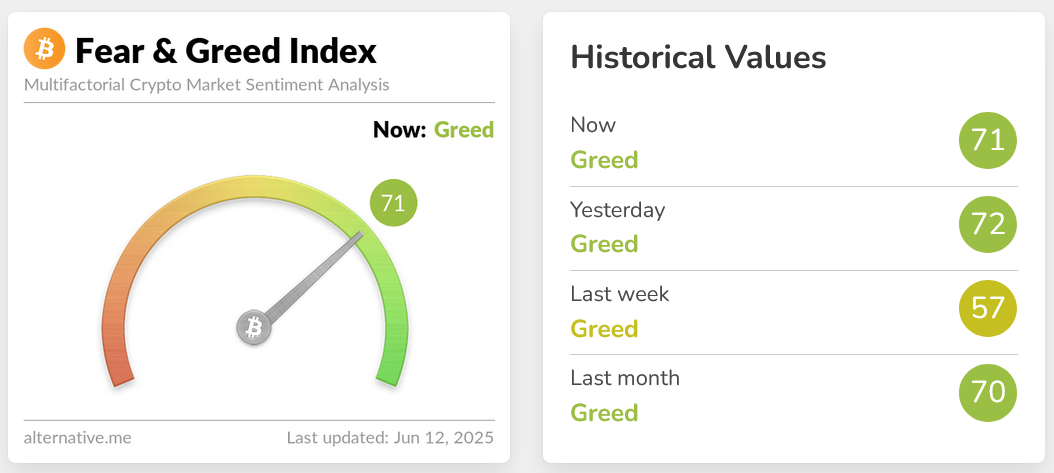

Market sentiment is firmly optimistic – Cointelegraph report over 2.1 positive BTC comments per negative comment on social media, the most bullish bias in 7 months. The overall Crypto Fear & Greed Index is in “Greed” territory (~71/100).

In bull markets, investors are actively hunting for the “next big thing.” As Bitcoin leads and retail interest picks up, capital often rotates into high-potential alt projects. Resolv, being a low-cap coin (~$50M) with a compelling story, fits the profile of an altcoin that traders might speculate on for outsized gains.

One cannot discuss stablecoins without noting regulation. In 2025, regulators worldwide are crafting stablecoin rules. The U.S. Congress, for example, has been working on a Stablecoin Bill, and the SEC has taken an interest in yield-bearing stablecoins.

Resolv’s approach – crypto-backed and algorithmic – might sidestep some rules intended for fiat-backed coins, but its use of derivatives and promise of yield could invite scrutiny. This represents an overhang for all projects in this niche. Short-term, regulatory actions (or even rumors) can swing sentiment.

Still, the “regulatory fog” remains a risk factor that could temper price exuberance if any negative news hits.

Comparing Resolv with Competing Projects

By examining peers, we can gauge how the market might value Resolv if it executes well.

Ethena vs Resolv

The closest parallel to Resolv is Ethena, which offers a crypto-backed, delta-neutral stablecoin called USDe and a governance token ENA. Ethena was formally launched in 2023 and quickly gained traction as a decentralized “synthetic dollar” solution. It uses a very similar hedging strategy.

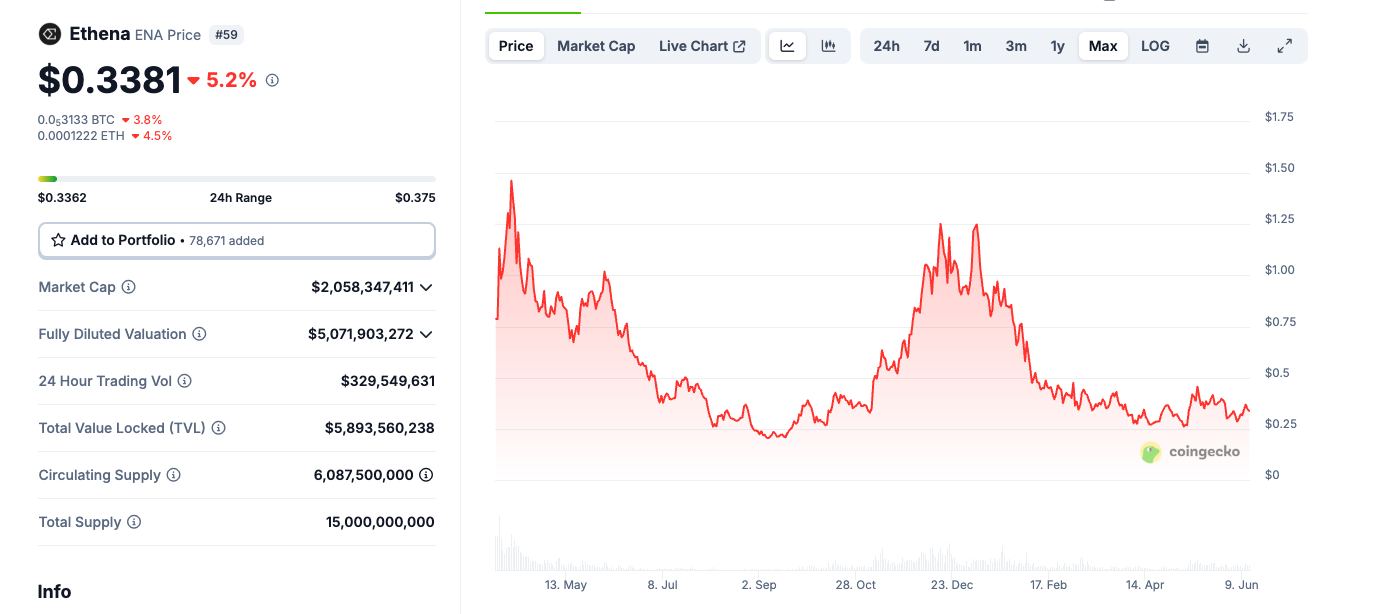

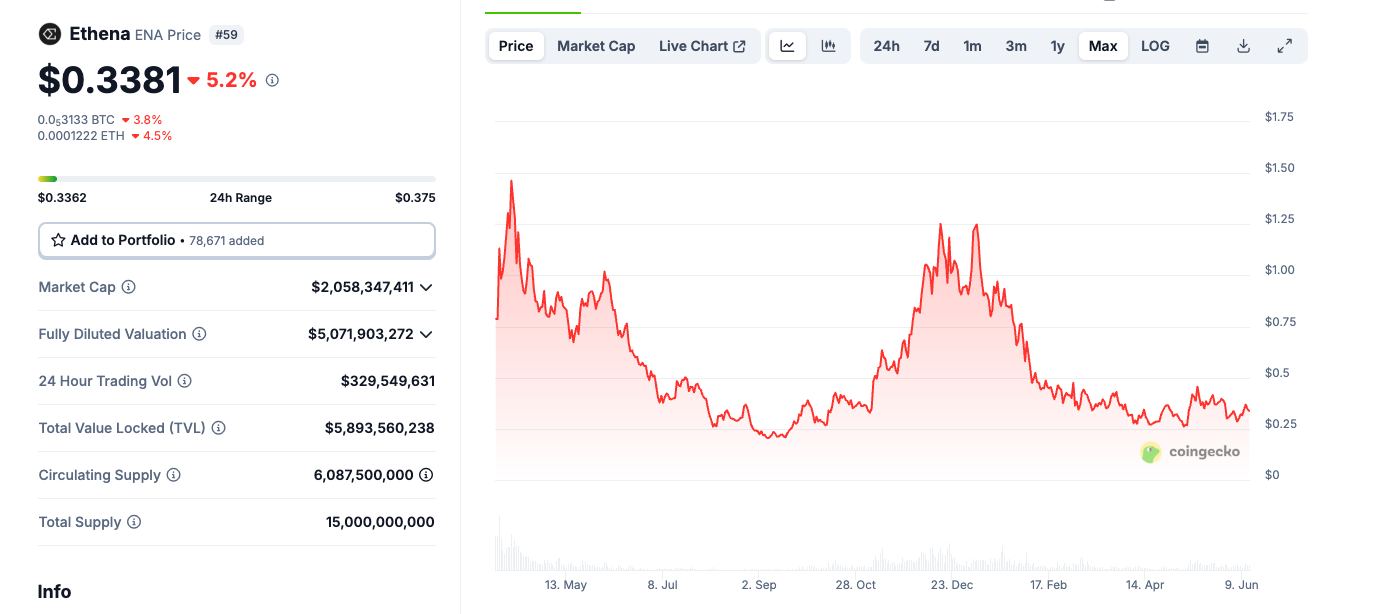

The result? Ethena’s USDe stablecoin has grown to about $5 billion in circulating value by mid-2025 – a remarkable adoption that signals strong market demand for crypto-native stablecoins. Ethena’s governance token ENA likewise commands a multi-billion valuation; with ~6.1 billion ENA circulating, its market cap is around $2.1B (price ~$0.34).

These numbers dwarf Resolv’s ~$50M market cap and highlight a huge valuation gap between the established leader and a newcomer. If Resolv can follow Ethena’s trajectory even partway, it suggests significant upside potential.

For instance, analysts at 99Bitcoins noted Resolv at ~$54M cap vs. Ethena at $5B and flagged RESOLV as possibly one of the “best low-cap bets of the season” given that disparity.

However, Ethena also illustrates some challenges:

- Ethena benefited from first-mover advantage in this specific delta-neutral stablecoin narrative, and it’s now a known quantity.

- Ethena saw its share of volatility; Resolv will likely face similar tests. A misstep by one could affect perception of all “algorithmic-yield stablecoins.”

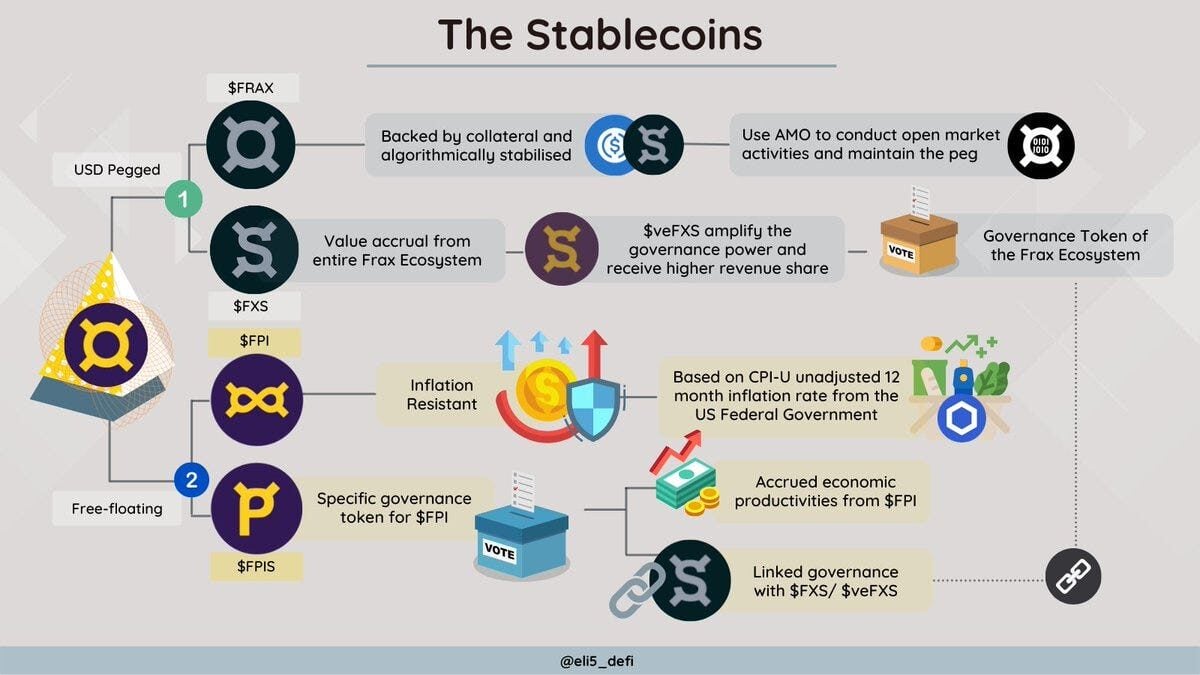

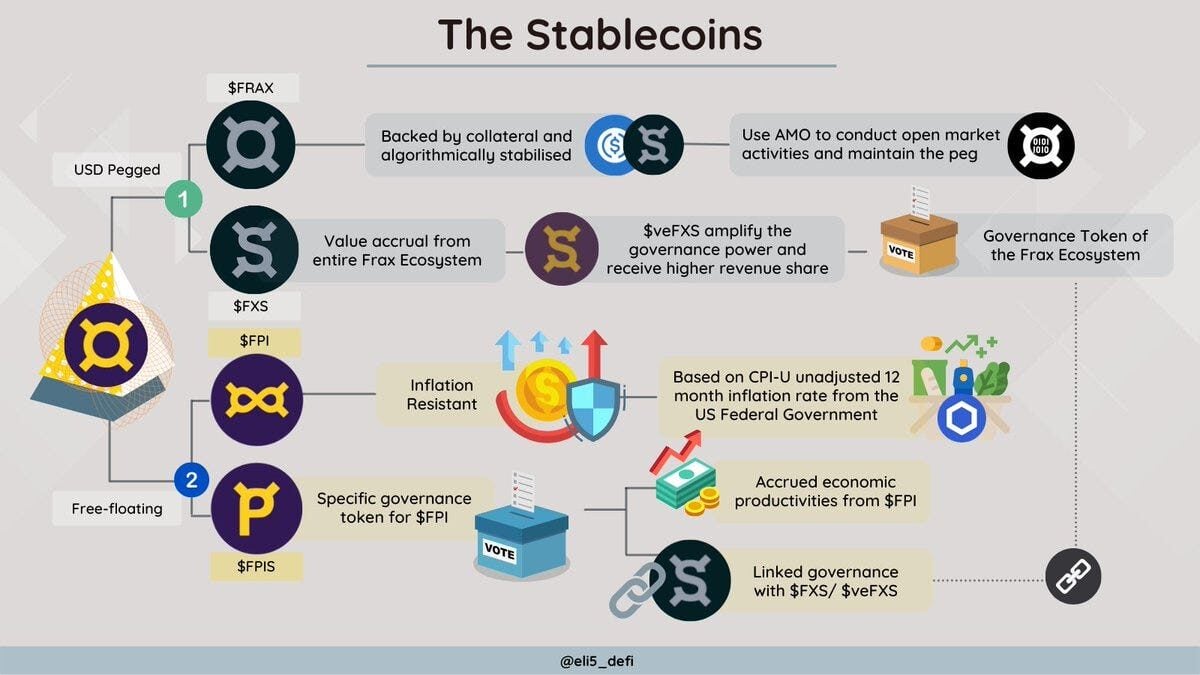

Frax vs Resolv

Frax introduced the idea of an algorithmic stablecoin partially backed by collateral and uses a governance token FXS. While Frax’s mechanism is different, it targets the same goal: a decentralized stable USD.

Frax’s FXS token currently holds a market cap in the mid-hundreds of millions, and many in the industry regard Frax as one of the successful post-Terra stablecoin models. Resolv contributes to this ongoing wave of innovation in stablecoins.

Frax has also moved toward real yield (investing collateral in Yearn, Curve etc., and even considering real-world asset yields) – which parallels Resolv’s “crypto-native yield” focus.

Frax has a multi-year head start and an ecosystem (FraxLend, FraxETH, etc.), whereas Resolv is just launching its first products. Short-term, investors might favor Resolv for its novelty and higher growth potential, but Frax’s existence shows that carving out a significant market share in stablecoins takes time and a proven record of stability.

In summary, Resolv’s fundamentals put it in league with some of the most exciting new DeFi projects of 2024–2025. Its closest peer, Ethena, shows a case study of rapid growth – and offers a yardstick that suggests Resolv trades at a discount if it captures even a small slice of the stablecoin market.

Resolv Price Prediction: Post-TGE

Taking all of the above into account, the short-term outlook for RESOLV appears cautiously optimistic. Resolv checks many boxes: an experienced team, substantial backing by reputable investors, a novel product addressing real demands (yield on stable assets + DeFi security), and tangible early traction.

Unlike the typical “airdrop + TGE dump” scenario, where early recipients rush to cash out, RESOLV has demonstrated signs of stronger-than-expected buyer support, hinting at a possible accumulation phase or coordinated buying effort.

More measured forecasts, a continued rally toward the $0.50-$0.60 range is conceivable if bullish catalysts emerge, but so is a dip back below the listing price (perhaps into the $0.20s) if early buyers cash out.

If such tailwinds emerge and the current momentum continues, RESOLV could realistically reach that price range within the next 2–4 weeks. However, any delay in roadmap execution or macro risk-off events could push this timeline back.

It’s important to emphasize that short-term predictions are inherently uncertain – especially for a brand-new token in a volatile sector. Resolv (RESOLV) will trade not just on its merits, but also on crypto market winds. Broader sentiment remains positive for now, with Bitcoin’s strength and investor enthusiasm providing a tailwind.

In comparison to its peers, Resolv’s upside could be significant – the gap with Ethena suggests a narrative of “undervalued up-and-comer” that could drive speculative inflows. Yet, one must remain mindful of the risks we outlined. Early volatility and the complexities of Resolv’s mechanism mean this token’s journey will not be a straight line upward.

Read more: Ethereum Price Prediction in June 2025

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave