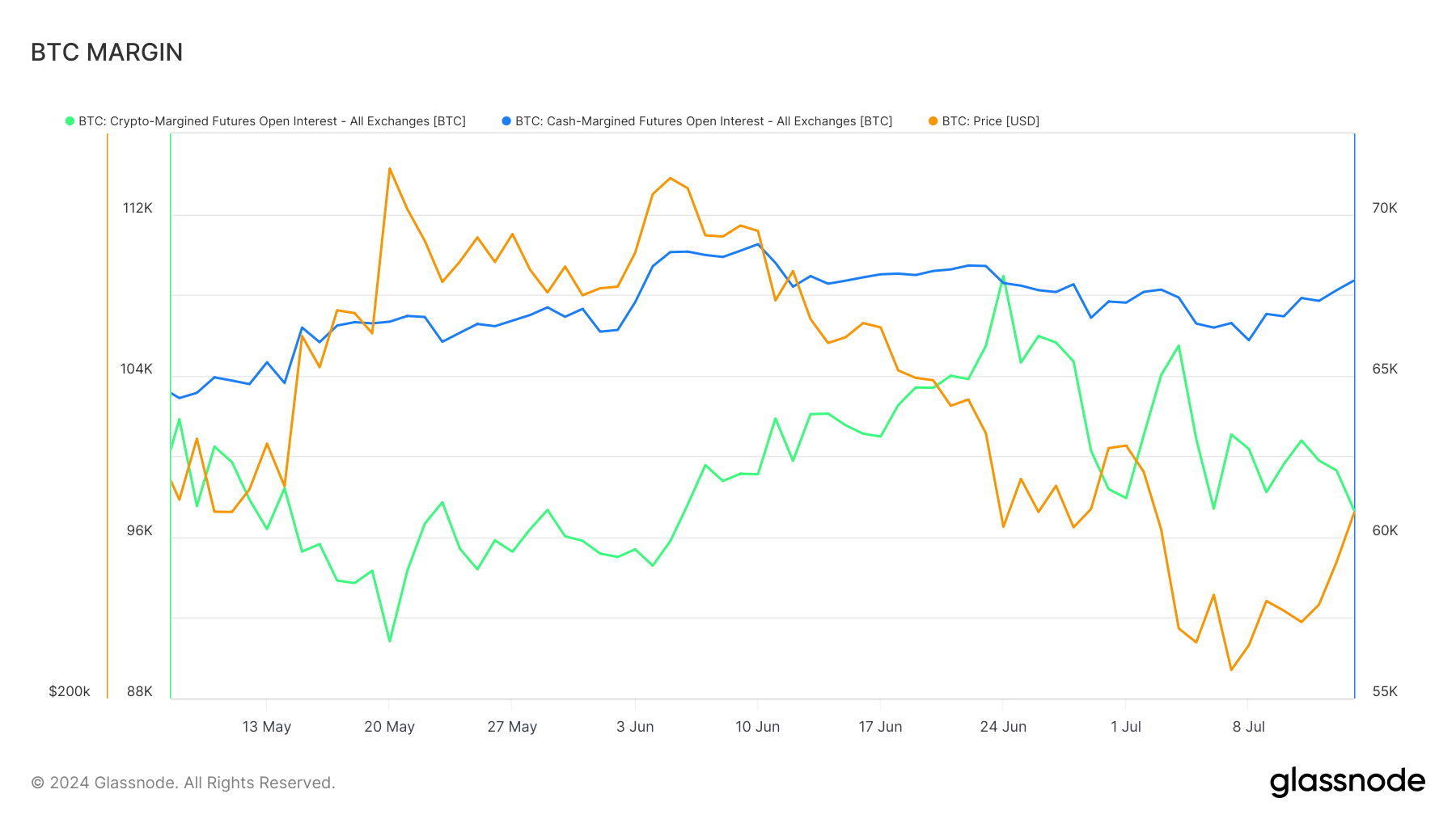

Bitcoin’s recent price action has seen a notable divergence in futures market activity. Data from Glassnode reveals a marked increase in cash-margined futures open interest across all exchanges, while crypto-margined futures open interest has declined.

This trend coincides with Bitcoin’s price surging past $62,000 following bullish momentum on former President Trump’s assassination attempt at the weekend.

The blue line, representing cash-margined futures, demonstrates a steady upward trajectory, suggesting increased interest in these instruments. Conversely, the green line, indicating crypto-margined futures, shows a decline over the same period. The orange line tracking Bitcoin’s price correlates with the uptick in cash-margined futures.

This shift implies a growing preference for cash-margined futures, particularly on platforms like the Chicago Mercantile Exchange (CME), as traders seek to hedge positions or gain exposure without holding the underlying asset—the divergence between cash and crypto-margined futures highlights differing market sentiments and risk management strategies among participants.

This trend emphasizes the evolving landscape of Bitcoin derivatives trading, where institutional engagement through cash-settled products appears to be gaining traction.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Canton

Canton  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore