Quick Take

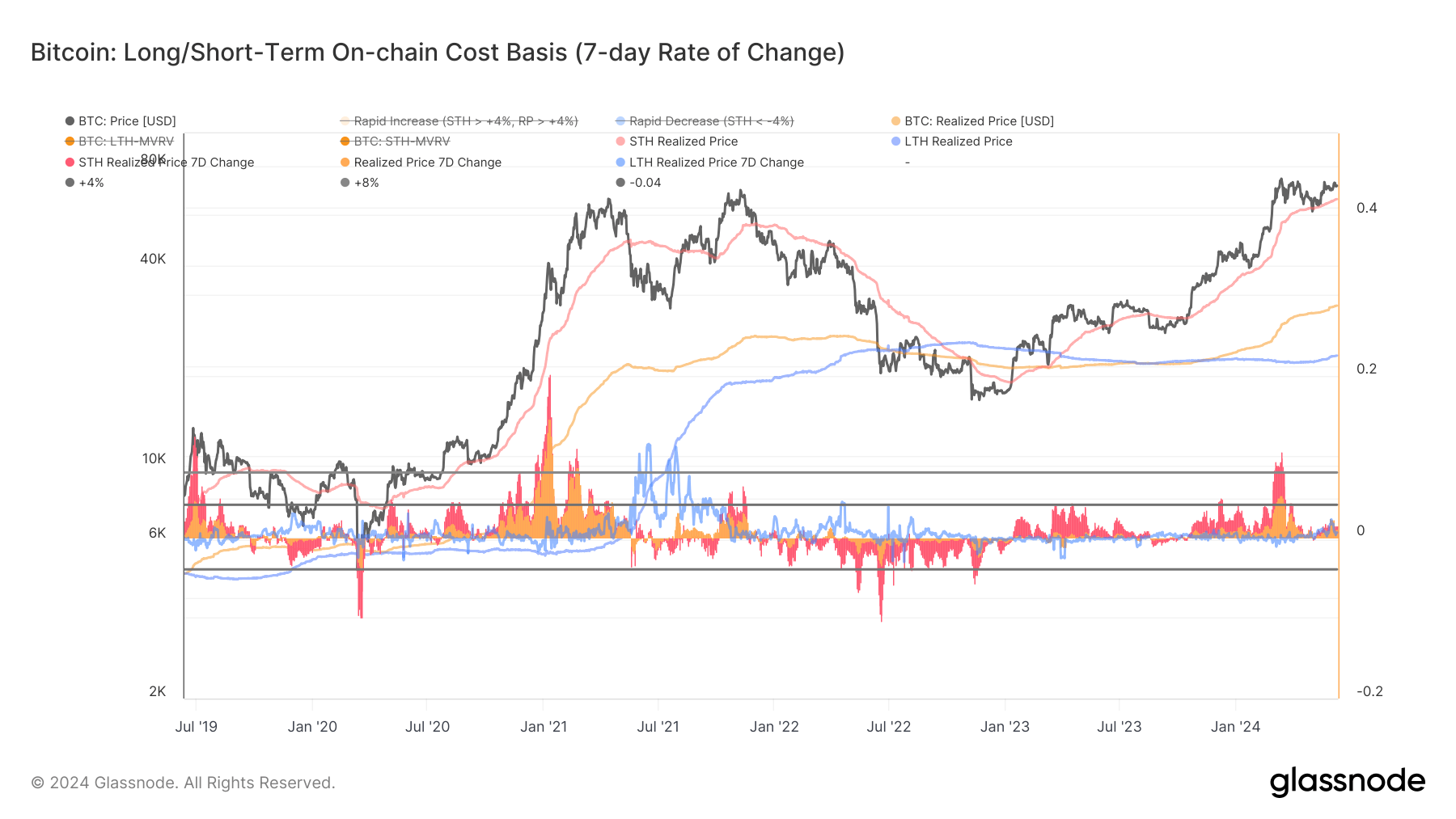

The Realized Price metric offers a comprehensive overview of the average on-chain acquisition price for the entire Bitcoin circulating supply. By analyzing Short-Term and Long-Term Holder heuristics, we can determine the realized price for different investor cohorts.

For the entire coin supply, the Realized Price denotes the aggregate on-chain acquisition price. For Short-Term Holders (STH), the Realized Price reflects the average acquisition price for coins moved within the last 155 days and held outside exchange reserves. These coins are the most likely to be spent soon. Conversely, Long-Term Holders (LTH) represent coins not moved within the last 155 days, indicating the least probable coins to be spent.

Data from Glassnode shows that the STH Realized Price has been steadily increasing, nearing $64,000, indicative of Bitcoin’s ongoing uptrend in the past 18 months. According to CryptoSlate, this metric provides crucial support, with Bitcoin testing this level at the start of May. The STH Realized Price rose 1.5% in the past week, signaling increased short-term speculation.

Notably, this metric spiked by 11% in March during Bitcoin all-time high over seven days, the highest since February 2021. The 1.5% increase indicates reduced market speculation compared to March, while Bitcoin consolidates below $70,000.

Additionally, CryptoSlate reported that the overall realized price recently surpassed $30,000, indicating investors exchanging Bitcoin at higher prices.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor