The market performance of the spot Bitcoin ETFs (exchange-traded funds) in the United States has been impressive over the last few weeks. Continuing their excellent streak, the crypto investment products closed the previous trading week with their best single-day performance in almost four months.

The positive investor sentiment surrounding the spot ETFs seems to have also bubbled into the Bitcoin and the general crypto market, which has recovered well from an early price slump in September.

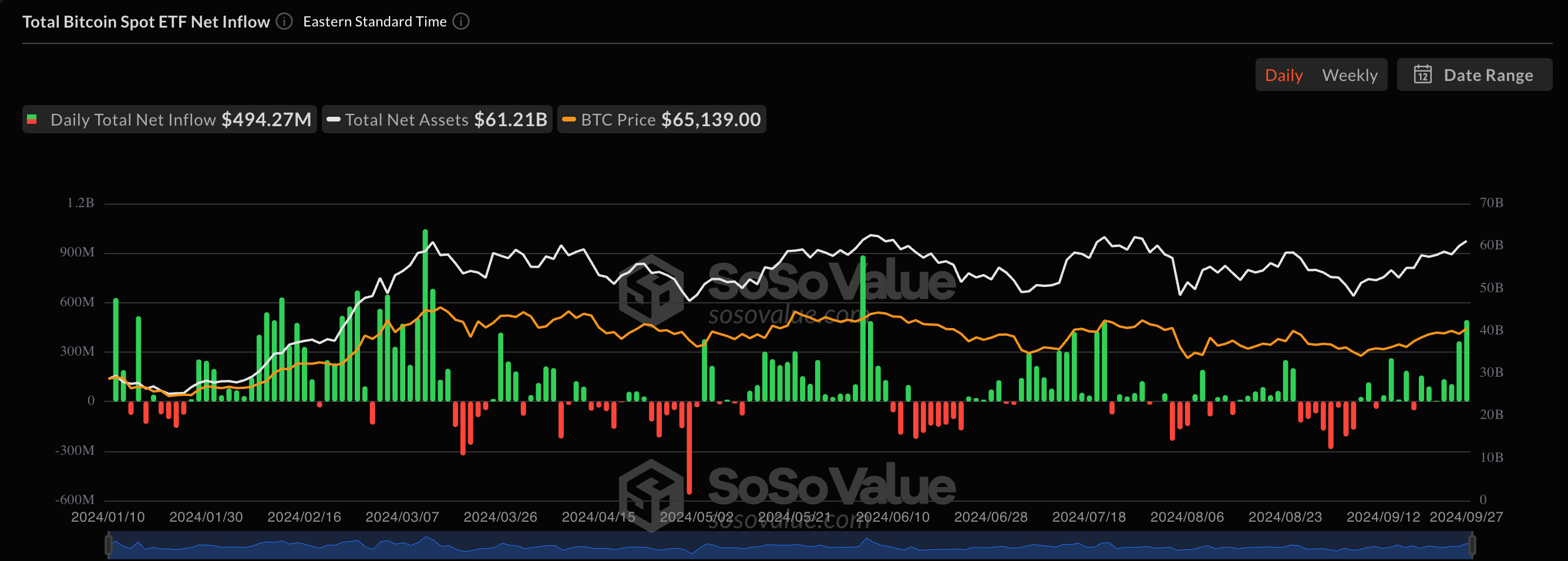

US Bitcoin ETFs Post Nearly $500 Million In A Single Day

On Friday, September 27, the US spot Bitcoin ETF market registered a total net inflow of $494.27 million, the highest value since the $886 million capital influx on June 4. This was another strong daily performance by the crypto-based products, which posted over $365 million in net inflows barely 24 hours before.

According to data from SoSoValue, Ark Invest and 21Shares’ ARKB led the day with an inflow of $203 million, while Fidelity’s FBTC followed in second place with a $124 million influx. In a seeming resurgence, BlackRock’s IBIT came in third with a net inflow of over $110 million.

Source: SoSoValue

Meanwhile, Grayscale Bitcoin Trust (GBTC) recorded a rare positive day, with $26.15 million flowing into the product. Unsurprisingly, this value represents the fund’s highest capital influx since mid-May, reflecting the level of redemption it has experienced since the spot Bitcoin ETFs launched.

As a result of Friday’s performance, the total weekly net inflows for the BTC exchange-traded funds rose to a remarkable $1.11 billion. This billion-dollar showing makes it the third consecutive week in which the US-based spot Bitcoin ETFs has recorded a cumulative weekly net inflow.

Spot Ethereum ETFs Record Second Positive Week Ever

The outstanding performance of the Spot Bitcoin ETFs seems to have inspired its Ethereum counterpart, as the ETH funds posted their second positive trading week since launch. The Ethereum ETFs registered a cumulative net inflow of more than $84.51 million in the past week.

On Friday, the total net inflow of spot Ethereum ETFs stood around $58.6 million. Data from SoSoValue shows that Fidelity’s FETH led with a capital influx of $42.5 million, with BlackRock’s ETHA in second with $11.46 million.

iShares Ethereum ETF eclipses $1bil in assets…

Now in top 20% of all 3,700+ ETFs.

Did this is 2 months. pic.twitter.com/iRWaxkjZxl

— Nate Geraci (@NateGeraci) September 28, 2024

In a post on X, ETF expert Nate Geraci mentioned that the BlackRock Ethereum ETF has surpassed the $1 billion mark in terms of assets. While acknowledging that this feat was achieved in two months, Geraci revealed that ETHA is now in the top 20% of over 3,700 ETFs in the United States.

The price of Bitcoin fails to hold above the $66,000 mark on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image created by Dall.E, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor