CryptoPunks, the top-tier NFT collection of the blockchain, has recently faced a trust loss from investors after a tax evasion bust. It occurred after many scandals these days, from jaw-dropping price swings to million-dollar missteps. But beyond the headlines, the NFT market in 2025 remains a battleground of risk and reward.

CryptoPunks Under Fire: Taxes and Massive Drops

A recent scandal has rocked the CryptoPunks community. Waylon Wilcox, a Pennsylvania investor, admitted to dodging $3.3 million in taxes on $13 million in profits from selling 97 CryptoPunks between 2021 and 2022. This guilty plea marks the first U.S. criminal case linking NFTs to tax evasion, signaling tighter scrutiny of digital asset gains. Wilcox now faces up to six years in prison—a stark warning to investors navigating the murky waters of crypto wealth.

🚨🇺🇸GUY MADE $13M FLIPPING PIXELATED NFTS—TOLD THE IRS “LOL, NEVER HEARD OF CRYPTO”

Waylon Wilcox, 45, of Pennsylvania, pleaded guilty to hiding over $13 million in profits from flipping 97 CryptoPunks NFTs—reporting nothing to the IRS in 2021 and 2022.

But when tax time came?… pic.twitter.com/RJACf8z6IU

— Mario Nawfal (@MarioNawfal) April 12, 2025

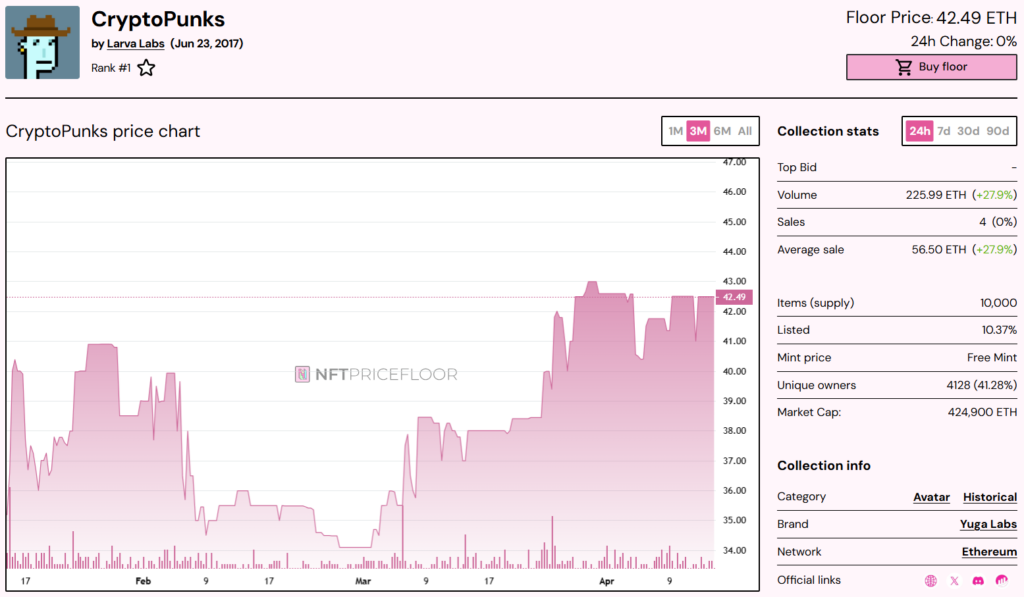

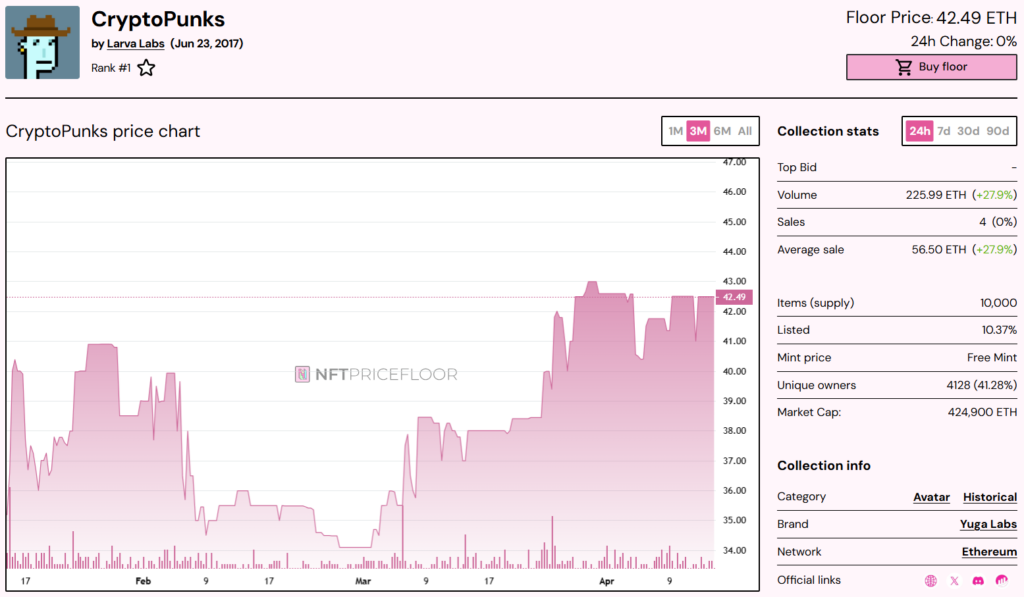

Meanwhile, CryptoPunks’ market performance tells a story of extremes. The collection’s trading volume surged 95% to $163 million, with floor prices climbing past $100,000, cementing its status as a blue-chip NFT.

Source: NFT Price Floor

Yet, not every transaction spells success.

CryptoPunk #3100, a rare Alien Punk, sold for 4,000 ETH ($6 million) in April 2025. This move witnessed a $10 million loss from its $16 million purchase (4,500 ETH) a year earlier. The drop reflects a 57% decline in ETH’s value, costing the seller 500 ETH and millions in USD. Facilitated by Fountain, the transaction likely involved a major investor, as the buyer’s wallet received funds from a Coinbase Prime address. Despite Alien Punks’ dominance in high-value sales, CryptoPunks’ floor price fell 44% to $65,373, signaling a steep decline from their 2021 peak. Such swings highlight the fine line between fortune and failure in the NFT space.

The NFT Landscape in 2025: Risks and Rewards

The narrative around NFTs in 2025 blends caution with opportunity. While scandals and losses dominate discussions, some investors are quietly capitalizing on market trends. A standout case from the first quarter of 2025 illustrates how strategic moves can yield impressive returns.

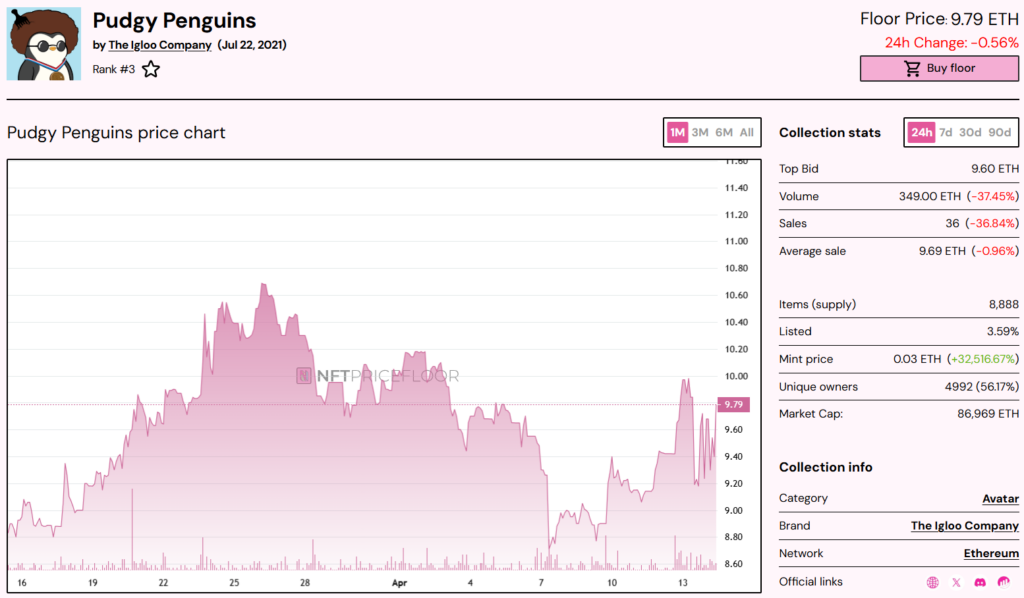

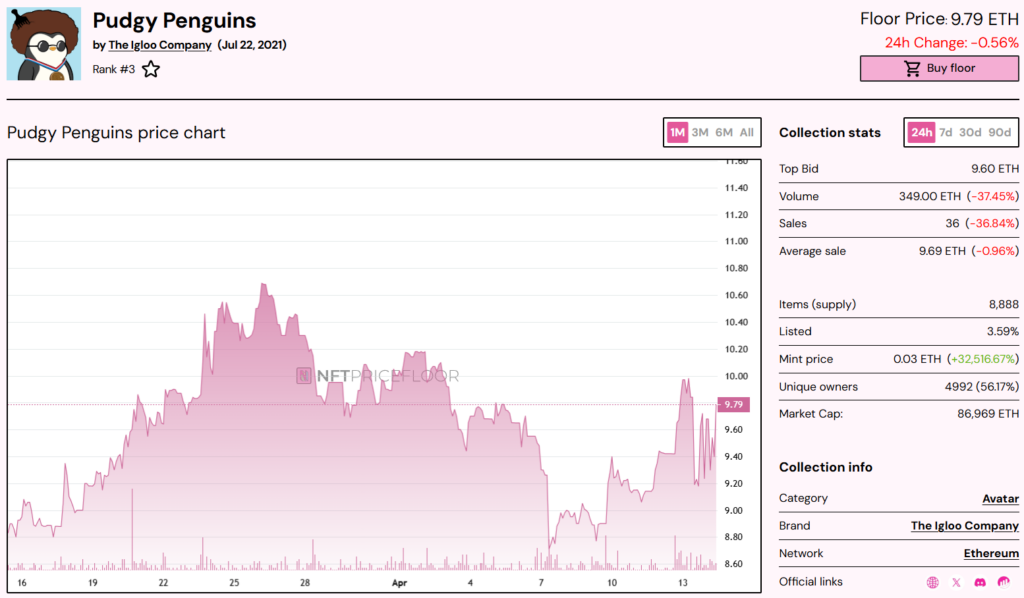

Consider the Pudgy Penguins, a collection that has risen to prominence through clever branding and community buzz. In January 2025, an investor purchased a rare Pudgy Penguin for 15 ETH—equivalent to $24,000 at the time. By April, that same NFT sold for 50 ETH, delivering an $80,000 profit in three months. The surge stemmed from Pudgy Penguins’ savvy marketing, including exclusive merchandise and a viral TikTok campaign that boosted its cultural cachet.

Source: NFT Price Floor

A comparable case of NFT collection performance in 2025 involves the Doodles collection. It saw a remarkable gain driven by strategic partnerships and community engagement. In February 2025, an investor acquired a rare Doodle NFT for 10 ETH, approximately $18,000 at the time. By April, the same NFT sold for 35 ETH, yielding a $45,000 profit in two months. The surge was fueled by Doodles’ collaboration with a major fashion brand for limited-edition apparel and a viral augmented reality campaign on social media, enhancing its mainstream appeal.

Source: Open Sea

Unlike CryptoPunks’ turbulent ride, these cases show how smaller, community-driven collections can offer steady gains for those who spot potential early. This success reflects broader trends in the NFT market. Solana-based projects are gaining traction, while Ethereum giants like CryptoPunks maintain their allure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token