One of the most reliable signals for future success remains venture backing from YZi Labs, which continues to shape the Web3 investment landscape following its restructuring. Projects that secure support from YZi Labs, particularly those approaching their first Token Generation Event (TGE), are widely seen as strong contenders for future Binance listings.

Yzi Labs (formerly Binance Labs): A Launchpad for Promising Projects

Following a restructuring process, Yzi Labs – the new name for Binance Labs, continues to maintain its position as one of the most influential venture capital entities within the Web3 ecosystem. Recent investments in projects like Initia, Babylon, Polyhedra Network, and AltLayer, all of which quickly secured listings on Binance after their TGE, have reinforced YZi Labs’ reputation for identifying high-potential opportunities early.

In a market environment where Binance is tightening its listing criteria, projects backed by YZi Labs are viewed as having a materially higher probability of being prioritized. Their endorsement often paves the way for greater liquidity access, institutional attention, and rapid capitalization growth.

According to internal estimates from Binance Research, over 70% of projects funded by YZi Labs between 2024 and early 2025 achieved a Binance spot listing within one month after their TGE – underscoring the strategic advantage of following the YZi Labs portfolio closely.

Read more: Farming Airdrops on Binance Alpha: Low Risk, High Reward

Some notable projects backed by Yzi Labs that have not yet held a TGE include:

- Aster

- Blum

- Sahara AI

- Perena

- Sophon

Aster

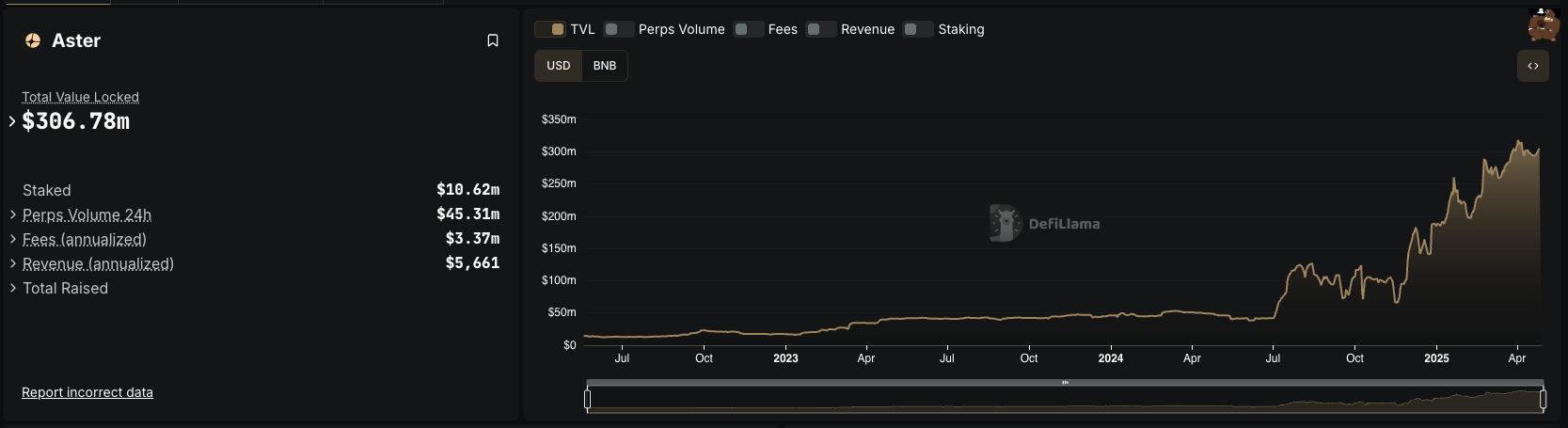

Previously known as Astherus, Aster is emerging as one of the most notable DeFi projects within the BNB Chain ecosystem. The project was incubated by Binance Labs and has garnered particular attention from Binance CEO Changpeng Zhao (CZ).

According to data from DefiLlama, Aster’s total value locked (TVL) currently stands at approximately $266.92 million. The platform’s perpetual trading volume averages around $50 million per day – a relatively strong figure given the challenging market conditions.

Backed by Binance Labs from its early stages, Aster has a high likelihood of joining Binance Launchpool or Launchpad upon its token launch, followed by a direct listing on Binance Spot. Historical trends show that projects incubated by Binance Labs, such as Hooked (HOOK), and Space ID (ID), were all listed within weeks after their TGEs, delivering significant returns for early investors.

In the current DeFi landscape, where strong perpetual DEX platforms are scarce, Aster – with backing from Binance Labs, a completed product, and a growing user base, stands out as one of the most promising projects to watch in the near future.

Blum

Blum is a decentralized cryptocurrency exchange (DEX) built directly on the Telegram platform, aiming to provide users with a simple and accessible trading experience. Supported by YZi Labs (formerly Binance Labs), Blum quickly captured attention in the crypto community with its innovative “tap-to-earn” model.

The project officially launched in June 2024 as a “tap-to-earn” game on Telegram, amassing over 32 million users within its first few months.

Blum’s ecosystem supports trading across more than 30 different blockchains, including The Open Network (TON). Financially, the project successfully raised $5 million from prominent investment funds such as gumi Cryptos Capital, The Spartan Group, OKX Ventures, and Wintermute. Additionally, Blum was selected as one of 13 projects for the seventh season of BNB Chain’s Most Valuable Builder (MVB) program.

Like Aster, Blum benefited from Binance Labs’ backing from its earliest stages. What further distinguishes Blum is its founding team, which includes several former senior executives from Binance. Gleb Kostarev, co-founder and CEO of Blum, previously served as Vice President at Binance, overseeing Eastern Europe, CIS, Turkey, Australia, and New Zealand. Co-founder and CMO Vladimir Smerkis was the former General Manager for Binance CIS.

Founder Blum took photo with CZ – Source: Blum

Moreover, Degenie – former head of design at Binance and Trust Wallet. now serves as Vice President and co-founder at Blum.

Sahara AI

Sahara AI is a decentralized artificial intelligence platform that integrates blockchain technology to build an open, fair, and collaborative AI ecosystem. The project has raised $43 million – a substantial figure, from leading investors such as Binance Labs, Pantera Capital, Polychain Capital, Samsung Next, Sequoia Capital, and Matrix Partners.

Although Sahara AI has yet to announce specific plans for a token launch, the strong backing from top-tier investors and an experienced founding team in the blockchain industry make a future token issuance highly likely. If a token launch occurs, listing on major exchanges like Binance is well within reach, particularly given the investment from Binance Labs.

Source: Sahara AI

Sahara AI is currently in an active development phase, highlighted by initiatives like the Sahara Incubator, which supports AI and Web3 startups. These efforts underscore the project’s commitment to building a robust and sustainable decentralized AI ecosystem.

With a long-term vision and strategic backing, Sahara AI holds strong potential to become one of the leading decentralized AI projects in the near future.

Perena

Perena develops decentralized stablecoin infrastructure on the Solana platform, aiming to address liquidity challenges and fragmentation within the stablecoin ecosystem. As of April 2025, Perena’s Total Value Locked (TVL) has surpassed $24.7 million, marking a significant milestone within Solana’s DeFi ecosystem.

Founded by Anna Yuan, former Head of Stablecoin at the Solana Foundation, Perena has attracted major investors including Binance Labs, Borderless Capital, Primitive Crypto, Anagram, Temporal, ABCDE Labs, and SevenX Ventures, raising approximately $3 million in a pre-seed funding round.

Perena’s flagship product is Numéraire, an Automated Market Maker (AMM) protocol designed to enable the creation, swapping, and liquidity provision for stablecoins efficiently. Numéraire utilizes an LP token named USD*, representing a share of a liquidity pool composed of stablecoins such as USDC, USDT, and PYUSD. This structure helps minimize liquidity fragmentation and improves trading efficiency.

With strong backing from Binance Labs and a founding team with deep expertise in the stablecoin sector, Perena holds strong potential for listing on Binance after its token launch.

Read more: Top 5 Best Airdrop Farming Projects on Solana (Part 1)

Source: Bloomberg

Currently, Perena is undergoing active development, with the goal of becoming a neutral infrastructure layer for stablecoin issuers on Solana. With a long-term vision and strong support from strategic partners, Perena aims to become one of the leading decentralized stablecoin projects in the near future.

Sophon

Sophon builds a next-generation blockchain project focused on entertainment, artificial intelligence (AI), and consumer applications, using zkSync Hyperchain technology.

The project successfully raised $10 million in a funding round in March 2024, with participation from investors such as YZi Labs, OKX Ventures, The Spartan Group, SevenX Ventures, Maven 11, HTX Ventures, Paper Ventures, and w3coins.

With support from YZi Labs (formerly Binance Labs) and other strategic investors, Sophon shows strong potential for a Binance listing once its SOPH token unlocks and becomes available for trading.

OVER $60M RAISED IN NODE SALE

ENTIRETY GOES INTO ECOSYSTEM FUND

NODE SALE CLOSES: MONDAY 13TH MAY 2024

NETWORK LAUNCH SCHEDULED: Q3 pic.twitter.com/4iOzLJPgH0

— sophon (@sophon) May 9, 2024

Another major advantage for Sophon is that it built a robust financial foundation from the outset. The project sold over 120,000 node licenses to approximately 5,800 participants, raising more than $63 million. This financial strength not only enables Sophon to maintain a rapid pace of product development but also provides the independence necessary to expand onto major exchanges like Binance.

Conclusion

The projects backed by YZi Labs demonstrate a consistent pattern: strong technical foundations, experienced teams, and strategic market positioning.

As Binance continues to tighten its listing standards, the endorsement from YZi Labs serves as a powerful validator, significantly enhancing the prospects for early-stage projects. While market conditions remain dynamic, Aster, Blum, Sahara AI, Perena, and Sophon each stand out as potential success stories – with upcoming TGEs likely to serve as catalysts for broader market recognition and potential Binance listings.

Read more: Grass Could Be the Next Project Listed on Binance?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  World Liberty Financial

World Liberty Financial  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  USD1

USD1  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold