In a post on X (formerly Twitter), acclaimed crypto trader Gert van Lagen has pinpointed Cardano (ADA) as the potential frontrunner of the ongoing bull market. His analysis leans heavily on Cardano’s foundational strengths compared to its rivals, Ethereum (ETH) and Solana (SOL).

Why Cardano Is Van Lagen’s Top Pick

Central to van Lagen’s argument is the concept of decentralization, where he posits Cardano as a model of “fundamental superiority.” He articulates, “Cardano stands out for its fundamental superiority over Ethereum and Solana, boasting greater decentralization and the notable absence of support from centralized entities like Gemini.”

This statement not only underscores Cardano’s commitment to decentralization but also implicitly critiques the reliance of other blockchains on centralized support, suggesting a purer adherence to blockchain’s original ethos by Cardano.

Highlighting the critical importance of network reliability, van Lagen points to Solana’s vulnerability, marked by its “sporadic inexplicable network outages of a few hours.” He contrasts this with the inherent stability of the Cardano network, which he notes is “mathematically embedded in the Cardano ecosystem,” suggesting a foundation built on rigorous scientific principles and peer-reviewed research that underpins Cardano’s operations, enhancing its reliability and user trust.

Van Lagen’s enthusiasm extends to Cardano’s Extended Unspent Transaction Output (EUTXO) model, which he believes is a game-changer for blockchain scalability and efficiency. He explains, “In this bullish market, my top bet is on Cardano, leveraging its EUTXO model to dramatically scale network capacity through TPT, not just TPS.”

This approach, focusing on Transactions Per Transaction (TPT) rather than just Transactions Per Second (TPS), allows for a more nuanced and complex handling of transactions, enabling a multitude of operations within a single transaction.

Roy M. Avila’s article, referenced by van Lagen, delves deeper into the TPT concept, illustrating how it differentiates from the traditional account model by allowing for a diverse array of transactions to be processed simultaneously within a single transaction. This significantly reduces the need for sequential transaction processing, enabling greater throughput and efficiency.

Technical Analysis For ADA

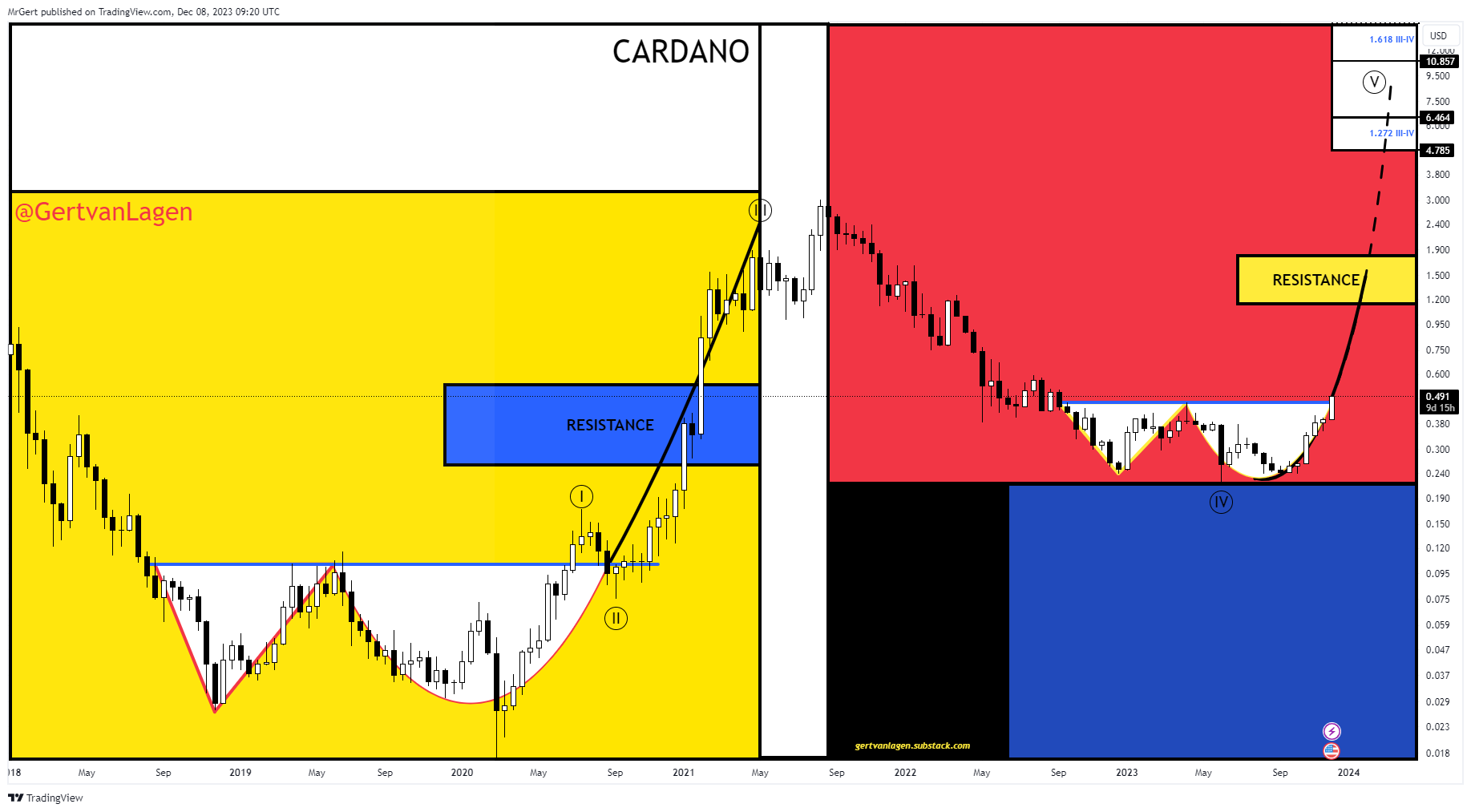

Van Lagen shares his technical analysis of Cardano, identifying key patterns and indicators that bolster his bullish stance. At the end of January, noted in a post on X, “Looks very much like ADA, broken black downtrend through weekly closes. Clear double bottom setup below red horizontal –> broken out, currently retesting.” This pattern suggests a strong reversal and potential for significant upward movement.

He further elaborates on ADA’s price action, observing, “ADA [2W] – Compare Adam and Eve bottoms within 🟨 & 🟥. Price has broken through the blue neckline and is on its way to the key resistance zone before ATH: $1.2-1.8. Conservative extension targets: $5-15. Invalidation EW-count: $0.17.”

These insights provide a detailed roadmap for ADA’s potential price trajectory, highlighting both the bullish outlook and critical thresholds for invalidation.

At press time, ADA traded at $0.5325.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Canton

Canton  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore