Since its launch in January 2025, the TRUMP token has quickly become a focal point in the crypto investment space, attracting both interest and skepticism from the market. With its highly volatile price movements and strong political undertones, the key question remains: can this politically charged token sustain its appeal and achieve long-term growth?

Currently, TRUMP is trading around $8 – down more than 90% from its all-time high of approximately $75, when its market capitalization briefly approached $30 billion.

As of the end of April 2025, its market cap has dropped significantly to around $1.67 billion. This sharp decline has raised serious questions about the token’s long-term viability, reigniting debate over whether TRUMP is merely a short-lived political bubble or a high-risk, high-reward long-term investment opportunity.

Trump Token: An Unpredictable Ride

One of the biggest factors influencing the value of the TRUMP token is the crypto-related policy direction of Donald Trump’s new administration. Looser regulations and a pro-blockchain innovation stance have provided positive sentiment for the U.S. crypto market overall and for TRUMP in particular.

However, since its launch, the token has shown a high sensitivity to macroeconomic developments, especially tariff and fiscal policy decisions from the Trump administration.

For example, on January 14, 2025, just days after Trump’s inauguration and the announcement of a 145% tariff on Chinese goods, the TRUMP token surged from around $4 to over $11 in just 48 hours, according to CoinMarketCap. This rally was driven by speculation that the token would benefit from the renewed “America First” rhetoric and protectionist agenda taking hold in U.S. politics.

Source: CoinGecko

But the rally didn’t last. By early February, after China retaliated with a 125% counter-tariff package and global markets began correcting, the TRUMP token tumbled back below $6. This price swing underscored the token’s extreme sensitivity to geopolitical news and its growing role as a proxy for political sentiment rather than a utility-based crypto asset.

Later, when the U.S. House of Representatives passed a $5.3 trillion corporate tax reform budget over the next decade, the TRUMP token once again jumped to nearly $14 before correcting sharply back to around $8. These fluctuations reflect the token’s speculative nature, closely tied to Trump’s speeches and headlines rather than its intrinsic value.

A new challenge emerged shortly after these policy-driven price swings: a major token unlock event.

On April 18, 2025, around 40 million TRUMP tokens – 20% of the supply, were unlocked, sparking selloff concerns. Investors braced for inflationary pressure and a potential breakdown in market stability.

Price held firm after two Trump-linked firms kept most of their unlocked tokens. The move helped stabilize market sentiment following a turbulent political quarter.

Still, such concentrated token holdings raise concerns. Should these entities decide to sell unexpectedly, they could trigger large-scale volatility or even a market crash. Sudden large sales have crashed tokens and triggered panic selling in past crypto cycles.

On-chain Analysis

First, the top 10 wallet addresses collectively control over 82% of the total token supply. High holder concentration risks sharp drops if big wallets sell during weak sentiment.

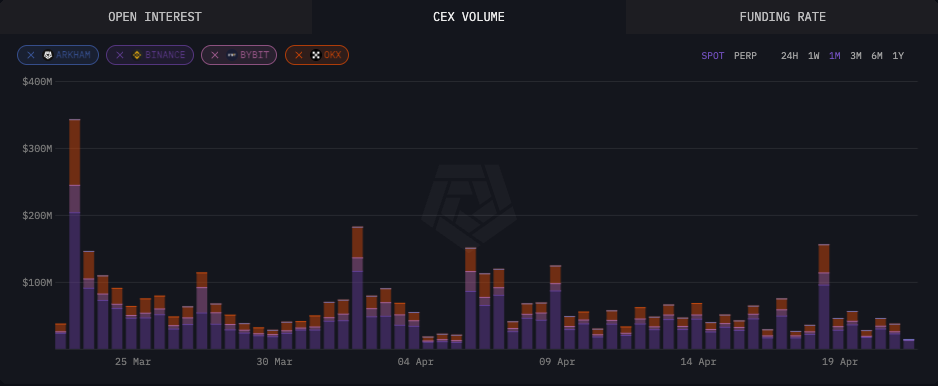

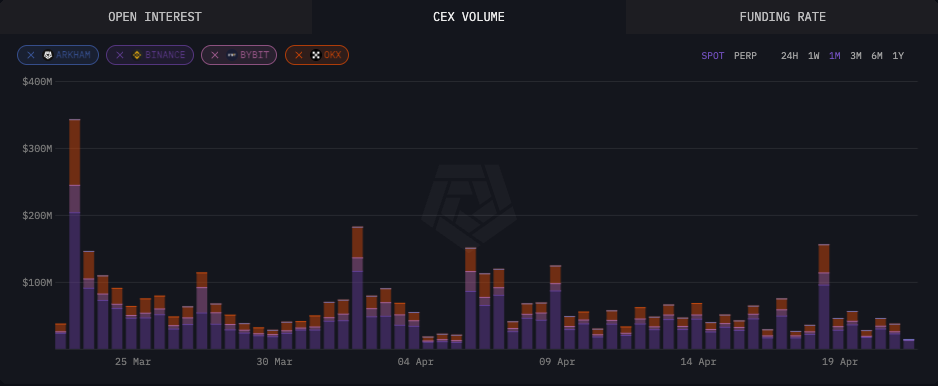

When Trump appears publicly, trading volume often spikes above $100 million. In contrast, during quieter periods with little news flow, daily volume can fall below $15 million. This reflects the token’s dependence on hype cycles and crowd behavior rather than steady capital inflows or fundamental utility.

For example, on March 23, 2025, following a post by Donald Trump on Truth Social saying, “I LOVE TRUMP – SO COOL!!! The Greatest of them all!!!!!!!!!!!!!!!!”, the TRUMP token surged 10% in price, and daily trading volume exceeded $1 billion, more than double the average volume from previous days.

Source: Arkham

However, such price rallies are often unsustainable. 60% of March trades came from new wallets, driven by FOMO, not long-term belief. Once media attention fades, these wallets tend to exit their positions, triggering sharp and rapid price corrections.

From a price prediction standpoint:

- In the short term (3–6 months): Media-driven volume spikes may spark quick rallies, but steep corrections will likely follow without fresh capital.

- In the medium term (6–12 months): Unless media hype gives way to real utility or steady inflows, the TRUMP token may stay range-bound or decline further.

All things considered, TRUMP remains a speculative asset—more a gauge of political sentiment than a utility-driven token. Its price remains extremely sensitive to both media volatility and large wallet behavior.

Read more: Survey: 1 in 7 Americans Has Bought TRUMP Memecoin

Trump Price Prediction

Short-Term Price Prediction (Next 3 – 6 Months)

In the short term, the TRUMP token will likely stay volatile, trading between $7 and $15. Political events like primary debates, Trump’s speeches, and surprise policy moves will likely fuel this volatility.

Trump’s threats on school funding stir debate and may keep driving TRUMP token price moves.

Source: IG

Strong trade rhetoric, especially renewed China tensions, may sway short-term sentiment and drive speculative trading.

Additionally, news of new partnerships or real-world uses, especially in politics or finance could boost the token’s price short term.

Mid-Term Price Prediction (6 – 12 Months)

In the mid term, the TRUMP token could rebound and stabilize between $15 and $35.

This outlook comes from TRUMP’s real-world use and support from pro-crypto U.S. policies.

Furthermore, using the TRUMP token for services like event tickets or campaign donations could support long-term price growth.

The forecast stresses clearing legal risks and politics to protect the token’s long-term reputation. If these issues aren’t addressed, the TRUMP token may struggle to sustain high prices long term.

Conclusion

The TRUMP token remains one of the most politically sensitive and speculation-driven assets in the crypto space. In the short term, news and Trump’s political moves will likely drive the token’s price action. In the mid-term, its potential depends on whether it can develop real-world use cases and gain regulatory clarity.

For investors, TRUMP represents both a high-risk and potentially high-reward opportunity. The key challenge lies in navigating its extreme volatility and distinguishing between short-lived hype cycles and lasting utility. The 2025 political shifts will shape the token’s behavior, keeping it unique but unpredictable.

Read more: Is May the beginning of a new growth cycle for Bitcoin?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  World Liberty Financial

World Liberty Financial  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  USD1

USD1  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold