What are real world assets? Real world assets (RWAs) are worldly possessions such as stocks, treasury bills, artworks, and real estate properties that exist outside the digital arena.

In the context of decentralized finance (DeFi), RWAs refer to virtual tokens that represent these physical, financial, and intangible assets on a blockchain. Touted as a transformative application of blockchain technology, RWA tokens are steadily gaining traction worldwide.

In this article, we shall walk you through the various aspects of real world assets – their significance, how they work, benefits, top RWA coins cum credit protocols, and role in DeFi.

What are Real World Assets (RWAs)?

Real world assets (RWAs) are tokenized versions of intangible (e.g., intellectual property), financial (e.g., bank deposits), and tangible assets (e.g., industrial equipment) that hold economic value in the non-digital sphere.

Each RWA digital token represents an asset in part or in full. They are governed by smart contracts, self-executing lines of code programmed to automate compliance checks, transactions, escrow accounts, ownership transfers, etc.

Real World Assets as Non-Fungible Tokens (NFTs)

Real world assets (RWAs) can also be represented as NFTs, unique crypto tokens reflecting the ownership of a virtual or physical asset. Most tokenized assets that exist as NFTs encompass arts, collectibles, memorabilia, sports, land parcels, and gaming items.

Since users can embed detailed metadata and distinct identifiers in NFTs, they are more suitable for RWAs that derive value from uniqueness.

If you want to capture specific attributes such as color, size, history, authenticity, provenance, or condition of assets, you must mint them as NFTs rather than multi-tokens, which look the same.

Why Are Real World Asset Tokens Important?

Real world assets (RWAs) bridge the gap between decentralized and traditional finance, enhancing liquidity, stability, scalability, accessibility, and diversification in the blockchain ecosystem.

Additionally, RWAs have lowered entry barriers and eliminated geographic hurdles. While before, you needed to set aside a significant portion of your funds to enter the DeFi market, now you can start trading or making money with a few dollars from anywhere in the world.

Most importantly, tokenization helps users bring off-chain assets on-chain and tap their investment yield in the DeFi space. It has also fostered fractional ownership of indivisible traditional assets like real estate and specialized machinery.

How Real World Asset Tokenization Works?

Tokenization is the process of harnessing blockchain technology to convert real world assets into crypto tokens. It fosters inclusion by democratizing access to multiple classes of intangible and tangible assets.

How to Tokenize Real World Assets

- Asset selection: Evaluate the RWA’s suitability for asset tokenization based on various parameters like market demand, long-term value proposition, and fractional ownership potential.

- Token specifications: Determine the token’s type (fungible, semi-fungible, or non-fungible), standard (ERC-20, ERC-1155, or ERC-721), and other basic aspects.

- Blockchain preference: Select a public or private blockchain network for tokenizing tangible, intangible, and financial assets.

- Legal compliance: Adhere to international and local laws, tax policies, and industry-specific norms applicable in your jurisdiction.

- Asset criteria: Use developer or visual toolkits to define asset criteria such as total supply, divisibility, name, account address, uniform resource locator (URL), and metadata hash.

- Offchain links: Many tokenized assets require trustworthy oracles to get high-quality real world data. Validate the assets backing RWA tokens and the chosen blockchain’s ability to maintain digital assets, using proof-of-reserves (PoR) verification services.

- Token issuance: Create and deploy smart contracts to mint the token.

- Integration: Integrate real world asset tokens with cloud-based platforms or applications that track the price movements of the underlying asset in real time.

- Listing: List the RWA token on a decentralized exchange for liquidation and trading.

How to create non-fungible tokens for RWAs?

- Identify the real world assets (RWAs) to be minted as NFTs.

- Select an NFT platform for asset tokenization.

- Create the NFT.

- Link the NFT to the underlying real world asset by embedding a near-field communication (NFC) chip or attaching a quick response (QR) code.

Benefits of Tokenizing Real-World Assets

Fractionalization

Asset tokenization breaks high-value assets into smaller and affordable units. It divides traditionally illiquid assets such as real estate into hundreds of digital tokens, each representing a stipulated area of the property. Users can sell, transfer, or trade these tokens on peer-to-peer networks using blockchain technology instantly.

With RWA tokens, making real estate investments and transferring ownership is a breeze. Investors can now own several square feet of land or a house without incurring the full cost of buying the property.

By enabling fractional ownership, tokenized real estate also creates crowdfunding opportunities, where numerous investors pool resources and own parts of the property.

As real estate grows faster in value compared to other physical assets, financial planners often recommend tokenized properties for portfolio diversification.

Debt financing

You can pledge RWAs as collateral for DeFi loans. As the underlying asset’s price grows, the loan gets paid faster.

Cost-efficiency

Tokenization reduces the costs associated with asset management, such as legal charges and documentation fees, by eliminating entry barriers and intermediaries prevalent in traditional markets.

Liquidity and flexibility

Unlike traditional financial markets that have fixed trading hours, blockchain networks facilitate 24/7 trading, enabling users to transact or engage with the token continuously.

Digitization

Tokenization creates digital footprints of off-chain real world assets by integrating them into blockchains.

Challenges and Risks in RWA Tokenization

Security

Security is one of the prime concerns surrounding tokenized real world assets because it is tough to ascertain if the token indeed represents the asset you want to buy.

Digital assets are also prone to hacks and fraud that can make their recovery impossible. Bugs in smart contracts make it easier for malicious entities to steal assets or modify terms, causing financial losses and disruptions in functionality.

As anonymity can compromise the security of RWA tokens, blockchains must implement regulatory compliance requirements like know-your-customer(KYC) and Anti-Money Laundering (AML).

Asset custody and legal compliance

Regulatory uncertainties or irregularities often leave a significant portion of the tokenized assets market untapped by locking out investors.

Establishing the legal custody of tangible or intangible assets reliably is also a major challenge. Managing RWA vaults entails complex tasks of ensuring regulatory compliance and valuing real world assets outside the blockchain.

These vaults also require legal frameworks that involve third-party custodians and trustees to secure the underlying assets and ensure asset owners have enforceable claims.

Real estate tokenization must navigate more legal complexities as it must adhere to both global and local laws governing property ownership, transfer, and acquisition.

Asset ownership

When RWAs are generated as NFTs, collectors hold, trade, or sell them. As the NFT transfers from one collector to another, the ownership of the corresponding intangible or tangible asset also changes hands.

Unless the seller and buyer agree to move the ownership of physical and digital items together through a trusted custodial house, particularly for high-value assets, there can be problems pertaining to asset ownership in the future.

Top RWA Coins by Market Cap

1. Chainlink (LINK)

Source: Coinmarketcap

Chainlink is a decentralized oracle network hosted on Ethereum with LINK as its native token. It helps create and update tokenized assets with real world data such as reference, pricing, identity information, and PoR. Its scalable infrastructure ensures RWAs are enriched with key information, which is synchronized in real-time.

With its trustworthy off-chain data and cross-chain interoperability, Chainlink enhances the liquidity, security, programmability, and utility of RWA tokens. It also links existing financial systems to public and private blockchain networks, improving the time-to-market of digital tokens.

Apart from securely bridging off chain assets on to a blockchain, Chainlink has PoR verification systems to enable users to implement timely circuit breakers in case the value of the underlying assets diverge from that of their tokenized versions.

Using Chainlink, investors can also fortify on-chain markets with decentralized data sources on traditional financial assets, cryptocurrencies, economic indicators, and more.

2. Ondo Finance (ONDO)

Source: Coinmarketcap

Ondo Finance is a proof-of-stake Layer 1(L1) blockchain network, enabling trades in thousands of RWAs backed by conventional stocks, government bonds, exchange traded funds (ETFs) and other steady collateral. With cutting-edge risk management measures in place, Ondo helps investors generate stable dollar-denominated yields.

Through its institutional-grade offerings and infrastructure, Ondo aims to bring traditional financial markets into the blockchain realm. ONDO is its prime governance token.

It enables users to create predictable revenue streams by depositing conventional securities on the platform for tokenization. It also facilitates cross-chain bridging of assets and offers liquidity-as-a-service (LaaS).

For boosting network security, Ondo chain allows its permissioned validators, comprising regulated financial institutions, to stake RWAs or high-quality liquid assets.

3. Algorand (ALGO)

Source: Coinmarketcap

Algorand is a quantum-secure and energy-efficient proof-of-stake L1 blockchain with high throughput, nominal fees, and ALGO as its principal utility token.

The Algorand ecosystem comprises the EXA NFT market, Folks Finance DeFi protocol, and NFDomains for trading non-fungible .algo domains.

Assets created on the Algorand blockchain are known as Algorand Standard Assets (ASAs), which encompass digital representations of loyalty points, stablecoins, in-game objects, system credits, etc. Users can create ASAs with both mutable and immutable characteristics.

Lofty.ai, a fractionalized real estate marketplace, leverages the Algorand blockchain to tokenize real estate and democratize access to homeownership. It has simplified real estate investment across the U.S. and promoted fractional ownership of properties, enabling holders to earn rental income without worrying about down prices, property rates, or inflexible terms.

Other asset tokenization platforms residing on Algorand are TravelIX to tokenize travel tickets, ClimateTrade for trading carbon credits, and Meld for gold trading.

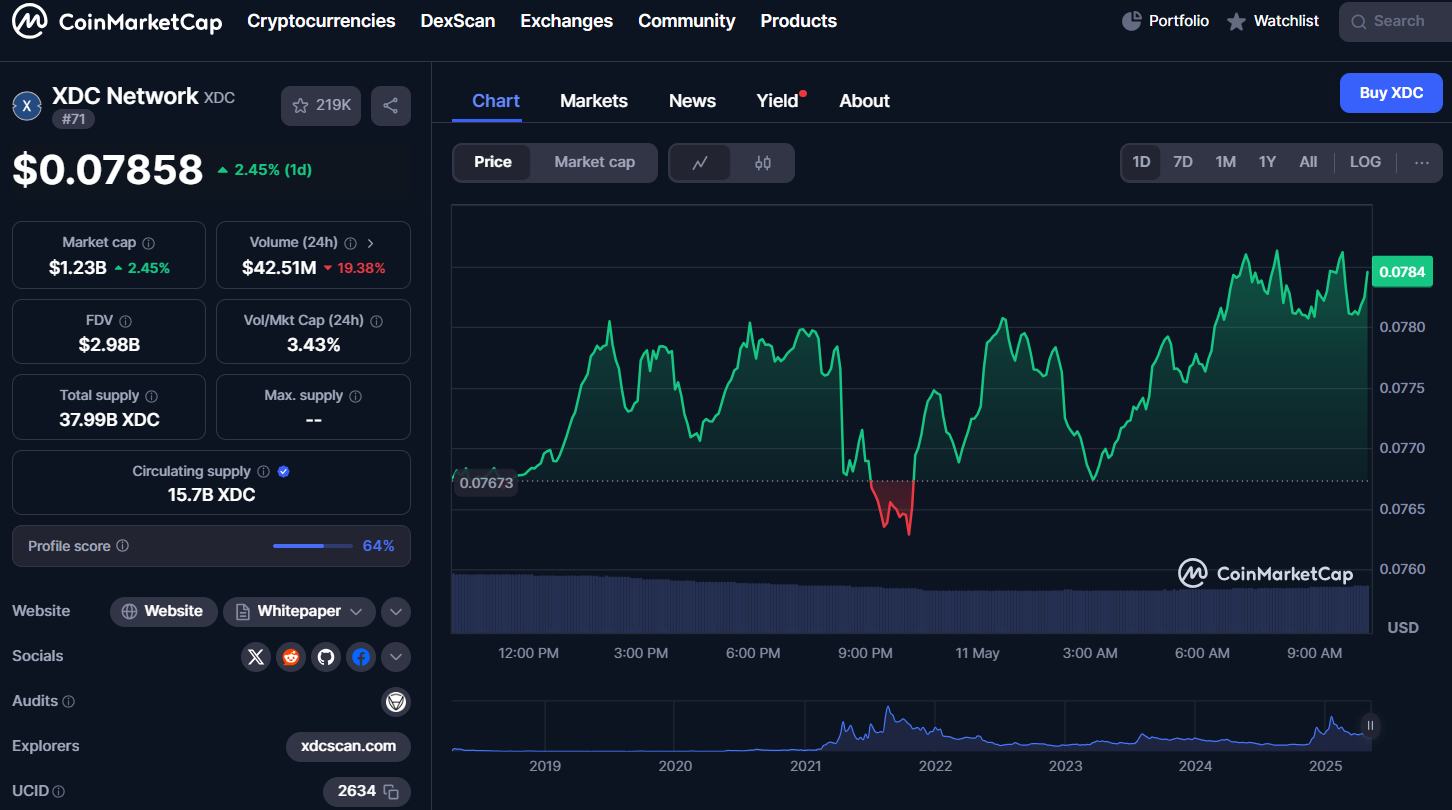

4. XDC Network (XDC)

Source: Coinmarketcap

XDC Network is an open-source L1 blockchain with the Ethereum Virtual Machine (EVM) compatibility and XDC as its native token. It aims to decentralize, transform, and liquify the trade finance sector through the tokenization of RWAs and financial assets.

Apart from tokenized U.S. Treasuries, XDC Network offers tokenized private credit, such as consumer, real estate, automobile, fintech, and carbon loans, to businesses.

Its RWA monitoring and analysis tool, RWA.xyz, has emerged as a go-to solution for tracking tokenized stablecoins, private credit, and U.S. treasuries. If you want to find projects in varying RWA categories, XDC Network’s real world asset intelligence database is helpful.

Other key features of XDC Network include swift transaction processing, low fees, eco-friendly architecture, robust infrastructure, and multi-chain interoperability.

RWA Credit Protocols in DeFi

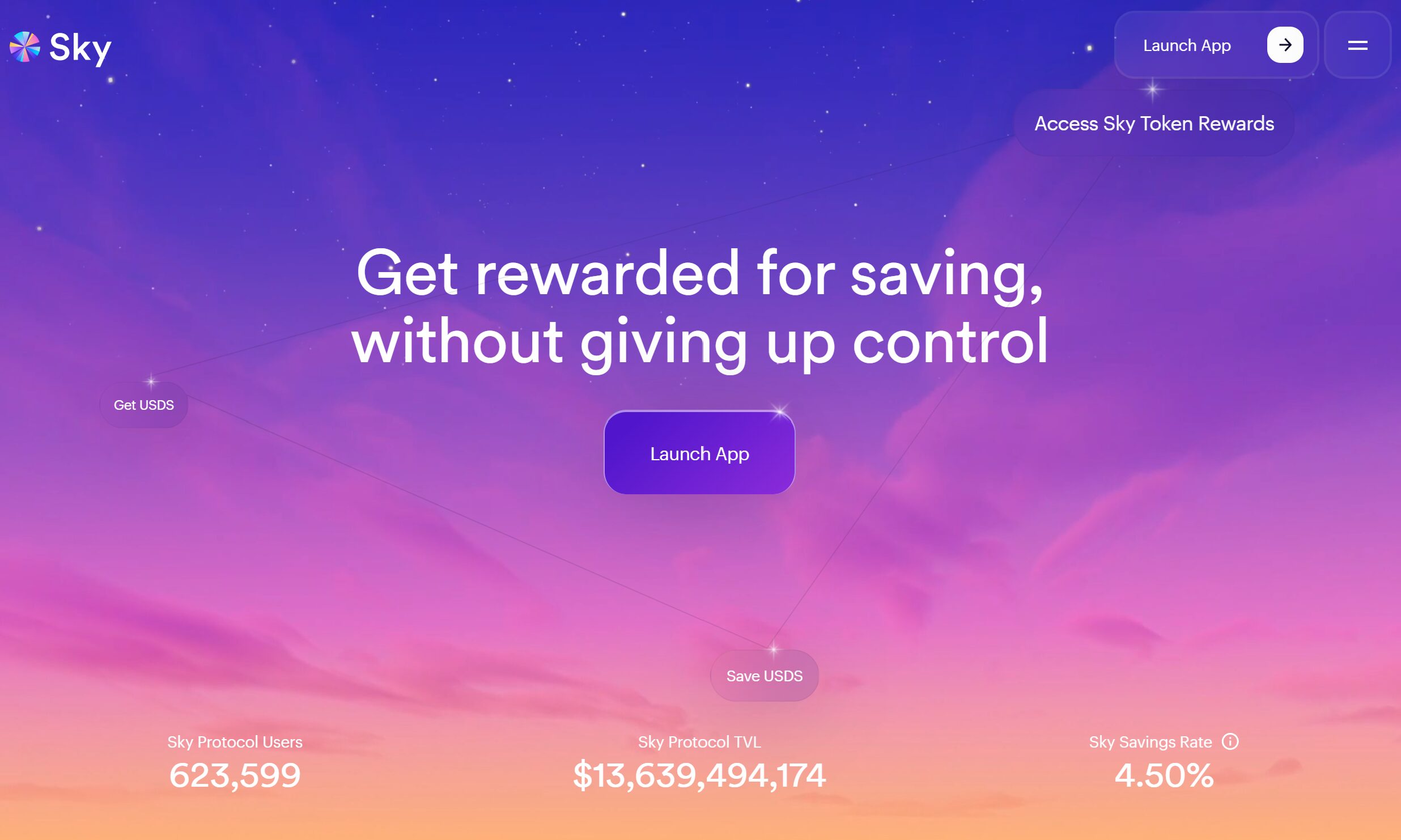

1. Sky

Sky (formerly MakerDao) offers RWA vaults under its Multi-collateral Dai (MCD) system to help users harness their assets to create stablecoins without disrupting the protocol’s decentralization and over-collateralization.

These vaults allow users to gain exposure to traditional financial assets, which are governed by off-chain legal frameworks and require tokenization. They are executed as a set of predetermined rules and differ from traditional vaults with regard to the type of collateral they support and the mechanisms required to manage them.

RWA vaults are liquidated off-chain, possess a diverse collateral base, and do not rely much on volatile cryptocurrencies.

The protocol has also implemented robust security measures in the form of formal verification of the codebase, bug bounties, and independent audits by trusted third-parties.

As a part of its Endgame overhaul, MakerDao will launch NewStable to get resilient and legally compliant real world assets. The new coin will also acquire the RWA and TradeFi integrations of DAI, Maker’s crypto-collateralized stablecoin.

2. Creditcoin (CTC)

Creditcoin is a multichain RWA protocol and a Layer1 blockchain, offering credit infrastructure and a decentralized network for financial institutions in emerging markets. It combines RWAs with EVM-friendly smart contracts, helping developers leverage cryptographic primitives to create decentralized applications for tapping the peer-to-peer, borderless financial system.

It nurtures an inclusive credit market landscape by enabling entrepreneurs, small businesses, and individuals to build an on-chain credit reputation and obtain microloans.

The Creditcoin protocol encompasses four parties:

- Creditcoin: A credit history protocol capturing, verifying, and securing the credit transactions of its institutional and retail customers. CTC is its governance token.

- Borrowers: Fintech lenders, businesses, and entrepreneurs seeking debt capital.

- Lenders: Users who join the investor decentralized autonomous organization(DAO) to lend to borrowers.

- Gluwa: It consists of the protocol’s developers who identify borrowers from emerging markets and integrate them into Creditcoin after thorough due diligence. They also assist in negotiating loan terms and propose borrowers to lenders. Through Gluwa, Creditcoin provides DeFi enthusiasts with investment opportunities, which they can accept or decline.

Prime use cases

- Facilitates cross-border transactions between non-custodial wallets, especially for the unbanked population.

- Enables lending and borrowing of secure loans.

- Promotes the development of applications with integrated decentralized identifiers to ensure creditworthiness, privacy, and access to global credit markets.

- Helps create global financial value by tokenizing real world assets into yield-bearing products.

3. Maple Finance (MPL)

Maple Finance is a decentralized finance platform facilitating digital asset lending, capital flows through secure on-chain loans, and yield generation from unproductive cryptos. It also provides a capital market infrastructure for institutional borrowers to leverage the DeFi ecosystem.

Through its cryptocurrency-backed lending pools that offer uncollateralized loans to institutions, Maple has revolutionized the global financial system. The permissioned nature of yield sources minimizes counterparty risks for liquidity providers or yield earners who deploy their capital for lending.

If you want to lower slashing and counterparty risks further, Maple gives the option of staking for specific cryptocurrencies like Bitcoin.

The Maple ecosystem has four participants:

- Corporate borrowers: Hedge funds, crypto exchanges, and market makers who require debt financing.

- Lenders: DeFi investors who deposit funds into Maple Finance lending pools.

- Pool delegates: A team of credit professionals who assess borrowers for creditworthiness, inspect loan terms, and manage liquidity pools.

- Stakers: Users who absorb the risk on loans in case of a default by staking Balancer Pool Tokens.

Along with its native crypto, MPL, Maple issues a permissionless yield token, SYRUP, specially designed for the DeFi community. Thus, users need not undergo detailed KYC procedures to deposit funds or earn investment yields.

4. Goldfinch (GFI)

Goldfinch is a lending protocol, providing on-chain exposure to the globe’s top institutional-grade multi-billion-dollar private credit funds. GFI is its native crypto. These fund pools comprise over 90% senior secured loans, less than 5% in-kind interest earnings, and non-accrual rates below 0.75%.

While private credit has formed a prominent part of institutional portfolios due to its high returns and low volatility, it has often been an inaccessible financial tool for individuals.

Detailed documentation, meticulous vetting process, and limited investment opportunities are the main challenges retail customers encounter when seeking private credit.

For creating diversified credit pools, GoldFinch uses blockchain technology and an affordable stablecoin, USDC. It also has a team of vetted managers to set up custom pools.

Borrowers undergo loan eligibility checks before being onboarded to the GoldFinch network to access capital. Once approved, borrowers form credit pools and define loan terms, which comprise interest rate, payment frequency, charges, and limits.

Investors – backers and liquidity providers – supply capital. The former deposits funds in borrower pools and earn higher investment yields due to the higher risk of first loss capital. The latter contributes capital to Goldfinch, which is distributed across all credit pools.

The Role of RWAs in Decentralized Finance (DeFi)

Real world assets (RWAs) have kick-started the next DeFi spring and a new wave of crypto adoption. They have stimulated the creation of on-chain digital assets by connecting traditional assets with blockchain technology.

RWAs are also becoming increasingly popular in the banking domain, given its myriad benefits such as instant settlements, nominal costs, 24/7 trading, and transformation of traditionally illiquid assets into liquid instruments.

For stablecoin holders, tokenized US treasuries serve as a hedge against the de-peg risk of stablecoins. They help diversify investment portfolios and improve capital flow in blockchains. The risk-free returns generated by US treasuries make their tokenized form even more appealing to investors.

Another interesting use case of DeFi is the rise of tokenized money market funds. Institutional investors view them as a means to digitize fund ownership on blockchain and streamline short-term investing. They can be traded outside of conventional market hours and in smaller denominations. These MMFs can also create new revenue streams through integration with DeFi staking and lending platforms.

Lastly, RWAs have redefined DeFi lending by unraveling liquidity, facilitating fractional ownership, and offering asset-backed loans across financial markets globally.

The Bottom Line

Since RWA tokens bring traditional finance on-chain, your intangible and tangible assets are no longer a mere store of value. They aid in asset management by converting unproductive assets into digital tokens with higher global accessibility, scalability, and tradeability.

While blockchain and other digital technologies aim to build a more transparent DeFi market for all, every investment opportunity comes with its own risks. Hence, investors must do their own research and due diligence instead of following any investment advice blindly.

FAQs

What is RWA in crypto?

RWAs in crypto are on-chain tokens, akin to bearer assets, which give holders a claim over assets existing outside the digital world. Each token represents a tangible or intangible asset such as intellectual property, real estate, currencies, equities, and commodities.

Are RWA coins safe to invest in?

Though investing in RWA coins carries some risks related to regulatory compliance, smart contract bugs, and custody of underlying assets, its advantages outweigh its pitfalls. RWA coins provide enhanced liquidity, accessibility, flexibility, and affordability. They also enable fractional ownership of assets and power innovative use cases across DeFi platforms.

What is an example of a real world asset?

Examples of real world assets include government bonds, money market funds, land, exclusive music rights, artworks, collectibles, and industrial equipment.

What are real world assets in SIS?

Symbiosis Finance (SIS) is a decentralized exchange that pools liquidity from L1 and L2 EVM and non-EVM blockchains. It enables you to swap or port digital assets, including RWA non-fungible tokens, across chains.

Where can I buy real world assets?

You can buy RWA tokens from crypto exchanges such as Binance, Coinbase, OKX, KuCoin, and Bybit. However, for users seeking a DeFi-native experience, some RWA tokens are also available on decentralized exchanges (DEXs) and blockchain-native platforms like Goldfinch or Ondo.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave