Chainlink is a prominent name in cryptocurrency discussions due to its unique functionality. Founded by Sergey Nazarov and Steve Ellis, Chainlink addresses the oracle problem of integrating real-world data into blockchains. This guide explains how Chainlink works, the role of its LINK token, and its future potential.

What is Chainlink?

Source: Chainlink Website

Chainlink is a solution that connects decentralized applications (DApps) and blockchains to reliable real-world data, ensuring smart contracts have secure access to external information necessary for proper functionality. As a decentralized oracle network, Chainlink ensures that external data is queried, verified, and authenticated before being sent to smart contracts. This process makes blockchain applications more reliable and secure.

The LINK token powers Chainlink’s ecosystem. It is used for transaction fees, payments, and rewards. Additionally, users can stake LINK to help secure the network’s oracles and earn incentives.

Chainlink also enables cross-chain interoperability, allowing data and assets to move between different blockchains. This makes it a vital component of the blockchain ecosystem.

Chainlink Social:

How does Chainlink work?

Chainlink operates through four main components that ensure secure and reliable data transmission.

- Oracles act as bridges between blockchains and external data sources. They fetch, verify, and transmit real-world data to smart contracts.

- Nodes are independent operators that supply data to the network. They help developers access essential information for decentralized applications (DApps).

- Data aggregation collects and organizes information from multiple sources, ensuring accuracy and reliability.

- LINK token powers the ecosystem. Node operators receive LINK as payment for providing data and maintaining the network.

Key Features of Chainlink

Chainlink goes beyond basic data feeds and interoperability by offering advanced features that enhance blockchain development.

- Verifiable Random Function (VRF): This feature provides secure randomness for decentralized applications, ensuring fair random number generation for blockchain games and crypto casinos.

- Hybrid Smart Contracts: Developers can combine on-chain logic with off-chain data, allowing smart contracts to execute automatically based on real-world events, leading to more complex use cases.

- Proof of Reserve (PoR): Chainlink’s PoR enhances transparency in DeFi by enabling real-time auditing of collateral assets, ensuring sufficient backing for tokens.

Chainlink’s decentralized oracle platform includes key highlights such as:

- Decentralized Data Model: A network of independent oracles delivers accurate data to smart contracts, minimizing risks and ensuring transparency.

- Offchain Reporting (OCR): This technology reduces on-chain costs by processing data off-chain, submitting only a single aggregated transaction on-chain, thus enhancing scalability.

- Wide Integration: Chainlink supports various data types, making it applicable in sectors like DeFi, insurance, and blockchain gaming.

- High Security: Its decentralized architecture protects data from manipulation and attacks.

Overall, Chainlink bridges the gap between blockchain and the real world, unlocking new possibilities for smart contract applications.

History of Chainlink

Chainlink is a decentralized oracle platform that has achieved numerous advancements in technology and partnerships since its creation in 2017 by Sergey Nazarov and Steve Ellis, with Ari Juels as a co-author of its foundational whitepaper. Here’s an overview of its history, technological milestones, and collaborations:

Technological Advancements

- Chainlink 2.0: Introduced in a 2021 whitepaper, this version expanded the capabilities of smart contracts through Decentralized Oracle Networks (DONs), enabling hybrid smart contracts with enhanced scalability and confidentiality.

- Offchain Reporting (OCR): This technology processes data off-chain and submits aggregated results on-chain, significantly reducing transaction costs and improving scalability.

- Verifiable Random Function (VRF): Provides provably fair randomness for use cases like gaming and NFTs, ensuring transparency and user trust.

- Cross-Chain Interoperability Protocol (CCIP): Facilitates seamless communication between different blockchain networks, enabling cross-chain functionalities.

- Advanced Privacy and Security: Incorporates cryptographic techniques, such as zero-knowledge proofs, to enhance data confidentiality while maintaining blockchain transparency.

Early History

Chainlink officially launched in 2019, following its creation in 2017. In 2018, it integrated “Town Crier,” an oracle solution using trusted execution environments. Later in 2020, it incorporated DECO, a privacy-enhancing protocol based on zero-knowledge proofs.

With its innovative technology, consistent advancements, and expanding ecosystem of partnerships, Chainlink continues to revolutionize the integration of smart contracts with real-world data.

The Counterparty Risk

Counterparty risk refers to the possibility that one party in a financial contract may fail to fulfill their obligations, resulting in potential losses for the other party. This risk is particularly relevant in transactions involving multiple parties, such as loans, trades, and other financial agreements. In traditional systems, users often rely on intermediaries, like banks or payment processors, to mitigate this risk. However, these intermediaries introduce their own vulnerabilities, making the overall system less secure.

How Does Chainlink Solve Counterparty Risk?

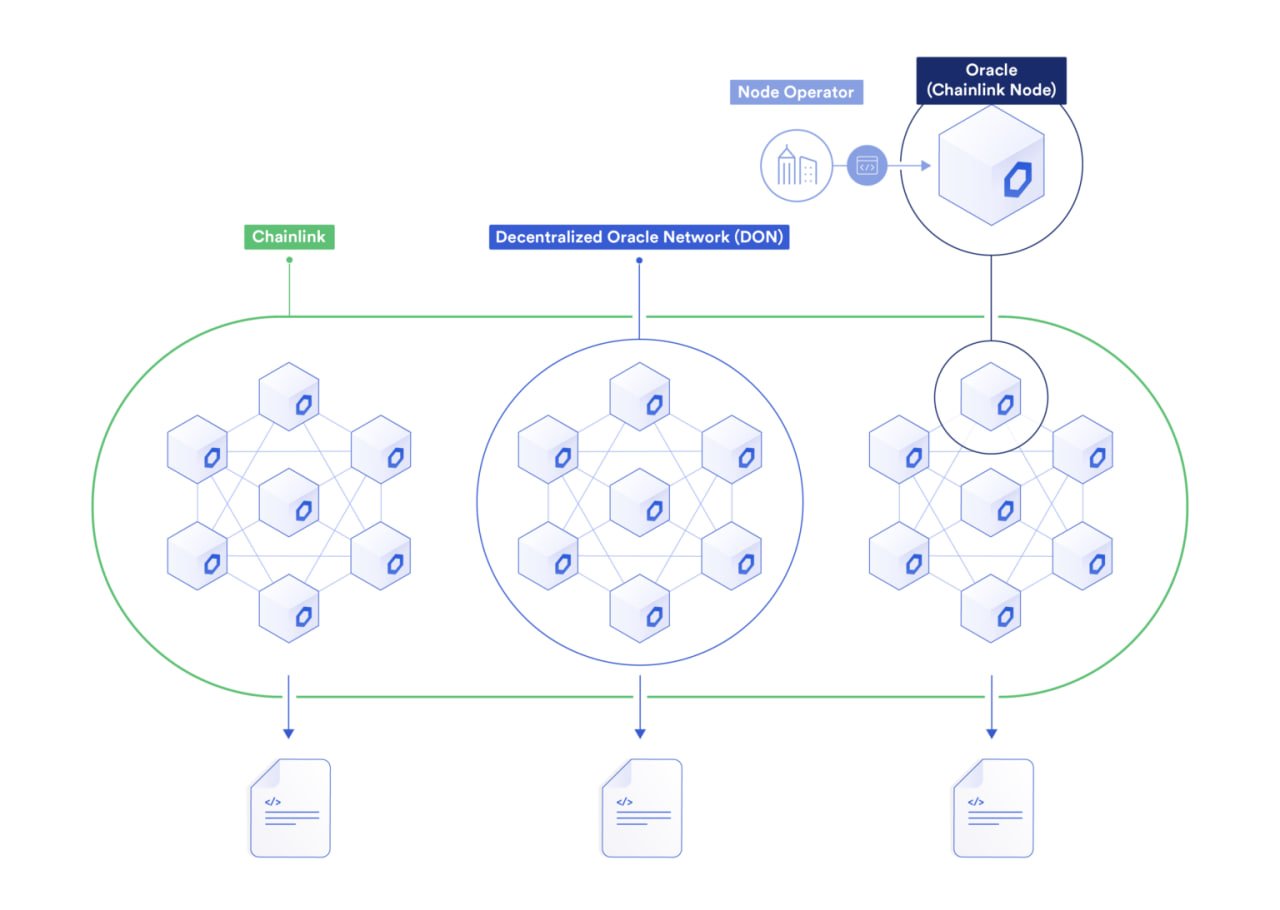

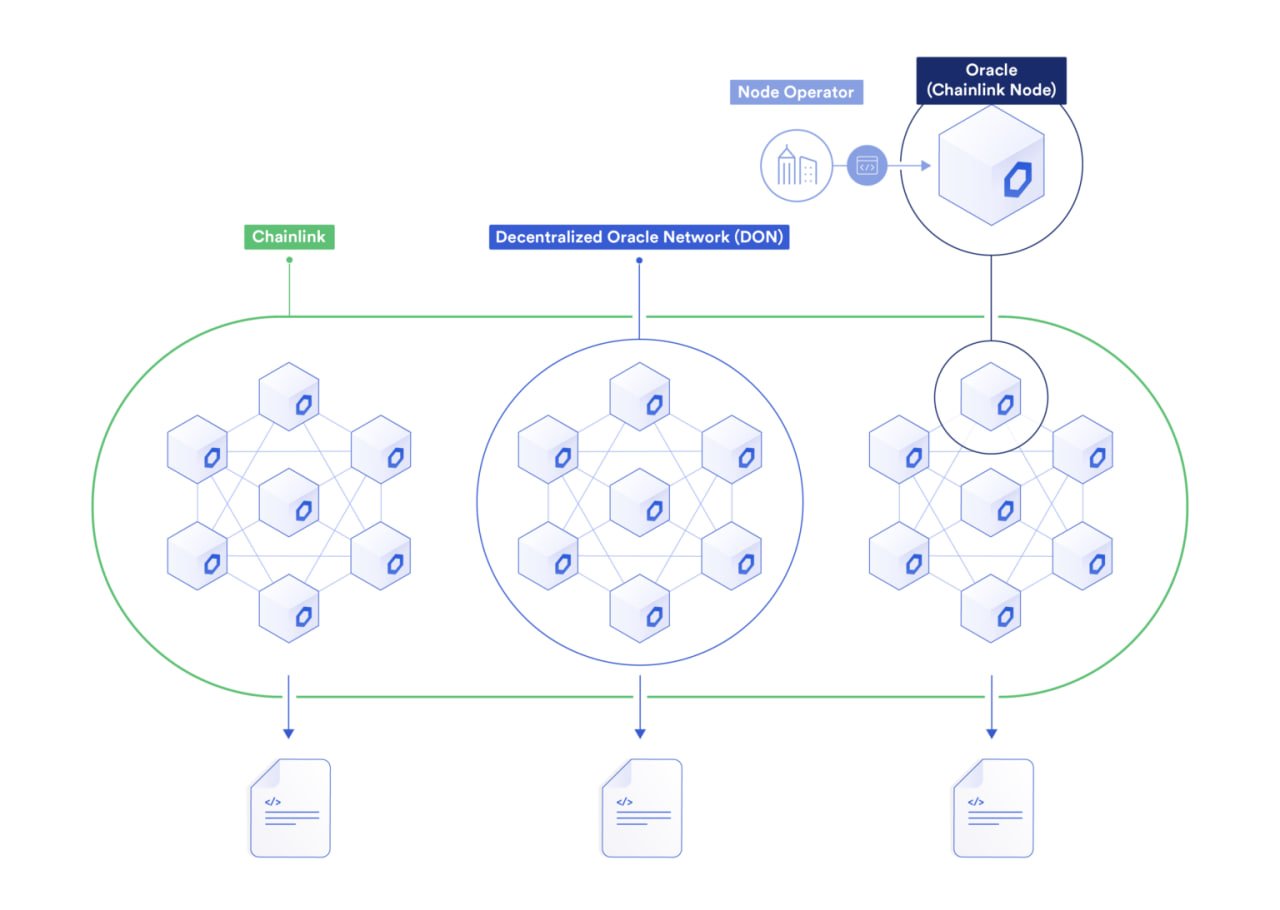

Source: Chainlink

Chainlink effectively mitigates counterparty risk through its decentralized oracle network. By utilizing a network of independent oracles, Chainlink collects and verifies data from multiple sources, ensuring that smart contracts execute reliably based on accurate information. This decentralized approach eliminates single points of failure, enhancing the security and trustworthiness of smart contracts. Chainlink’s system allows for transparent and automated transactions without the need for central authorities, empowering users to engage in secure agreements with confidence.

Chainlink vs Ethereum

Both Chainlink and Ethereum play vital roles in the cryptocurrency market. Chainlink focuses on providing real-world data to smart contracts, while Ethereum serves as a platform for decentralized applications. Each has significant potential for long-term investment and trading.

Technological Differences and Use Cases

Chainlink connects real-world data to smart contracts through a network of nodes, utilizing the LINK token to ensure security and reliability. It primarily facilitates the creation of decentralized finance (DeFi) applications, such as exchanges and prediction markets, by delivering accurate data for smart contracts to execute on-chain actions.

In contrast, Ethereum functions as a decentralized platform for applications and smart contracts, employing the Solidity programming language and using ETH for transaction payments. It supports a wide range of use cases, including identity verification, supply chain management, gaming, and initial coin offerings (ICOs).

Strengths, Weaknesses, and Market Performance

Chainlink implements various security measures, including two-factor authentication and SSL encryption, along with scaling solutions like sharding and state channels to enhance performance. The price prediction for Chainlink in 2024 stands around $16.82, following its peak at $50.07.

On the other hand, Ethereum adopts similar security protocols but utilizes the Proof-of-Work (PoW) consensus algorithm, facing challenges related to scalability due to high transaction fees and network congestion. The estimated price for Ethereum in 2024 is approximately $3,541, having previously reached $376.36 after the split into Ethereum and Ethereum Classic.

Community Support and Future Prospects

Chainlink boasts a growing community of users and developers who appreciate its ability to link smart contracts with real-world events. Ethereum enjoys one of the largest and most active communities in the industry, with numerous developers creating applications on its platform.

Despite Chainlink’s heavy reliance on Ethereum, it has considerable growth potential due to its focus on secure and reliable data provision. Meanwhile, Ethereum maintains a higher market capitalization, supporting more decentralized applications and offering increased utility. As both projects evolve, they promise exciting opportunities in the cryptocurrency landscape.

Use Cases of Chainlink

Decentralized Finance (DeFi)

Chainlink’s oracle network is integral to decentralized finance by securely connecting smart contracts to accurate and tamper-proof data feeds. It enables DeFi protocols such as lending platforms, stablecoins, and automated market makers to access real-world data from multiple sources, including price feeds and interest rates, ensuring seamless and secure operations on blockchain networks.

Insurance

With its blockchain-agnostic oracle nodes, Chainlink empowers parametric insurance by allowing smart contracts to access real-world data from external data sources like weather APIs or IoT sensors. This ensures that off-chain data triggers automated payouts in a tamper-proof manner, revolutionizing the insurance industry with decentralized oracle networks.

Gaming

Chainlink VRF (Verifiable Random Function) provides provably fair and tamper-proof randomness for blockchain applications, such as gaming and NFTs. By integrating Chainlink’s blockchain oracle network, developers can create hybrid smart contracts that securely connect to real-world information and enhance user trust in decentralized gaming ecosystems.

Traditional Systems

Chainlink enables the integration of traditional enterprise systems with blockchain technology. Through its decentralized network of oracle nodes and data providers, Chainlink connects smart contracts to external APIs and payment systems, bridging the gap between on-chain and off-chain data. This innovation facilitates cross-chain interoperability and enhances the functionality of blockchain applications across various industries.

The LINK token

Key Information about $GPS Token

- Token Name: Chainlink

- Symbol: LINK

- Blockchain: Ethereum, BSC, Fantom, Solana, Avax…

- Contract Address: 0x514910771af9ca656af840dff83e8264ecf986ca

- Total Supply: 1,000,000,000 LINK

- Circulating Supply: 638,100,000 LINK (Source: Cryptorank.io)

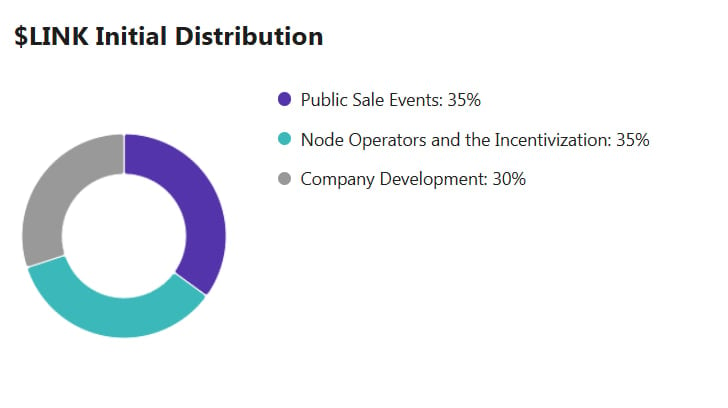

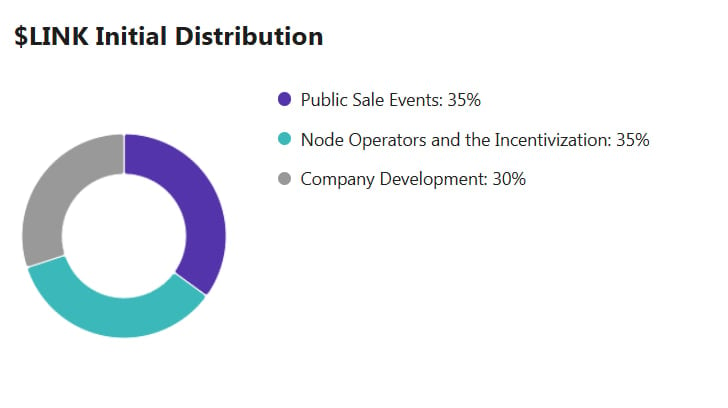

LINK Tokenomics

Source: tokeninsight.com

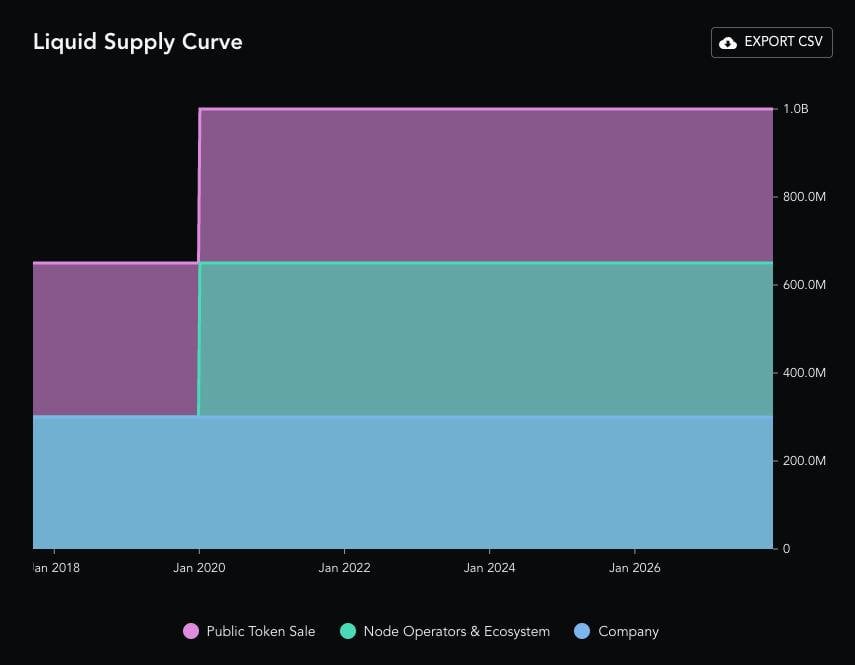

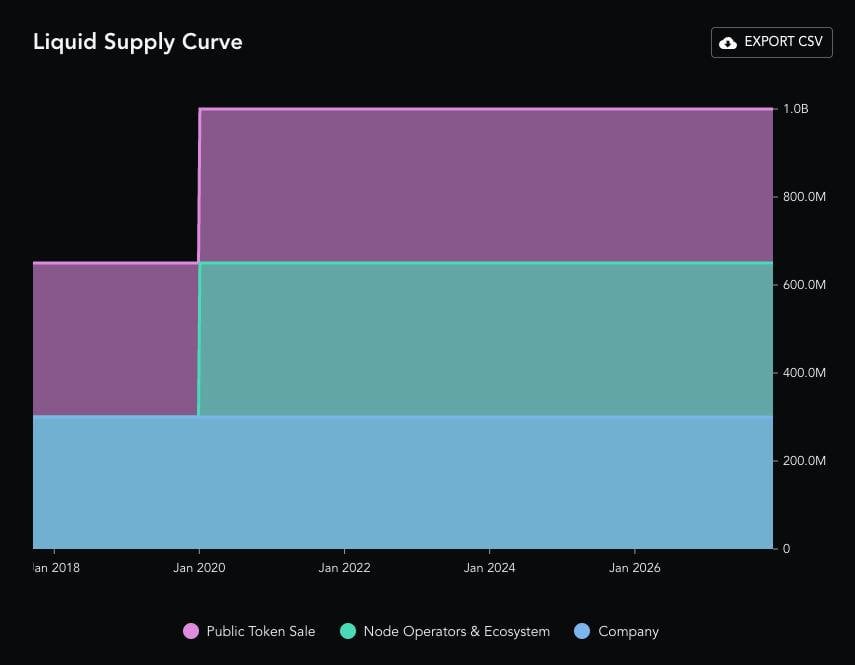

LINK Vesting Schedule

Source: tokeninsight.com

LINK Utility

During downturns, blockchain projects pause, reducing demand for data feeds and lowering oracle revenues. Fewer node operators and LINK sales create supply pressure. To address this, Chainlink Economics 2.0 enhances cross-chain interoperability, secures real-world connections, and expands hybrid smart contracts, ensuring LINK’s sustainability.

Summary of LINK’s Utility:

- Payment: LINK serves as the native cryptocurrency in the Chainlink ecosystem, rewarding node operators for providing accurate data.

- Staking: Oracle nodes stake LINK to access data feeds and ensure honest behavior.

- Expanding DeFi & Web3: LINK connects smart contracts with external data sources, supporting DeFi protocols and enterprise systems in accessing real-world data securely.

- Multi-Chain Integration: Chainlink works across various blockchain networks, enabling cross-chain interoperability and on-chain finance.

How to buy Chainlink (LINK)

- Create an Account: Sign up for free on Binance via the app or website. Verify your identity to start trading.

- Select Purchase Method: Choose how you want to buy Chainlink (LINK) on Binance. You can buy Chainlink on Binance using Debit/Credit Card, Google Pay/Apple Pay, or Third-Party Payment options. Simply select your payment method, confirm the order, and your LINK will be deposited into your Spot Wallet.

- Confirm Payment: Review fees and confirm your order within 1 minute to lock in the current price.

- Store or Trade: Keep your LINK in Binance, trade it for other crypto, or stake it for passive income. For decentralized exchanges, you can use Trust Wallet.

Is Chainlink a good investment?

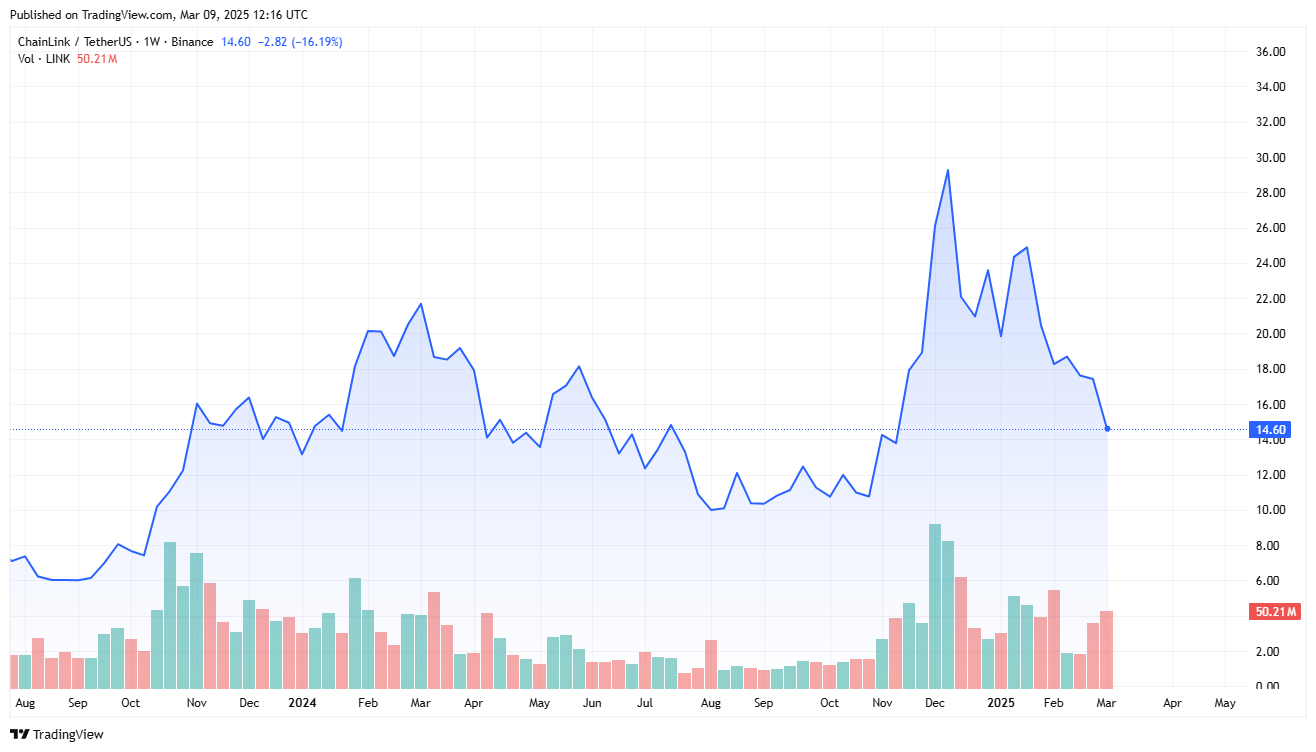

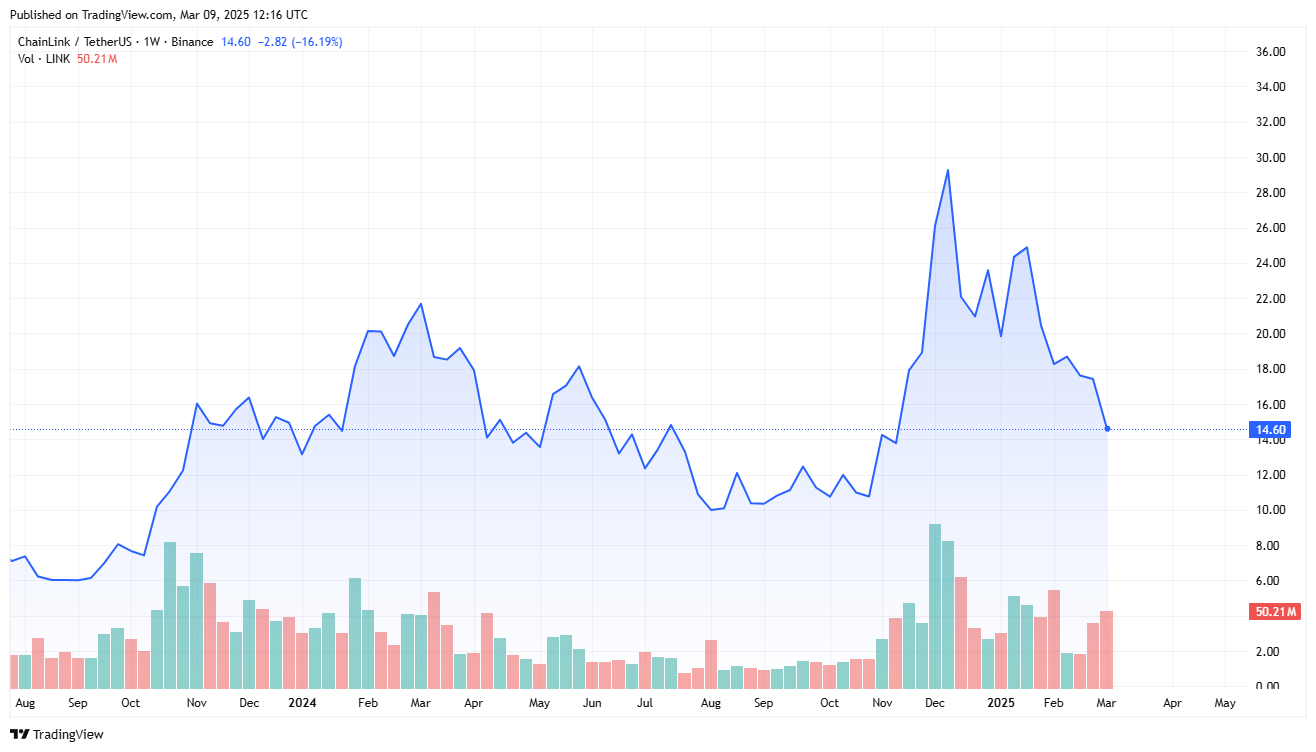

Source: Tradingview.com

Chainlink (LINK) is a decentralized oracle network that connects smart contracts on blockchains with real-world data, APIs, and off-chain payment systems. This allows blockchain applications to securely access external data, expanding the capabilities of the Web3 ecosystem.

Key partnerships of Chainlink include Google Cloud, which facilitates smart contract integration with its cloud services, and SWIFT, which showcases cross-chain interoperability for global financial institutions. Major DeFi projects like Aave, Synthetix, and Compound utilize Chainlink for price feeds. Additionally, traditional enterprises such as AccuWeather, T-Systems, and the Associated Press leverage Chainlink to connect blockchain with real-world data. The Cross-Chain Interoperability Protocol (CCIP) enables seamless communication between blockchains.

With a maximum supply of 1,000,000,000 LINK and approximately 631,099,972 LINK in circulation, Chainlink has demonstrated strong resilience in bear markets. As of March 9, 2025, LINK is priced at $14.5, making it an attractive long-term investment.

The Future of Chainlink

Chainlink continues to evolve as a crucial infrastructure for blockchain applications, with ongoing advancements in oracle technology, cross-chain interoperability, and decentralized finance (DeFi). The introduction of Chainlink Economics 2.0 aims to enhance sustainability through staking mechanisms and incentivized data accuracy. With key innovations like hybrid smart contracts, Proof of Reserve (PoR), and Verifiable Random Function (VRF), Chainlink is set to expand its role in DeFi, gaming, and enterprise integrations. As blockchain adoption grows, Chainlink network will remain a vital bridge between real-world data and smart contracts, driving the next wave of Web3 innovation.

FAQs

Can I make passive income with Chainlink?

Yes, you can earn passive income with Chainlink by staking LINK tokens and operating a Chainlink node.

Can Chainlink reach $100?

Chainlink could reach $100 if adoption grows, but its price depends on market trends and investor demand.

Is Chainlink a coin or token?

Chainlink is a token, not a coin, because it runs on the Ethereum blockchain as an ERC-20 asset.

What is Chainlink price?

The current price of Chainlink is around LINK according to data from CoinGeeko.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  PayPal USD

PayPal USD  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Pepe

Pepe