What is ERC20? It is a foundational standard and framework within the Ethereum ecosystem that specifies the rules for issuing, managing, and creating fungible tokens. It prescribes the canonical functions that must be implemented in their underlying smart contract code. Since its inception in 2017, ERC20 has been a dominant gateway for creating new tokens in the crypto world.

In this article, we’ll walk you through the fundamentals of ERC-20, its history, key functions, benefits, pitfalls, creation process, and use cases. We’ll also touch on Ethereum wallet addresses, well-known ERC-20 tokens, and other ERC token standards.

What is ERC20?

ERC20 is a technical standard for minting fungible digital tokens on the Ethereum blockchain. In the crypto universe, a fungible token is indistinguishable from and interchangeable with every other token. You can compare it to the United States Dollar (USD), where one USD is indiscernible from every other USD. Thus, traders, investors, and developers can swap these tokens easily.

ERC-20 helps developers generate smart contract-enabled tokens that represent a digital asset, ownership, rights, access, cryptocurrency, or any non-unique item that lives on Ethereum. These tokens can also serve as virtual representations of loyalty points, reward bonuses, and exclusive benefits.

Additionally, you should not confuse ERC-20 tokens with Ether (ETH), the native cryptocurrency of the Ethereum network. While ETH is used to pay gas fees, ERC20 tokens embody virtual or real-world assets (RWAs). Some top cryptocurrencies that follow the ERC20 standards are USD Tether (USDT), USD Coin (USDC), Wrapped Bitcoin (WBTC), Chainlink (LINK), Shiba Inu (SHIB), and Maker (MKR).

History of ERC20

Intelligent contracts started gaining traction in 2015, as they helped users create tokens seamlessly. However, most smart contract-powered tokens had a serious flaw. They were not interoperable with other tokens. Without a standardized framework, it was impossible to ensure that everybody using a blockchain could generate, transfer, trade, or interchange different tokens.

To address this issue, Fabian Vogelsteller, a developer, proposed the idea of implementing standards within smart contracts on Ethereum in 2015. He submitted the proposal through the project’s GitHub page as an Ethereum Request for Comment (ERC). Since it was the 20th comment, it was designated as ERC-20.

Using a pre-defined procedure, the Ethereum developer community evaluated and sanctioned the proposal. In 2017, it was introduced as the Ethereum Improvement Proposal Twenty (EIP-20) but retained its original name, ERC-20. Since then, tokens deployed on Ethereum must adhere to these guidelines if the developers want them to be interoperable or market them as ERC20-compliant assets.

In 2023, Ethereum split the method for recommending and implementing changes for the network into two distinct repositories – ERC and EIP. Users can now suggest, process, and document modifications for Ethereum using EIP. For the standardization and documentation of the blockchain’s application layer, users must use ERC.

The Purpose of ERC20

The prime purpose of ERC20 is to define a uniform set of rules that each Ethereum token powered by intelligent contracts must comply with. It also includes guidelines for a token’s total supply, transfer, approval, and data access. This compliance also enhances the compatibility between various tokens leveraging Ethereum, enabling the network to scale faster.

For developers, the ERC-20 standard is a boon. It helps them accurately forecast how new tokens will function, eliminating the need to redo each project whenever a token is launched. Furthermore, new projects need not worry about compatibility with older ones, as long as they meet the compliance requirements.

Additionally, ERC-20 helps developers produce their own tokens and specify rules for issuing and trading them. These tokens can digitally represent various tangible and intangible assets such as real estate, patents, equities, bonds, or precious metals. You can also exchange them with other Ethereum users. As Ethereum is the second-largest blockchain after Bitcoin, it hosts numerous ERC20 tokens, which are listed and traded on crypto exchanges. Outside of centralized exchanges (CEXs) and decentralized exchanges (DEXs), ERC20 tokens represent RWAs or in-game coins.

Circle, a stablecoin giant, has implemented a revised ERC-20 framework, which converts standard ERC-20 tokens into confidential wrapped versions with enhanced privacy features like concealed transactions, encrypted balances, programmatic risk management, Fully Homomorphic Encryption technology, etc. It leverages the ERC-20 standard to issue fiat-backed stablecoins, USDC and Euro Coin (EURC), enabling faster borderless transactions by bridging the gap between traditional and decentralized finance (DeFi).

How Does The ERC20 Standard Work?

Main Functions of ERC20 Tokens

Source: Toptal

ERC-20 comprises a list of events and methods, also known as functions, that must be included in a smart contract-enabled token to be considered ERC-compliant. The main functions to be included in the intelligent contract program are:

- TotalSupply: This function returns the total number of tokens that will be minted.

- Transfer: It automates transfers of a stipulated number of tokens to a specified address for transactions executed using the token.

- BalanceOf: This function returns a token user’s account balance.

- TransferFrom: It automatically processes the transfer of a specified amount of tokens from a designated address using the token.

- Approve: This function returns a boolean value that confirms whether a spender (delegate) account is approved. It permits delegates to withdraw and spend tokens as per the prescribed spending limits from a specified account.

- Allowance: This function returns a pre-defined number of tokens from a spender to the owner.

The optional functions you can incorporate are the token’s name, symbol, and permitted decimal points. Moreover, you must implement two events: Transfer and Approval. A Transfer event is activated upon a successful transfer. Conversely, Approval encompasses the log of sanctioned events.

Methods and events implemented in an intelligent contract-enabled token are primarily coded in Solidity, the programming language specially designed for the Ethereum blockchain. These functions devise a common structure for tokens, helping users and developers access, identify, evaluate, and utilize them effortlessly.

Additionally, they minimize confusion, which is likely to emerge if every contract consists of different information. The code functions also help determine a token’s circulating supply, store and return balances, initiate transfers and withdrawals, grant approvals, and authorize automated transfers.

What is the ERC-20 Wallet Address?

Crypto wallets enable you to send, receive, and store your cryptocurrencies and non-fungible tokens (NFTs). Unlike conventional bank accounts that hold traditional money, blockchain wallets require users to enter private keys to confirm their crypto transactions or access their virtual assets. These keys must be stored offline and never shared with anyone.

When you set up a crypto wallet, a unique address will be generated. It is publicly available and can be shared with your contacts to help them send you crypto assets, including both fungible and non-fungible ones.

An ERC-20 or Ethereum wallet address is an alphanumeric string of 42 characters that begins with the prefix “0x”. It differs from a contact address and is generated by a compatible digital wallet like Ledger Nano X, Trezor Model T, Trust Wallet, or Exodus Wallet.

Most Web3 wallets like Metamask or Coinbase Wallet support ERC-20 tokens, and help you interact with decentralized Applications (dApps) on Ethereum. However, you require Ether (ETH), the native crypto of Ethereum, to engage with ERC20 tokens. You can buy, sell, trade, swap, and hold ETH using an Ethereum wallet.

If you want to store and manage crypto assets across blockchains from one address, you can opt for non-custodial multi-chain wallets like Infinity Wallet. Those who want to transfer their digital currencies into bank accounts can explore wallet options like eToro, Kraken, and BitPay.

Types of ERC20 wallets

1. Hot Wallets (Online Wallets)

Hot wallets are always connected to the internet and are ideal for frequent transactions.

- Software Wallets: Desktop or mobile apps like MetaMask, Trust Wallet, Coinbase Wallet, and Zengo allow users to send, receive, and store ERC20 tokens with ease. They often include features like DApp support and private key backup.

- Web Wallets: These are browser-based extensions, such as MetaMask and Binance Wallet, which make it easy to access assets directly from Chrome or Firefox.

- Mobile Wallets: Tailored for smartphones and tablets, mobile wallets offer quick access, biometric login, and QR scanning. Examples include Atomic Wallet and Coinbase Wallet Mobile.

2. Cold Wallets (Offline Wallets)

Cold wallets store your private keys offline, making them the most secure option.

- Hardware Wallets: Devices like Ledger Nano X/S/Stax and Trezor Model T are ideal for long-term holders who want maximum protection.

- Paper Wallets / Air-gapped Devices: These store keys completely offline, with no internet exposure. Not recommended for beginners.

BEP-2 vs. BEP-20 vs. ERC-20: Key Differences

| BEP-2 | BEP-20 | ERC-20 |

| Acronym for Binance Chain Evolution Proposal. | Abbreviation for Binance Smart Chain Evolution Proposal. | Acronym for Ethereum Request for Comment – 20. |

| Token standard for Binance Chain – Binance crypto exchange’s first blockchain – and BNB, Binance’s native cryptocurrency. | Multipurpose token standard for Binance’s side chain – BSC – and BNB coin, the native crypto for BSC. | Token standard for the Ethereum network and Ethereum Virtual Machines (EVMs). |

| Doesn’t support smart contracts and hence, can’t be used in the DeFi realm. | Compatible with BEP-2, ERC-20, EVM, and Ethereum-based intelligent contracts. | Helps create tokens powered by smart contracts. |

| Used for paying transaction costs on CEXs and DEXs. Best for decentralized exchange-based crypto trading. | Designed to facilitate interoperability and decentralized application development. | Implemented to standardize fungible Ethereum-based tokens and promote dApp building and deployment. |

| Fantom(FTM), Bitcoin BEP2(BTCB), Cardano(ADA), and Polkadot (DOT) are examples of BEP2-compatible cryptocurrencies. | Pancakeswap (CAKE), Cream (CREAM), Safemoon (SFM), Burgercities (BURGER), and Sxp(SXP) are examples of popular BEP-20 tokens. | USDT, USDC, Uniswap(UNI), and Dai(DAI) are some well-known assets that comply with ERC-20 standards. |

| Validates blocks every 2 seconds. | Authenticates blocks every 2 seconds. | Verifies blocks every 13 seconds. Relatively slower transaction processing speed. |

| Low transaction fees. | Nominal transaction charges. | Relatively high transaction costs, as gas prices fluctuate based on network load and demand. |

How to Create an ERC-20 Token?

Understand ERC20 tokens

ERC-20 is a standard for generating tokens on Ethereum. These are fungible, meaning every token will carry the same value and type. It is also a pivotal component of the Ethereum ecosystem, as it enables the creation of a diverse range of virtual assets and DeFi protocols like loan collateral, governance tokens, and interest-bearing products.

Complete the pre-requisites

Before you start minting ERC-20 tokens, you must be well-versed in the fundamentals of smart contracts and the Ethereum blockchain. As these contracts are coded in Solidity on Ethereum, you should be familiar with the programming language. Additionally, you must create and link a wallet like Metamask to engage with the network. You should also top up the wallet with sufficient ETH to deploy your contract in the Ethereum testnet.

Write the smart contract code

You must write the code in Solidity and ensure that it is ERC20 compliant. You should ensure that all the mandatory functions – totalSupply, BalanceOf, Transfer, TransferFrom, Allowance, and Approve – are included in the underlying program. Although name, symbol, and decimal places are optional functions, you should include them to make your token more flexible, customizable, usable, and functional.

Formulate a token contract

Set your token’s total supply and initialize it in the contract. Utilize mappings to monitor token balances and allowances. Select a contract name and token symbol. You can also specify token divisibility, which is denoted by decimals, and the standard is typically 18 decimals.

Deploy the token

You must deploy the token contract to the Ethereum testnet using test ETH. You can also use an Integrated Development Environment (IDE) like Remix, VSCode, or EthFiddle, or a library like Solmate, OpenZeppelin, or Solady to write, compile, test, and debug your contract code. These libraries provide you with a standard-compliant contract base, eliminating the need to write a program from scratch.

Assess and verify

Once you deploy the token on the testnet, evaluate and validate its functionalities. Check if it complies with the ERC-20 standards so that it is compatible with wallets and exchanges.

Publish and maintain

After thoroughly assessing your token for various parameters, publish it on the mainnet. You should also evaluate and update the contract code regularly.

Perform security checks and audits

Comprehending the security implications of every function is essential. For contracts handling real value, get professional audits done periodically. If you are new to token contract development, seek guidance from the developer community or experts.

Benefits of ERC-20 Tokens

1. Interoperability

The principal benefit of ERC20 tokens is multi-chain interoperability. This cross-chain functionality facilitates a superfluid movement of virtual assets across blockchains, especially the EVM-compatible networks like Polygon, BSC, and Avalanche.

Since every ERC-20 token follows the same standard and carries the same value, they can be easily exchanged with one another. Their versatility fuels the development of numerous decentralized applications and financial services on blockchains.

2. Standardized framework

A standardized interface simplifies the development, deployment, auditing, and integration of Ethereum-based tokens. It also minimizes barriers to entry for developers and promotes innovation and experimentation.

3. Security

As ERC-20 tokens are built and hosted on Ethereum, they inherit the blockchain’s security features, such as minimal disclosure, private transactions, decentralization, tamper resistance, immutability, and transparency. The network also regularly upgrades its security features and is gradually migrating to Ethereum 2.0, an L2 chain.

4. Accessibility

Since ERC20 tokens are easy to use, they can be generated, preserved, and managed by wallets and IDEs like Metamask and Remix, respectively. Thus, they are accessible to traders, investors, and developers alike and foster new-age development in the blockchain arena.

5. Liquidity

ERC-20 tokens are highly liquid. Hence, you can easily buy, sell, transfer, convert, or trade them on crypto exchanges and trading platforms. Due to their inherent liquidity, these digital tokens are popular among investors and traders looking to profit from market trends.

6. Scalability

ERC20 tokens are customizable, meaning developers can tailor them to specific requirements. These include determining the total supply of tokens, their divisibility (decimal places), or any other functionality.

Moreover, every transaction involving an ERC-20 asset is recorded on the Ethereum blockchain, making it easier to establish the authenticity of transactions, track token movements, and maintain transparency.

Challenges and Limitations of ERC-20 Tokens

1. Security vulnerabilities

The Ethereum blockchain has some security vulnerabilities. Firstly, the network is transitioning from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) system. PoS is less decentralized and more prone to Sybil attacks, manipulation, forking, and double-spending compared to PoW.

Of the 72 million ETH distributed before genesis in Ethereum’s crowd sale, 12 million ETH was allocated to early adopters. This concentrated ownership can pose an additional threat to PoS.

Due to the fluid nature of Ethereum’s codebase, hard forks occur frequently, introducing additional technical and token contract risks to the network.

2. Smart contract risks

Though smart contracts are a bedrock of the emerging DeFi space, they possess innate risks. Malicious actors often target security loopholes in these contracts to execute crypto thefts, scams, or fraud.

Additionally, the dependence of these contracts on external data sources poses significant threats. Smart contracts often malfunction when there are irregularities in the tracked off-chain data.

Intelligent contracts are usually prone to the following attacks:

- Reentrancy: A bad actor calls a susceptible contract repeatedly before the original transaction is executed. Consequently, a contract may display unexpected behaviour, causing loss of funds.

- Integer overflow or underflow: Using math libraries that are incompetent to handle advanced arithmetic operations can often help hackers tamper with the program logic by passing values that exceed a variable’s maximum or minimum value.

- Access control flaws: If access to confidential data and sensitive functions is not restricted, hackers can exploit this flaw to gain unauthorized access and manipulate the contract.

- Unaudited external calls: If external contracts aren’t validated properly, they can trigger security breaches while interacting with a smart contract.

- Coding errors: Bugs in the underlying program can make contracts vulnerable to hacks and make it easier for attackers to steal users’ assets.

3. Scalability issues

As the Ethereum network experiences heavy network congestion during periods of peak demand, gas prices skyrocket. Consequently, the usability of ERC-20 tokens becomes restricted as users may not prefer to utilize them for transactions with high throughput.

Furthermore, small investors, who lack adequate financial resources to meet the soaring transaction costs, will not actively participate in the Ethereum ecosystem. In the long run, Ethereum may lose its market share to more energy-efficient and cost-effective blockchains and find it harder to scale.

4. Regulatory uncertainty

Crypto laws vary across jurisdictions, with governments of some countries restricting or banning the adoption of cryptocurrency tokens. Consequently, digital assets, including ERC-20 tokens, may be subject to intense scrutiny in many geographies. Therefore, launching new projects becomes daunting as creators must navigate complex regulatory challenges.

5. Other risks

While ERC-20 tokens are customizable, they aren’t suitable for advanced use cases, because intricate conditions cannot be coded into the underlying contracts to automate rigorous processes. This lack of flexibility can be a major hindrance for businesses that are growing rapidly and require more customization.

While most exchanges support Ethereum-based tokens, a few platforms like River, Relai, and Swan Bitcoin aren’t compatible with ERC20 tokens, lowering their liquidity to some extent. Additionally, poor governance can result in token dumping, conflict of interest, and insider trading. These issues, coupled with a lack of transparency, can erode user trust.

Use Cases of ERC-20 Token Standards

Stablecoins

Tokens such as the USDC and USDT are pegged to a fiat currency (USD in this case) and offer price stability in the volatile crypto space.

Governance tokens

Cryptocurrencies such as MKR, Sky protocol’s governance token, grant voting rights to holders within the decentralized ecosystem, enabling them to influence and participate in the decision-making process.

Utility tokens

These digital tokens offer access to a project’s platform or services. For example, the Basic Attention Token (BAT) is designed to redefine digital marketing by rewarding users for their attention and is integrated with the Brave browser.

Asset-backed tokens

These tokens are tied to and represent ownership of physical or virtual assets such as real estate, intellectual property rights (IPR), gold, etc. Tokenized financial assets can be perceived as securities by regulators, potentially subjecting the holders or issuers to multiple legal obligations.

In-game tokens

In the iGaming space, ERC-20 tokens help manage digital economies by acting as in-game currencies, collectibles, or assets.

Metaverses and virtual worlds

Metaverses powered by virtual reality (VR), augmented reality (AR), or mixed reality (MR) issue utility tokens. These tokens help you buy land, souvenirs, services, or other tokenized assets within the three-dimensional world. For instance, Decentraland’s native token (MANA) can be used to purchase land parcels and wearables while traversing its Genesis city.

Decentralized Finance applications

Many DeFi lending, borrowing, interest-bearing, and staking protocols issue their own native ERC20 tokens. These decentralized applications match you with peers, automate transactions by offering a range of financial options, and help you give or receive services in the DeFi realm seamlessly.

For instance, Compound protocol, an open-source financial infrastructure built on Ethereum, distributes its governance token, COMP, to lenders and borrowers who actively supply and borrow assets. COMP holders can propose and vote on protocol upgrades. Moreover, lenders earn interest when they deposit their holdings into one of the numerous liquidity pools created by the platform.

Top ERC-20 Tokens

- Tether (USDT): USDT is the first stablecoin pegged 1:1 to USD, offering high liquidity on top exchanges. It’s widely used for trading, payments, and stable transactions across multiple blockchains, including Ethereum.

- USD Coin (USDC): Issued by Circle, USDC is a regulated, fully-backed stablecoin redeemable for USD. It’s favored for global payments, business use, and financial app development. USDC on Ethereum is a native ERC-20 token.

- Chainlink (LINK): Chainlink is a decentralized oracle network that connects smart contracts with real-world data. LINK tokens are used to pay node operators and are required to access Chainlink services.

- Aave (AAVE): Aave is a DeFi protocol for lending and borrowing assets. It uses overcollateralized loans, variable interest rates, and flash loans. AAVE is also a governance token allowing holders to vote on protocol upgrades.

- Lido Stake ETH (stETH): Lido enables ETH staking without locking assets. stETH represents staked ETH and accrues rewards over time. It’s widely used in DeFi protocols for collateral and yield farming.

- Wrapped Bitcoin (WBTC): WBTC brings Bitcoin liquidity to Ethereum by wrapping BTC as an ERC-20 token. It allows BTC holders to access DeFi apps and faster transaction speeds compared to Bitcoin’s native chain.

- Shiba Inu (SHIB): SHIB is a meme coin and part of the broader Shiba ecosystem, which includes DeFi, NFTs, and Layer 2 solutions. SHIB, BONE, and LEASH are all ERC-20 tokens with distinct roles in the ecosystem.

- Uniswap (UNI): Uniswap is a leading decentralized exchange using an AMM model. UNI is its governance token, allowing holders to influence protocol decisions. Users trade directly via liquidity pools without needing intermediaries.

Other Ethereum Token Standards

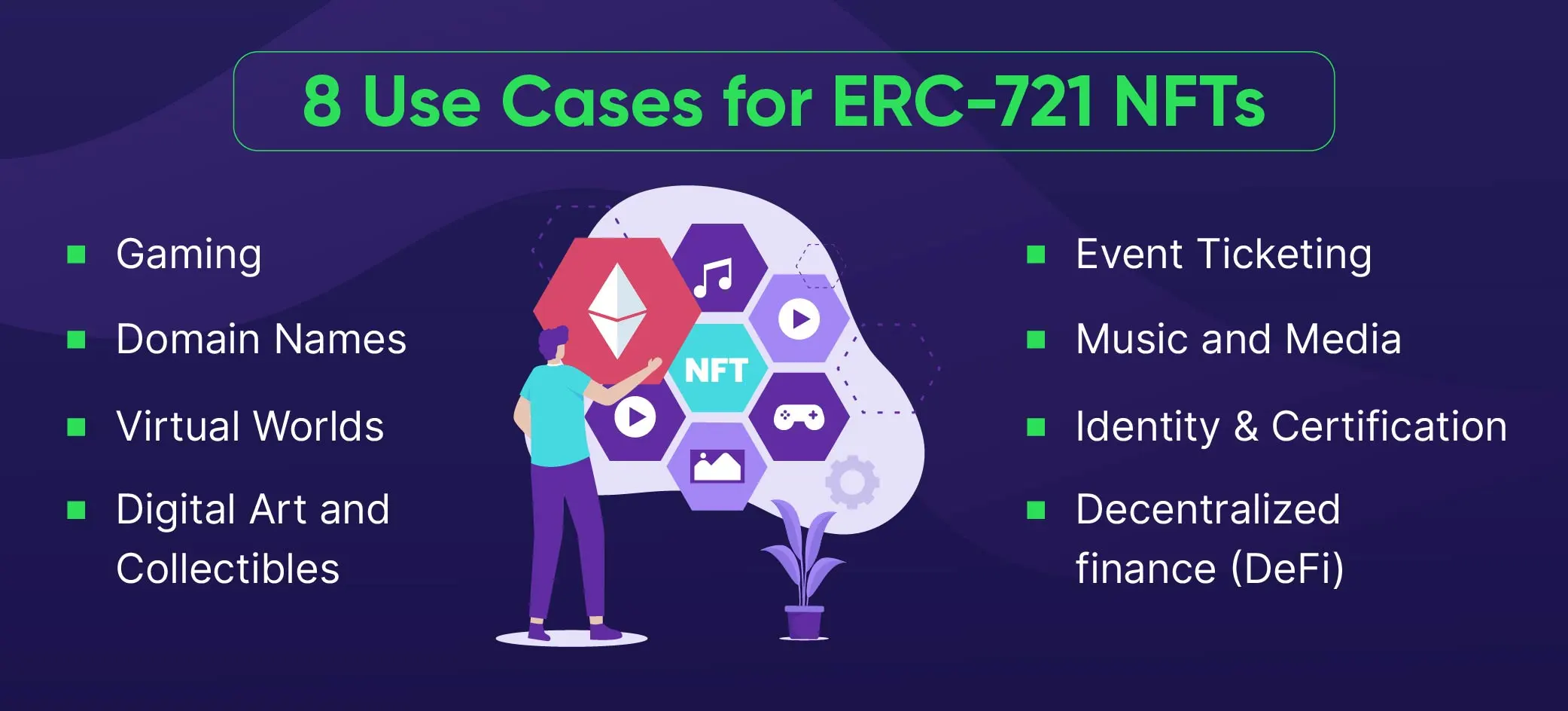

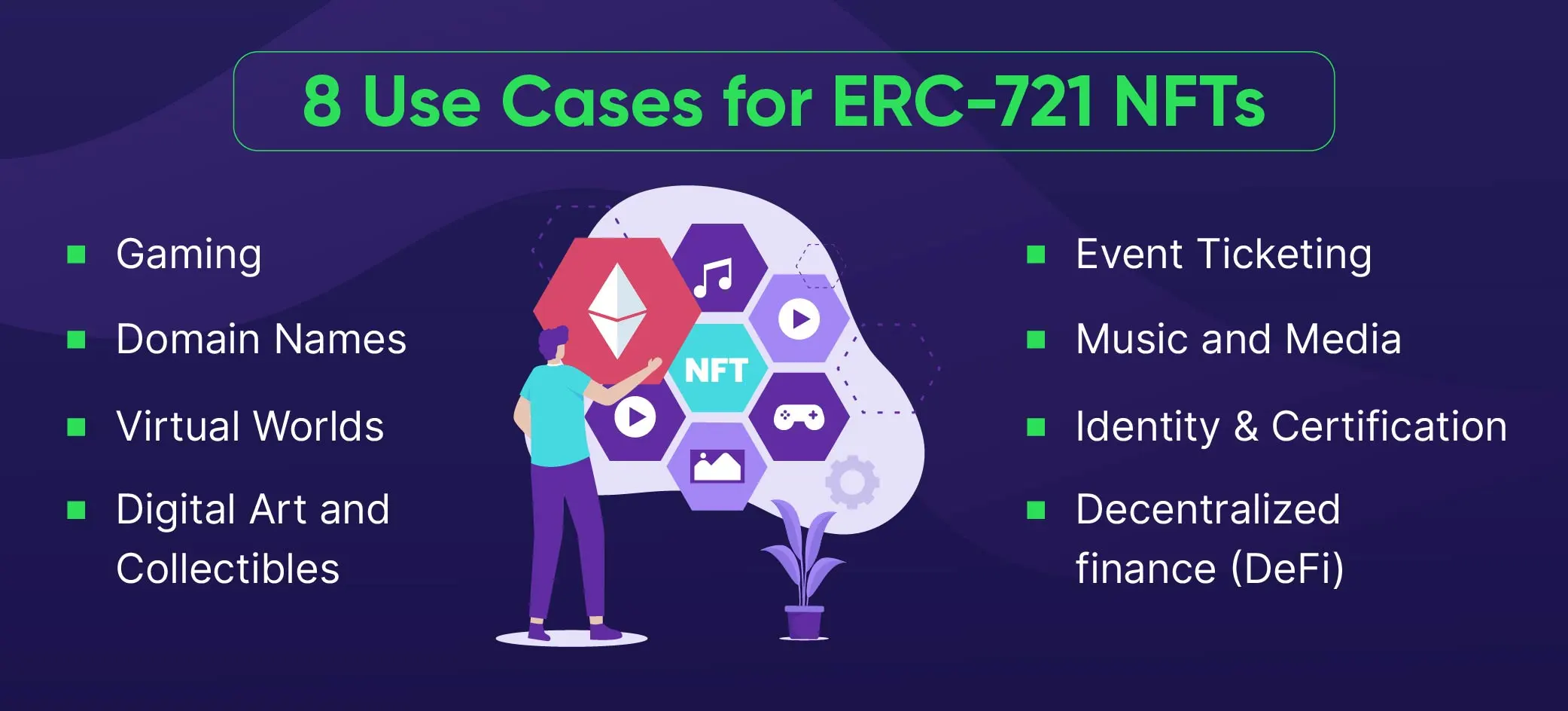

ERC-721

Source: BloxBytes

ERC-721 is the standard for NFTs. Each token is distinct from another in terms of rarity, attributes, age, value, visuals, and more, even if they share the same smart contract. Thus, ERC-721 is best suited for tokenizing unique items like collectibles, memorabilia, souvenirs, audio or video snippets, game-changing moments, lottery tickets, access keys, and numbered seats for a concert. Due to their uniqueness, ERC-721 tokens are not divisible or interchangeable.

ERC-1155

It is a standard interface for managing multiple token types. The underlying intelligent contract of the ERC-1155 multi-token standard comprises any combination of fungible, semi-fungible, or non-fungible tokens. It performs the functions of both ERC-20 and ERC-721 standards, detects implementation errors, and specifies rules for transferring tokens.

ERC-1155 also has some unique functions, such as batch transfer, batch balance, batch approval, and hooks. If you’re looking for NFT support, you can opt for ERC-1155, which treats tokens with a supply of 1 as NFTs.

ERC-404

ERC-404 is a token standard that enables fractional ownership of NFTs, making high-value virtual assets such as real estate, artworks, in-game coins, collectibles, etc., more accessible to a wider audience.

It is a hybrid version of ERC-20 and ERC-721 as it combines the properties of both to make NFTs highly liquid. While ERC-404 has played a crucial role in introducing semi-fungible assets, it has also democratized asset ownership and fostered the creation of innovative NFT-based financial instruments.

Simply put, you can now purchase fractional shares of premium NFTs and even claim full ownership once you’ve accumulated and burned enough ERC-404 tokens. Additionally, you can utilize these tokens as collateral in lending protocols and for building liquidity provisions.

ERC-677

ERC-677 is an extension of ERC-20. It adds a new function, transferAndCall(), to the existing ERC20 standard. Using this method, you can transfer tokens to a contract and call the recipient contract with additional data submitted by the sender.

A significant benefit of ERC-677 is that you can use the regular ERC-20 transfer() method to send tokens, even if the recipient contract doesn’t have the onTokenTransfer() function. Thus, you don’t need a dependent function on the recipient contract, making ERC-677 compatible with ERC-20 assets.

On Chainlink, ERC-677 allows you to send LINK tokens, assess if the recipient is the contract, and call a function on the Verifiable Random Function (VRF) smart contract in a single transaction – transferAndCall(to, value, data). Unlike ERC-20, ERC-677 allows you to complete the process in a single step, saving both time and transaction costs.

The Future of the ERC20 Standard

ERC-20 tokens can be seamlessly integrated into Ethereum-based DeFi protocols, transforming open-source financial systems and the Web3 landscape. Their interoperability supports cross-chain compatibility and streamlines migrations to L2 scaling solutions.

Another premium use case of the ERC-20 standard is the tokenization of RWAs. It has revolutionized how users trade and gain exposure to both tangible and intangible assets like real estate and IPRs. It also offers more accessibility and liquidity to a large number of markets.

Greater regulatory clarity in the crypto space is likely to drive institutional adoption of ERC20 tokens. This, in turn, could fuel the growth of financial products based on these assets. As the transition to Ethereum 2.0 will address the core issues of efficiency and scalability, ERC-20s will benefit considerably.

Additionally, ERC-20 tokens have democratized access to funding by stimulating crowdfunding through Initial Coin Offerings(ICOs). They have also enabled more individuals and organizations to participate in the digital economy.

Conclusion

Since there are low barriers to creating ERC20 tokens, thousands are in circulation. While only a few are worth billions, most have a low or subpar value. This proliferation underscores the standard’s inherent pitfalls that must be addressed to accelerate the Ethereum ecosystem’s growth. Alternate token standards based on the ERC-20 framework, like ERC-777 and ERC-621, have been proposed to overcome these limitations.

Ongoing efforts to develop cost-effective L2 chains, coupled with advancements in blockchain technology, are likely to transform ERC-20 tokens significantly. Lastly, ERC-20 will continue playing a crucial role in the crypto ecosystem.

FAQs

Are tokens and cryptocurrencies the same?

Though the terms tokens and cryptocurrencies are used interchangeably, they don’t necessarily mean the same. Cryptocurrencies are the native fungible assets of a blockchain and the primary medium of exchange on the network. Conversely, crypto tokens are secondary assets built on an existing blockchain and don’t form a core part of how the network functions. They can be fungible or non-fungible and even represent rights and assets outside the blockchain.

In the context of ERC-20 compliance, tokens are simply digital representations of something that adheres to the technical standards formulated by the Ethereum community. In essence, all cryptocurrencies are tokens, but the reverse is not always true.

What does ERC-20 stand for?

ERC stands for Ethereum Request for Comment. As Fabian Vogelsteller’s proposal of implementing standards within smart contracts on Ethereum was the 20th comment on the project’s GitHub page, the resultant token standard was named ERC-20.

Is ERC-20 the same as ETH?

ERC-20 tokens and Ether (ETH) are not the same. ETH is the native cryptocurrency and governance token of Ethereum and is used to pay transaction costs (gas fees) on the network. Conversely, ERC-20 is a standard for creating smart contract-enabled tokens that represent tradeable, transferable, interchangeable, and interoperable RWAs or digital assets on Ethereum and EVMs.

What is an ERC-20 wallet?

An ERC-20 wallet is a crypto wallet that enables users to buy, sell, trade, transfer, store, and manage ERC-20 tokens on Ethereum. It allows you to interact with Ethereum, meaning you can use various DeFi protocols, buy NFTs, participate in gaming projects, and more on the network. It can be a software application or a hardware device exclusively designed to store private keys. Popular ERC-20 wallet options include Metamask, Trust Wallet, Trezor, and Exodus.

Is Coinbase an ERC-20 wallet?

Yes. Coinbase is an ERC-20 wallet, meaning it supports ERC-20 tokens residing on Ethereum or EVM-compatible chains like Avalanche or Polygon. Thus, you can send, receive, transfer, trade, store, and manage your ERC-20 tokens using the Coinbase wallet.

What is an Ethereum Wallet Address?

An Ethereum address comprises a series of 40 hexadecimal characters, which can be a combination of letters (A-F) or numbers (1-9). This series excludes the first two characters that indicate the blockchain on which the wallet address is being used. For Ethereum, the cryptographic representation (prefix) is “0x”. The next 20 characters show your unique identifier, the public key hash of your address, while the last 8 characters are a checksum to ensure your wallet address has been typed correctly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor  Pepe

Pepe