As decentralized finance (DeFi) continues to grow, the question of how to generate sustainable returns has become a major and persistent challenge that has yet to be solved. Falcon Finance has emerged as a next-generation DeFi protocol, aiming to rebuild the foundation of yield generation one that is not based on speculation, but on collateral efficiency, interoperability, and real-world utility.

So, what exactly is Falcon Finance, and why is it gaining traction among the myriad of DeFi projects, hailed as a paradigm shift in DeFi infrastructure?

What is Falcon Finance?

The period of short term, hyped Defi projects and unsustainable yields is over. Recently, the market has begun to welcome many projects that promise longevity and real yields, opening a new chapter for the Defi world.

At its core, Falcon redefines what “yield” means in decentralized finance. Instead of relying on inflated token rewards or temporary farming incentives, Falcon introduces a real-yield model powered by smart collateralization mechanisms and data-driven strategies. This allows users to unlock the full earning potential of their digital assets – securely, transparently, and efficiently.

The project’s mission is summed up clearly in its mantra: “Your Asset, Your Yields.”

Falcon’s architecture is designed so users always retain ownership of their assets while participating in a system that maximizes returns through intelligent, sustainable mechanisms rather than speculation.

Behind the protocol is a team of experts with extensive experience in blockchain, financial engineering, and quantitative analysis, and the support of AI to calculate and make decisions quickly and promptly, keeping your assets safe and at the lowest risk possible. Their focus lies in achieving a delicate balance between performance and reliability, ensuring Falcon can act as a trusted layer for global liquidity and yield generation.

Falcon is not just about technology, the Protocol aims to rebuild trust in DeFi by integrating transparency into every layer from how assets are collateralized and deployed to how yields are generated and distributed.

At its core, Falcon Finance is not just a DeFi platform that promises returns; it is a sustainable financial system where user control, accountability, and real performance metrics replace the hype cycles of the past, all transparent.

How Falcon Finance Works

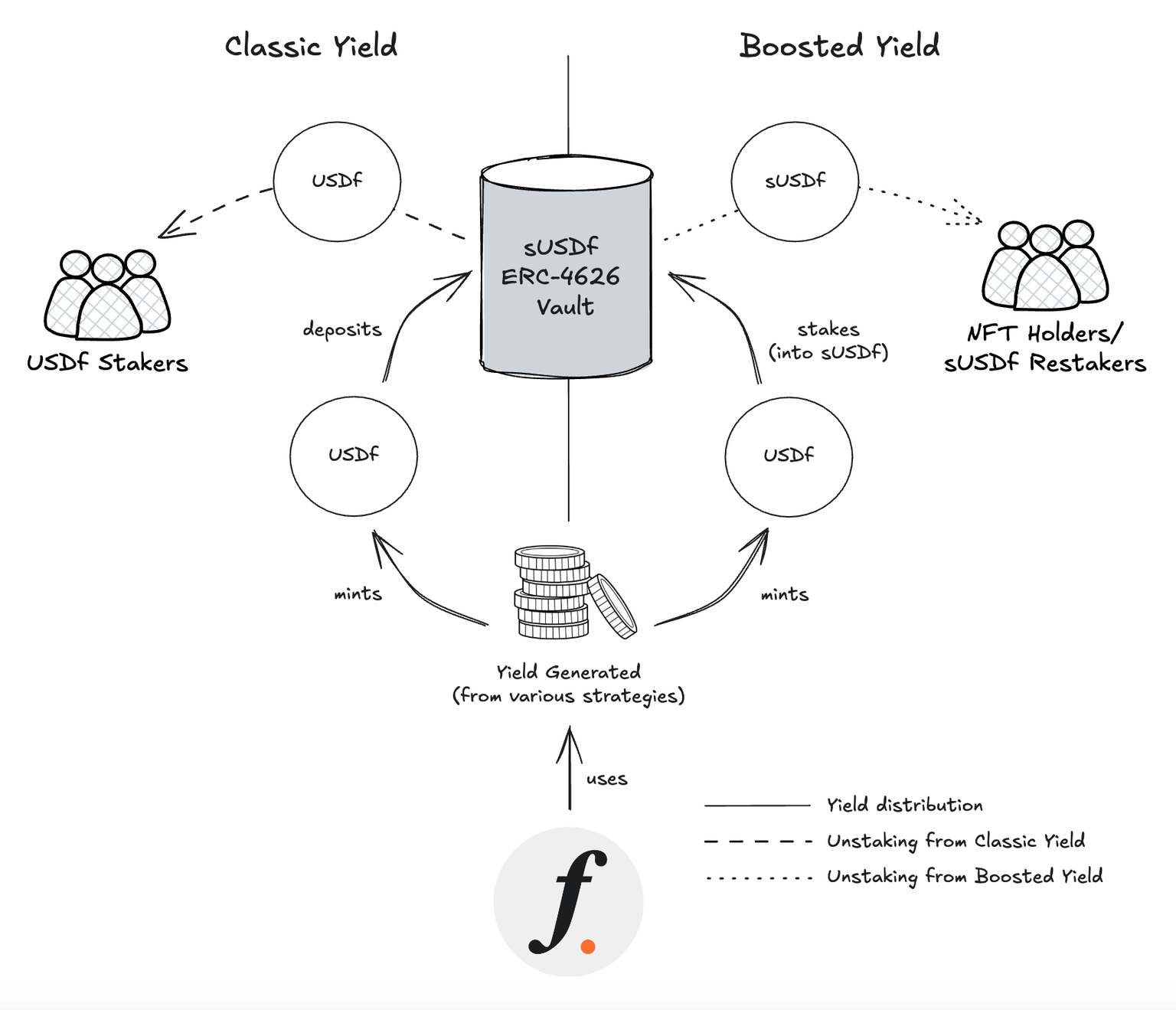

How Falcon Finance Works – Source: FalconFinance

Falcon Finance combines collateralization, synthetic assets, and AI powered allocation to create a sustainable, transparent, and automated yield system. Every step, from user deposit to yield generation, all is designed to protect user ownership while unlocking the productive potential of idle assets.

User Deposit Process

When users deposit their assets (such as ETH, USDC, or BNB) into Falcon, they are not simply “locking” funds – they are activating capital in a smart, self-sustaining system.

Here’s how it works:

- Deposit: Users connect their wallets and deposit supported crypto assets into Falcon Vault. In return, when they collateralize their assets, users receive an equivalent amount of USDf tokens.

- Collateral: Assets are deposited to a third party that uses multi-sig and multi-party computation (MPC), ensuring safety, transparency, and protection from illegal misappropriation. These collaterals form the backbone of Falcon’s lending and yield strategies.

- AI Risk Assessment: Falcon’s AI-driven risk management engine evaluates real-time market data – price movements, liquidity depth, and protocol safety – to determine safe collateralization ratios and yield targets.

- Yield Deployment: Once validated, the system deploys these collaterals across selected DeFi strategies (centralized exchanges (CEXs), liquidity pools, or staking pools) to generate sustainable yield.

- Transparency & Control: All movements are recorded on-chain. Users can track their positions, collateral ratios, and yield performance via the Falcon dashboard.

This ensures full transparency, security, and composability – users always retain ownership and visibility of their assets.

USDf – The Synthetic Dollar

When collateralizing, Falcon creates a synthetic stable asset called USDf, which serves as the protocol’s internal liquidity and accounting unit. Falcon Finance maintains the stability of the USDf peg through a combination of delta-neutral and market-neutral strategies.

USDf is Falcon Finance’s over-collateralized synthetic dollar, minted when users deposit eligible collateral, including stablecoins (e.g., USDT, USDC, DAI) and non-stablecoin assets (e.g., BTC, ETH, and some altcoins).

Users can easily mint USDf by collateralizing assets as described in the “User Deposit Process” section. If USDf has a fixed price <1USD, a KYC user can buy USDf at market price and exchange them for 1USD worth of collateral, the user eats the difference.

In short, USDf represents the stable, collateralized platform on which Falcon’s yield economy is built.

sUSDf – Yield Token

sUSDf is the yield version of USDf. When users deposit assets and receive USDf, the system automatically issues a yield version of USDf, called sUSDf (Staked USDf). Besides, sUSDf can be minted when USDf is deposited and staked in Falcon’s ERC-4626 repository.

Here’s how it works:

- When you stake USDf, you will receive sUSDf in return.

- sUSDf automatically accumulates yield over time as the protocol generates yield from deployed strategies.

- The value of sUSDf increases relative to USDf – meaning the number of tokens you hold increases even if the number of tokens remains the same.

- You can redeem sUSDf at any time to receive the base USDf plus the accumulated yield.

Basically, sUSDf = USDf + Actual Yield Accumulation.

This model eliminates the need for manual compounding or active management. By simply holding sUSDf, users will continuously earn yield in a transparent and on-chain manner.

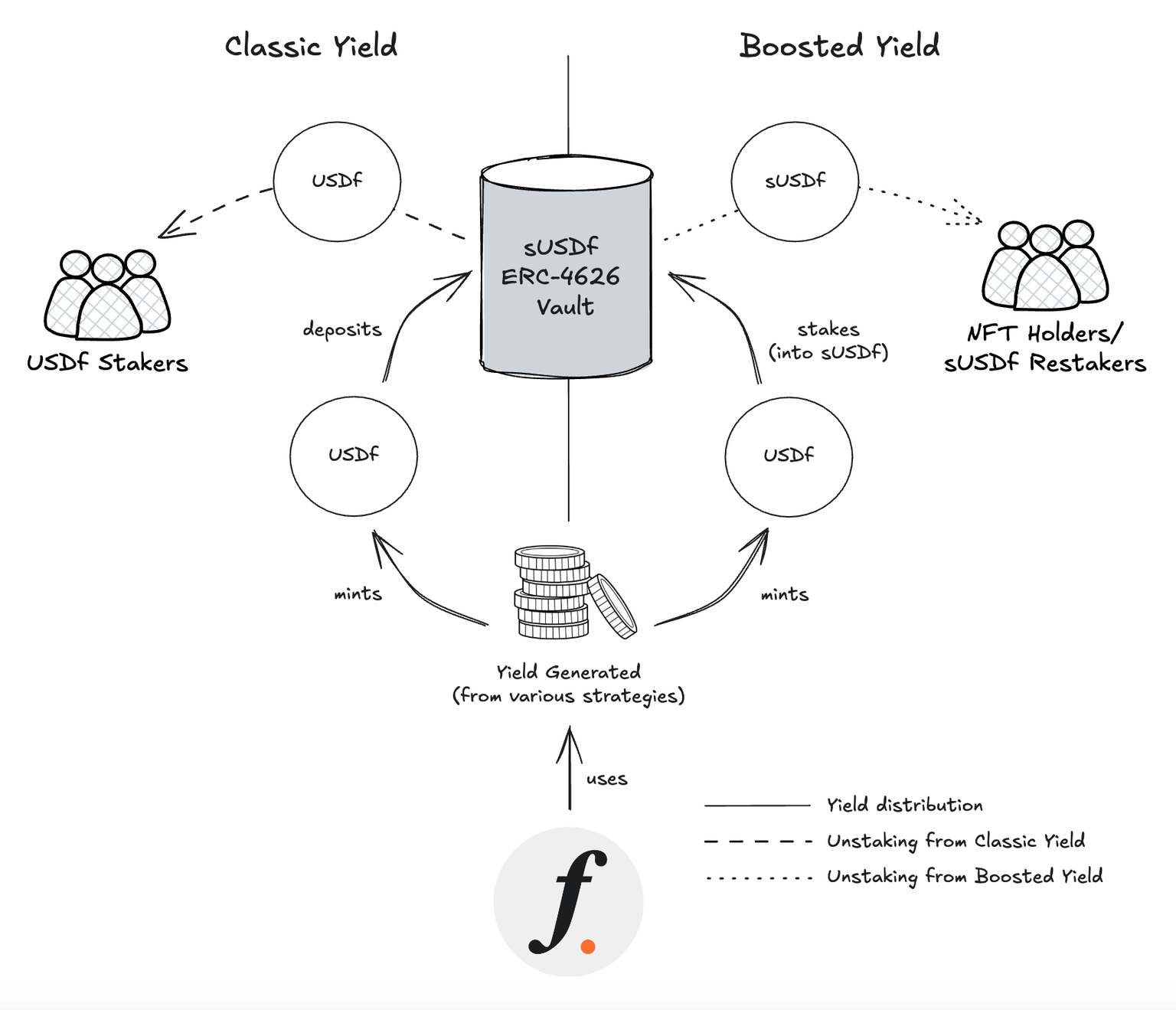

sUSDf – Yield Token – Source: FalconFinance

Falcon distributes yield fairly and transparently by calculating and verifying the daily returns across all active strategies. It then mints new USDf based on the total yield generated.

A portion of this newly minted USDf goes directly into Falcon’s sUSDf ERC-4626 Vault, increasing the vault’s USDf-to-sUSDf ratio over time. The rest converts into sUSDf, which continues to accrue yield. Users receive this yield through Boosted Yield NFTs, introducing a gamified layer of participation and rewards.

By linking USDf and sUSDf in a unified system, Falcon Finance turns idle digital assets into productive, yield-generating instruments. This integration builds a resilient and modular yield infrastructure designed for the next generation of decentralized finance.

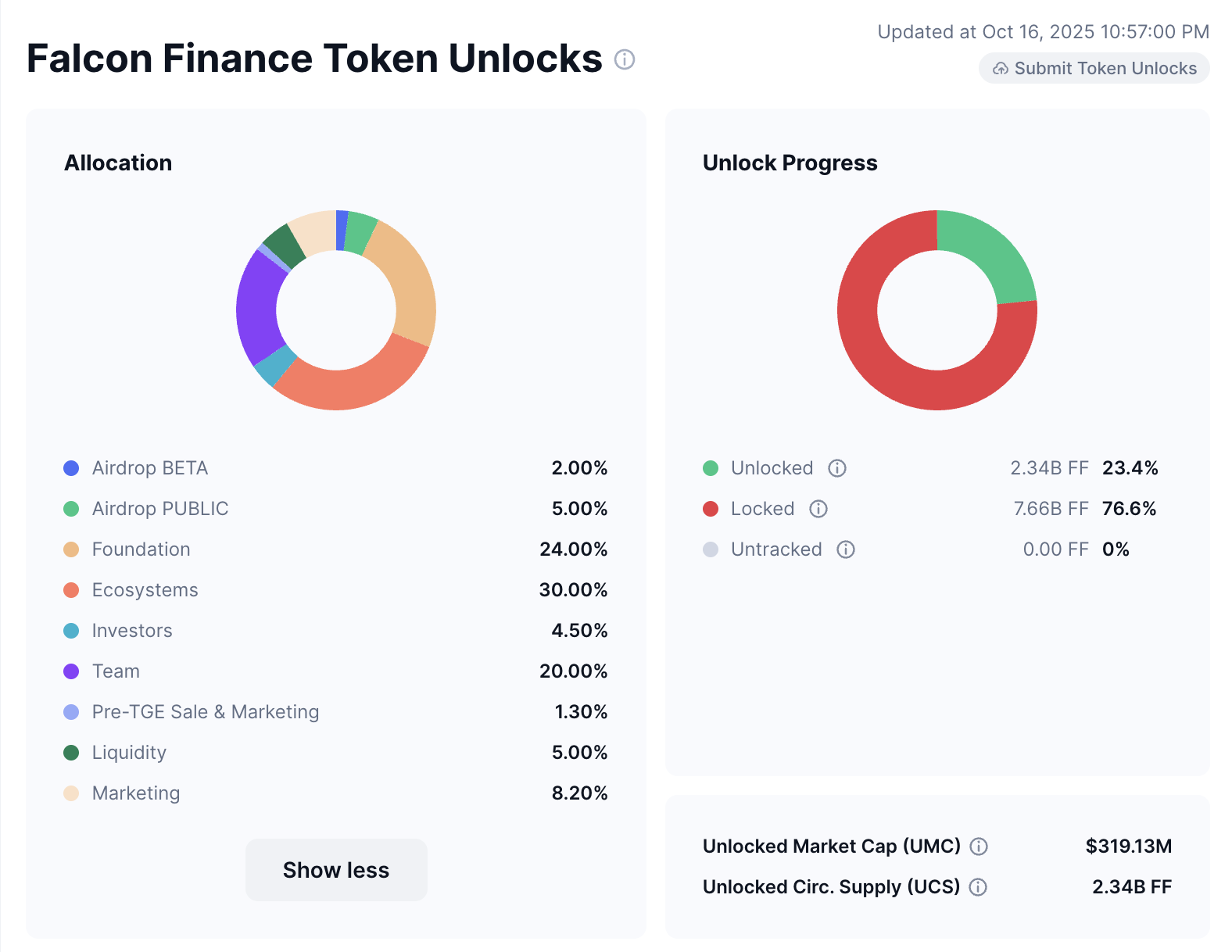

Tokenomics

The native token (let’s denote it as FF) serves as the economic and governance anchor of the ecosystem. Beyond governance, staking or holding FF tokens grants users enhanced economic benefits within the Falcon ecosystem – including higher APY when staking USDf, lower overcollateralization requirements during minting, and reduced swap fees. These incentives are designed to encourage active participation and long-term alignment with the protocol’s growth.

- Total Supply: 10B FF

- Circulating Supply: 2.34B FF

- Market Cap: 334.26M

- Max Supply: 10B FF

- Unlock Market Cap: 333.58M

Falcon Finance Token Unlocks

Falcon Finance Token Unlocks – Source: FalconFinance

- Airdrop BETA: 2%

- Airdrop PUBLIC: 5%

- Foundation: 24%

- Ecosystems: 30%

- Investor: 4.5%

- Team: 20%

- Pre-TGE Sale & Marketing: 1.3%

- Liquidity: 5%

- Marketing: 8.2%

How to buy FF

The FF token is Falcon Finance’s native asset powering governance, staking rewards, and economic incentives across the ecosystem. You can easily purchase FF on major centralized exchanges (CEX) by following the steps below.

Create an Account on a Centralized Exchange

- Choose a reputable exchange that lists FF, such as Binance, OKX, KuCoin, Bybit, or MEXC.

- Go to the exchange’s official website or app and sign up using your email or mobile number.

- Complete the KYC verification to enable trading, deposits, and withdrawals.

Swap Your USDT for Falcon USD (USDf)

For better compatibility, it’s recommended to start with a stablecoin such as USDT or USDC, cryptocurrencies pegged to the U.S. dollar and accepted in most swaps.

- In the exchange’s Spot Trading section, type “FF” in the search bar.

- You’ll see available pairs such as FF/USDT or FF/USDC.

- Click on the pair you prefer to start trading.

Place Your Buy Order

Decide how much you’d like to purchase and select your order type:

- Market Order: Executes instantly at the current market price.

- Limit Order: Executes only when the token reaches your chosen price.

Enter the amount of FF you wish to buy and confirm the order. Once filled, the tokens will appear in your Spot Wallet.

Always double-check that you are trading the official FF token by confirming the contract address and listing announcement from Falcon Finance’s official channels.

Avoid unofficial links or unverified listings to ensure the safety of your assets.

FAQ

What is Falcon Finance?

Falcon Finance is the first universal mortgage infrastructure protocol that creates sustainable yield opportunities.

How does Falcon generate yield?

Falcon’s AI engine allocates user collateral into low risk, real yield strategies such as lending, liquidity provisioning, and institutionalgrade DeFi markets. The yield is generated from genuine on-chain activities not from inflationary token emissions or unsustainable farming rewards.

What happens if markets crash or yields fall?

Falcon’s AI risk management and collateral security controls help mitigate losses by automatically adjusting exposure, rebalancing portfolios, or withdrawing from risky pools. Yields may fall during periods of high volatility, but users’ capital is protected by overcollateralization and insurance.

How is Falcon different from traditional DeFi platforms?

Falcon focuses on real yields, collateral security, and absolute institutional readiness and transparency. The platform introduces a universal cross-chain collateral mechanism, integrates AI-based governance, and emphasizes compliance and transparency, bridging the gap between DeFi and traditional finance.

Why is Falcon focused on sustainability?

Because long-term returns require real economic activity, not short-term speculation or hype, Falcon sees the need for sustainability in the many projects out there. Falcon’s design prioritizes stable returns, risk management, and transparency, paving the way for a DeFi ecosystem that can scale globally while maintaining user trust and financial integrity.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  Shiba Inu

Shiba Inu  sUSDS

sUSDS  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle