DeFi has moved beyond the “AMM experimentation” phase and entered an era that demands intelligence: liquidity must not only be abundant but also driven by data; user experience must not only be smooth but also smart in real time.

Within this context, Momentum (MMT) emerges as a next generation DEX, powered by AI and ve(3,3) built on the belief that algorithms can replace emotional reflexes and protocols can evolve on their own.

While traditional AMMs merely react to market conditions, Momentum aims to go a step further to predict and coordinate with the rhythm of data, block by block, trade by trade.

What is Momentum (MMT)?

What is Momentum (MMT) – Source: Momentum

On the surface, Momentum functions as a decentralized exchange (DEX). But at its operational core, it is a self adaptive liquidity protocol built upon three foundational pillars:

- AI-driven decision engine: An artificial intelligence layer that analyzes on-chain data including price movements, trading volume, pool depth, and MEV patterns and, when applicable, off chain signals such as news sentiment or volatility indicators, in order to continuously adjust the protocol’s behavior.

- ve(3,3) tokenomics: An incentive model that encourages users to lock their tokens (veMMT) to sustain long term growth. The longer the lock period, the greater the user’s voting power and share of trading fees, allowing them to influence the emission flow toward the most efficient liquidity pools and strategies.

- Dynamic liquidity routing: A mechanism that redistributes and routes liquidity in real time to minimize slippage, optimize trading fees, and balance risk exposure across the ecosystem.

The core philosophy is to turn data into trading actions, and to transform veMMT holders from passive yield farmers into active growth coordinators of the entire protocol. With mission is to make liquidity not only decentralized but also intelligent.

Momentum operates as an AI powered Automated Market Maker (AMM) that continuously learns from on chain behavior. Every trade, every liquidity shift, and every user interaction feeds into a feedback loop where data becomes intelligence, and intelligence becomes action. The result is a DEX that doesn’t simply exist on the blockchain, but one that adapts to it.

Momentum therefore represents a new paradigm in DeFi a transition from passive liquidity to active intelligence, from human reflex to machine prediction, and from fragmented incentives to autonomous equilibrium. Where anyone can trade any asset, unconstrained by space, time, or anything else.

Learn more: What Is Morpho Crypto? The DeFi Protocol Optimizing Lending on Ethereum

Core Products of Momentum

Momentum isn’t just a DEX, it’s an entire financial operating system designed for the tokenized economy. Each product in its ecosystem contributes a vital function: security, liquidity, and capital efficiency, forming an integrated suite that powers the next era of global finance.

MSafe – Secure Treasury Infrastructure

MSafe is Momentum’s institutional-grade, multi signature (multi sig) wallet solution built specifically for Move based chains such as Sui, Aptos, Movement, and IOTA. Designed to manage treasuries, token vesting, and on chain execution, MSafe provides flexible approval flows and top tier security becoming the backbone of governance and capital management for major projects in the Move ecosystem.

- Treasury Management: Protects protocol treasuries with configurable multi sig access, ensuring collective control and minimizing single point of failure risks.

- Token Vesting: Enables teams and investors to securely lock, schedule, and release tokens via transparent, on chain smart contracts preventing manipulation or premature unlocks.

- dApp Store: Offers secure integrations with DeFi applications through a smart contract based App Store, allowing DAOs and teams to interact safely while maintaining multi sig protection.

Trusted by leading protocols across Sui, Aptos, and beyond, MSafe has become the de facto security standard for treasury operations, token distribution, and DAO level governance within the Move ecosystem.

Momentum DEX – The Central Liquidity Engine

At the center of the ecosystem is Momentum DEX, a next generation decentralized exchange built on a concentrated liquidity model (CLMM) inspired by Uniswap v3. The platform allows liquidity providers to allocate their capital within specific price ranges, creating deeper liquidity and tighter spreads where trading activity actually happens.

Since its beta launch on March 31, 2025, Momentum DEX has quickly become a key liquidity engine for the Move ecosystem, surpassing 1.6 million unique swap users, over $600 million in total value locked (TVL), and a cumulative trading volume exceeding $25 billion.

But the numbers only tell part of the story. Momentum DEX leverages Sui’s programmable transaction blocks (PTB) to compress complex actions, such as swapping, adding liquidity, staking LP tokens, and claiming rewards, into a single atomic transaction. This makes DeFi execution smoother, cheaper, and safer.

Retail users enjoy an intuitive CEX like interface with low fees and guided trading, while institutions access deep liquidity, transparent pricing, and secure self custody through MSafe integration.

Cross chain compatibility via Wormhole ensures assets move seamlessly across ecosystems. While Sui’s Programmable Transaction Blocks (PTB) enable traders to bundle multiple actions, such as swap → add liquidity → stake LP → claim rewards, into a single atomic transaction. One click, one signature, one outcome: either everything executes, or nothing does.

Leveraging Sui’s object centric, parallel execution, Momentum DEX achieves higher throughput, near instant finality, and reduced MEV exposure, making it one of the most efficient and secure DEX infrastructures in DeFi today.

By combining CLMM architecture, PTB capabilities, and Sui’s high performance environment, Momentum DEX delivers an unprecedented mix of capital efficiency, institutional grade infrastructure, and composable DeFi innovation, the true liquidity engine of the tokenized era.

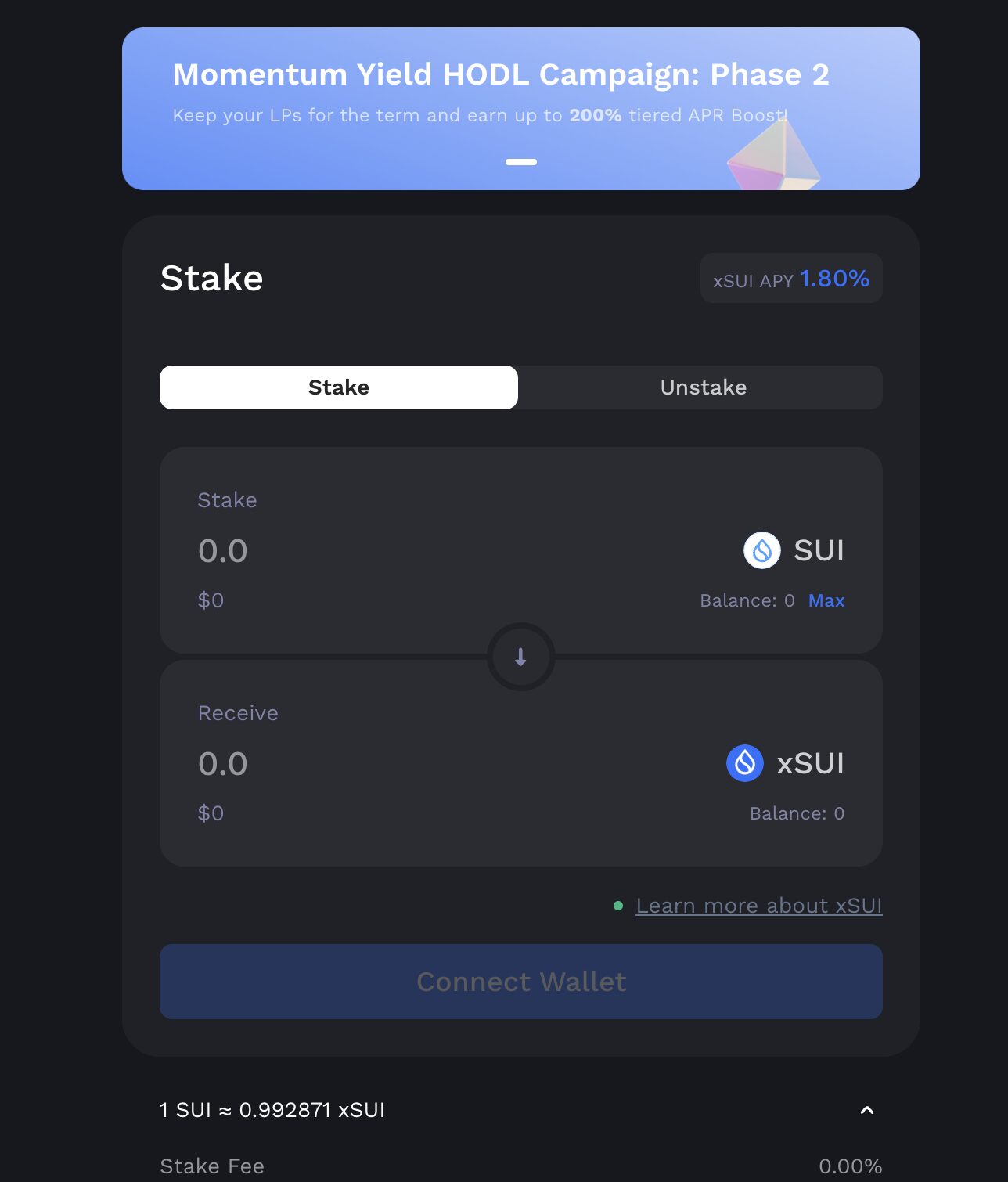

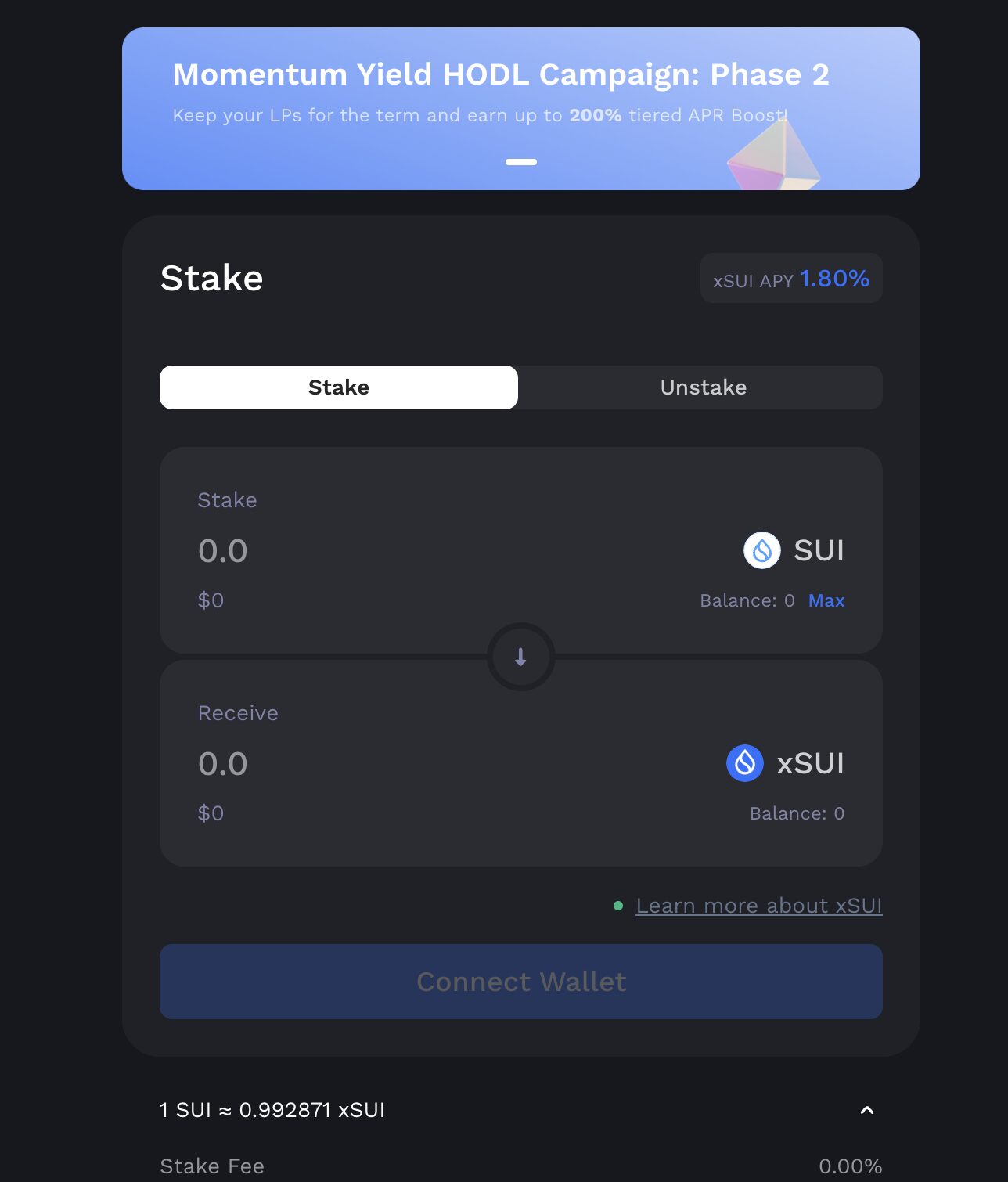

xSUI – Liquid Staking, Unlocked Liquidity

xSUI – Liquid Staking, Unlocked Liquidity – Source: Momentum

The second pillar of Momentum’s ecosystem is xSUI, a liquid staking protocol that transforms staked SUI into a yield bearing, composable asset. Users can stake SUI to validators with one click and receive xSUI, a token that represents their staked position earning staking rewards while remaining fully liquid for DeFi activities.

With xSUI, users can earn native staking yield and simultaneously deploy their capital across lending, liquidity pools, or collateralized products. It effectively turns idle staked assets into productive capital, allowing users to stack multiple yield layers from staking rewards to trading fees and ecosystem incentives.

The synergy between xSUI and Momentum DEX amplifies efficiency: xSUI injects yield bearing liquidity into the DEX, while the DEX enhances xSUI’s utility through swaps, farming, and composable DeFi markets. Every liquidity provider holding xSUI earns both trading fees and Sui staking rewards, creating a dual yield structure that strengthens the entire Sui economy.

As adoption grows, xSUI is poised to become a cornerstone of Sui DeFi, merging network security, liquidity depth, and yield generation into a single, fluid mechanism.

To lay the foundation for a DeFi dream, Momentum begins by building its core infrastructure and liquidity on Sui, with three main flagship products: Momentum DEX, xSUI (liquid staking), and MSafe (treasury management and token allocation).

From this foundation, Momentum expands into cross chain assets and eventually unlocks real world assets (RWA), bridging the gap between traditional value and the on chain economy.

The Operating System for the Next Era of Global Finance

Momentum’s ambition is to build a financial operating system for the entire crypto market. Reshape, become the operating system for the next era of the financial world.

Unlike most DeFi platforms that focus on a single use case, Momentum takes a modular and interoperable approach. Each of its core products, Momentum DEX, xSUI, MSafe, Token Generation Lab (TGL), Vaults, and Momentum X, plays a specific role in the broader architecture, while remaining deeply integrated with one another. Together, they form a self-sustaining system where liquidity, security, and compliance continuously reinforce each other.

We have analyzed Momentum DEX, xSUI, MSafe in detail in the previous part. In this part, we will go into the remaining parts.

Token Generation Lab – Bluechip Launchpad for the Next Wave of Projects

Momentum isn’t just shaping how we trade. It’s redefining how projects launch. At the heart of that vision lies the Token Generation Lab (TGL), Momentum’s new age bluechip launchpad for high quality teams who want more than hype cycles and quick listings.

While most launchpads focus on fast token sales, TGL prioritizes long term alignment. It brings together the most influential players in the Sui ecosystem. These include the Sui Foundation, leading investors, market makers, centralized exchanges, and top tier protocols. The goal is to give every project the same starting point: real liquidity, verified partners, and immediate market access.

No upfront fees, no dump culture, no short term speculation. Instead, TGL locks launchpad fees for twelve months. This pushes liquidity directly into the markets and rewards Momentum’s community of over 150,000 participants, including DEX referrers and NFT holders. As a result, the launch feels organic. Projects debut with strong community backing and deep liquidity already in place.

Moreover, the story doesn’t end there. Every token launched through TGL integrates directly into Momentum DEX, seeding new pools and trading pairs from day one. This steady inflow of fresh assets turns the DEX into a living, expanding marketplace. It is not just for trading, but also for discovery.

TGL is essentially a bridge between project creation and sustainable liquidity. It gives developers a fast track to the market and gives the Momentum community early access to high conviction opportunities.

In an industry defined by short attention spans, TGL bets on depth over speed. That focus could make it the go to launchpad for serious builders.

Momentum Vaults – Automated Yield for the Rest of Us

Momentum Vaults – Automated Yield for the Rest of Us – Source: Momentum

Momentum’s next frontier is making DeFi yield simple again. The Momentum Vaults are designed for one thing: to let users earn like pros without trading like pros.

These vaults act as automated portfolios powered by curated strategies from experienced DeFi builders. Users deposit their assets, and the vaults do the rest, optimizing liquidity ranges, rebalancing positions, and compounding rewards in real time.

Momentum’s rollout starts with auto rebalancing vaults, directly plugged into Momentum DEX, where each vault dynamically manages liquidity for a specific trading pair. Later phases introduce multi strategy and multi chain vaults, allowing users to combine leverage, looping, and yield farming across chains such as Ethereum, Solana, and Sui.

For retail users, the vaults mean hands off income, no charts, no bots, no sleepless nights.

For institutions, they represent capital efficiency at scale, giving funds and DAOs a way to deploy liquidity with transparent, auditable logic.

Beyond convenience, vaults serve a strategic role: they keep liquidity on the platform “sticky.” Instead of funds hopping between protocols for the next yield farm, capital stays productive within Momentum’s ecosystem, reinforcing the DEX’s depth and price stability.

In essence, the vaults turn DeFi’s biggest challenge, complexity, into its biggest strength. By wrapping advanced strategies into automated, composable tools, Momentum is setting a new standard for accessible, data driven yield generation on Sui.

Momentum X – Where Compliance Meets Composability

If Momentum DEX is the engine that powers liquidity, Momentum X is the trust layer that keeps the entire system compliant, transparent, and ready to scale globally.

Momentum X – Where Compliance Meets Composability – Source: Momentum

Solving DeFi’s Long-Standing Compliance Challenge

In the race to build faster and smarter DeFi, one old obstacle still stands in the way, regulatory compliance. While blockchains can settle trades in seconds, institutions still need weeks to onboard, verify identities, and satisfy jurisdictional rules.

Momentum X aims to change that by creating the first institutional grade trading layer that merges compliance, liquidity, and real world assets under a single on-chain roof.

Fixing Fragmentation in Tokenization

For years, the tokenization space has been deeply fragmented. Each chain runs its own KYC process, forcing investors to repeat verification across platforms just to trade the same asset.

Momentum X solves this problem with a “verify once, access everywhere” approach built on Sui’s full stack architecture, powered by Walrus and Seal.

When a user starts a transaction through a connected DApp, Momentum X quietly handles the heavy lifting behind the scenes.

Real Time, Privacy Preserving Compliance

A real time eligibility request is sent to the Momentum X API, which confirms that the DApp is authorized to request identity checks.

Using Seal, encrypted identity data is fetched from Walrus, and only the necessary information is decrypted to prove compliance.

No unnecessary personal data ever leaves the system.

If the user meets the asset’s regulatory requirements, such as jurisdiction, certification, or transfer limits, the transaction is approved instantly, on chain.

This process feels invisible to the user, yet it enforces regulatory standards, privacy protection, and speed all at once.

For institutions, it removes one of the biggest barriers to DeFi participation. Meanwhile, for individuals, it means frictionless access to regulated products without giving up control of their data.

Compliance Baked Into Smart Contracts

Under the hood, Seal’s programmable access control embeds compliance directly into smart contracts, eliminating the need for centralized gatekeepers.

Moreover, when combined with zero knowledge identity proofs for privacy and Wormhole bridges for cross-chain interoperability, Momentum X transforms a patchwork of isolated pilots into a unified, composable financial network.

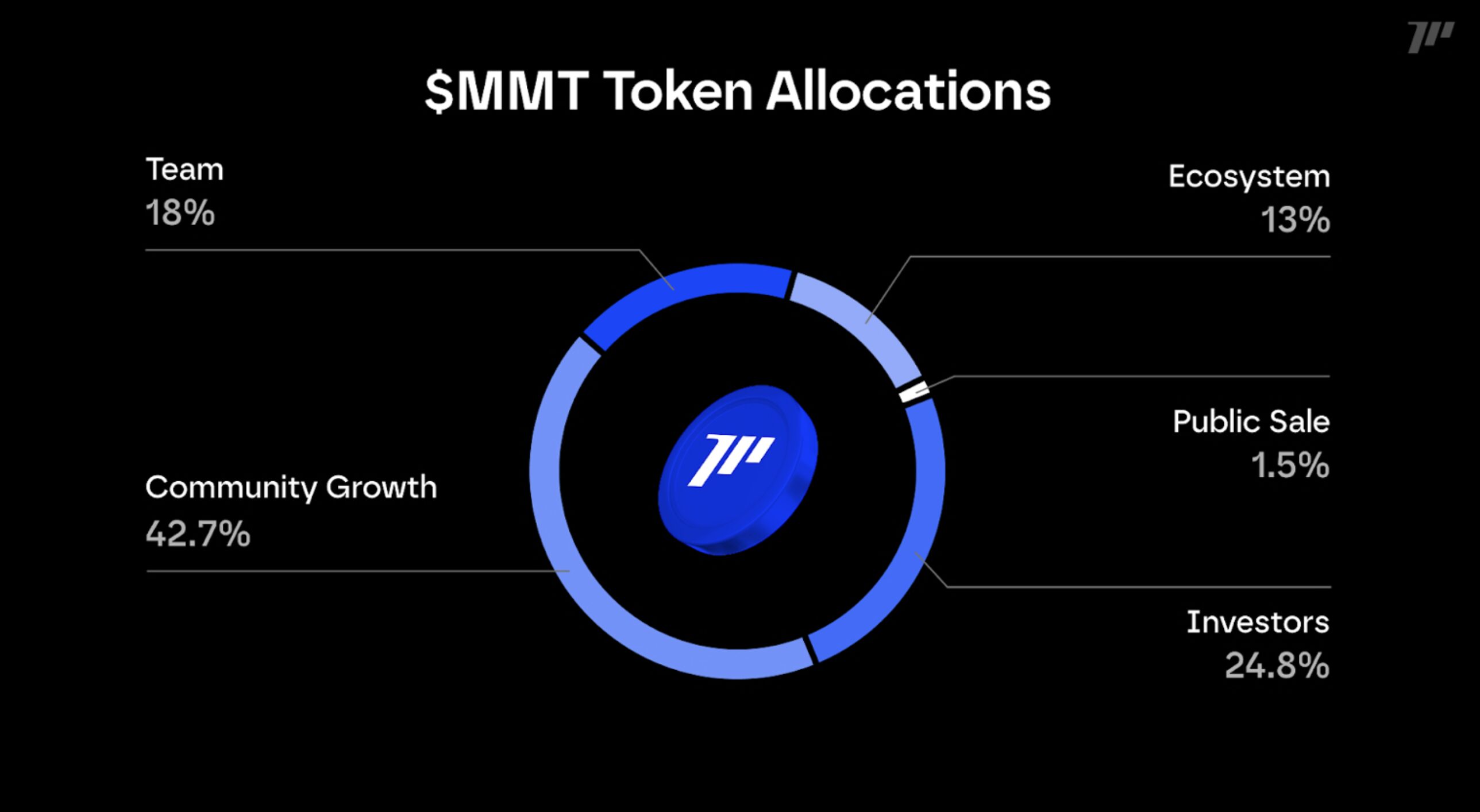

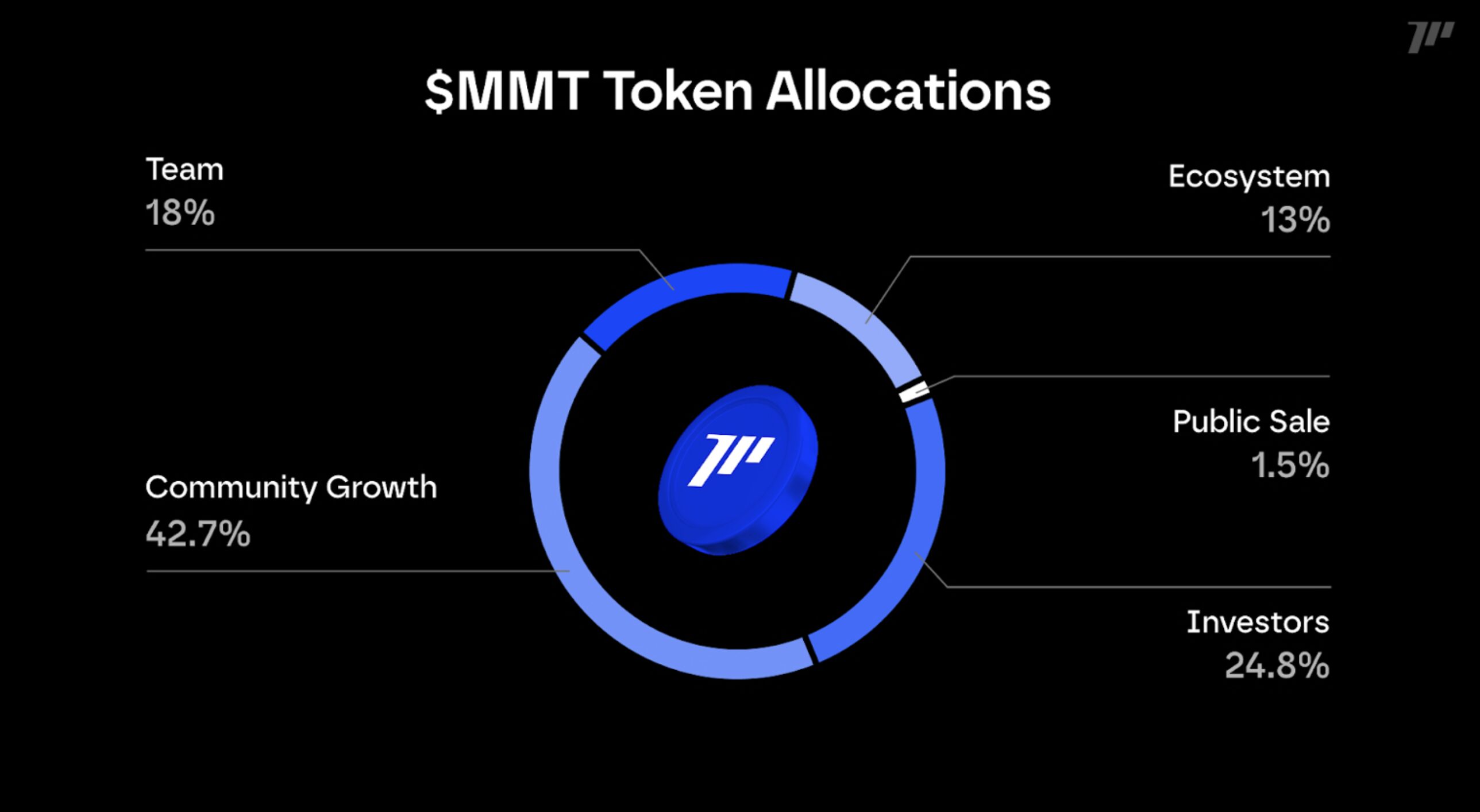

MMT Tokenomics

Momentum’s native token, MMT, serves as the economic and governance core of its financial operating system, powering trading, liquidity, incentives, and community participation across all products. With a total supply of 1,000,000,000 MMT, the token’s design carefully balances early market liquidity with long term sustainability, ensuring both growth and stability as the ecosystem expands across DeFi and tokenized finance.

At the Token Generation Event (TGE), an initial 204,095,424 MMT (approximately 20.41% of the total supply) will enter circulation.

MMT Tokenomics – Source: Momentum

- Ecosystem (13%)

- Community Growth (42.72%)

- Investors and Early Supporters (24.78%)

- Public Sale (1.5%)

- Team (18.00%)

Learn more: Momentum (MMT) Will Be Listed on Binance HODLer Airdrops!

How to Buy MMT Token

Buying MMT on centralized exchanges (CEXs) is quick and simple.

Choose an exchange

MMT will be listed on leading exchanges such as Binance, KuCoin, Gate.io, and MEXC. Always check official announcements from Momentum Finance for verified listings.

Buy MMT

Search for the trading pair (e.g., MMT/USDT) and place a market or limit order to purchase your desired amount.

Secure your tokens

Once purchased, store MMT in your CEX wallet or transfer to MSafe, Momentum’s official wallet for staking, governance, or participation in DeFi products.

FAQ

What is Momentum (MMT)?

Momentum is an AI powered, ve(3,3) based decentralized exchange (DEX) built on the Sui Network, designed to provide deep liquidity, dynamic routing, and intelligent, data driven trading. It’s more than just a DEX, Momentum is building a full financial operating system that connects DeFi, real world assets (RWA), and institutional infrastructure.

What makes Momentum different from other DEXs?

Momentum integrates AI algorithms, programmable transaction blocks, and the ve(3,3) model to continuously optimize liquidity and user experience. It doesn’t just react to markets it predicts and adjusts dynamically, offering a CEX like experience with DeFi transparency.

What are the core products of Momentum?

Momentum’s ecosystem includes six interconnected products:

- Momentum DEX – AI powered, concentrated liquidity market maker.

- xSUI – Liquid staking for Sui with DeFi integration.

- MSafe – Institutional-grade treasury and asset management.

- TGL (Token Generation Lab) – Bluechip launchpad for new projects.

- Vaults – Automated, high-performance yield strategies.

- Momentum X – Compliance and RWA trading layer connecting DeFi and TradFi.

What is the total supply of MMT?

The total supply of MMT is 1,000,000,000 tokens, with an initial circulating supply of approximately 204 million (20.41%) at TGE. This design balances early liquidity with long-term governance and ecosystem stability.

How does the ve(3,3) model work in Momentum?

Momentum’s ve(3,3) model encourages long term alignment: Users lock MMT to receive veMMT, which grants governance power, trading fee rebates, and boosted yields. veMMT holders decide how emission rewards are distributed, ensuring incentives flow to productive markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Stellar

Stellar  Canton

Canton  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Tether Gold

Tether Gold  Uniswap

Uniswap  Mantle

Mantle