The global NFT market cap today is $67.00 billion, reflecting the growing interest in digital ownership. To enter the NFT market, you need a marketplace to buy and sell these digital arts. So, what is an NFT marketplace, and why is it gaining so much attention?

These marketplaces play a crucial role in connecting creators and collectors. They provide a space where users can buy, sell, and trade non-fungible tokens (NFTs). In this guide, we will dive into what an NFT platform is, how it works, and why it matters in today’s digital landscape.

Key Takeaways:

- An NFT marketplace is an online platform where you can buy, sell, and create non-fungible tokens (NFTs), ensuring proof of authenticity for digital assets.

- The different categories of NFT platforms include open marketplaces for all kinds of NFTs, curated marketplaces focusing on quality, and niche-specific platforms like gaming and sports.

- The best NFT marketplaces to buy digital art are OpenSea, Rarible, Binance NFT, Magic Eden, and Blur.

What is NFT Marketplace?

An NFT marketplace is an online platform where you can buy, sell, trade, or create non-fungible tokens (NFTs). NFTs are unique digital assets representing proof of authenticity for items like art, music, videos, or virtual real estate. These tokens use blockchain technology to verify their uniqueness and ownership. You can read our full guide on what is an NFT.

In an NFT marketplace, you can browse collections, participate in auctions, or list your own NFTs for sale. Transactions are usually conducted using cryptocurrency, such as Ethereum (ETH), which is the most common blockchain network for NFTs. Once an NFT is bought, the ownership is transferred on the blockchain, ensuring that the buyer has a verified, secure record of their purchase.

Some platforms are open to all kinds of NFTs, while others focus on specific niches, such as digital art or gaming. NFT marketplaces also provide tools for creators to mint, or generate, their own NFTs, which can then be listed for sale.

Types of NFT Marketplace

NFT marketplaces come in different forms, each offering distinct features for users. Here are the main types:

- Open marketplaces: Anyone can mint, sell, or buy NFTs here. These platforms usually support a wide variety of NFTs, including digital art, music, gaming items, and more. OpenSea is one of the most popular examples, offering a broad selection of NFTs across various categories. These marketplaces are flexible and attract users interested in exploring different types of NFTs.

- Curated Marketplaces: Curated NFT marketplaces focus on offering high-quality, carefully selected NFTs. These platforms have strict criteria, often requiring artists or creators to go through an approval process before listing their NFTs. Examples like SuperRare and Nifty Gateway specialize in digital art, emphasizing quality over quantity. For collectors, curated marketplaces offer a chance to discover unique, premium NFTs.

- Niche-Specific Marketplaces: Niche marketplaces cater to specific types of NFTs or industries. For example, Rarible focuses on art and collectibles, while platforms like Decentraland specialize in virtual real estate and gaming assets. These marketplaces are tailored for users who are only interested in a particular niche, offering a more focused experience. Niche marketplaces often come with unique features that support their specific focus, such as trading items that can be used in a virtual game or world.

- Gaming and Virtual World Marketplaces: These platforms specialize in NFTs related to gaming and virtual environments. Players can trade items like characters, skins, or virtual land. Axie Infinity and The Sandbox are popular examples where users buy and sell game assets as NFTs. These marketplaces not only support trading but also allow users to own parts of the virtual world, offering a decentralized approach to in-game economies.

- Sports Collectibles Marketplaces: NFT platforms for sports collectibles, like NBA Top Shot and Sorare, have become very popular. These platforms attract fans from all over the world, especially in places where sports are loved. For example, NBA Top Shot is big in the U.S. because of basketball, while Sorare is popular in Europe and Latin America, where soccer is a favorite.

Centralized vs. Decentralized Marketplaces

NFT marketplaces can also be divided into two main categories: centralized and decentralized. The comparison below highlights the major differences in how centralized and decentralized marketplaces operate, focusing on control, security, fees, and user experience.

| Aspect | Centralized Marketplaces | Decentralized Marketplaces |

| Ownership | Controlled by a single company or authority | Operated by a network of users (peer-to-peer) |

| Control | Full control over transactions, listings, and policies | No single authority; decisions are made by the community or smart contracts |

| Security | Vulnerable to hacking due to a single point of failure | More secure due to its distributed nature, with no central point of failure |

| Transparency | Limited transparency; platform controls data visibility | Fully transparent; all transactions recorded on a public blockchain |

| Fees | Charges higher fees | Lower or no fees, but gas fees (transaction costs) may apply |

| Censorship | The platform can ban or remove users/content | No censorship; users have full control of assets and activities |

| Ease of Use | Easier to use, more user-friendly, with customer support | More complex for beginners, and less customer support is available |

| Trust | Requires trust in the central authority | Trustless; relies on blockchain technology and smart contracts |

| Speed of Transactions | Generally faster as transactions are controlled centrally | Can be slower due to blockchain confirmation times |

| Examples | OpenSea (partial centralization) | Rarible, LooksRare (fully decentralized) |

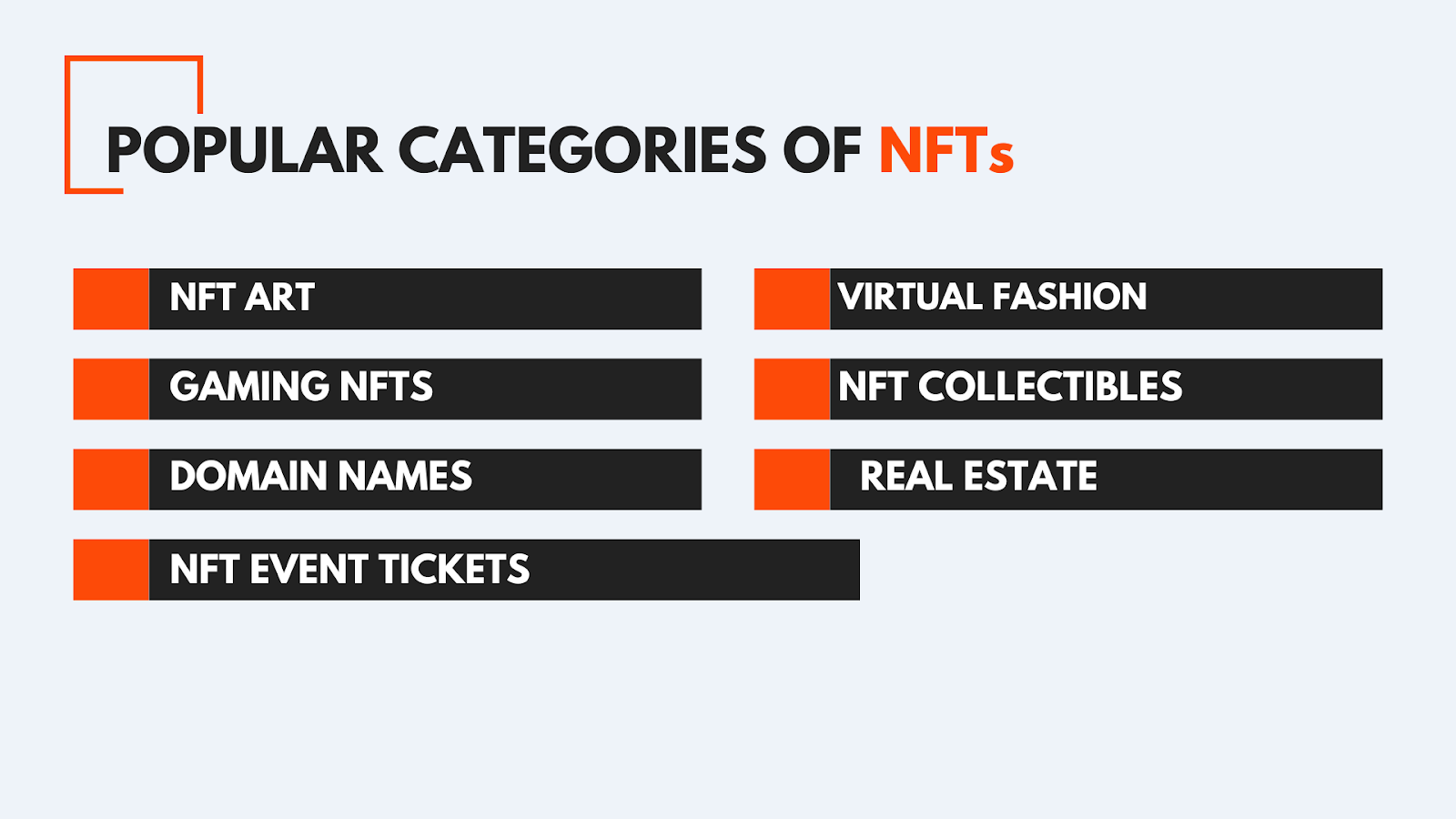

Popular Categories of NFTs

NFT Art

NFT art was one of the first major breakthroughs for non-fungible tokens. It allowed artists to tokenize their artwork on the blockchain. NFT art skyrocketed in popularity, especially in early 2021 when digital artist Beeple sold a piece titled “Everydays: The First 5000 Days” for $69.3 million through Christie’s auction house. This sale brought NFTs into the mainstream.

Numerous platforms have emerged to cater to the growing demand for NFT art. Popular platforms like OpenSea, Rarible, and Foundation serve as marketplaces for artists to mint and sell their work. These platforms act as digital galleries where collectors can browse and purchase a wide array of art, from simple animations to intricate digital paintings. Since 2021, OpenSea reported a trading volume of $38 billion alone, showcasing the financial scale of NFT artwork.

Gaming NFTs

Gaming is another major sector embracing NFTs, especially for in-game assets like weapons, skins, characters, or even virtual land.

In traditional gaming, players often purchase in-game items, but they do not own them outside the game. If a game shuts down, players lose access to these assets. NFTs solve this issue by allowing players to own in-game assets across platforms. Players can sell or trade their items in secondary markets.

For instance, Axie Infinity, one of the most popular blockchain-based games, allows players to own and trade creatures called Axies. By mid-2024, Axie Infinity had generated over $4.2 billion in revenue, and the game’s NFTs could be traded in external markets like OpenSea.

NFTs have also given rise to the play-to-earn model in gaming. Players can earn NFTs as rewards and trade or sell them for real money. Games like “The Sandbox and Decentraland” are further expanding this concept by allowing you to create, own, and monetize virtual worlds.

Virtual Fashion

Virtual fashion is an emerging and intriguing category of NFTs. Fashion isn’t limited to physical clothing anymore. People are increasingly investing in digital outfits for avatars or social media appearances.

Virtual fashion primarily targets users of social platforms and virtual worlds, where people showcase their digital identities. Virtual fashion NFTs allow users to purchase unique digital clothes and accessories for avatars.

One of the most notable early examples is RTFKT Studios, which sold a collection of virtual sneakers that generated over $3 million in minutes. Other brands like Gucci and Dolce & Gabbana have also entered the NFT space, selling virtual fashion items that people can showcase in virtual spaces like Decentraland.

The future of virtual fashion could see further integration with augmented reality (AR). With AR glasses or apps, you could display virtual outfits in real life, blending the physical and digital worlds. Virtual fashion could also extend to virtual fashion shows and collaborations between digital artists and fashion designers.

NFT Collectibles

Collectible NFTs can range from digital trading cards to unique pieces of pop culture memorabilia. One of the most famous examples is CryptoPunks, a collection of 10,000 unique, algorithmically generated characters. Some CryptoPunks are selling for millions of dollars. Bored Ape Yacht Club is another successful NFT collection, with individual NFTs in this collection being sold for high prices.

The value of collectible NFTs often comes from their scarcity and the hype around their release. Many NFT projects use a limited-edition model, creating demand by restricting the number of NFTs available.

For example, NBA Top Shot, a digital collectible platform, sells highlight moments from basketball games as NFTs. Each moment has a limited number of copies, creating demand and increasing the perceived value of rare moments.

NFT collectibles also have a community-driven aspect. Owners of certain collections get access to exclusive events or clubs. For example, Bored Ape Yacht Club owners receive membership to exclusive online spaces and events. This sense of community adds to the appeal and value of collectibles, turning them into status symbols.

Domain Names

NFTs have also been applied to domain names, allowing users to purchase and trade decentralized domain names. Unlike traditional domains managed by central authorities like ICANN, blockchain domains are decentralized.

Platforms like Unstoppable Domains and ENS (Ethereum Name Service) allow you to purchase domains like “yourname.crypto” or “yourname.eth” as NFTs. These domains are stored on the blockchain, and owners have full control over them without needing to rely on centralized registries.

Blockchain domains have several advantages. They are censorship-resistant, meaning no government or corporation can take them down. They can also function as wallet addresses for cryptocurrency, simplifying transactions. For example, instead of using a long string of characters as a wallet address, users can send funds to “yourname.eth”.

NFT Event Tickets

Traditional ticketing systems often suffer from issues like fraud and scalping, where tickets are sold at inflated prices. NFT tickets can solve these problems by ensuring that each ticket is verifiable and cannot be duplicated. The blockchain makes it difficult to create counterfeit tickets.

NFT tickets can offer additional perks. For instance, event organizers can provide exclusive content, such as behind-the-scenes videos or meet-and-greet opportunities, to NFT ticket holders. Plus, since the tickets are stored as NFTs, they can become valuable collectibles after the event.

The entertainment industry is slowly adopting NFT tickets. In 2021, Italian football club AS Roma partnered with Chiliz to offer NFT tickets to fans. As the technology evolves, more event organizers may adopt NFT tickets for concerts, sports events, and festivals, enhancing the overall experience for attendees.

Real Estate

Real estate NFTs can represent ownership of physical or virtual properties. Platforms like Decentraland and The Sandbox allow users to buy, sell, and trade virtual land as NFTs. Some plots of virtual land in Decentraland were selling for over $900,000.

NFTs can also represent ownership of physical properties. Tokenization allows real estate assets to be divided into smaller portions, enabling fractional ownership.

For example, a property can be represented by several NFTs, with each NFT representing a fraction of the property. This makes real estate investment more accessible, as people can purchase portions of expensive properties without buying the whole asset.

Key Features to Consider When Choosing an NFT Marketplace

Platform Fees

One of the first things to consider is the platform fees associated with each NFT marketplace. These fees can vary significantly from one platform to another. Typically, marketplaces charge a percentage of the sale price when an NFT is sold, often ranging from 2.5% to 5%. For example, OpenSea, one of the largest NFT marketplaces, charges a 2.5% fee on each transaction.

In addition to selling fees, other costs can be incurred. Some platforms may also have minting fees, which are charged when you create a new NFT. Gas fees, which are transaction fees on blockchain networks like Ethereum, can also add to the overall costs. During times of high demand, these fees can spike, making it crucial to research current gas prices before minting or buying NFTs.

NFT Token Standards

Different blockchains have various token standards that dictate how NFTs are created and traded. The most common standards are ERC-721 and ERC-1155, both used on the Ethereum blockchain.

- ERC-721: This is the original standard for NFTs, allowing each token to be unique and not interchangeable. This is suitable for digital art, collectibles, and other unique items.

- ERC-1155: This standard allows for the creation of both fungible and non-fungible tokens. This means multiple copies of an item can be created, which is beneficial for games and other applications requiring identical items.

Wallet Compatibility

An NFT marketplace needs to support various cryptocurrency wallets, as users often hold their NFTs in these wallets. The most popular wallets include MetaMask, Coinbase Wallet, and Trust Wallet.

Before selecting a marketplace, check which wallets it supports. Some platforms require users to connect their own wallets to facilitate transactions. Dapper, for instance, has the Dapper Wallet that you need to use on their NBA Top Shot marketplace.

Verification Processes

The verification processes of a marketplace can significantly affect the quality and authenticity of the NFTs available. Some platforms have strict verification processes to ensure that sellers are legitimate and that the NFTs are genuine.

For instance, platforms like Rarible and SuperRare require artists to undergo a verification process before they can mint NFTs. This adds a layer of trust, as buyers can feel confident that the NFTs they are purchasing are authentic and created by verified artists.

On the other hand, marketplaces with lax verification processes may allow anyone to mint NFTs, leading to potential scams and counterfeit items.

Security and Trustworthiness

The decentralized nature of blockchain technology can provide a level of security, but marketplaces are still vulnerable to hacks and scams.

It is vital to look for marketplaces that have a strong reputation and proven security measures. For example, OpenSea has implemented multiple security features, such as two-factor authentication and regular security audits.

Additionally, checking user reviews and feedback can provide insights into the experiences of others. Platforms with a history of security breaches or poor customer service may not be reliable options.

Community

A strong, active community provides support, knowledge sharing, and networking opportunities. It can help you stay informed about market trends, discover new artists, and find potential buyers or collectors for your NFTs.

For instance, platforms like Rarible and Foundation have vibrant communities that engage with artists and collectors. They often organize events, contests, and promotions, creating a dynamic environment for users.

When considering a marketplace, look for one that has an active and welcoming community. Engaging with fellow users can enhance your understanding of the NFT space and provide valuable insights into successful strategies for buying, selling, and creating NFTs.

Supported Blockchains

Different blockchains offer various advantages in terms of speed, fees, and environmental impact. The most popular blockchain for NFTs is Ethereum. However, Ethereum can also have high gas fees, especially during peak times.

Other blockchains, such as BNB Smart Chain, Solana, Flow, and Polygon, offer alternatives with lower transaction fees and faster processing times.

Top NFT Marketplaces in 2024

OpenSea

OpenSea is the world’s largest NFT (non-fungible token) marketplace. It was launched in 2017 and has become a key platform in the NFT space, supporting various blockchains like Ethereum, Polygon, Avalanche, Optimism, Base, and Solana. This allows users to access a wide range of NFTs across different ecosystems.

In terms of usage, OpenSea has an intuitive interface that even beginners can navigate easily. To start using it, you first connect a crypto wallet such as MetaMask, Coinbase Wallet, or WalletConnect. OpenSea doesn’t hold your assets; instead, they remain in your wallet, which you use for transactions.

The marketplace supports multiple NFT categories such as art, gaming, photography, and utility NFTs (e.g., membership passes). Users can explore trending collections, filter results by time period, and even select specific blockchains to narrow their search.

To buy NFTs, you typically need cryptocurrency like Ether (ETH) or Wrapped Ether (WETH). OpenSea does not accept fiat currencies, so transactions happen in crypto. When making a purchase, you can either buy at the listed price or make an offer. OpenSea is also a hub for creators. You can create your NFTs by uploading digital items and minting them on the blockchain. Creators set their prices, decide on royalties, and control how their NFTs are listed.

Rarible

Rarible is another best NFT marketplace, launched in 2020, and quickly became a key player in the NFT space, reaching significant milestones. Within 18 months of its launch, Rarible had generated over $150 million in sales. Today, it boasts more than 1.6 million registered users, making it one of the top NFT platforms available.

One unique aspect of Rarible is its multichain capability. It supports several blockchains, including Ethereum, Aptos, ImmutableX, Tezos, and Flow. This flexibility allows users to mint NFTs on the blockchain that best suits their needs, whether for cost efficiency or environmental concerns.

Rarible also gives creators full control over their digital assets. Users can set royalties, meaning that every time their NFT is resold, they receive a percentage of the profit. This feature is especially attractive to artists, musicians, and other creators looking to generate long-term revenue. The marketplace is powered by its native cryptocurrency, RARI. RARI holders can participate in the governance of the platform, voting on key decisions about its future.

Creating an NFT on Rarible is simple. Users can either mint their own NFT collections or add their work to existing collections. There are options for lazy minting, where the NFT is only minted when sold, reducing upfront costs for creators. The platform is also known for its focus on community, offering tools to create custom marketplaces and even build personalized storefronts for collections.

Binance NFT

Binance NFT marketplace was launched in 2021 and quickly became popular due to Binance crypto exchange’s large user base and lower transaction fees compared to other platforms. You can access NFTs from multiple blockchains, including BNB Smart Chain (BSC) and Ethereum, giving you a wider variety of digital assets to explore.

One of the unique features is the Mystery Boxes for new users as a gift. These boxes contain random NFTs with different levels of rarity. You can either open the box to reveal the NFT or sell the unopened box if you prefer. This adds an element of surprise and potential value, as some NFTs can be highly sought after.

Binance NFT charges just 1% as a platform fee for trades, making it more affordable compared to other NFT marketplaces. You can trade using several cryptocurrencies, including BNB, BUSD, ETH, and MATIC. Additionally, the platform offers NFT staking, allowing you to earn rewards or use your NFTs as collateral for loans.

Binance NFT also offers exclusive NFT drops and collaborations with global artists and brands. This gives you access to limited-edition NFTs.

Magic Eden

Magic Eden is one of the largest Solana NFT marketplaces. The platform now supports multiple blockchains, including Solana, Ethereum, Polygon, and Bitcoin. It is also best for Bitcoin ordinals NFTs. It hosts over 8,000 NFT collections, and the platform has gained significant market share, holding over 90% of the trading volume for Solana-based NFTs.

A standout feature of Magic Eden is its Launchpad, a platform where new NFT projects can be minted. The Launchpad is selective, accepting only 3% of applications, and offers projects extensive support to ensure successful launches.

In addition to trading, Magic Eden is also community-driven, offering partnerships with global brands and providing developer resources. Its fast transaction speeds and low fees, particularly on Solana, make it an attractive option for NFT enthusiasts.

Blur

Blur is an advanced NFT marketplace launched in October 2022, designed specifically for professional traders. Operating primarily on the Ethereum blockchain, Blur is well-known for its unique features that cater to high-volume NFT traders, often referred to as “whales”. Unlike many other platforms, it focuses on speed, efficiency, and zero transaction fees.

While most NFT platforms charge transaction fees, Blur allows traders to buy and sell NFTs without any marketplace fees, though users still pay Ethereum gas fees. The platform also provides flexible royalty settings, recommending a 0.5% royalty to support creators, though users can customize or even set royalties to zero.

Blur also emphasizes speed, claiming to be the fastest NFT marketplace with batch transactions, sweeping functionality (bulk buying of NFTs), and updates every four seconds. These features are designed to enhance the experience of traders who often rely on quick transactions to gain an edge in the market.

Blur also integrates an innovative lending feature called Blend, introduced in 2023. This peer-to-peer NFT lending protocol allows users to borrow against their NFTs without fixed terms, making it easier to leverage digital assets for liquidity.

How to Use an NFT Marketplace

Step 1: Create a Crypto Wallet

Before you can start using an NFT marketplace, you’ll need a crypto wallet that supports NFTs. Popular wallets include:

- MetaMask

- Coinbase Wallet

- Ledger Nano X

- Trust Wallet

These wallets allow you to store cryptocurrencies like Ethereum (commonly used for NFTs) and your NFTs themselves. After setting up the wallet, you’ll need to fund it by buying cryptocurrency from an exchange (like Coinbase or Binance) and transferring it to your wallet

Step 2. Connect Your Wallet to the Marketplace

Once your wallet is set up, connect it to the NFT marketplace you want to use. Most platforms have a “Connect Wallet” button at the top right. Click this, select your wallet type, and follow the prompts to authorize the connection.

Step 3: Browse NFTs

After connecting your wallet, you can browse available NFTs. Marketplaces typically have search features that allow you to explore by categories like digital art, music, virtual real estate, and more. You can also use filters to sort by price, trending items, or newly listed NFTs.

Step 4. Buying or Selling an NFT

To purchase an NFT, find the one you want, check its price (usually in cryptocurrency), and click the “Buy” or “Place Bid” button if it’s part of an auction. You’ll need to confirm the transaction through your wallet and ensure you have enough cryptocurrency to cover both the price and the transaction fees, known as gas fees.

If you wish to sell an NFT you already own, you can go to your profile, select the NFT, and choose the “Sell” option. You can set a fixed price or choose to sell it through an auction.

Step 5: Mint Your NFTs

If you want to create or “mint” your own NFT, you can upload your digital file (art, music, or any other content) and provide details like a name, description, and any royalties you wish to receive from future sales. After setting these parameters, you will finalize the minting process through your wallet.

Step 6: Managing Your NFT Collection

After purchasing or creating NFTs, you can manage them in your wallet. You’ll be able to view your collections, monitor their value, or choose to sell them again. If you sell an NFT and want to withdraw your earnings, you can transfer the funds from your wallet to a cryptocurrency exchange and convert them to your local currency.

How to Create an NFT Marketplace: Development Guide

Here is the guide on how to create your own NFT marketplace:

- Research the Market and Pick a Niche: Start by learning about the NFT world and figuring out the focus of your marketplace. Decide whether you want to specialize in digital art, gaming items, or collectibles.

- Choose a Blockchain: Ethereum is the most popular option for NFTs because it has strong support for smart contracts. However, alternatives like Solana, BNB Smart Chain, or Polygon offer faster transactions and lower fees.

- Design the User Interface: Create a clean, easy-to-use interface that allows users to browse NFTs, see prices, and complete transactions. Use tools like Figma to design the look of the marketplace. The design should include pages for NFT listings, user profiles, and categories.

- Create Smart Contracts: For your NFT marketplace, smart contracts will handle things like creating NFTs (minting), trading, and royalties. If you’re using Ethereum, the most common standards are ERC-721 (for individual NFTs) and ERC-1155 (for batch NFTs).

- Set Up the Backend and Frontend: The frontend is what users see and interact with, while the backend handles data and connections to the blockchain. You’ll also need a way to store large files like images, for which decentralized storage solutions like IPFS are commonly used

- Add Essential Features: Your platform should enable user registration for linking crypto wallets and provide NFT creation tools for users to upload and mint their NFTs. It should also facilitate listings and auctions for selling NFTs, display transaction history, and include search and filter options for easy NFT discovery.

- Launch and Maintenance: Once testing is complete, you can deploy the platform on the mainnet. After launch, regular updates, bug fixes, and feature enhancements are necessary to keep your marketplace competitive and secure.

- Ongoing Marketing and User Acquisition: After launching, you’ll need a solid marketing strategy to attract users. Consider collaborating with influencers, running airdrop campaigns, and creating incentives like reduced fees for early adopters. Building a community around your marketplace (on platforms like Twitter, Discord, or Telegram) will also help in promoting your platform.

Conclusion

To summarize what is an NFT marketplace, it is a platform that enables you to purchase, sell, and exchange unique digital things. It runs on blockchain technology, ensuring that each NFT is unique and securely recorded. Smart contracts enable automated transactions, making it easier for artists and collectors to trade digital assets.

As interest in NFTs rises, these marketplaces become increasingly vital to artists, musicians, and content providers. Understanding how an NFT marketplace operates will help you navigate this new digital world and make smart purchases or sales of NFTs.

FAQs

How does NFT marketplace work?

An NFT marketplace works by using blockchain technology to track unique digital items called NFTs. Each NFT is created through smart contracts, which are self-executing agreements stored on the blockchain.

These contracts follow specific standards, like ERC-721, to ensure uniqueness. The digital asset, such as an image, is often stored off-chain using systems like IPFS. Users connect digital wallets to the marketplace to buy and sell NFTs securely.

When a transaction occurs, it is sent to the blockchain for confirmation. Once confirmed, ownership changes are recorded, allowing users to trade digital items easily and securely.

What is the most popular NFT marketplace?

OpenSea, Rarible, and Blur are among the most popular NFT marketplaces today. OpenSea is the largest and most well-known, with a vast selection of NFTs, from digital art to gaming assets. It’s known for being user-friendly and accessible to newcomers.

Rarible is another top marketplace, offering a decentralized platform that lets creators easily mint and sell their NFTs, while also allowing buyers to purchase directly. Blur, on the other hand, is relatively newer but has gained attention due to its focus on high-volume NFT traders and zero-fee NFT trading. It offers advanced analysis tools for those who buy and sell frequently, making it popular among experienced traders.

Can I trust decentralized NFT marketplaces?

Yes, you can trust decentralized NFT marketplaces to a certain extent, but you should always be cautious. Decentralized NFT marketplace platforms operate without a central authority, which means transactions are peer-to-peer, and the blockchain verifies ownership. This system reduces the risk of manipulation by middlemen.

However, with decentralized systems, you are responsible for your own security, including managing your cryptocurrency wallet and private keys. Some marketplaces may also have issues with fake NFTs or scams, so it’s important to research the platform and the sellers before making a purchase. Checking reviews or sticking to well-known marketplaces can also help ensure a safer experience.

How do I mint an NFT?

Minting an NFT means creating a new digital asset on the blockchain. First, you need to choose an NFT marketplace, such as OpenSea or Rarible, where you want to mint your NFT. Then, you’ll need a cryptocurrency wallet, usually with some Ethereum (ETH) in it, to cover the minting fees.

Once you’re set up, you can upload your digital file, whether it’s artwork, music, or something else, to the marketplace. After adding details like title, description, and price, you can hit the mint button. The marketplace then creates a unique token on the blockchain, which represents your ownership of that digital asset.

What are the fees on NFT platforms?

NFT platforms often charge various fees, which can vary depending on the marketplace you use. The most common fee is a “gas fee,” which is the cost of processing transactions on the blockchain. Gas fees can fluctuate based on network congestion, especially for platforms like OpenSea that run on Ethereum.

In addition to gas fees, platforms may charge a listing fee when you put an NFT up for sale. They might also take a small percentage as a service fee once your NFT is sold. These fees help cover the platform’s operational costs and the underlying blockchain’s transaction costs.

For example, Opensea charges a 2.5% service fee on each transaction, whereas Blur does not charge any fees for buying and selling NFTs.

Is it safe to buy NFTs?

Yes, buying NFTs can be safe if you take the right precautions. Always make sure to use a reputable NFT marketplace like OpenSea, Rarible, or Blur. These platforms are generally secure and use blockchain technology to ensure the authenticity of the NFTs.

However, there are still risks involved. Scams, fake NFTs, or phishing attacks can happen, especially on lesser-known platforms. You should always double-check the source of the NFT and verify that the seller is legitimate. It’s also important to use a secure crypto wallet and never share your private keys.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor